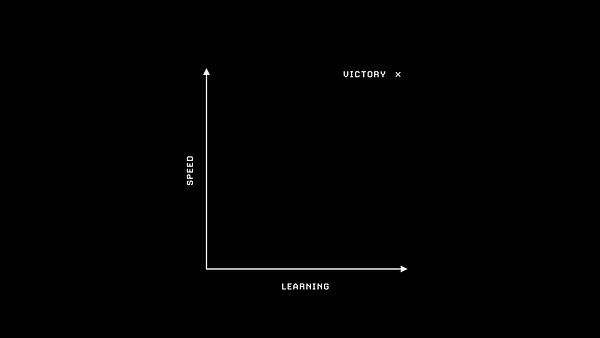

If I can sum up 2020 for enterprise tech and the venture markets, this is it 👇🏼

And here’s why FOMO is so big at earliest stages.

Everyone is trying to invest for the future Top 25 and the only way to get in many of these is if you’re first. The challenge is that this may not bode well for founders.

This race to be first and not miss out means most companies are getting overfunded early and in many cases 12 months ahead of where the business really is. This is most pronounced when going from seed to early A round and the expectations from A round investors to monetize and build a sales motion which can scale at the B. But, my biggest 😨 is that founders and investors need to understand that you can’t force or buy yourself to product market fit with more 💰 or 🧍🏼♂️🧍♀️. '

Trust me, I’ve been through this 🎥 before, back in the bubble days. Yes, it was different then, but many companies were flush with 💰 with no product market fit and tried to spend their way to realize growth. Why? Because they promised their investors outlandish numbers based in a bizarro world with no hopes of achieving unless they hired more sales, spent more marketing dollars, and 🙏🏼 for the best. But guess what, hope is not a strategy. For many of the companies that we’ve backed who have raised early rounds, we keep reminding founders to build 2021 targets to be challenging but also achievable on the top end versus setting unrealistic goals. Think about what each incremental 💵 of burn will yield back in revenue.

Building a developer first community takes time. Building a product led growth engine takes time. Getting the product right takes time. Ensuring that your first couple of customers succeed takes time. And all of this can get complicated if you monetize too early and bring in the heavy guns built to scale cos from $1-10-20 when what you really need is the expertise and help to go from $0-1m. Money is a commodity and having a true partner who not only understands where you are as a business, who can help you think about building the right way for the long term, and also who will not skip steps becomes even more important in 2021. Make sure you are not just an option but a truly valued portfolio company where real work and time will be spent helping you hit your milestones.

As always, 🙏🏼 for reading and please share with your friends and colleagues. Happy Holidays to you and your families!

Scaling Startups

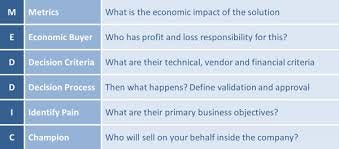

Classic 🎧 and must listen from Hunters + Unicorns who interview the creator of MEDDIC, John McMahon and playbooks from 33 CxOs like MongoDB, Datadog… (🎩 Crissy Costa from B Capital)

Marketing 101 from the master - first principles!

What hypothesis are you trying to solve and for whom? Must read 🧵

This is pure gold from Lenny Rachitsky - a survey of product managers from skills necessary to get hired to what gets you promoted and what some of the best companies gravitate towards

Takeaways:

Companies who spike on Communication: HubSpot, Salesforce

Companies who spike on Execution: Salesforce, Tesla, VMware

Companies who spike on Product sense: Asana, Flipkart, Intercom, Netflix, ServiceNow, WhatsApp

💯

Which side of the debate are you on? Read the 🧵 but I agree, especially as 13 of our 18 investments in fund iv have at least one international co-founder. So excited about the future

Enterprise Tech

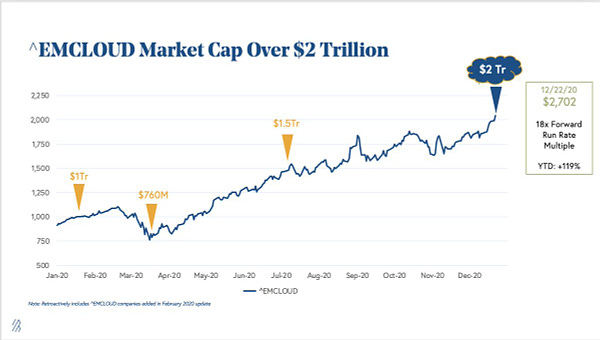

Multiples 🤯 - 130x for Starburst data at $12mm ARR and $1.6 billion price and 50x for Ironclad which was at around $13mm ARR, double from last year

Zoom looking to expand footprint, evolve from best of breed to true platform as rumored to add email and calendaring and exploring messaging

Important follow up note from last week on AWS and its new managed Grafana service - it is partnering with Grafana and not killing it first by forking their own version!

On this go-round, AWS has changed the script. Going beyond offering coding contributions, it is adding a revenue sharing and joint support component. There are precedents for this in the cloud landscape – we're thinking about the Google Cloud open source database partnership program that involves joint licensing, go to market, and technical support. We believe that this is the first time that AWS has entered such an active partnership with an open source provider, which proves the maxim, never say never.

The most amazing thing about AWS…

As soon as we hatched that plan for ourselves, it became immediately obvious that every company in the world was going to want this. What really surprised us was that thousands of developers flocked to these APIs without much promotion or fanfare from Amazon. And then a business miracle that never happens happened — the greatest piece of business luck in the history of business, so far as I know. We faced no like-minded competition for seven years. It’s unbelievable.

Salesforce Ventures has become quite an investment powerhouse and congrats to friend Matt Garratt as his team has been quietly generating 🤯 returns (the Information). All I can say is they are great partners as they are co-investors in Snyk and BigID an a stealth co at seed.

Market for alternative data will only grow in 2021 as Bloomberg buys Second Measure, imagine all the infra needed to process data rife with privacy, to share and sell that data…

Bloomberg L.P. announced today that it has completed its acquisition of Second Measure, a consumer data analytics company that analyzes billions of anonymized purchases to help investors and businesses gain insight into company performance and consumer behavior. Bloomberg acquires Second Measure’s proprietary analytics for daily tracking and real-time exploration of thousands of public and private companies, providing users with insights that complement Bloomberg’s company fundamentals and market data.

What’s next for RPA? A 🔦 will be on it as UiPath goes public in 2021 - human in the loop will still matter but how far can this all go?

DeWitt and others see far greater possibilities in the future based on more integration between complementary technologies. DeWitt even anticipates the beginnings of “autonomous automation” in 2021 – that is, bots that can themselves automate processes. Today, IT teams often need to intervene to connect to various apps, interfaces, and databases to retrieve information or apply rules to complete processes, Dewitt says.

“By the middle of the decade, or in some cases, next year, we’ll be able to automate the process of automation,” DeWitt says, “and once this moment happens, the enterprise will be able to rewrite itself.”

So true…

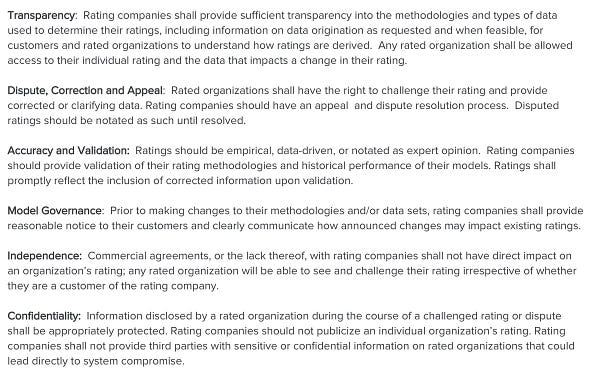

Importance of security ratings as explained by Phil Venables, ex-CISO of Goldman Sachs, esp. important in light of solar winds attack and an enterprise need to monitor vendor supply chain security

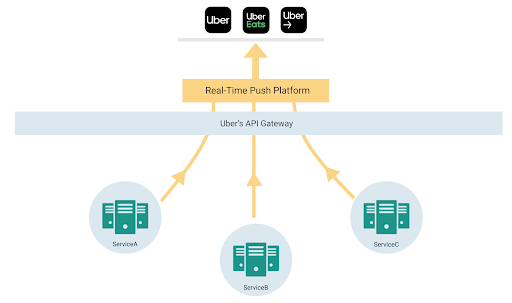

Another beauty for Uber engineering blog on how they went from polling to push messaging and their new system RAMEN (Realtime Asynchronous MEssaging Network).

Read the rest of the article for future plans: eng.uber.com/real-time-push… I'm *seriously* impressed with the details of this writeup, and how @UberEng keeps being so open about implementations. Great summary @udaykiran, @nilesh_mahajan, @anirudh_53 & @hackinghabits & team!

Five interesting data engineering projects to track, DBT, Prefect, Dask, Great Expectations, DVC…

🤯 - spoiler alert if you have not watched the last episode of Season 2 but deepfakes are here and will be someting to deal with for years to come…

Markets

Woo hoo! Must read 🧵 - direct listing and raise primary capital!

Yes, much more room to run for the☁️