What's 🔥 in Enterprise IT/VC #223

We're past the age of decacorns 🦄 - what's the new bar for enterprise outliers?

| Ed Sim | Feb 6 |

What's 🔥 in Enterprise IT/VC #223We're past the age of decacorns 🦄 - what's the new bar for enterprise outliers?

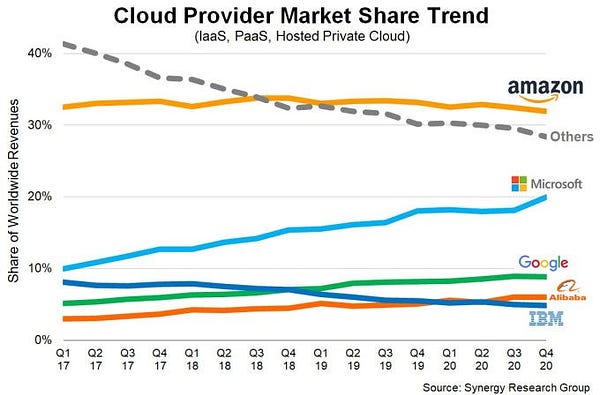

The ☁️ and enterprise software market continues to be on 🔥 in 2021. First, who would have thought that when Jeff Bezos stepped down as CEO of Amazon that the head of Amazon Web Services would replace him? That’s exactly what happened and shows the ever growing importance of the ☁️ at Amazon and overall. Second, who would have thought that we’d have a number of pre-IPO fundings in the $30 billion range for enterprise software companies. That’s exactly what happened this week with both Databricks and UIPath at $28 billion and $35 billion respectively. 🤔 about those numbers for a second…🤯 When I started boldstart in 2010, our goal was to partner with technical enterprise founders armed with an idea and a slide deck on day one and 🙏🏼 that we would get one, just one, $1 billion company per fund where we had close to 10% ownership on exit. With those numbers, one could create a significant return of capital on a small fund size. 11 years later, and it’s clear that I dramatically underestimated how big and how fast some of these enterprise software companies would become. I wasn’t thinking big enough! The goalposts seem to keep moving for what a category creating, private enterprise software company is and the growth and valuations they are realizing. Here’s a slide from our boldstart annual meeting in June 2020 - notice the valuations (courtesy of SaaStr). Here, I was suggesting the equivalent of the $1 billion exit en years ago has become a $10 billion one, a decacorn. And 8 months later, look at the valuations 😲 (from Meritech). Forget about 🦄 or decacorns, the new mythical creature is a pentacontacorns (yes a mouthful). Clearly the new investors in UIPath and Snowflake are thinking much larger outcomes. Working backwards from IPO, this has a dramatic effect on valuations all the way back to the seed and Series A rounds. There is so much capital trying to get ownership as early as possible in the next potential pentacontacorn (ok, we need a better name 😬) that valuations are inflated across the board. Fund sizes keep increasing and the question we all need to ask is, will this last and is this sustainable? If you look at numbers on ☁️ spend from Ron Miller at Techcrunch, for example, then the answer is yes.   So much more to chew on and think about as 2021 evolves. As always, 🙏🏼 for reaching and please share with your friends and colleagues! Scaling Startups

Enterprise Tech

Markets

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Saturday, January 30, 2021

🥾Bootstrapping works, the value of constraints + the scrappiness of not raising too much 💰, Qualtrics, Calendly...

Saturday, January 23, 2021

The developer first dilemma, the value of patience, and why going enterprise too early can be hazardous to your health ⚠️

Saturday, January 16, 2021

Coming out of stealth and what to 🤔 about to optimize the 👯♂️, all about momentum...

Saturday, January 9, 2021

Talent, not capital is a rate limiting factor to scale, importance of wiring recruiting/retention on day one

Saturday, January 2, 2021

Predictions: enterprise remains 🔥 in 2021, 🦄 anywhere, SaaS collaboration + dev 1st product to embedded workflow, everyone is a 🌱 investor, SRE is the new DevOps, security continues to go dev first

Friday, February 14, 2025

What could $120K+ in funding do for your business?

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏