Accelerated - 🚀 What's going on with NFTs?

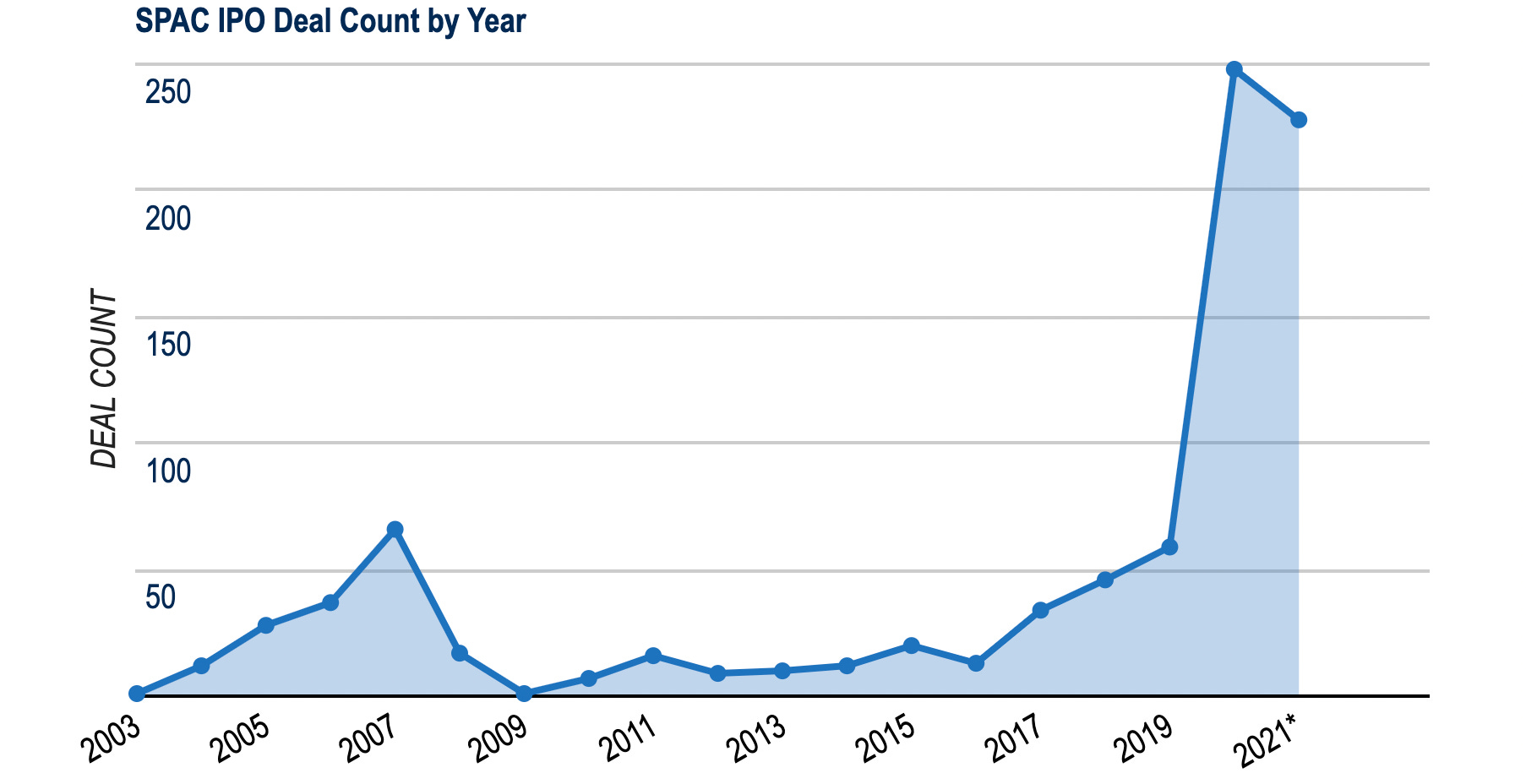

2021 is shaping up to be the year of SPACs! The above graph (from SPACInsider) illustrates the dramatic rise of SPAC IPOs, with the YTD deal count for 2021 already quickly approaching 2020’s total. SPAC critics argue that they’re being used to take lower-quality companies public, and point to the fact that SPACs have historically underperformed traditional IPOs. And it’s true that the recent SPAC boom has led to companies with no revenue (e.g. Nikola, Lordstown Motor Corp, Virgin Galactic) going public. However, it’s worth noting that the world of SPACs isn’t completely lawless territory. There are public disclosures required before a SPAC IPO (primarily the S-4 filing, which is similar to an S-1), and it typically takes ~4-6 months to complete the process. We’ve also seen a number of high-quality companies elect to go public via SPAC recently, including Opendoor, Hims & Hers, SoFi, and 23andMe. If you’re interested in learning more about how SPACs work and the pros & cons vs. a traditional IPO or direct listing, we recommend checking out John Luttig’s overview! news 📣📹 Instagram launches Live Rooms. If you’re one of the brave souls who’s gone live on IG, you’ll know that you can only invite one person to stream with you. That changed this week, as Instagram upped the limit to four creators per broadcast (which allows for collabs, talk shows, podcasts, and interviews). Instagram’s head of product for creators, Kristin George, said that “collab culture is the future”- adding more contributors has been the #1 request from creators as Live usage soars post-COVID. 🎵 Square acquires Tidal for $297M. Jay-Z’s music app Tidal has found an unlikely new home - Square! CEO Jack Dorsey explained on Twitter that Square aims to reinvent artist monetization, similar to what the company has done for SMBs (Square Sellers) and individuals (Cash App). According to Dorsey, this may include “new listening experiences to bring fans closer together, simple integrations for merch sales, modern collaboration tools, and new complementary revenue streams.” Square also announced the launch of its own bank to offer expanded business loans, deposit products, and more! However, the stock ended the week down 10%, due to: (1) investor confusion around the Tidal acquisition; and (2) market volatility that hit growth stocks. 🛍️ Klarna raises mega-round. “Buy now, pay later” startup Klarna announced a $1B round at a $31B valuation, making it the most valuable private company in Europe! Klarna’s valuation tripled in just six months 😲. Similar to competitor Affirm, Klarna customers access the product through a “Buy with Klarna” button on merchant partner sites, or they can use the Klarna app to pay at any retailer. The company is headquartered in Sweden - only ~10% of its 90M customers are in the U.S. 🛑 Okta buys Auth0. Identity and access management (IAM) company Okta acquired rival Auth0 for $6.5B (20% of Okta’s market cap!). Auth0 targets a slightly different market segment than Okta, allowing developers to add IAM functionality to their own products via API. Though Okta’s stock fell 10% on the news, CEO Todd McKinnon defended the price tag, noting that he paid a lower revenue multiple for Auth0. 📈 The IPO train keeps rolling! Another week, another slew of IPO updates:

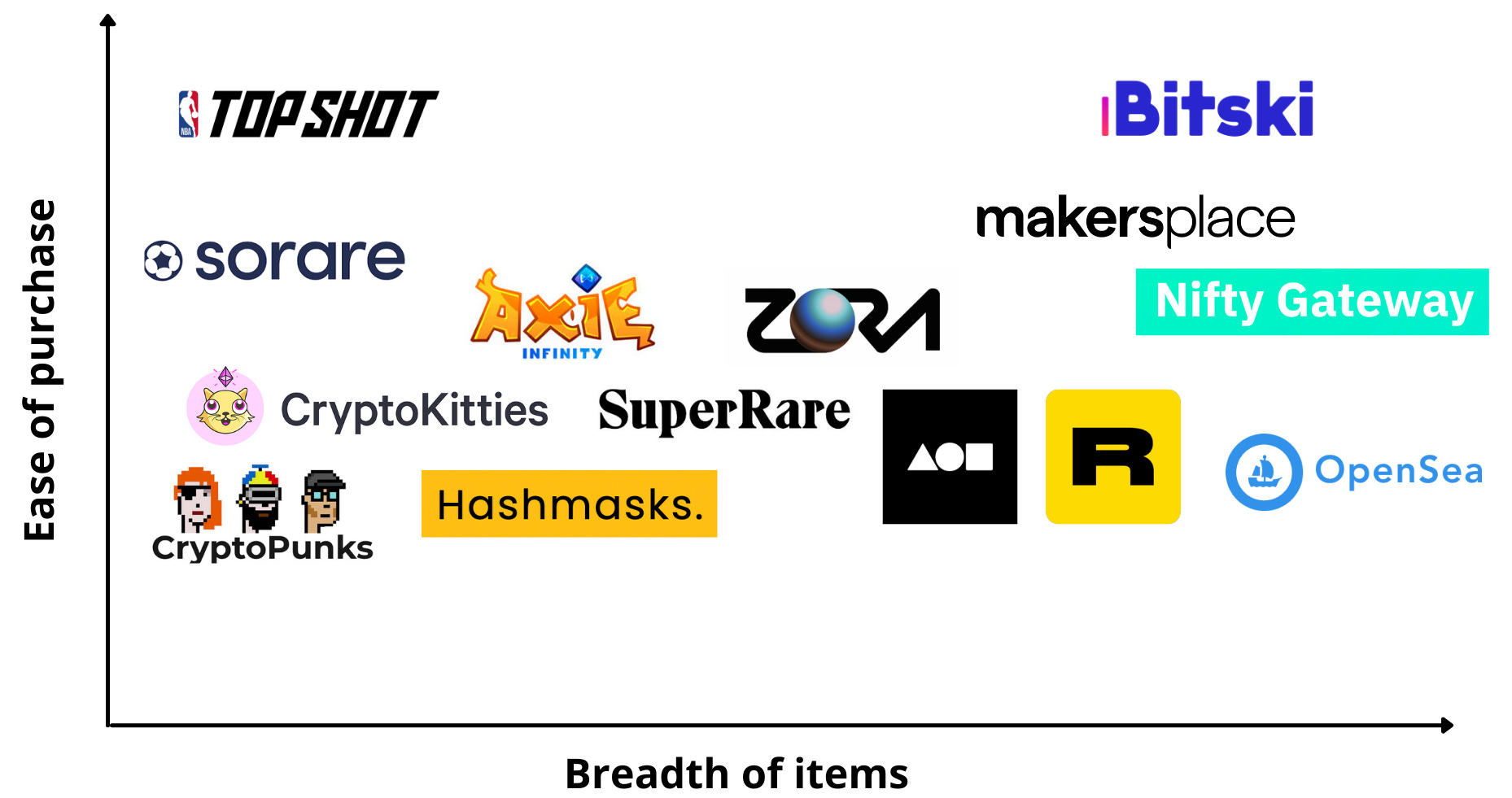

Despite the chronic and worsening Zoom fatigue that we’re all experiencing (too soon to call it a second pandemic?), Zoom itself continues to chug along! The company’s stock jumped 10% after Q4 earnings, beating revenue expectations with 370% YoY growth. SMBs continue to be an area of growth, as most of these businesses weren’t using Zoom pre-pandemic. The company saw a ~500% YoY increase in customers with <10 employees, which concerns some investors looking towards post-COVID churn. what we’re following 👀Lenny Rachitsky shares lessons on content-driven growth from top startups. A teen went briefly viral for his sneaker reselling business - did his success force his mom to resign from Nike? Thingtesting on the rise of D2C ice cream & why it’s so hard to ship to your door. The team at Heartcore Capital published an incredible report on the state of consumer tech over the past year & the trends they’re tracking. We’d highly recommend checking it out, lots of great data and insights here! It’s been a wild week for non-fungible tokens (NFTs)! Grimes sold $6M of digital art and videos, Kings of Leon announced their new album will be released as an NFT, and TRON founder Justin Sun bid $2M to “own” Jack Dorsey’s first tweet. We mapped out some of the companies in this space, focusing on two dimensions:

The first dimension is straightforward - accessibility enables more consumers to participate, which is a good thing for most consumer products! The second dimension is still up for debate - having a broader platform isn’t necessarily a good thing, as we’ve seen with vertical-specific startups stealing market share from eBay. Allowing anyone to mint and sell an NFT could create significant “noise” for buyers. We expect some of the hype around NFTs to die down, for a few reasons:

However, we think some use cases will stick around:

jobs 🎓Songbird Therapy - Strategy & Ops (Remote, SF) Alchemist Accelerator - Chief of Staff (Remote, SF) SESO Labor - Growth Analyst (Remote, SF) Divvy Homes - Strategic Partnerships Associate (SF) Two Chairs - Ops Associate (SF) OMERS Ventures - Associate (SF)* Whatnot - Ops/Customer Support, Partnerships Manager (Remote, LA) StockX - Financial Analyst (Detroit) Rockefeller Foundation - Innovative Finance Associate (NYC) Prose - Product Analyst (NYC)* *Requires 3+ years of experience. internships 📝Human Capital - Delta Fellowship (Remote) - $50k for student founders Atom Finance - Finance Intern (Remote, NYC) Kyte - Finance / Business Ops Intern (Remote) June - MBA Summer Intern (Remote) Box - Education Intern (Remote) Pitchbook - Research Intern (Seattle) Plastiq - MBA Partnerships and Strategy Intern (SF) Uber - Marketing Intern (SF) Silicon Valley Bank - SVB Capital Intern (Menlo Park) M13 - MBA Investment Associate (LA) Komodo - MBA Corp Dev Intern (NYC) puppy of the week 🐶Meet Cosmo, a one-year-old Lagotto Romagnolo (an Italian breed!) who lives in NYC. Cosmo enjoys frolicking in the snow, playing with his stuffed animals (his alligator is his favorite), and watching other dogs run around at the park. Follow him on Instagram @cosmoillagotto! Hi! 👋 We’re Justine and Olivia Moore, identical twins and venture investors at CRV. Thanks for reading Accelerated. We’d love your feedback - feel free to tweet us @venturetwins or email us at twins@crv.com. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Would you pay for tweets?

Sunday, February 28, 2021

Plus, announcing our latest investment!

🚀 How much is Coinbase worth?

Sunday, February 21, 2021

Plus, a new TestFlight "broke the Internet" this week!

🚀 Can Snap beat TikTok in short-form video?

Sunday, February 7, 2021

Plus, announcing our latest investment!

🚀 A note on Internet culture

Sunday, January 31, 2021

Plus, we need your thoughts on dating apps!

🚀 Netflix crosses major milestone

Sunday, January 24, 2021

Plus, what % of companies are now starting fully remote?

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏