Margins - Cathie Wood and Content Strategy

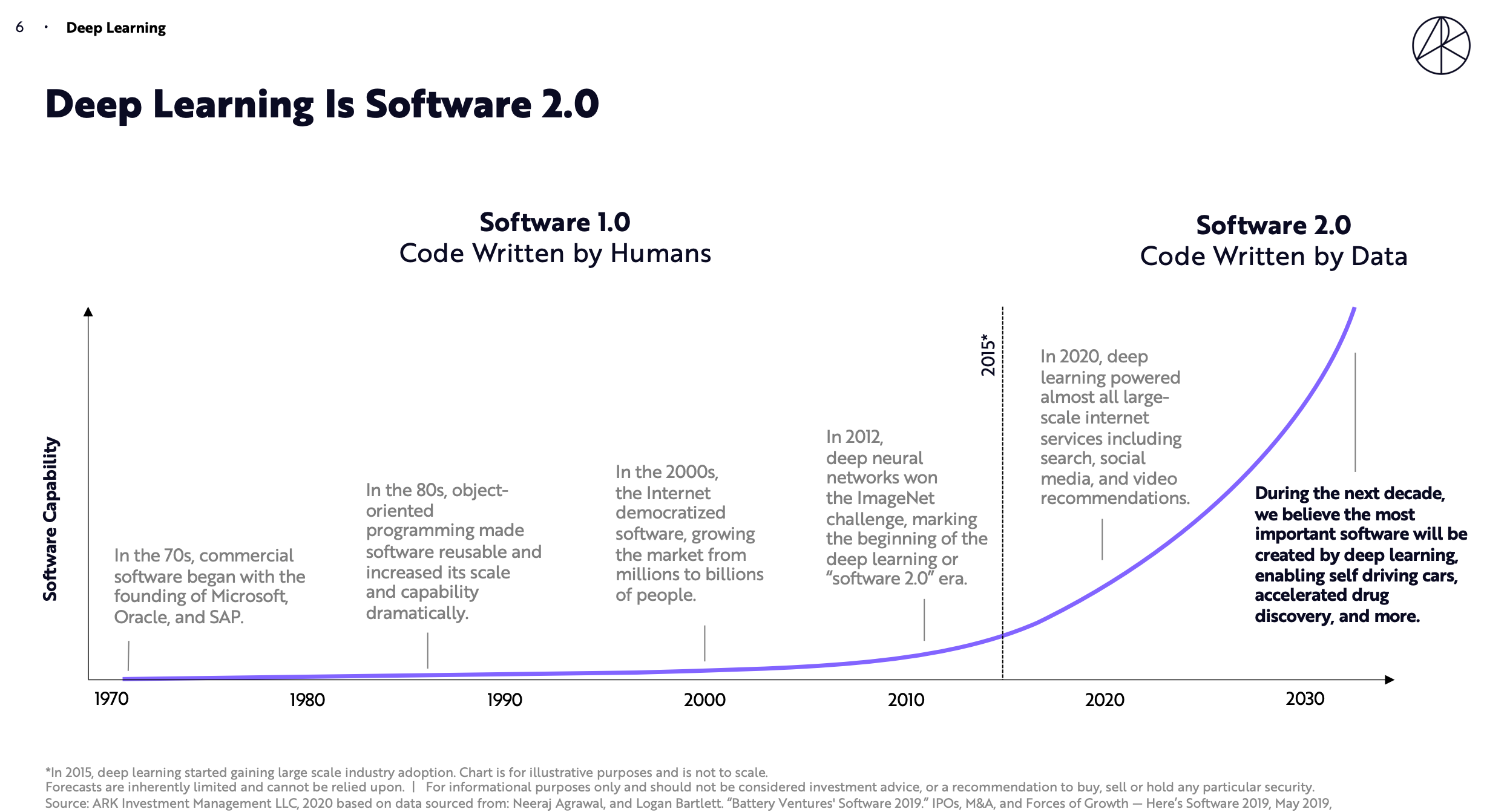

Ranjan here. This week I’ll be writing about the ARK Innovation ETF and how its founder/owner/analyst has hacked the media in a brilliant way. You may have noticed my co-host Can has taken a recent writing break. He just started a new company so we'll excuse him, but in his last post he posed the somewhat existential question of ‘what is content?’ This led to us uncomfortably passing each other by at the Slack watercooler, as my job is "content strategist", so, to my co-host Can, I’d like to lay out an example of an utterly brilliant, perfectly executed, comprehensive, content strategy. I present to you The Case of Cathie Wood. Brain Real EstateGreat content strategy understands that content is much more than words written into paragraphs or a person talking to a camera. It’s numbers and stories and emotion all intertwined to drive feedback loops and desired actions. It's a compelling story that ends up occupying some amount of our collective thinking. For those unfamiliar, Cathie Wood runs a portfolio of ETFs. The flagship and most famous one is the ARK Innovation ETF (ARKK). ETFs used to be kind of a boring financial vehicle that tracked other existing indices or portfolios. While you couldn't technically "buy" the Nasdaq 100, you could buy the QQQ ETF which would give you a fairly close proximation of its performance. Stuff started to get weird with things like triple-levered reverse ETFs (where you'd be promised 3x the opposite of an index, yes these are real) but the ARK Innovation ETF is kind of an entirely different animal - it’s an actively managed ETF and doesn’t track some other index or portfolio. The stocks included are picked by the ARK team and the ETF gives everyday investors easy access to what Cathie Wood and her team would consider the disruptive companies that will transform business and society. There’s been a lot of writing about the mechanics of the ARKK financial vehicle itself, but this post is about telling Can how this product that, at its core, is effectively a spreadsheet of stocks, has used content to dominate both the financial conversation and deliver pretty spectacular returns (150% over the last year, 52% a year in the past 5 years). Everything is ContentNormally when we think of financial content marketing, we think of corporate blogs, quarterly investor letters, media appearances. Things have progressed a bit as you now have Ray Dalio LinkedIns and Clifford Asness tweets, but traditionally investors have been a bit reticent to open up their books. Their investment theses and decisions were their competitive advantage, and there’s a bunch of compliance reasons they’d need to be careful about what they say. But financial content isn’t simply as things like a Warren Buffett shareholder letter or a Bill Ackman CNBC appearance. Let’s first step back and look at ways companies use non-traditional forms of content to try to drive business outcomes. Think about something like good technical documentation. It can play a huge marketing role in building lucrative developer communities and can drive word of mouth marketing far better than promotional videos created by the marketing team. (Can told me he'd consider Stripe the gold standard for documentation, with ObservableHQ as a close 2nd). There are other customer-oriented ways to think about this - like how Zappos approached service phone calls (they famously had one that lasted 10 hours, 43 minutes, that’s content, Can!) - but you can extend this even beyond written and spoken words. It could be open-source datasets for others to create with. This might be a bit of a stretch, but I’d argue the very idea of open-source software is a form of content marketing. It introduces people to the way you think and what you do while building brand awareness far more effectively than any number of high-gloss commercials. Facebook's developer community is certainly better content than its Chairs commercial (this is just an excuse to, once again, include this video).  ARKK and TransparencyCathie Wood's firm has been lauded as creating a new level of transparency. They create things that we’d all consider standard content. There is a yearly Big Ideas report that reads a cross between Masayoshi Son and Mary Meeker. They have weekly 'brainstorming sessions' where:

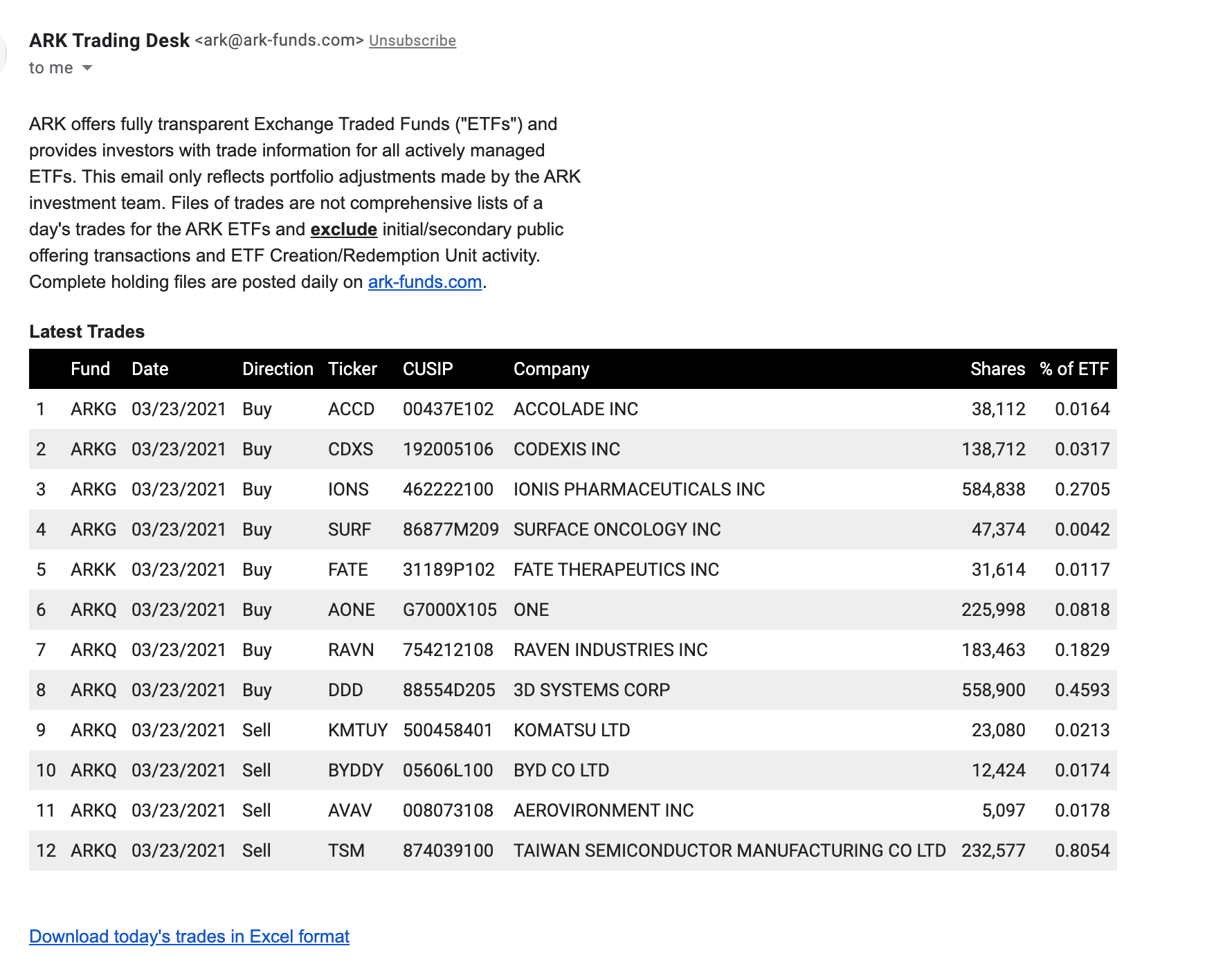

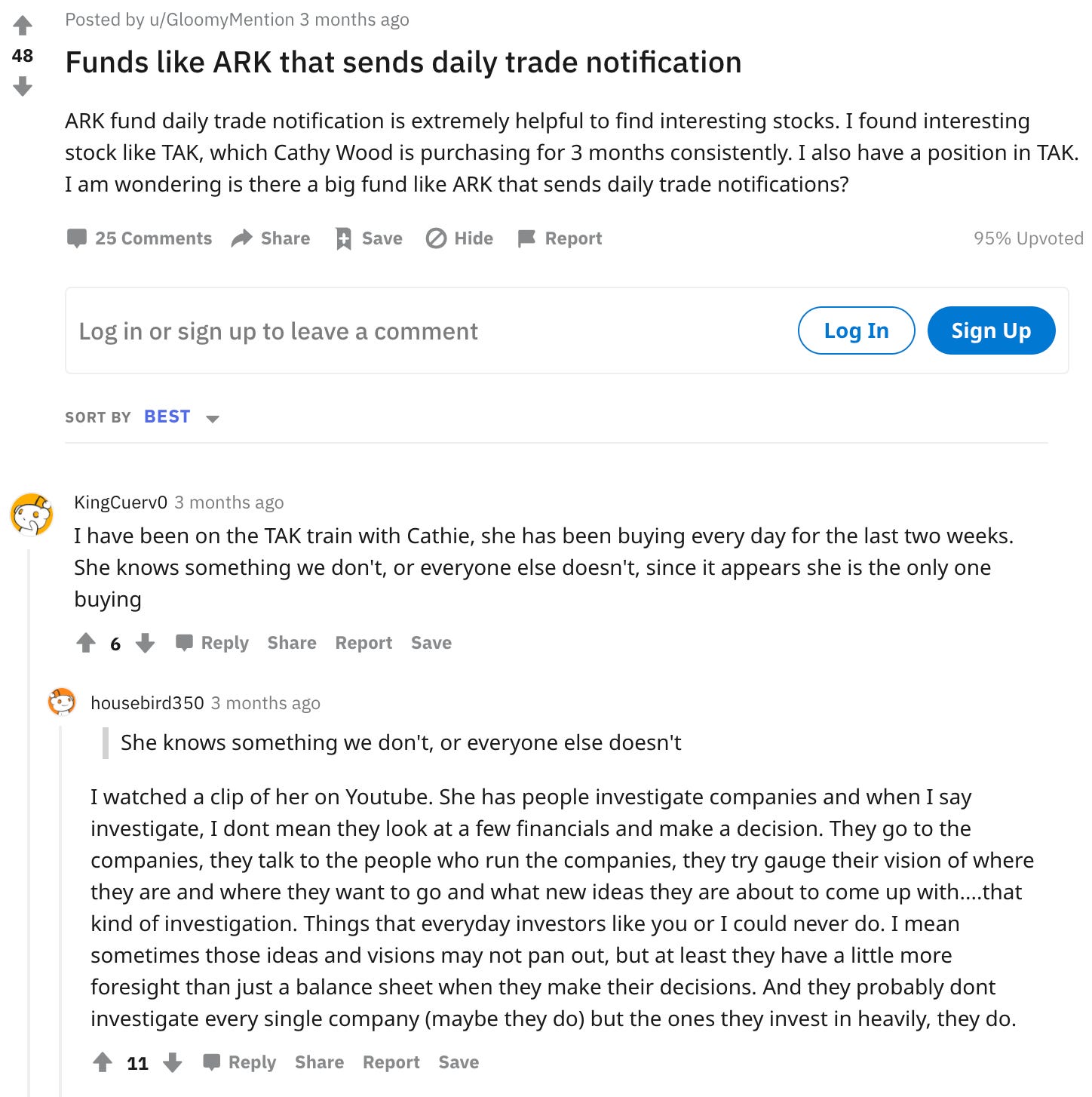

They have this video about their investment process, which honestly, makes me jealous at how corporate-y well done it is:  Again, the above three examples are all done very well but still feel fairly traditional in the realm of content. Where things get really interesting is how they've “open-sourced” their actual trades. Anyone can sign up on their website for intraday trade notifications: It’s brilliant. All the trades are right there. You can even download it to Excel. This has spawned an entire ecosystem. There are websites devoted to ARK daily trade activities. There are Twitter accounts. CNBC and Bloomberg regularly cover the trading activity. ....and just as importantly, this transparency helps drive conversation among retail traders: When I first learned about this, I was floored at how smart it was. While other firms go out of their way to hide their investments, ARK is an open book. This is also uniquely tailored to our current market environment. It’s effectively pushing a press release to the entire world every day. The financial media eats it up, while it dominates social media. They remain in the conversation every single day. That simple push of numerical information catalyzes an army of investors, all looking for guidance, affirmation, and just something to think about, to think about your stocks. Every day you manage to live, as the saying goes, rent-free in all of our heads. It's become pretty clear in the past decade there's a correlation between power and the space you occupy in our collective consciousness. This is even more applicable in financial markets (than, say, politics) as this kind of feedback loop can result more directly in a desirable outcome. Cathie Wood’s sole job is to get others to buy the stocks she owns, and with one email push, it’s magically done. Hacking the PressAnd it's certainly not just retail investors. "Tesla's stock will rise 350% by 2025, analyst predicts" That is the headline on a CNN article written by a Senior Business Writer. "Analyst predicts". Publishing a report saying Tesla could go to $3,000 is not a case of an "analyst predicting" something - it's an organization with a vested financial interest pushing a specific message. Nowhere does the CNN piece mention TSLA is the biggest holding in the ARK Innovation ETF. It takes a conventional journalistic effort at presenting 'both sides' of Tesla's valuation (insurance might or might not work! Robotaxis might or might not work!), yet leaves out that integral detail that a major Tesla shareholder is pushing a very aggressive valuation call at a time when there's a lot of stimulus money looking for a home and TSLA has hit a bit of a rough patch. And that headline is coming out on CNN, meaning it will trickle down to any number of other publications. We’re left with this simmering narrative that there is this $3000 price target is just "out there". It's not just CNN. Bloomberg did their own version:

A 'growing chorus of Wall Street professionals'. This is Wood's content genius on the PR side of content strategy. ARK even started building up the hype a few weeks ago like a Yeezy sneaker drop: ...and suddenly every newsroom is compelled to cover it, in some way. Hacking the NewsWhen you see how the traditional financial media reacts to this self-interested press release, which is also propelled by social media battles (both for and against), it made me think about how journalism professor Jay Rosen described Trump’s hacking of the press. Rosen’s insight was that Trump understood the news media always keep trying to adhere to some traditional code:

You see it in how the financial press covers this as a disinterested analyst simple analyzing and tries to cover that analysis in a detached, objective manner. It’s the way financial research has worked for years so why would this be any different? GatekeepersIn this whole weird tech vs. media thing, the term “gatekeeper” has been pejoratively thrown at journalists. As someone who is (checks notes) not a journalist, and (checks notes) even does a lot of PR work for a venture-funded tech company, I find it an odd insult. Journalists are supposed to be gatekeepers because there is something behind that gate worth keeping. Someone, somewhere has to be a check on something. That’s the whole point! Cathie Wood’s content strategy, and for that matter, any corporate communications effort, only works this effectively when the media relinquishes that role. Any good content strategy pushes your message out to drive specific outcomes. For any businessperson, of course, you’re going to want to bypass and/or co-opt the media because that means you’ll sell more widgets. ARK’s goal is even cleaner than most other businesses - it’s to get more people to buy the stocks they own. I can promise you, I'm not some virulently anti-Cathie Wood person. I wasn't even really familiar with the ARK story until the beginning of this year. As we’re indirectly talking about Tesla here, for full disclosure (Note 1), while I respect the Cathie Wood content strategy for its subtlety and originality, I don’t feel the same way about Elon Musk and his more brute force, Trumpian media-hacking style of content. But any regular reader will certainly know my greatest bugbear is the current distortion, and borderline absurdity, of the financial markets. It’s why the content strategist in me finds the way ARK does content so deviously brilliant, yet the person who lives in society and is trying to plan the next few decades of my financial future finds it utterly frustrating. But Cathie Wood is doing what Cathie Wood should do, and we should all just recognize it for what it is - a great content strategy. Pushing out daily trade notifications to drive the daily conversation towards your portfolio while an unquestioning press eats it up, all with a grandiose story about disruptive innovation is working really well. Hopefully, this will give my co-host Can a bit more context as to how I think about content. Note 1: For even more disclosure, I currently don’t have any financial interest either way with Tesla or any ARK holdings. There’s no real reason for me to tell you that as this is just a Substack newsletter, but hey, we want to treat you better than David Brooks treats his readers, and I still believe disclosure is important. If you liked this post from Margins by Ranjan Roy and Can Duruk, why not share it? |

Older messages

Bitcoin and Buying Things

Sunday, February 28, 2021

Here's to the risk managers, not the risk takers.

Game. Stop.

Thursday, February 18, 2021

It's not what you think.

Joke Capital

Thursday, February 18, 2021

GameStop Populism and the Desire for Narrative

Who Gets a Slice of Apple’s Pie?

Thursday, February 18, 2021

A Discussion of Tech Platform Antitrust

You Might Also Like

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The