Bouncing back from losing a big deal to an even bigger competitor

When I closed the transaction for Reconcile.ly, I felt like I had struck a very lucky deal considering the terms, the multiple I paid, and the multiple I could fetch today by selling the product. Soon after the purchase, my focus divided for the first time between MicroAngel scouting and actually having to start operating the product I had just acquired. While I’m learning to compose with a few interesting learnings, everything has mostly gone according to plan, and so far, the first month of pretty much holding Reconcile.ly has delivered against most goals:

I mostly did a few tweaks to the app listing, some support articles and added a really small feature. The rest of my time on it was spent on customer support and training with the seller. Fully expecting to hire someone off Upwork to help out with customer support as soon as I’m happy with my level of product and customer knowledge. At something like $6/hr, it’s money well-spent, especially if it’s where I spend 80% of my time in the portfolio. The rest of my weeks were spent working on Batch in pursuit of being featured by the Shopify App Store team. Happy to say it finally happened, and it triggered the launch of the product out of its beta. Unfortunately, my MicroAngel work suffered as I focused on developing my existing assets. I don’t regret it or wish it were any different. That is the very design of the fund: it’s secondary to the work that feels like play. And I got to play a lot over the last week or two. Though my first acquisition is now “stable,” it needed a little bit of love, and the time spent doing that additional to the focus on Batch meant I didn’t take nearly as many micro-acquisition meetings as in weeks prior. Despite this, some of the conversations I had over the last month began to show signs of progress. One deal in particular took nearly all of my attention. I’m going to release a Deal Review once it either closes or falls through. It’s something out of a fairy tale, to be honest. When I designed the fund’s model, I made an important assumption early on to protect myself: the odds I will find one perfect deal to cover all my bases are slim to none, and I ought to model around that limitation. Were I to field $500k in a single transaction yielding $15k MRR & having the ability to return 2x+ in 24 months, I’d likely be signing up to buy a popular product that would demand nearly all of my attention, both engineering-wise and support-wise. The odds of it being a super simple product are just as low. Super simple products tend to cap out because they’re simple. To get something to keep growing, you need to deliver constant value over time. You need to keep your current customers as well as new ones you bring on. If value delivery tops out, so does potential revenue, especially if the value topping out causes second—order consequences across conversion and retention metrics. You already know that churn, as some point, caps MRR growth. So something that has managed to grow beyond $10k MRR likely is producing consistent value for a considerable number of people. A considerable amount of people = support burden, any way you slice it. Once you hit a thousand paying users, you can’t escape the numbers: customers will be reaching out throughout the day. Being able to focus on a single product would be incredible, though. It’s just a question of how likely I’d ever be to land an amazing deal in the timeline and in my range. By focusing on only one or two products, I’d hedge the risk involved in holding 3-4+ products, which is quite a handful, and the safeguarded brainshare would benefit all my products. Instead, I designed the entire model around the idea that I’d buy several small, super simple products. Because they’re all small, they collectively don’t have big support burdens. If I accumulate them together, the eventual $15k MRR I perceive from the entire portfolio doesn’t come with the support baggage a single $15k MRR business would usually have. There is nearly perfect balance between the two options: as many benefits as there are inconveniences. I recognized that the odds were stronger for the multi-product scenario simply because I wasn’t confident I would find as many $15k MRR businesses that tick all of my criteria. Instead, I saw many, many $50k ARR businesses every day, and stitching them together seemed more and more viable with time. I’m not going to hide I’d much prefer holding a single strong asset since my number 1 goal is cash flow + time. More focus on a single thing is always better no matter how you look at it, and if there’s a version of this first fund that allows me to only hold 1-2 products instead of 4, I’d be remiss not to explore and try to materialize that option. Then, it started to happen. The week I closed Reconcile.ly, a new deal appeared on MicroAcquire that took me by storm. Exactly like my first deal, this one landed in my inbox late at night. The only reason I even saw it is because I was up coding for Batch. I don’t get to do those super late night sessions as much anymore, but being the father of a 3 year old + another in the making means much of my day to day goes to running the household. Sometimes, the only way I can get 4 hours of undisturbed work is to get started at 11pm. 💀 It’s expensive on my well-being and I can’t do those too often, so I’m lucky that the deal appeared as I was starting to close up shop on one of those nights. Unsurprisingly, a bunch of other friends also saw the deal come through and messaged me about it, as it is exactly the type of product I’m looking for, with solid revenue to boot. Took a look a the listing and confirmed the product is right up my alley. It’s the type of product I’d have built myself, and it’s an idea I had been thinking about for a few years, but just slightly outside my focus that it kept being pushed down my list of priorities. In fact, I had a feeling it was going to score really well on my investment criteria. I was really excited because it creates value doing something I’m an expert at. As usual, I added the deal to my watch list, sent a super simple message to the seller, and requested a phone/Zoom call to explore the opportunity together. I was pretty confused to receive a message minutes later, considering it was the middle of the night. That told me the seller probably wasn’t in North America. To my delight, I discovered the sellers were two Israeli serial-entrepreneurs with more than a decade in tech and a passion for the product category we were exploring. It’s rare for context alone to create a strong atmosphere of comfort and transparency between the buyer and the seller. I often rely on the fact I’m a super simple and human guy to talk to on a Zoom call to build a relaxed, open atmosphere. So even if my counterpart isn’t like that, the conversation still maintains an undertone of openness because I’m open and transparent about who I am, what I’m looking for, and what I’m trying to do. When both parties behave this way though, it creates intensely positive energy that feeds both the buyer and the seller and excites them about the future. More often than not, this energy creates good will that can lead to a successful transaction that would otherwise have stalled and disappeared right away or some time later down the line. I’m blessed to say I hit it off instantly with the sellers. We connected on a cultural, personal level. It’s as though we would have hit it off if we had just sat next to each other at a bar, or at a startup meetup. I might have even met them at startup meetup last I was in Tel Aviv, but the stars aligned for that to happen now, through the Internet. A connection was there from the moment the call began, and both parties visibly could feel this. If there’s something that really gets me going, it’s exactly this type of energy. That led to a hugely productive conversation. We got booted off Zoom after the time limit, and had to set up a second call “to finish up.” We ended up spending another hour talking to each other. In those two hours with the founders, we explored the origins of their friendship, their story, the product’s story, their aspirations, why they were listing to sell, and everything in between. Of course, I shared my own background, interests and aspirations too, and we snake-charmed each other by basically recognizing how similar our personal and career goals turned out to be. It was a conversation and both parties were getting to know each other. I might even call it speed dating at this point. Because I made it clear very early that I was serious about making an offer, we were able to clearly communicate what each other’s goals are and under what circumstances a great deal might come together. We closed the first call looking forward to reconnecting the next week, to give the merchants some time to process and think. Understandably, the seller was getting a lot of inbound interest, and needed to process through all of those, take meetings and then clarify the list of qualified buyers interested in their product. We booked to chat same time the next week. Couldn’t wipe the smile off my face all day after that call! It felt like I had made a truly valuable connection with these folks, and regardless of the deal, I was excited to develop that relationship into the future. I really wanted to work with them. The next week, things started to get interesting. I received a data package that made due diligence possible, so I was already off the the races to dig deep into the product and figure out if the opportunity was as good as it was smelling. A second, more important element was introduced that day. The sellers mentioned that among the sea of interested buyers, 2 large, public companies had come out of the woodwork with potentially game-ending offers. Let me just preface by saying that this deal was already going to be big. Big by Fund I’s standards. Mid six digits. The choice was whether to purchase this product and nothing else considering the cash position I’d need to field to secure the acquisition (i.e. the rest of the fund). I huddled with the sellers and they requested a few extra days to mull their options. It made perfect sense: why even keep talking if a multi-million dollar offer was going to come together? Of course, that wiped the grin right off my face. I wasn’t happy with the idea of being outbid. But it was largely out of my hands, and not something I could ever really defend or hedge against. But as we’ve learned, it’s not over until the Fat Lady sings. You just need to keep playing your cards and make deliberate moves that inch you closer to a state of success. You miss every shot you don’t take and all that jazz. Three days later, we reconnected and the dominos started to fall in the wrong direction. They transparently shared that one of the two companies had withdrawn their interest, but that the other was getting ready to send them an offer to acquihire the company. An acquihire sucks 99% of the time in my books. Unless you’re trying to earn your stripes, learn something new, or take up a cushy 9-5 job while your vest some shares, it makes little sense to sell your company to someone and join it. At the micro-acquisition level, that locks you up for a long time for very little benefit. It could work out if the revenue share is interesting or if you’re vesting some equity during the 2-4 years following the acquisition. A few friends sold their companies to Shopify ($SHOP) before the share price reached its current levels. They are incredibly happy with their decision:

It can make sense if the company’s huge, but most micro-acquisitions will fall through if an acquihire is even mentioned. It just doesn’t make sense. Despite this, the competing buyer was showing a lot of interest in hiring the sellers. I didn’t have enough intelligence on the buyer to really qualify how likely this was really going to happen. But because this was an acquihire — and public companies don’t tend to be all-remote — I had an inkling that the buyer was probably headquartered in Tel Aviv with a personal relationship with the sellers. That really broke my legs because that’s not really something you can defend against either. There’s nothing like a warm introduction. That will instantly traverse through any blockers. Pair that with a handsome offer and, well, you’re not even in the game anymore. At first, of course, I was disappointed. It had been a few weeks now talking with the sellers, and the relationship had already started to blossom in a direction that was really promising. I hadn’t developed many more deals from there mostly because I hadn’t put in any work in outbound, and inbound deals had mostly been disqualified, or were longer-term plays on my watch list. More importantly, this was a truly must-take deal. I don’t tend to make emotional decisions, but my very being was yelling at me to move fast and secure the deal. I couldn’t get excited about anything else with this kind of transaction in jeorpardy. I was determined to keep pushing and discover a few things:

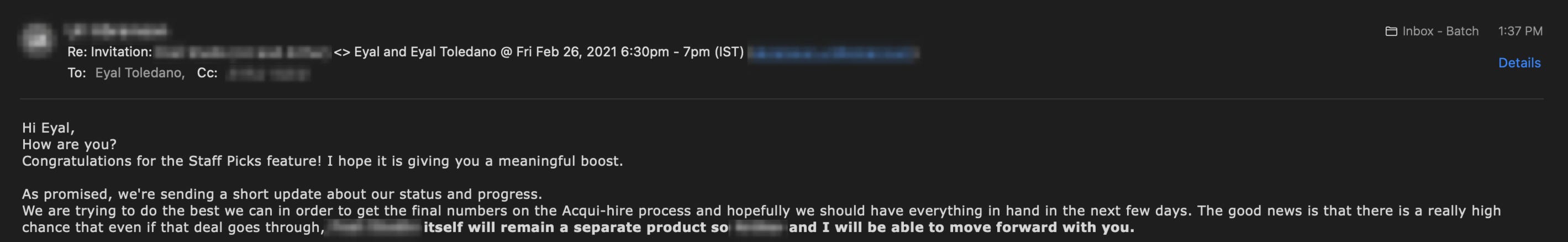

Because we had created some good faith with each other, the seller’s openly remarked that they wanted to sell the product to nobody else but me, but that their hands would naturally be tied in the event a large offer came through from the other buyer. They wanted to explore revenue-share and/or a percentage of proceeds at exit so they’d have a vested interest to keep in touch and keep helping out. That became the basis of our terms in the event we could move forward. That’s something I’m always happy to explore, and we settled on regrouping in a few days to confirm whether buying the product was still on the table considering the other elements at play. Because the success rate of the transaction had plummeted, I made the difficult choice to inform the sellers I was unofficially withdrawing from the deal because the future was too uncertain, and I need to field my funds ASAP. I had already stalled most of my angel work for this deal, and I couldn’t justify doing more of that without some level of certainty that there was still a deal to be made. For that reason, we agreed to keep in touch with each other as new information became available. Specifically, they’d let me know if the acquirer wasn’t interested in the product, which would mean the deal was back on the table. I explained, of course, that there was a decent chance I’d have made other investments with those funds by then, and the sellers understood where I was coming from. All cards laid out on the table. No reason to play poker. Then, just this afternoon, this landed in my inbox: Not celebrating yet, but that’s certainly a step in the right direction! I’m confident I’m the only other horse in the race, and even if any other potential buyer were to show up now, it’d be too late relative the strength of my offer and relationship with the seller. The next step is to receive a confirmation that the deal is back on the table, at which point I’ll formalize my offer in an LOI, go through full due diligence quickly, and hopefully materialize this home run within 30 days. If I manage to succeed in securing this deal, MicroAngel Fund I will be comprised of only two products, and will be delivering on its growth targets right away. Mission 1 will be done and complete. Most importantly, the product in question has real potential for a multimillion dollar outcome — as may be the case for today’s sellers, for all I know. It has reached a point of adoption that calls for the creation of a brand. It’s not micro-acquisition work anymore because there’s potential to create a real category winner out of what already exists, and that expands the potential returns of the fund beyond what I originally planned for. I’m so excited by this deal that I’ve got the jitters. It would be an amazing fit for me as an entrepreneur and would shatter my long term goals as a microangel. Look forward to the rest of the story as it develops! Can’t wait to bring you along for the ride. As I may be transitioning out of the Buying stage of my fund’s lifecycle, I’d love to know what kind of content/stories you’d like to keep reading on microangel.so. I’d love to do short podcast episodes and share them with the newsletter. Hit reply and let me know what you’d like to read! If this was a good read, go ahead and share it with a friend. You’re on the free list for Micro Angel. For the full experience, become a paying subscriber. |

Older messages

My micro-acquisition process from first-touch to close & asset transfer — Part 1

Wednesday, March 31, 2021

How to execute a lean micro-angel acquisition process that is fast, efficient and scalable

You Might Also Like

BSSA #116 - Outsourcing to scale 🚀

Tuesday, March 4, 2025

March 04, 2025 | Read Online Hello everyone! The Wide Event is almost sold out. More than 90% of the tickets have been booked. If you're one of the people waiting until the last minute to purchase,

🔥 The secret factories big brands don’t want you to know 👗👖

Tuesday, March 4, 2025

The best fashion suppliers don't advertise—here's how to find them. Hey Friend , If you've ever struggled to find high-quality fashion manufacturers, there's a reason: The best

Making Wayves

Tuesday, March 4, 2025

+ Girls just wanna have funding; e-bike turf war View in browser Powered by ViennaUP Author-Martin by Martin Coulter Good morning there, Since 2021, VC firm Future Planet Capital (FPC) has secured more

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏