A look at MoneyMade: A new investment platform

New alt investment platforms to explore Welcome to Alternative Assets. You are receiving this because you are subscribed to our General newsletter. To change your settings, scroll down to Subscription Options. We hope you enjoyed last week's issue on Investing in Sneakers. Welcome to the 331 new subscribers who've joined since then. Today we dive into a new exciting alternative investment platform: MoneyMade. But first... We've had a very exciting week here at Alternative Assets. There is TONS going on right now. A recap of our big week:

Whew! So much happening, and so much to explore. Set your preferences to let us know what to update you on. We’ll only send updates for categories you follow. Okay, now let's dive in...! What is MoneyMade?Okay, so as we all know, there are a plethora of investment opportunities out there right now. With so many options across so many categories, making sense of this brave new world can be a challenge. Enter MoneyMade. MoneyMade.io is a new management platform that helps you find, compare, and manage investment opportunities. Founded by Richard McBeath and Denys Kravchenko in 2020, MoneyMade began as a transparent, simple way to discover investments. (Full Disclosure: MoneyMade is an Alternative Assets sponsor. However, this article was independently written & reviewed. We were not paid to write this article, all opinions are those of the author.) HistoryI first discovered them last year, when they were the #1 Product of the Day on ProductHunt. To me, it felt like a gigantic investment database that didn't feel like a database. With features like unbiased user reviews and some social conversation, MoneyMade was like a spreadsheet on steroids, with a user-friendly veneer, and without pushy affiliate links. Last September, they launched a community, where members could ask questions and share their experiences using various platforms. (I remember I got some great feedback about the FarmTogether platform, which we later highlighted in our issue on Investing in Farmland). Through MoneyMade I've probably discovered at least a dozen new platforms that I'd never heard of before. As MoneyMade has grown, they've added what seems like hundreds of companies to their database. In fact they are now at 159 companies and counting, across a wide variety of categories, including stocks, real estate, collectibles, artwork, farmland, loans, crypto, and much, much more. Site Design & UXSince last year, the team has been hard at work completely redesigning their website. And the new design looks awesome. Upon hitting the site, you're met with a delicious blue & white color scheme. Within seconds it's apparent this is a serious investment website with a breadth of options. Page loading was a bit clunky for me. The company logos on the homepage took nearly a full minute to fully load, and transitioning between pages was not as smooth as the sleek interface implies. But the overall design feels silky smooth, terminology is easy to understand, and 24/7 help is just a click away. Profile & Investor QuizOne cool feature that immediately sticks out to me is the investor quiz. MoneyMade asks simple questions, such as whether you want a balanced portfolio, and what level of risk you’re willing to take. To receive your results, you'll need to create an account, which is a small ask for what they give you in return — a personalized profile with tailored recommendations and platform investment suggestions. Each suggestion has a well-written ‘details’ section which divulges what it is you’re investing in on this platform, outlines the risks, how you make money, and how the platform itself makes money — which is something I found particularly interesting, as not all business models are immediately obvious (take Robinhood, for example.) If you want to take your due diligence a bit further than a basic summary, certain platforms (such as Public.com) have ‘deep-dive’ reviews, which go into pros and cons and attempts to paint an unbiased picture of who the platform will suit. But the real "money feature" is their new dashboard. Sponsored

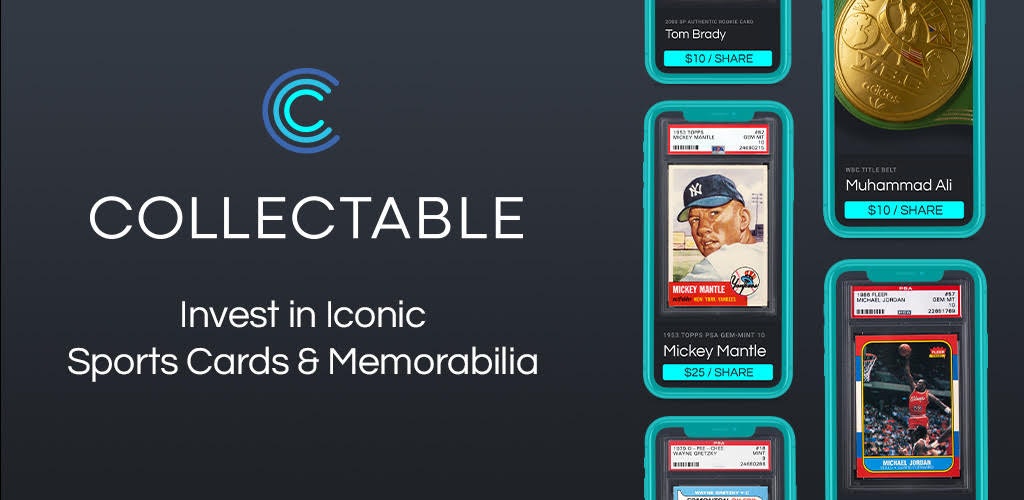

Collectable exits so far: 75.0% ROI in 3 months for 139 investors... 2009 Signed Steph Curry Rookie Cards Basket

104.5% ROI in 3.5 months for 152 investors... 1980 Magic Johnson, Larry Bird & Dr. J Scoring Leader PSA 10

35.2% ROI in 1.5 months for 196 investors... 2017 Patrick Mahomes Panini Flawless Emerald Rookie Patch Auto -

Since January 2008, high value sports cards have outperformed the S&P 500 by 81% (source: PWCC). Join over 20,000 investors and invest from just $1 per share in some of the most rare and exciting sports collectibles in the world! Please review risks and disclosures in our offering circular, and at collectable.com. MoneyMade's Investment Tracking DashboardFor months, the team has been working on a brand new product offering. They've been teasing users with promises of great things to come, and encouraging everyone to sign up for the beta. Just last month, they announced the wait is over, and their investment tracking dashboard is now live and in beta! The problem they're trying to solve is simple: With so many investments spread across so many different platforms, the space beckons for a unified hub to manage them all. This problem is an obvious one, and it is definitely worth solving. "But wait, aren't there other investment management platforms that already do this?" Yes, but there's a key difference: While existing investment tracking platforms simply integrate with Plaid or other solutions that allow you to connect your bank/brokerage accounts, MoneyMade lets you connect to platforms directly. This means that, in theory, you can track all of your investments across all platforms, apps, and asset classes, and see everything in one place. No more managing assets across a million different platforms. Just connect your existing accounts from dozens of investment platforms, and track them from a single dashboard. Trading accounts, crypto, real estate, art, collectables, gold and more - the idea is that you can now track all of your investments through one single hub. Remember that APIs are a two-way street: Each platform first needs to provide an API, then MoneyMade needs permission to tap into it. Users can connect many accounts, but there are still many others that need manual entry. This is a frustrating but understandable blocker. With 150+ companies in the database, it will surely take some time for MoneyMade to work with each platform's API — if one even exists yet. (In many cases they don't). A fully automated dashboard is the dream, and MoneyMade has been hard at work to make this happen, but a little "nudge" from their users will push this process along much quicker. The good news is that they have spent months creating a unified API that all platforms can easily plug into, which should make future integrations much easier for companies. MoneyMade is hyper-focused on onboarding new platforms, and plan on announcing new integrations weekly. (Customers will have their balances and transactions automatically synced with their MoneyMade portfolio.) In the meantime, this is where the "poke" feature comes into play. Platforms will always listen to their users, so MoneyMade is encouraging people to encourage these platforms to work with MoneyMade and speed things up. I must say, it's a very clever approach, but only time will tell how effective it will be. Performance and Projected ReturnsMoneyMade's goal is to not only be a place to discover and manage investments, but to track them as well. They've started down this path by giving insights on your investments and portfolio, including allocations, performance comparisons and more. Furthermore, they have also launched a cool projected returns and fee calculator for each platform. This helpful feature allows users to get a good sense of how much they'll invest over X amount of years, and, if the platform charges a fee, how much they'll pay. iOS & Android AppTo really round out the experience (and help with customer acquisition), MoneyMade has recently launched a new app for iOS and Android. This app is hot off the presses. Launched just 2 weeks ago, MoneyMade got it into the App Store & Google Play early in order to get feedback. However, it may have been just a tad early. Compared to the slick desktop site, I was a bit taken back by the iOS app. The design isn't as nice, there are some exposed HTML tags, and it's missing some of the well-established movement interactions, (such as swipe to go back, etc.) Frustratingly, while the Dashboard menu option is shown in the app, it's not actually ready yet. Users are shown a "Coming Soon" with a tease of how it will look. (Per a company spokesman, the dashboard feature will be available in about 2-3 weeks). The app mostly does the job, and is definitely a helpful addition to the MoneyMade experience. But it could use some tightening up before it's ready for prime-time. The Future of MoneyMadeI really love what MoneyMade is doing. The idea is clearly a winner, their database is extensive, they have a solid community, and the site is professionally designed & easy to navigate. The founders have clearly put their heart and soul into building a killer investment management platform, and it shows. Their flagship Investment Management Dashboard is still in beta, so I expect improvements to come. But while this dashboard is well ahead of its time, I think they have a big challenge here in turning this into the end-all-be-all investment hub we all want. The "poking" feature is certainly smart and well-executed, but attempting to coax hundreds of independent platforms to build a connection to MoneyMade's by creating a "mutiny" is a tall order. I'm rooting for them, but it will be tricky and take quite a bit of time! They have some pretty cool features planned:

In the meantime, the site offers tons of value for both casual and serious investors. You can already connect to two dozen platforms without hassle, with more coming each week. They also let users connect to other investment accounts such 401k, retirement, bank accounts not listed on MoneyMade. So the true number of accounts is well over 1,000. So get cracking! Sign up today, connect your accounts, and most importantly keep your eyes peeled for great things in the future. (What might the future hold? Who knows. But if a unified dashboard for management is the dream, a unified dashboard for full active management is like, the dream within the dream.)

SponsoredWant to supercharge a website before you start building? ODYS is a fantastic new way to kickstart the site of your dreams with an aged, brandable domain that’s relevant and full of link juice. These aren’t just premium domains, they come with a backlink profile that can boost your site for years. Think of it like building a house: Instead of starting from scratch, you can build on top of an existing strong foundation. NEW: ODYS has launched a new dashboard! To celebrate, they're giving away $500 to all existing and new members throughout March. Funds expire April 1st. If you were thinking of buying a domain, now's the time! Save years of building authority with ODYS. Your referral code is Alternative Assets. Other news.crypto domain names now available.crypto domains are now available at Unstoppable Domains. The idea behind this is really cool — instead of sending funds to your crypto wallet, users can send crypto directly to your "domain." And you own the domain forever. One of Flippa's co-founders (Matt Mickiewicz) just joined their board of directors. Very cool company to watch. Claim your .crypto domain now! Comparing luxury investmentsVisual Capitalist has created an infographic of a Knight Frank survey to understand the state of 10 of the more common luxury alternative investing categories. A few notes:

Beeple sells NFT art for $69 million...However, digital art is catching up fast! In the biggest news of the week, digital artist Beeple is the new king of the crypto-art boom, with his sale of Everydays: The First 5000 Days on March 11th. The Christie's auction closed with a bid of over $69 million, making him the third-most-valuable living artist in the entire world (!) Wow.

Yeah, that's for sure. This reaction video from Beeple himself says it all: Follow the NFTs topic to get the latest on new NFT drops. That’s it for this issue! See you next time, – Stefan & Wyatt Work with us!As discussed above, we now have 13 alternative asset classes covered, but are looking to add more. We are currently seeking experts in wine & whisky, fine artwork, and domains. If you have a relevant background and want to join an awesome team, let us know. SponsorshipInterested in sponsoring Alternative Assets? Let’s chat. Each issue of Alternative Assets receives over 2,200 impressions. Due to high demand we've added a third ad slot. Three ad units are now available per issue. Subscription OptionsStart your free trial of Insider.Deep research and unparalleled insights, now on thirteen alternative investment classes. Unlimited insight for less than $9 per week. Can I get a sneak peek without starting a free trial?Yup. Just set your preferences. We’ll send basic updates for each asset you follow. Remember only Insiders get the full scoop. Full deal analysis. Asset valuations. Benchmarks. Trends. Outlooks & risks. Scores and recommendations. Unfollow General NewsletterThis will remove you from the General newsletter. You'll continue to receive updates on other asset categories you follow. Follow Other CategoriesSet your preferences to receive updates on other categories. You can follow as many as you'd like. |

Older messages

Exploring SDIRAs with AltoIRA

Wednesday, March 31, 2021

Understanding the Self-Directed IRA and how it works Welcome to Alternative Assets. You are receiving this because you are subscribed to our General newsletter. To change your settings, scroll down

You Might Also Like

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last Trader Standing

Friday, February 28, 2025

The Evolution of FX Markets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

My secret 15-minute video sharing my triple digit options strategy

Friday, February 28, 2025

Free training + book ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👋 Bye bye, bitcoin

Thursday, February 27, 2025

Bitcoin's biggest one-day blow, Trump's latest tariff threat, and robots playing soccer | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 28th in 3:12 minutes.

Don't Overlook this Sector Billionaires are Quietly Investing In

Thursday, February 27, 2025

The Billionaires' Energy Secret (You Can Get In) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏