On-Chain Metrics Explain The Bitcoin Price Dip

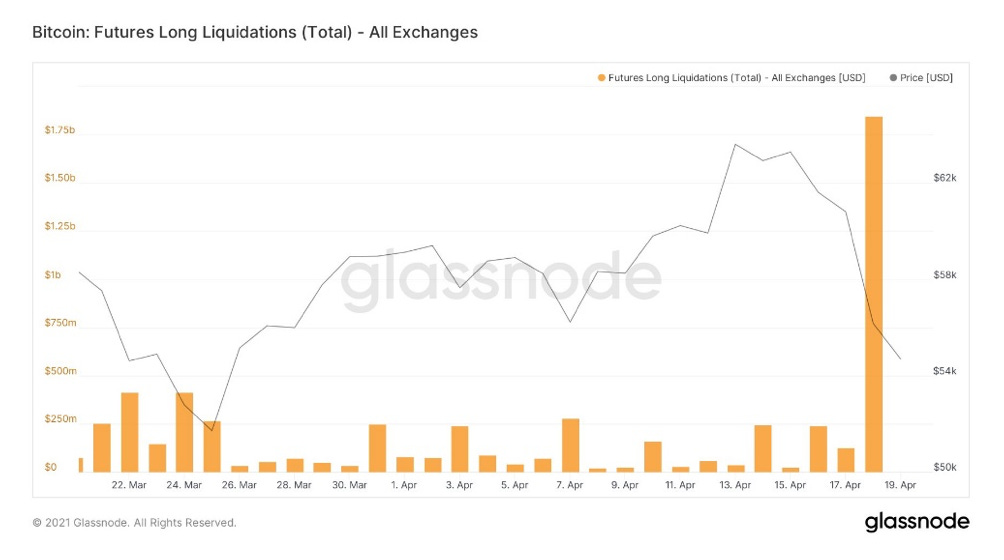

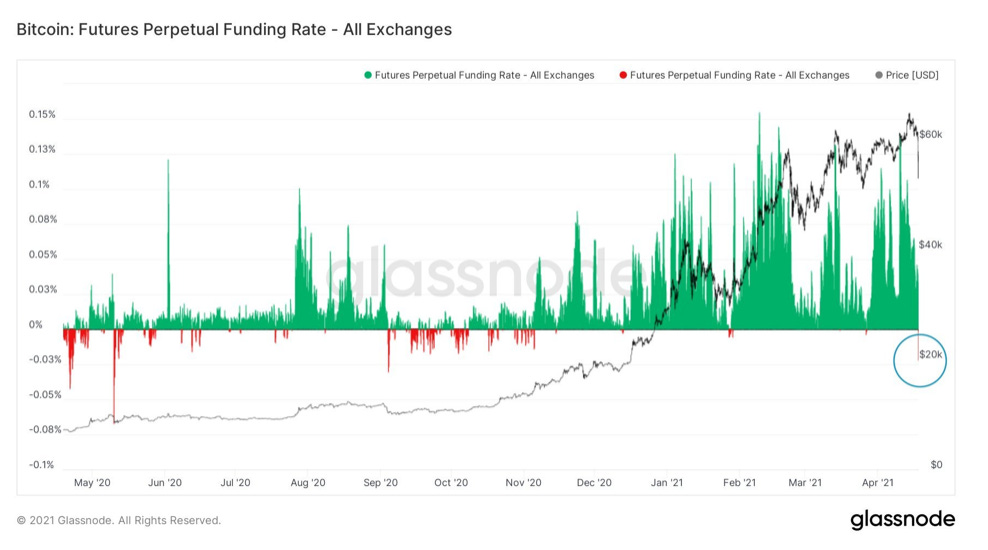

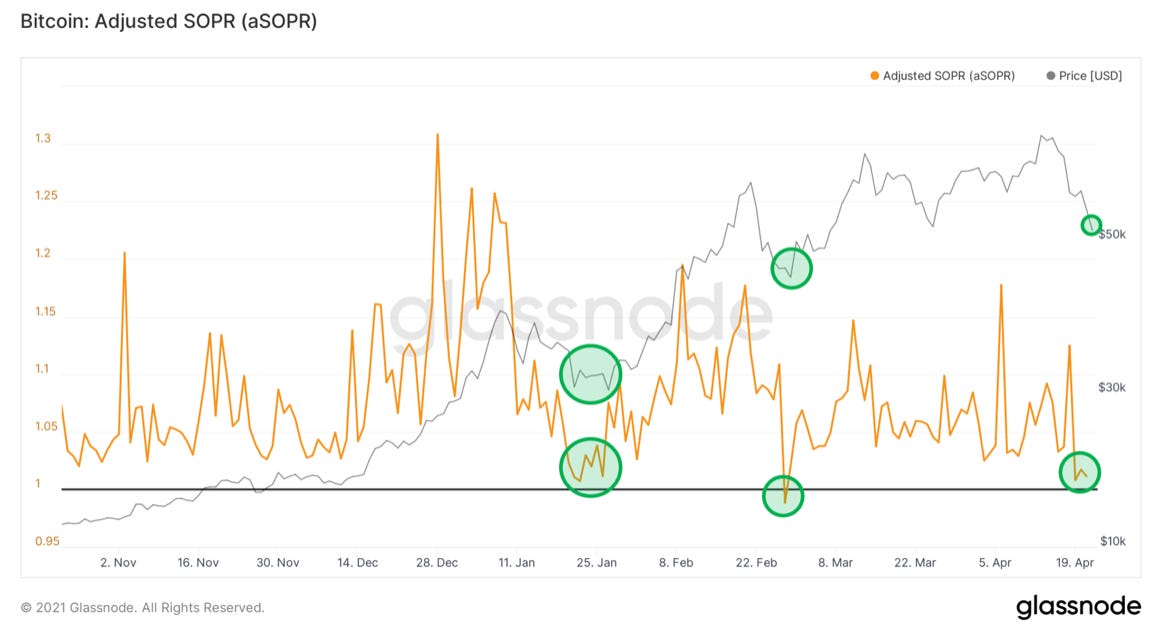

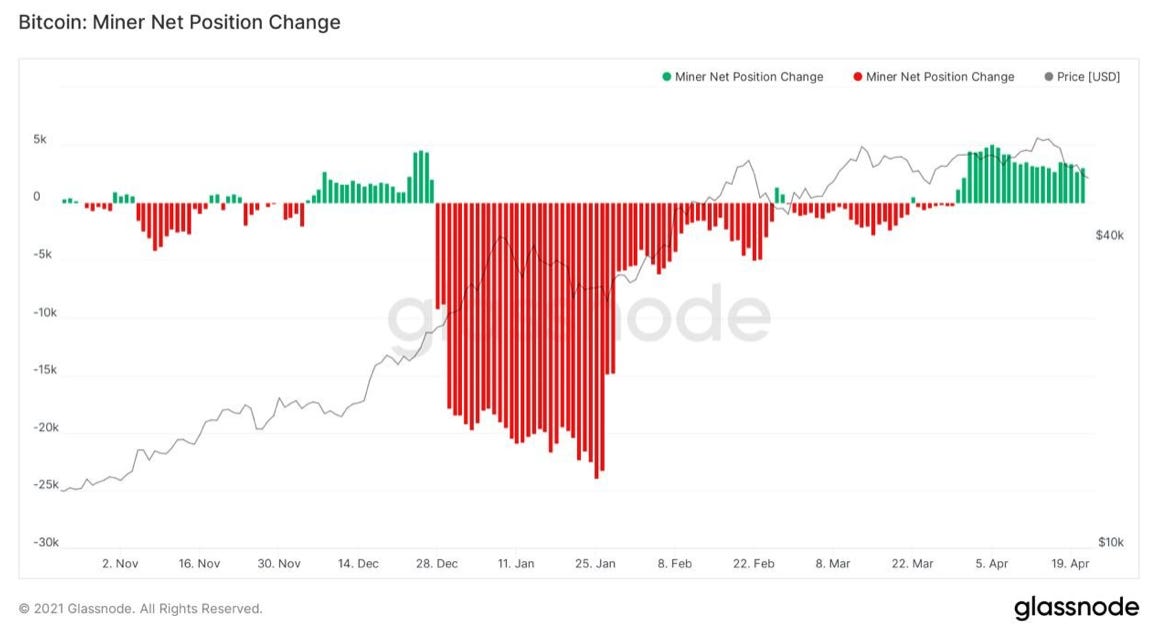

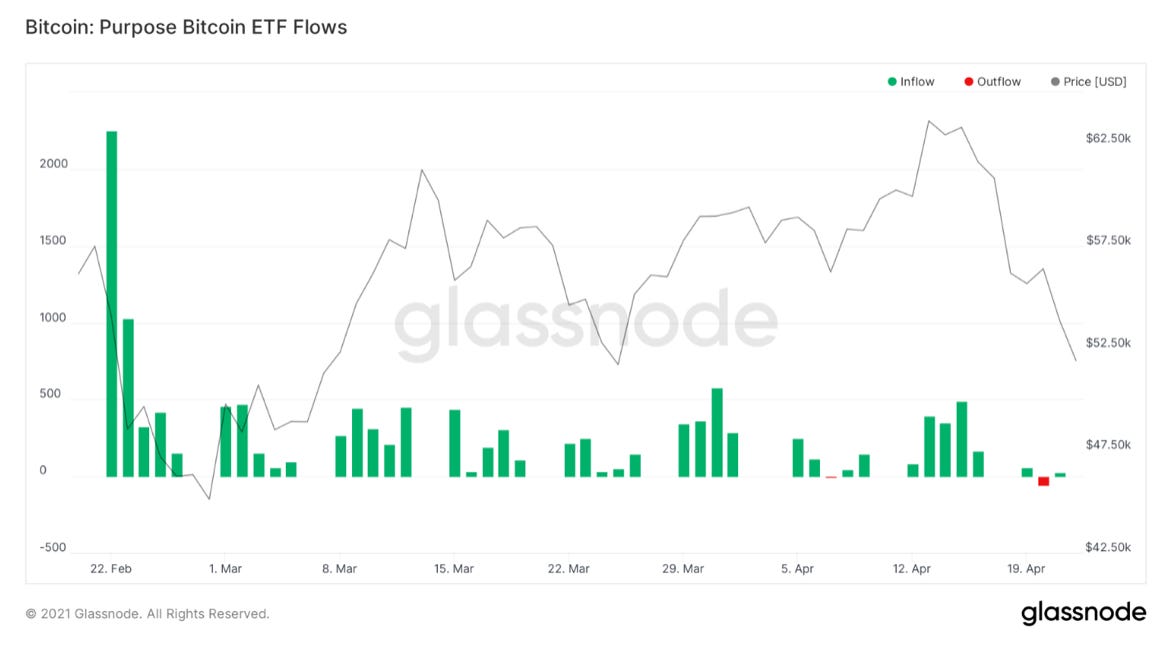

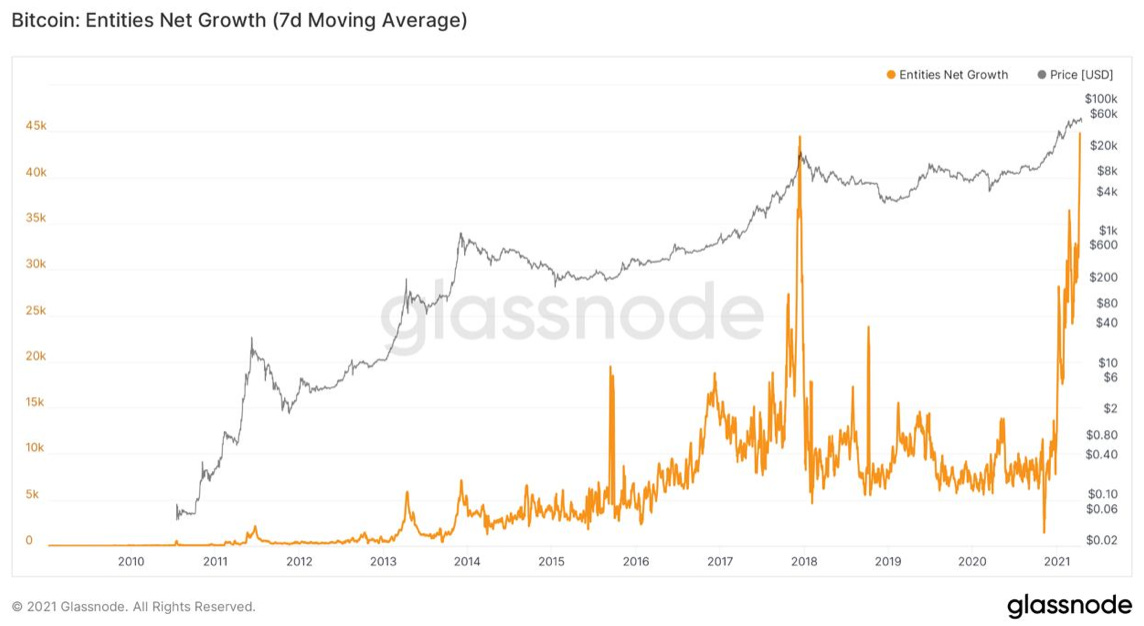

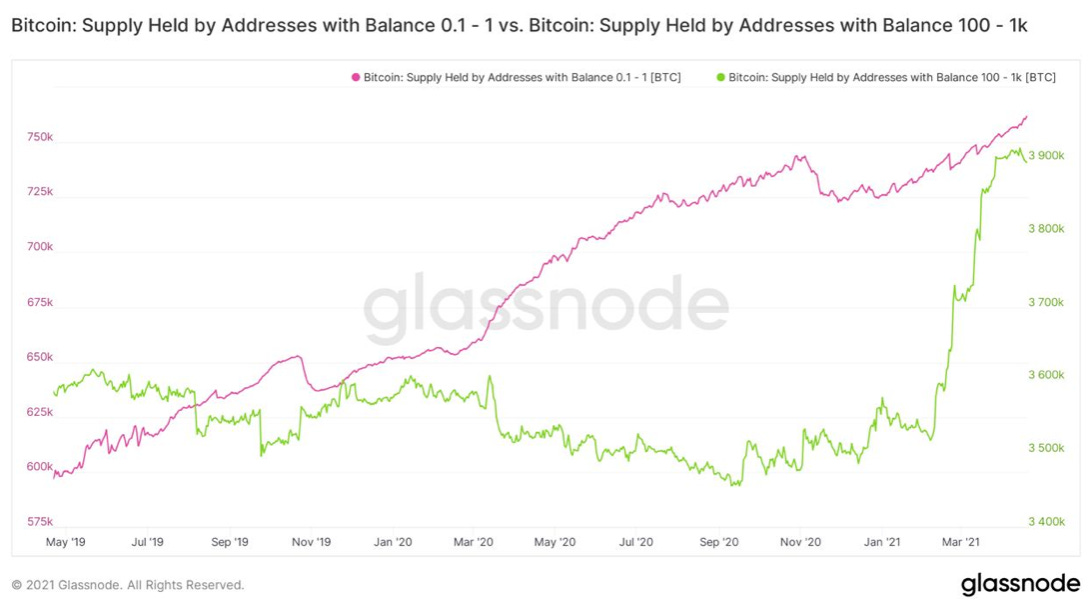

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 160,000 other investors today. To investors, Below is the weekly on-chain metric analysis from Will Clemente of Bitcoin Magazine Research. Hope all is well, and happy Friday! At the time of writing, Bitcoin’s price sits at $52,200 after a choppy week, price is currently down 18.63% in the last 7 days. This letter will recap the events of last weekend’s rapid price drop, try to estimate where we are in the current price correction, and some other interesting on-chain metrics. Let’s dive into some of the latest developments seen on-chain. Last Weekend Over the weekend Bitcoin saw one of its largest days of long liquidations in history, with data provider Glassnode reporting $1,847,700,724 of longs being liquidated throughout the event. The catalyst/cause of these liquidations can’t be known for certain, but several on-chain analysts such as Willy Woo suspect the catalyst was 9,000 BTC that were moved onto Binance, an exchange used primarily in Asia. Nonetheless, the massive leverage that been in the Bitcoin derivates markets was wiped out and caused the rapid price decline. On Binance quarterly futures contracts, price fell as far as $35,000 during the event. To put the event into perspective, this number of liquidations dwarfed that of the March price crash last year, when price fell roughly 50% in a single day. Over 1 million trader accounts were liquidated in total. There was some silver lining to this event, greed and leverage was flushed out. In addition to the liquidations, this can be illustrated by funding rates. To peg the perpetual swap contract to Bitcoin spot price, funding rates are used. When majority of traders go long, it becomes profitable to go short, and vice versa. During the event, funding rates flipped negative, meaning it became profitable for traders to take the long side of the trade. This has shown to be a buy signal in the previous two times this happened during this bull market. Another indicator suggesting we have either reached, or are very close to reaching, the bottom of this correction is SOPR. SOPR (Spent Output Profit Ratio) measures the net profit/loss of the market, it is relatively rare to see the aggregate of market participants to take losses in a bull market except during significant corrections. During these corrections, you will see the metric reset to 1(black line), indicating that participants are neither in profit/loss, but rarely reset below 1, indicating that participants have realized a net loss in aggregate. However, as the bull market goes on, it is increasingly likely that SOPR dips fully below 1, especially as unconvicted retail arrives who have tendency to panic sell. Any dips below 1 have historically been great buy opportunties. In January’s correction SOPR reset to just above 1 and in February’s correction SOPR did a full reset below 1. Currently, SOPR is approaching the full reset mark, meaning price has either reached, or is very closing to reaching, the bottom of the current correction. Price action aside, another interesting development on-chain is the continuation of miners accumulating. This can be illustrated by Glassnode’s “Miner Net Position Change” metric. Accumulation from miners has clearly become a trend over the last few weeks. This indicates two things: miners are expecting higher prices to come and are reluctant to sell their stack now, and also the fact that they are able to cover their CAPEX without having to dump coins onto the market. Throughout the 2016/2017 bull market, miners consistently sold. This is a key differentiating factor between that cycle and the current one, possibly made possible by newly matured Bitcon borrowing/lending platforms. This allows miners to borrow against their holdings while generating fiat to cover their cost to maintain operations. Another interesting trend is Canada’s Purpose Bitcoin ETF. This ETF has already reached over 1 billion dollars in assets under management in just two months. Not only that, but they have only had two days of outflow total, both of which were insignificant. This is great to see as there is clearly demand for new on-ramps to take on Bitcoin exposure via ETF and leads one to think the magnitude of the flows a US-based fund would generate. With several major ETF applications on the SEC’s desk, it’s only a matter of time. Finally, I’d like to introduce entities net growth. Anyone bearish on Bitcoin is not taking this into account. There are currently over 50,000 new entities a day coming onto the blockchain, we are in the “hockey stick” adoption curve phase of the cycle. This is great for the Bitcoin network as there is a tremendous amount of new individuals, corporate treasuries, investment funds, etc. that are all onboarding to the Bitcoin monetary network. To support this, let’s take a look at the chart below visualizing wallets with different size of Bitcoin holdings. The pink line, addresses with 0.1-1 BTC, have accumulated steadily throughout the last few years. However, the green line, addresses with balances of 100-1,000 BTC, have gone parabolic throughout 2021. These wallets are indicative of high-net-worth individuals and new institutions coming onto the blockchain and taking significant positions. In conclusion, we are approaching a bottom in the short-mid-term for this current correction and are just waiting for profit taking to reset and a general shift of coins from weak to strong hands. The exact timeline for this is never predictable, but we as macro cycle indicators show, we are far from the top. Many indicators are resetting currently, therefore whenever this period of consolidation is over, there is a lot of room for price to run upwards. As always, these on-chain trends can change quickly, and will be monitored throughout the coming week until next Friday. Hope you enjoyed this week’s letter, looking forward to being in touch next week. HODL on, cheers! You can follow Will Clemente on Twitter by clicking here. Do you want to work in the Bitcoin and crypto industry? Do you run a business that has open roles to fill? I recently launched the industry-leading job board focused on our industry. We have hundreds of open roles at companies like Coinbase, Gemini, BlockFi, and many others. Get a Job or Post a Job here: http://www.pompcryptojobs.com Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber. |

Older messages

Bitcoin: Origins And Cultural Significance

Tuesday, April 20, 2021

Listen now (10 min) | The birth of Bitcoin marked a paradigm shift in the finance world — with philosophical, technological, and economic implications that continue to expand.

Special Message From Pomp 🙏🏽

Monday, April 5, 2021

Hey! What a wild ride bitcoin bull markets are. Thanks for being a free subscriber to The Pomp Letter. Hopefully this has helped you understand what is currently transpiring across assets and markets.

A Fighting Chance Is All You Can Ask For

Wednesday, March 31, 2021

Listen now (5 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 150000 other

The Education Behind Elon Musk's Children

Wednesday, March 24, 2021

Listen now (2 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 145000 other

Bitcoin's Information Insurgency

Friday, March 19, 2021

Listen now (7 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 140000 other

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these