Accelerated - 🚀 Who paid a $5M Bitcoin ransom?

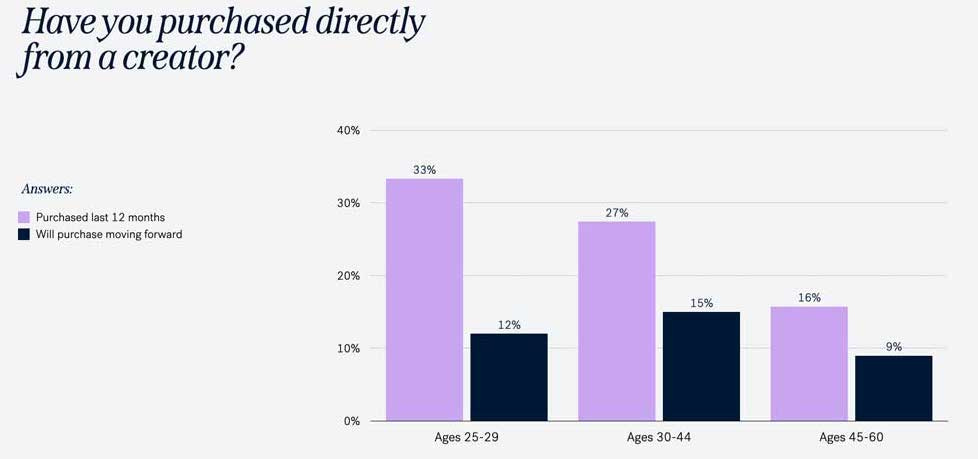

Forerunner Ventures released an interesting new report this week on how COVID has changed consumer behavior and attitudes. After surveying 1,000 consumers age 25+, the team outlined some of the trends that may persist in a post-COVID world. Check out the full report here - we’ve summarized some of the results below:

news 📣⛽ Colonial Pipeline pays ransom in BTC. Notice gas prices soaring this week? A ransomware attack that shut down Colonial Pipeline (the largest refined products pipeline in the U.S.) was to blame. The hacking group DarkSide was reportedly responsible - Colonial Pipeline paid $5M in Bitcoin to recover its stolen data and resume operations of its network. DarkSide, which has received $17.5M in Bitcoin ransoms thus far this year, now claims that it’s shutting down after being targeted by the U.S. government. 💰 Vitalik donates to COVID relief. Ethereum co-founder Vitalik Buterin donated over $1B to the India Covid Relief Fund and other charities. His donation came in the form of several dog-themed meme coins (e.g. SHIB, AKITA) that he had been gifted from the coins’ creators. Buterin, who is 27, became the youngest known crypto billionaire this month after the price of Ethereum surged. In other crypto news, Tesla will no longer accept payments in Bitcoin due to environmental concerns. Elon Musk tweeted that he is working with the creators of Dogecoin to “improve system transaction efficiency" as a potential alternative. 🛴 Bird preps for public debut. E-mobility startup Bird (a CRV portfolio company) will be going public via SPAC at a $2.3B valuation. The pandemic hit e-scooters hard - Bird’s revenue fell 37% last year to $95M. However, the company’s pivot to a fleet manager model (where individuals earn money by managing 100+ scooters) notably improved the unit economics. Consumer demand is also beginning to bounce back, with 81% growth in gross transaction value over the past four weeks. 📊 Earnings updates. It was an exciting week for consumer tech earnings:

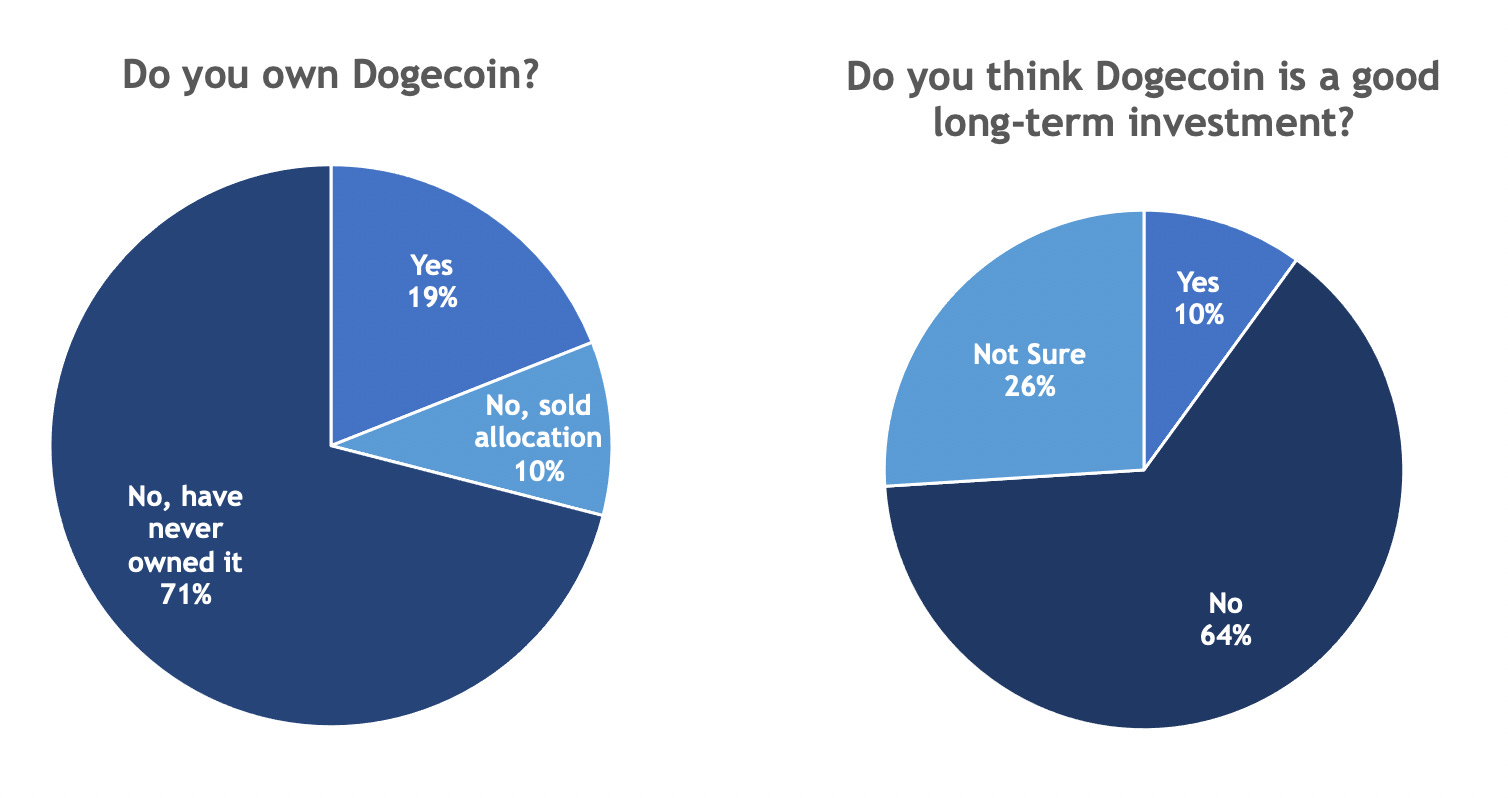

As huge Sweetgreen fans (we’ve even been to the company’s test kitchen!), we were excited to see that one of our favorite salad chains is reportedly preparing to IPO. Sweetgreen was founded in 2007 and has raised a total of $671M, according to Pitchbook. The company has started expanding its product line to appeal to salad skeptics like Ron Swanson, with the launch of grain bowls in 2016 and Plates last year. Pre-COVID, Sweetgreen was so popular among office workers that the company was testing free delivery to "Outposts” at corporate buildings. Sweetgreen even acquired a meal delivery startup in 2019. We’re interested to learn how the business fared during COVID - we’re guessing order volume shifted to delivery platforms like DoorDash. what we’re following 👀Meet Jennifer Daniels, the new head of the committee that picks which emojis we get. Packy McCormick explains how we’re all playing the Great Online Game. The Thiel Fellowship pays students to drop out - what’s its track record? Casey Caruso on juggling a Google role and a VC gig at Bessemer at the same time. Card issuing platform Marqeta filed to go public this week. We’ll cover the business in-depth when it IPOs, but summarized some fast facts from the S-1. Last week, we asked you to fill out a survey about your investing habits - and you delivered! 72% of respondents were Gen Zers, and 90% had invested in at least one asset class. Some insights on your investing behavior:

jobs 🎓Human Capital - Associates (SF) Atmos - Chief of Staff (SF) Twitter - Strategy & Ops Associate (SF, Remote) Streamlabs - Growth Marketing Manager (SF, Remote) Robinhood - Benchmarking & Strategy Associate (Menlo Park) Schematic Ventures - Analyst (Bay Area) Citadel Defense - PM (San Diego) Fractal - Engineers (NYC) Nasdaq Ventures - Senior Analyst (NYC) Overtime - Product Manager (NYC) Lockstep Ventures - Associate (NYC)* High Output - Chief of Staff (NYC, Remote) March Capital - Associate (LA, Boston) *Requires 3+ years of experience. internships 📝Atomic - Growth Marketing Intern (Remote) Ohi - PM Intern (SF, LA, NYC) SVB Capital - Credit Platform Investments Intern (Seattle) Zendesk - Sales Ops Intern (SF) Faire - Data Science Intern (SF) Snap - Developer Relations Growth Intern (LA) Boulevard - Operations Intern (LA) Thrasio - Product Launch Analyst Intern (Salt Lake City) OpenView - Investment Intern (Boston) Drift - Brand & Comms, Content Marketing Interns (Boston) DataDog - PM Intern (NYC) Spotify - Content Strategy & BD Intern (NYC) puppy of the week 🐶Meet Basil, a 3-year-old beagle who lives in the UK. Basil enjoys frolicking around in the woods (and taking pictures with flowers), hanging out at the beach, and making TikTok videos. Check him out on Instagram @basil_the_beagle.uk! Hi! 👋 We’re Justine and Olivia Moore, identical twins and venture investors at CRV. Thanks for reading Accelerated. We’d love your feedback - feel free to tweet us @venturetwins or email us at twins@crv.com. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Which D2C brand blew us away?

Sunday, May 9, 2021

Plus, announcing our very own puppy of the week!

🚀 Neobanks cash in on Gen Z

Sunday, May 2, 2021

Plus, special access to a new app for Accelerated readers!

🚀 How to escape the Internet hype cycle

Sunday, April 25, 2021

Plus, which viral Super Bowl company filed for IPO?

🚀 Dogecoin heads to the moon!

Monday, April 19, 2021

Plus, the SEC puts SPACs on ice.

🚀 Coinbase preps for takeoff

Sunday, April 11, 2021

Plus, which country launched its own digital currency?

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏