Is the Sell-Off Over Or Will There Be More Pain?

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 180,000 other investors today. To investors, Will Clemente breaks down the volatility from this week using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up for his email by clicking here. Here is Will’s analysis: Hope all is well and you had a great week. Last time we spoke we discussed the price drop of Wednesday 5/19 and how outlook was moving forward. At the time I didn’t have a strong opinion on the speed of the recovery. I still hold don’t have a strong opinion, but this week has shown some positive signs and I would now expect that full recovery will take place sooner rather than later. Some key takeaways from this week’s recap:

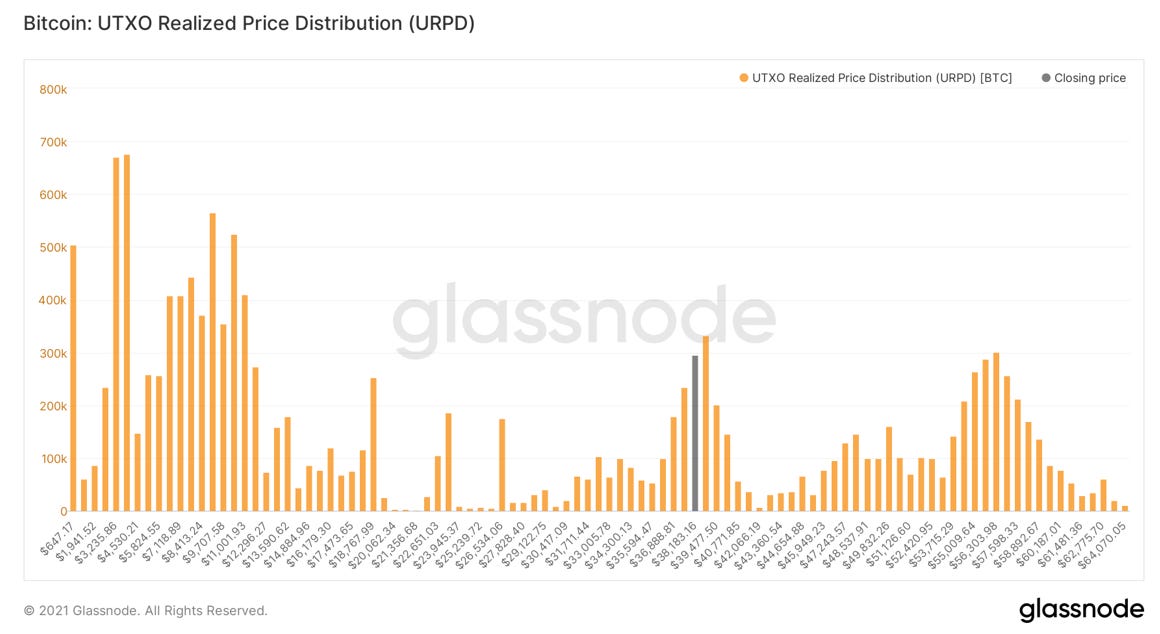

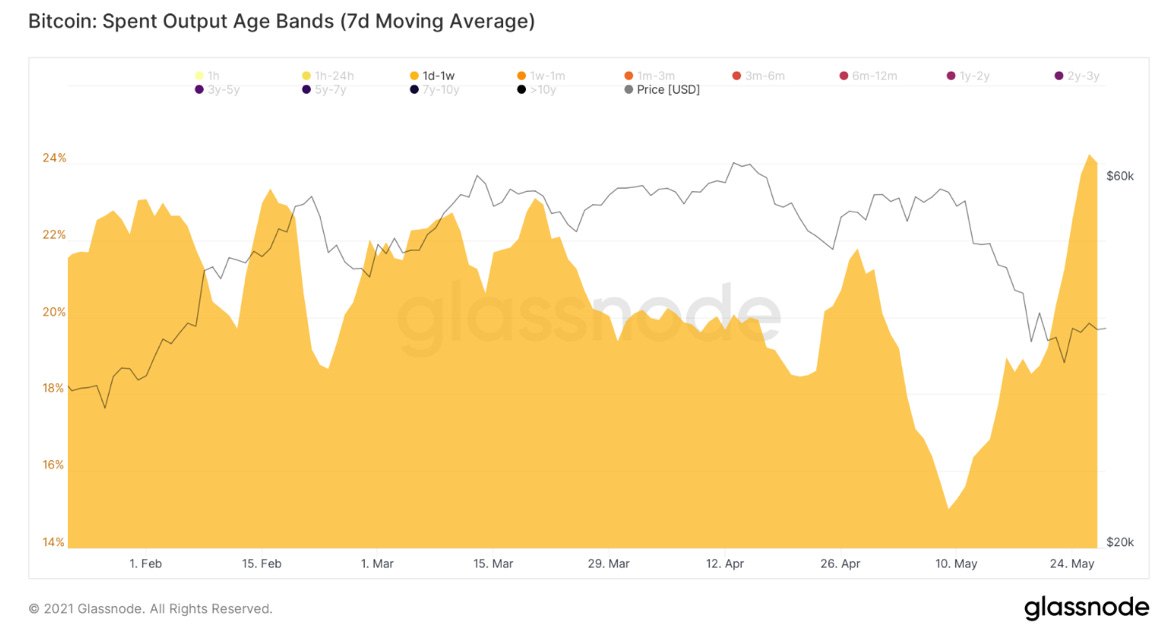

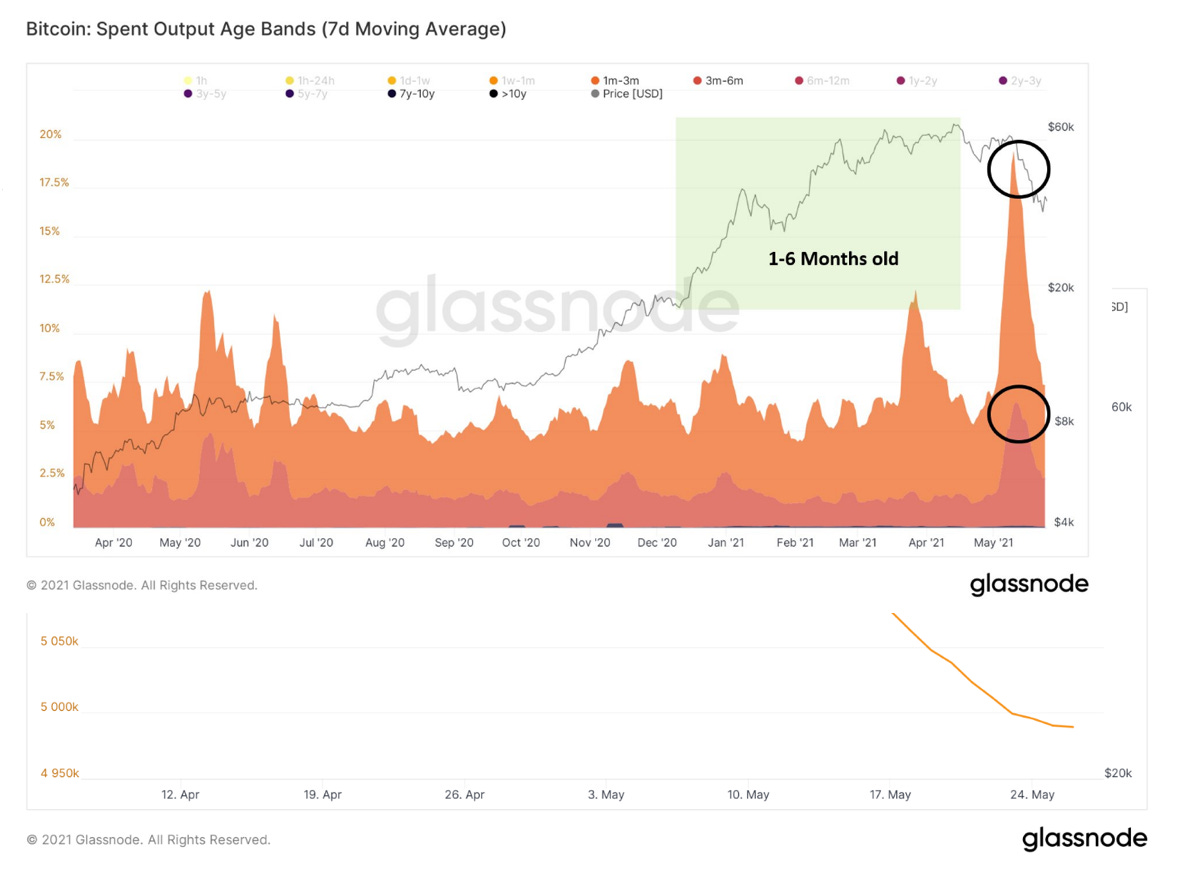

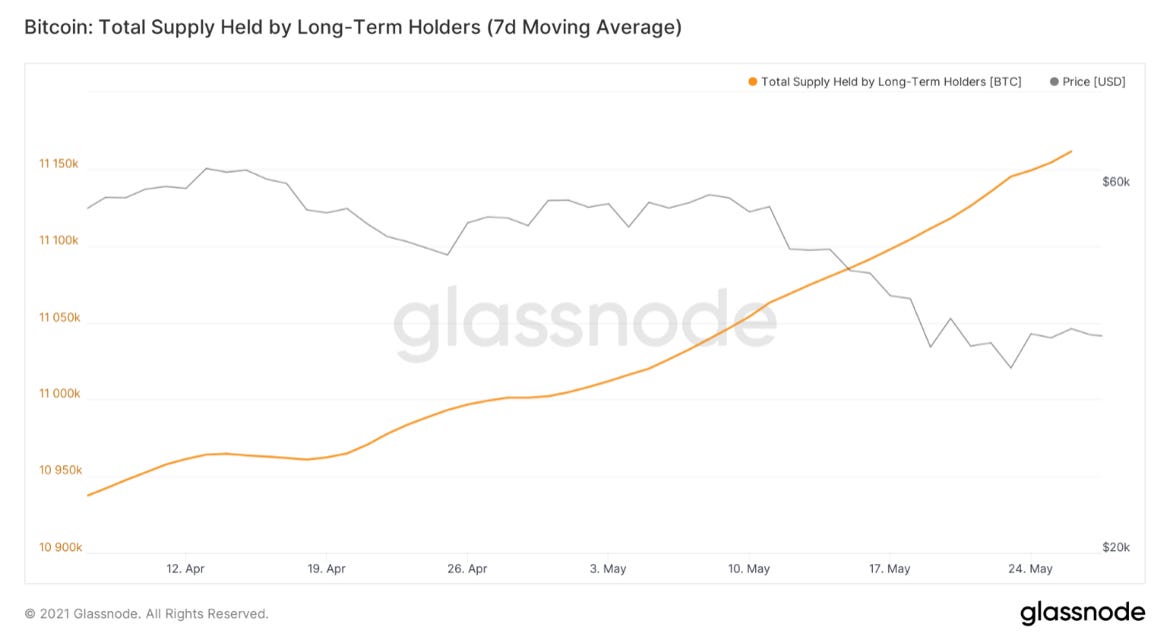

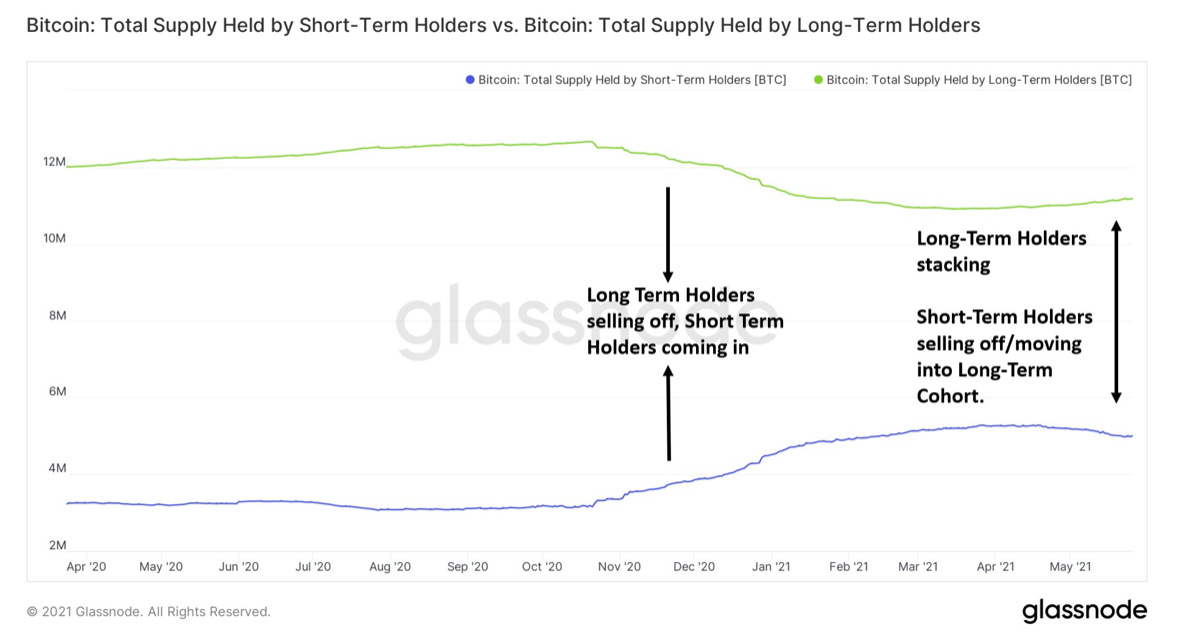

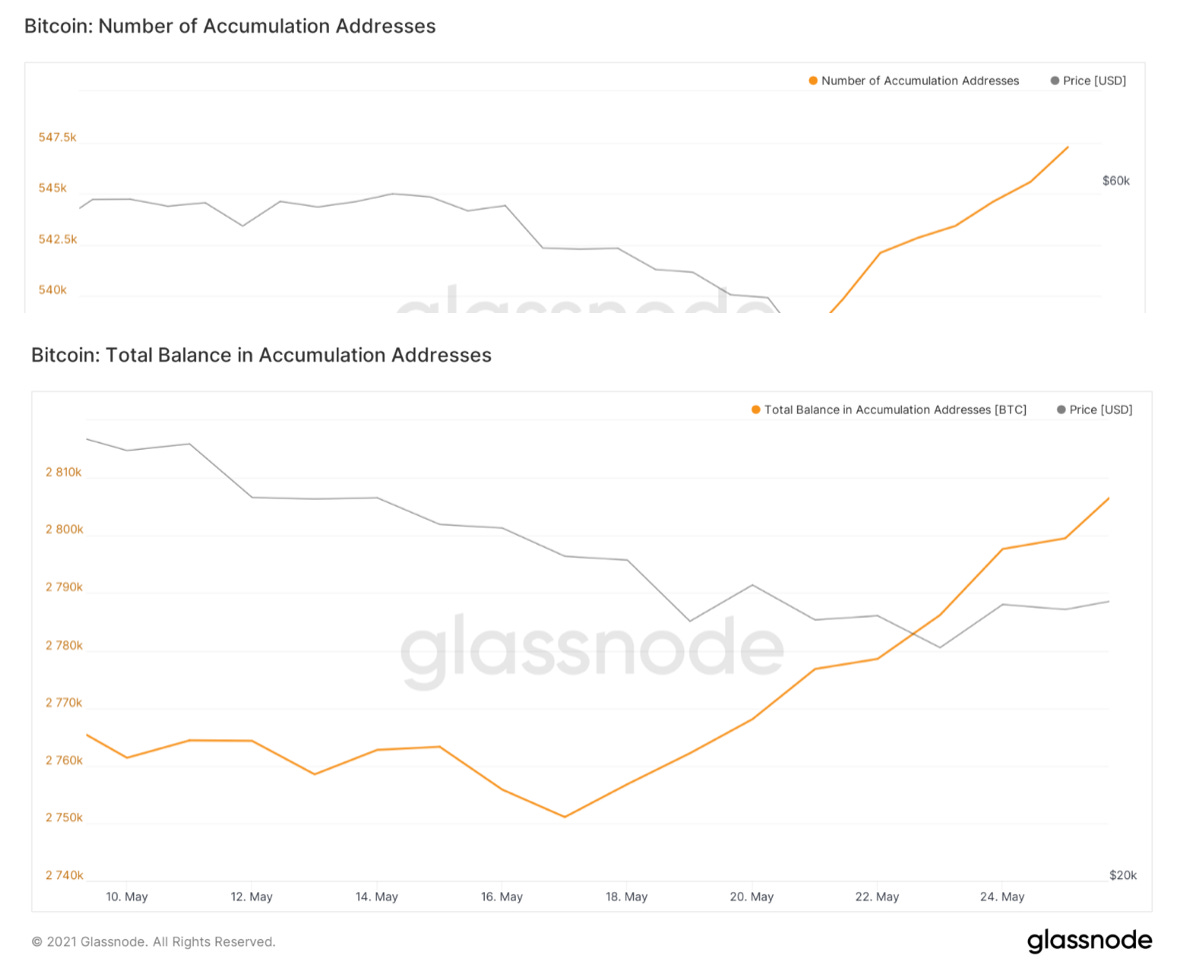

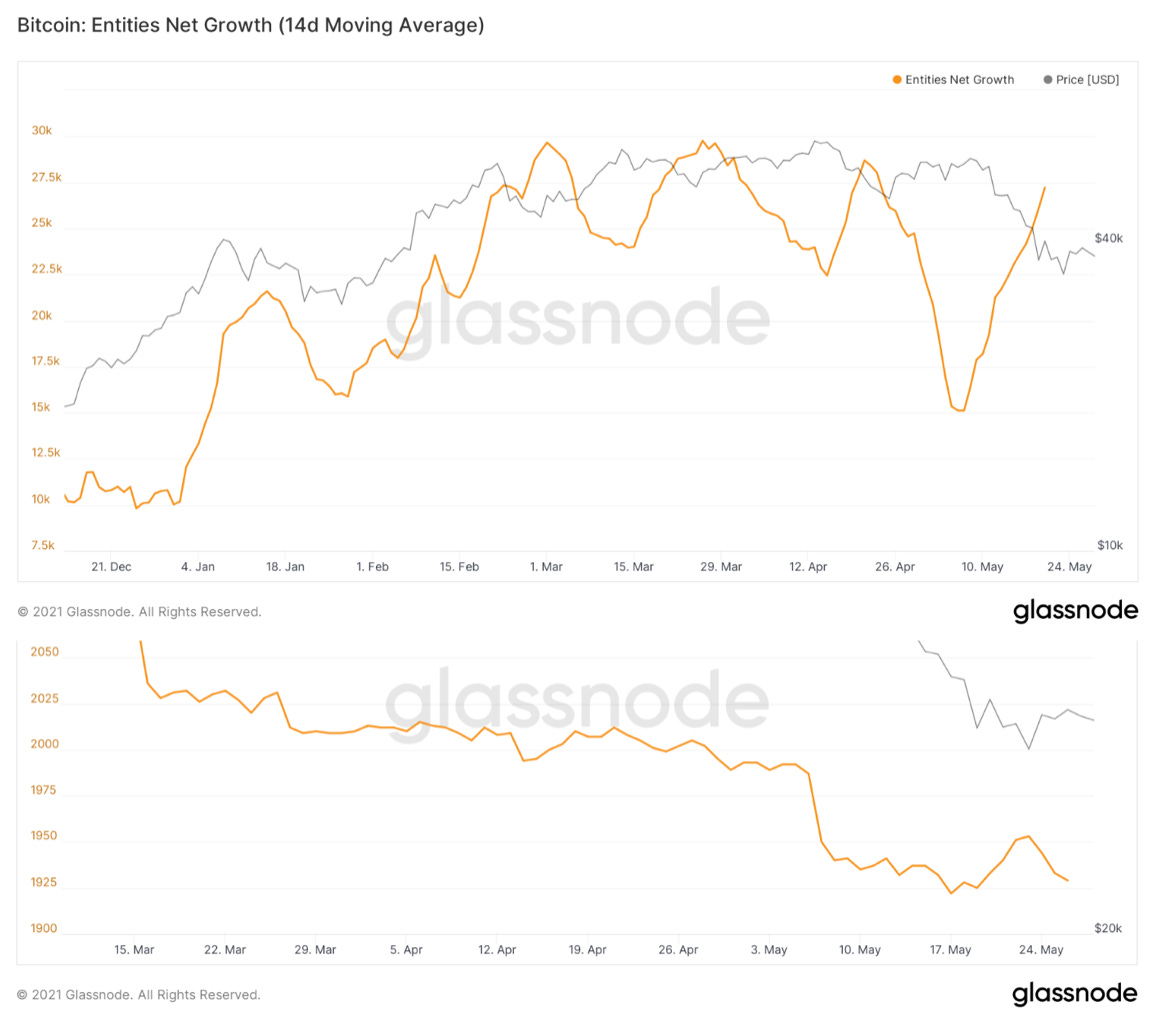

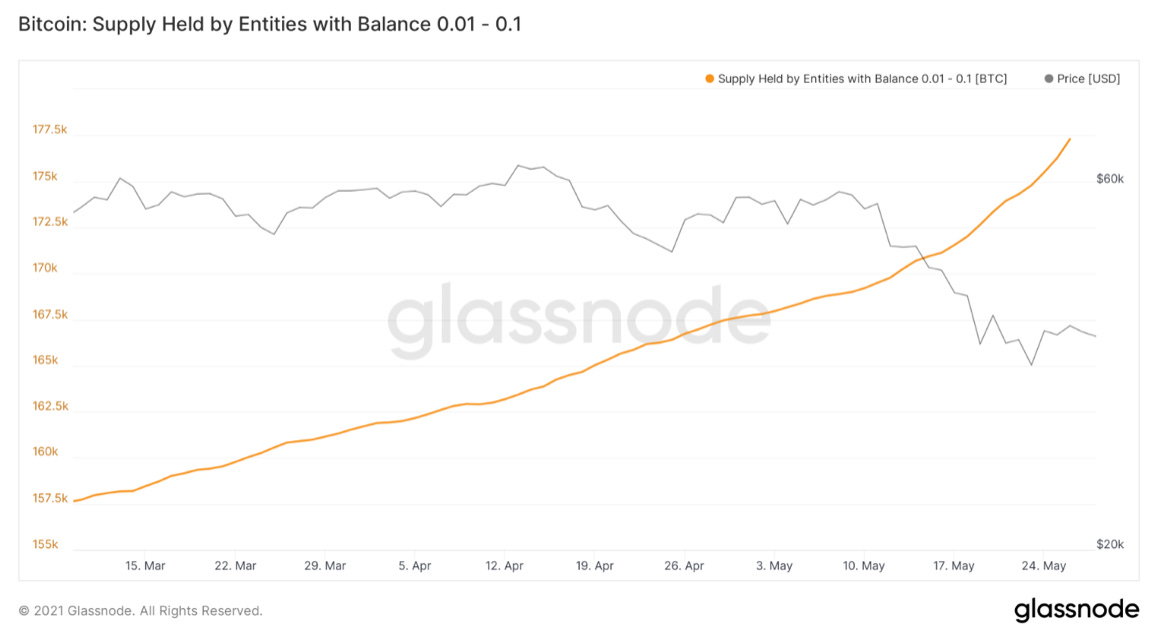

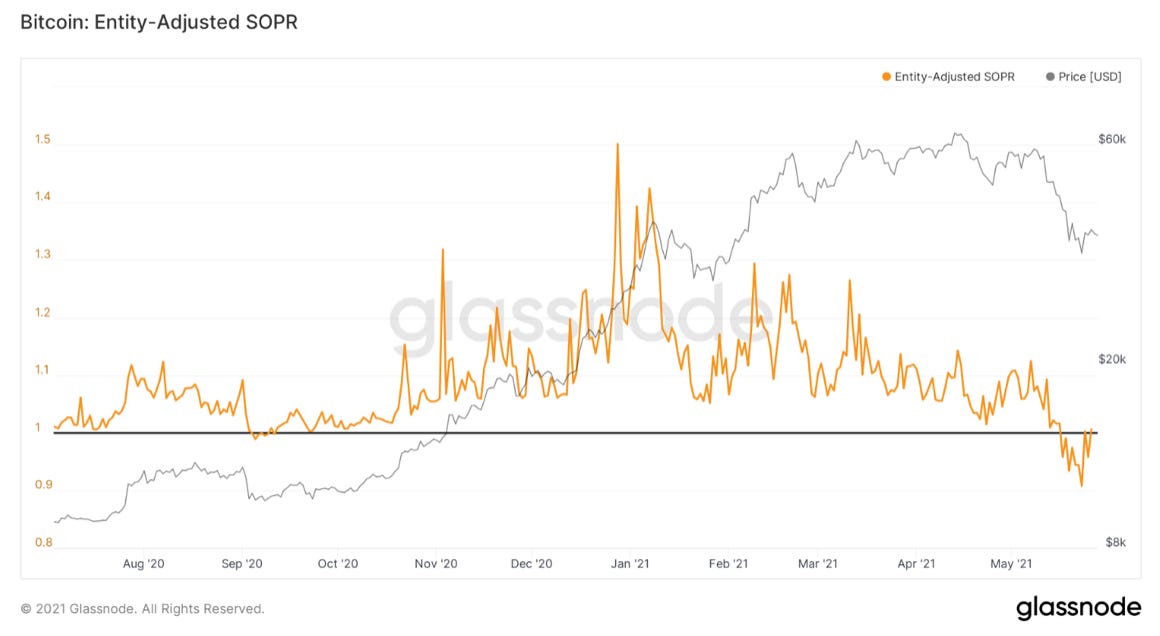

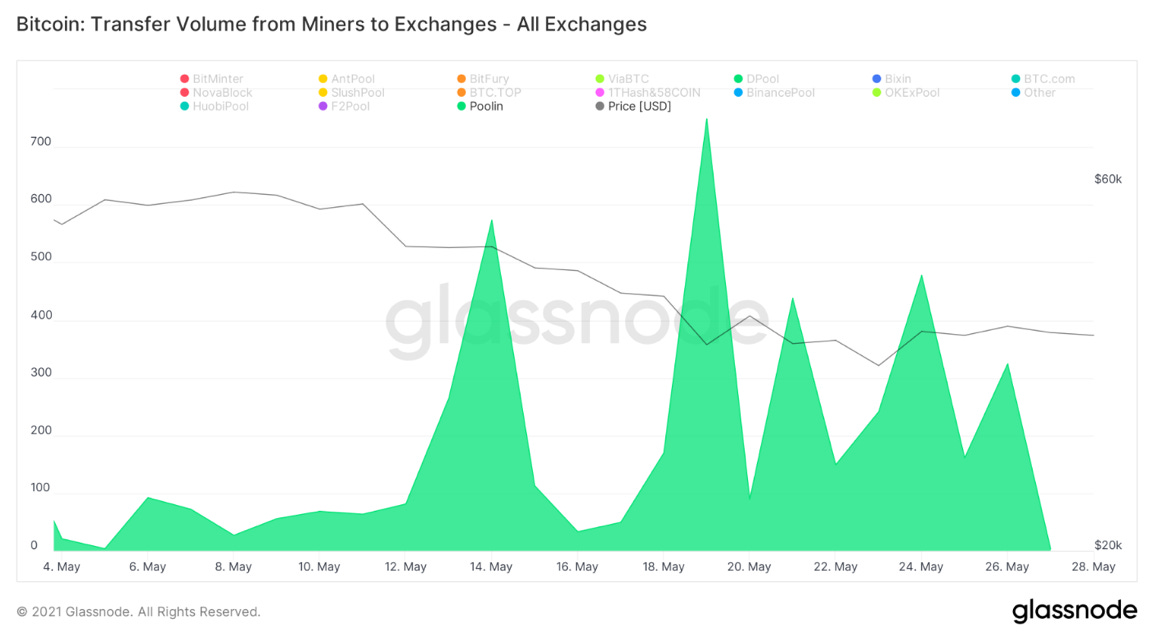

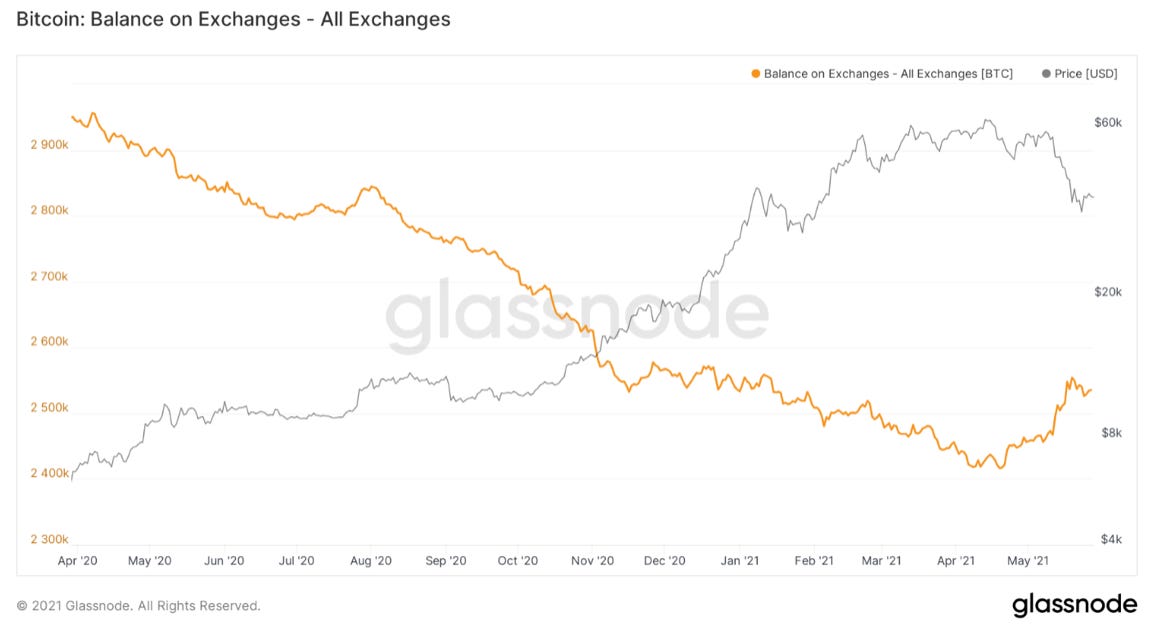

In the shorter term, some key price resistances to the upside are the 200DMA (~$47,750), $50K, $53K, and $59K. In terms of support, the strongest zones are $30K of course, but then $20K after. If $30K is broken I would see $20K as the next likely support level based on price structure and on-chain volume. One interesting theme that has taken developed is seeing long-term holders and accumulation addresses stacking through this dip. Let’s break this down; first with a quick overview of who is selling on the other side and then the buy side. This metric looks at the different age of coins selling every day. Running a simple 7 day moving average over this can smooth out the picture. This week there was a larger amount of selling coming from coins aged 1 day to one week old than usual. Coins aged this young are traders moving in and out of the market. Perhaps this spike is highlighting some swing trading while Bitcoin ranges between the low $30K’s-$40K and traders are not confident in taking a directional bet at this time. Also, you can see a lot of recent selling has been done by coins aged 1 month to 3 months old, and also 3-6 months old. These coins were last moved in the green zone highlighted below. At the same time, long-term holder have been steadily accumulating. The chart below compares short-term holder supply to long-term holder supply. You can see short-term holders take up a larger portion of supply between November to mid-April. On the right side, you can see the divergence that we are currently in. This is showing the following: long-term holders are adding to their positions, short-term holders are selling, some entities in the short-term cohort have now reached the 155-day threshold for this metric and are now in the long term cohort. On a similar note, another way to illustrate convicted buyers stacking through the dip is looking at accumulation addresses and accumulation balance. An accumulation address is defined as an address that has received at least two BTC txs but has never moved funds out of the address. This cohort continues to climb, with 7,430 new accumulation addresses in the last 7 days. These new accumulation addresses are likely overlayed with this next metric: net entity growth. Glassnode clusters addresses together forensically to identify entities, they then subtract the new entities from dormant entities with 0 balance. This shows a v shaped recovery in new users coming onto the network after a downtrend since early March. Meanwhile, supply held by entities with .001 BTC to 1 BTC continues to grow. Overall, it seems that retail is accumulating while whales sell-off. Regardless of who is exactly buying/selling, the market is no longer selling at a loss on aggregate. This sharp uptick is a sign of a recovery. The behavior from miners has slightly changed from the previous letters sent out. For the last 1-2 months miners have been stacking heavily. However, in the last week this trend seems to be stalling out. This plateau in miner unspent supply can be seen in the chart below. This miner selling looks to be coming primarily from China. One of the most constant sellers over the last week has been Poolin, the second largest mining pool in China. This can be shown in the chart below by looking at larger than usual transfers to exchanges. General exchange flows are no longer bearish, exchanges are down 14,207 BTC in the last 7 days. However, it appears the broader trend of coins moving off exchanges has come to a halt. Looking forward to touching base Monday. Hope you have a great weekend. Cheers! That is it for today’s analysis. Hopefully you found this helpful. I highly suggest you subscribe to Will Clemente’s email where he breaks down on-chain metrics multiple times per week: Click here This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 180,000 other investors today. You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber. |

Older messages

There Are No Gods Among Us

Monday, May 17, 2021

Listen now (8 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 175000 other

Fix The Education, Fix The World

Tuesday, May 11, 2021

Listen now (3 min) | To investors, Today I am announcing that I have led a $5 million Series A investment in Synthesis, which is the education spin-out from the school that Elon Musk custom built for

On-Chain Metrics Show Bitcoin Is Coiling Like A Spring And Ready To Rip Higher

Friday, May 7, 2021

Listen now (6 min) | To investors, The letter today is from Will Clemente, who has become one of the best bitcoin analysts in the industry in my opinion. He recently started his own, free email that I

Special Message From Pomp 🙏🏽

Monday, May 3, 2021

Hey! What a wild ride bitcoin bull markets are. Thanks for being a free subscriber to The Pomp Letter. Hopefully this has helped you understand what is currently transpiring across assets and markets.

Information Markets Create A New Asset Class

Wednesday, April 28, 2021

Listen now (8 min) | To investors - I'm personally fascinated by the creation of new asset classes or investment types. Previously, I've looked at companies like Pipe, which turn a

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these