🚀 Which country made Bitcoin legal tender?

🎉 Exciting news - Olivia graduated from the Stanford GSB this week, and is joining Andreessen Horowitz (a16z) as a consumer investment partner! She’ll be focused on working with early stage consumer startups - find her on Twitter @omooretweets. Justine has one year left at the GSB, but has joined Canal as the Head of Go-to-Market. You can find her @venturetwins (taking suggestions for a new handle!). A massive thank you to the Accelerated community for being such a huge part of our venture careers so far. We’re excited to keep working with you - you can still expect Accelerated in your inbox every week! news 📣📱 Apple hosts WWDC. Apple announced product updates at its annual Worldwide Developers Conference. Some of the things we’re most excited for:

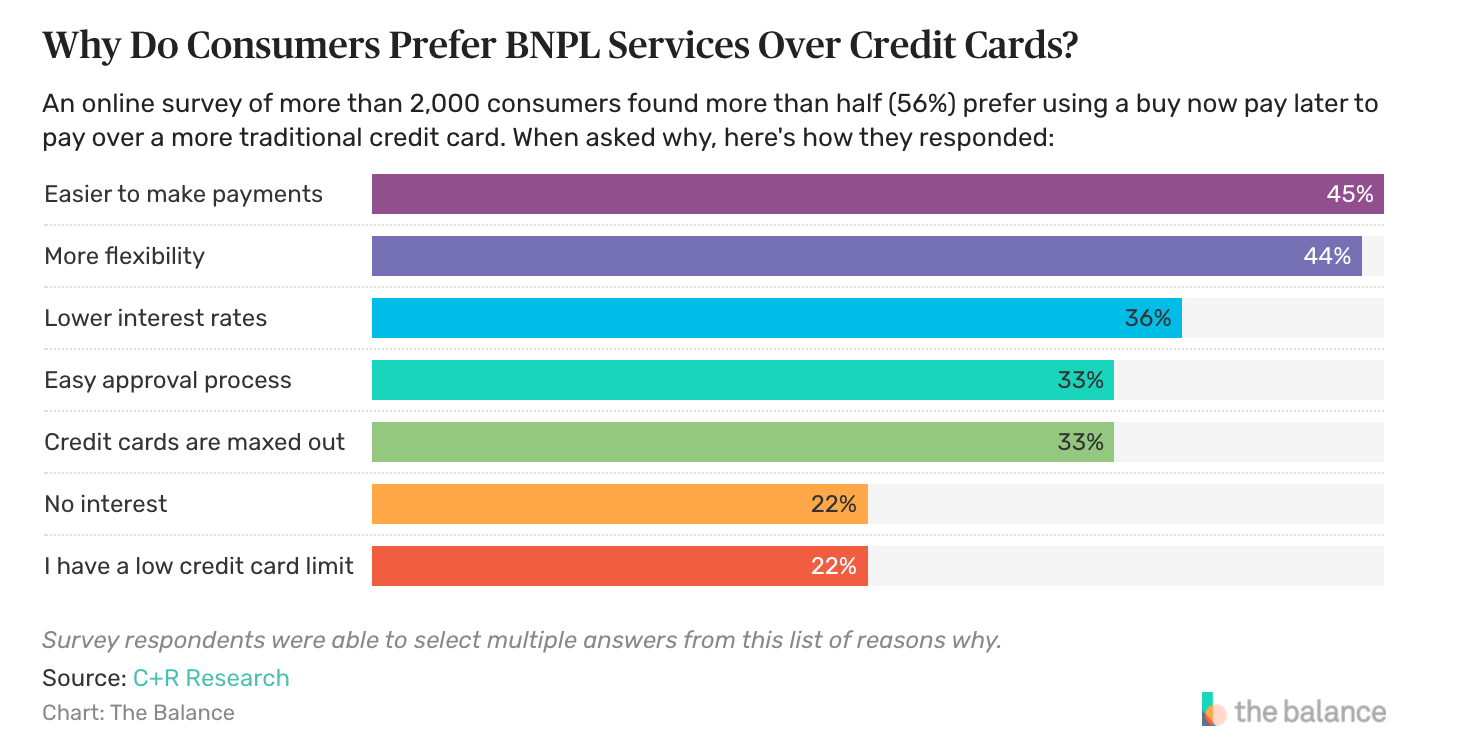

✈️ CLEAR preps for IPO. Speaking of airports - biometric security company CLEAR filed to go public on the NYSE. CLEAR’s $179 annual subscription allows consumers to use their fingerprints and irises for identity verification at airports, stadiums, and venues. Despite the fact that U.S. airline volume dropped 60% in 2020, CLEAR saw 20% revenue growth. How? The company retained an impressive 79% of members, and launched a new product called Health Pass to verify COVID testing / vaccine status. 🛑 Will Biden ban TikTok? TikTok and WeChat are yet again under threat from the U.S. government. While President Biden revoked Trump’s executive order to ban the apps, he also signed a new order to review the national security risks posed by software with ties to “foreign adversaries.” The order specifically calls out China as an area of concern. It’s still TBD what this will mean for apps like TikTok - we’ll keep you posted as the story develops. 🛍️ Faire raises mega-rounds. Faire, a platform that enables retailers to source inventory from independent brands, announced a $250M Series F at a $7B valuation. This is nearly a 3x markup from the company’s last round in late 2020. Faire was founded just four years ago (!!) and has been on a rapid growth path, connecting 200,000+ local retailers with 20,000+ brands. The company is now expanding into Europe and pursuing new categories like food and apparel. Big news for Bitcoin fans - El Salvador became the first country to adopt the currency as legal tender. What does this mean? While the U.S. dollar will remain El Salvador’s primary currency, Bitcoin will be accepted as payment in all transactions. You can even use Bitcoin to pay taxes! The law was proposed by the country’s president, Nayib Bukele, who sees the currency as a way to promote financial inclusion. 70% of El Salvador’s population doesn’t have a bank account - it’s hard for these people to get access to credit, invest, and even make secure transactions. Bukele also noted that Bitcoin will provide a more efficient way for people living abroad to send remittances back to El Salvador, cutting out the intermediaries that take a cut of these transactions. what we’re following 👀Three months after the David Dobrik controversy, Dispo announces a $20M Series A. As Uber and Lyft face driver shortages, taxis are making a comeback! Head of Instagram Adam Mosseri sheds light on how the algorithm actually works. Twitch co-founder Emmett Shear shares key lessons on Twitch’s 10th anniversary. The “buy now, pay later” (BNPL) space is heating up - Klarna just announced a $639M round at a $45.6B valuation led by SoftBank’s Vision Fund. This represents a ~50% markup from the company’s last round, which took place just three months ago! Klarna has 90M global active users (18M are in the U.S.), and saw $18B in transaction volume in Q1 2021 - up 2x from the same period last year. “Buy now, pay later” has become a core behavior for millennials and Gen Zers. PYMNTS’ survey of ~3,000 shoppers found that 26% of millennials and 11% of Gen Zers used BNPL for their last e-commerce purchase, compared to <8% of older generations. Surprisingly, this behavior also carries over to in-person purchases, where it’s not as easy as clicking a button. 15% of millennials and 6% of Gen Zers used BNPL for their last in-store purchase! Along with Klarna, the biggest BNPL companies in the U.S. are Affirm (which IPOed in January), Afterpay, and PayPal Credit. The driving force behind BNPL versus credit cards for younger generations seems to be ease of access and use, especially for consumers who may otherwise have limited credit. In many markets (such as Australia) where BNPL has surged, credit card issuance has fallen sharply. If you’ve been on the TikTok or Instagram accounts for any brands recently, you’ve likely seen Gen Zers begging for a BNPL option in the comments! BNPL payment rates range from 2-8%, and unlike credit cards, both BNPL applications and late payments typically don’t impact a user’s credit score. Data from Afterpay, Quadpay, and Affirm shows that only 1-2% of BNPL transactions are completely delinquent - though 43% of BNPL users report making late payments. Do you use BNPL for purchases? Thinking about starting a company one day? Canal, Stytch, and Merge are hosting a panel this Thursday evening in SF on the engineer-to-founder journey! The event is outdoors (rooftop bar 😍) & COVID protocol will be followed. If you’re interested in attending, email me (justine@shopcanal.com) for more details. jobs 🎓Finix - Business & Strategy Analyst (SF)* Section 32 - Principal (SF) Faire - Marketplace Quality Specialist (SF) Chan Zuckerberg Initiative - Program & Ops Associate (Redwood City) Robinhood - Financial Benchmarking & Strategy Associate (Menlo Park) CookUnity - Expansion Associate (LA) Guild Education - Chief of Staff (Denver) Canapi Ventures - Associate (DC) Atom Finance - Full Stack Engineer (NYC) Bowery Farming - Chief of Staff (NYC) XRC Labs - Principal (NYC)* PepsiCo Ventures - Principal (NYC)* *Requires 3+ years of experience. internships 📝Robinhood - Marketing, Content, & Comms Intern (Remote, Menlo Park) Polarr - Marketing & Editorial Intern (Remote) Flexport Capital - MBA Intern (SF) Glow - Marketing Intern (SF) Trash Warrior - Biz Ops Intern (SF) Cerebral - MBA Technical PM Intern (SF) Nova Credit - Data Analyst Intern (SF, NYC) WorkBoard - Product Dev & Infrastructure Ops Intern (Redwood City) Choco - BD Intern (Chicago) Literati - Marketing Intern (Austin) nate - Marketing Ambassador Intern (NYC) Uber - Sales Analytics Intern (London) puppy of the week 🐶Meet Sunny, a one-year-old mini goldendoodle who lives in NYC. His hobbies include playing at the park with friends, going to brunch, and digging in sand at the beach. Check him out on Instagram @dooditsalwayssunny! Hi! 👋 We’re Justine and Olivia Moore, identical twins and consumer investors. Thanks for reading Accelerated. We’d love your feedback - feel free to tweet us @venturetwins or email us at twins@crv.com. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Etsy snags a deal

Sunday, June 6, 2021

Plus, do you think sharing Spotify data is cringy?

🚀 Poparazzi debuts in the App Store at #1!

Sunday, May 30, 2021

Plus, should founders raise VC $ when still in TestFlight?

🚀 What app averages 30 opens per day?

Sunday, May 23, 2021

Plus, retail investors can now get access to IPO allocations!

🚀 Who paid a $5M Bitcoin ransom?

Monday, May 17, 2021

Plus, sharing the results of our investing survey!

🚀 Which D2C brand blew us away?

Sunday, May 9, 2021

Plus, announcing our very own puppy of the week!

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏