Flipside Crypto - The Bounty Brief #17

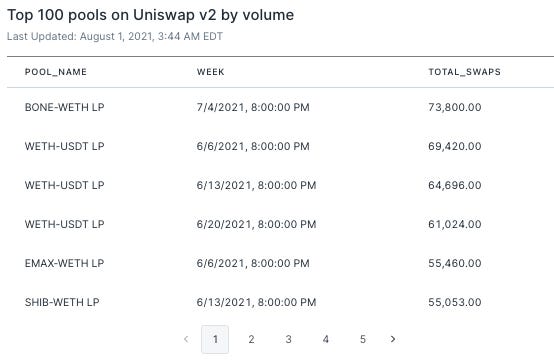

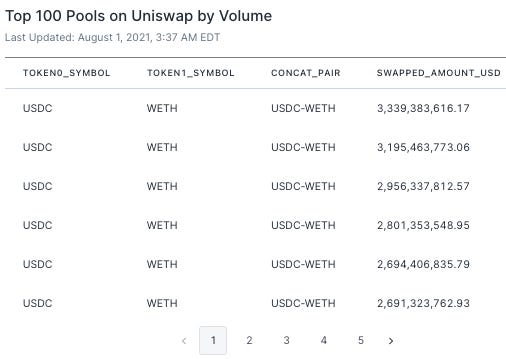

Hey there analytics experts, Want new ways to earn crypto? We’ve got you covered. In case you missed it, Flipside is now offering content bounties for great writing, infographics, and more. Learn more below. We’ve also got some brand new analytics bounties from Flipside Crypto below, plus the best from around the web. Need help solving them? Join our community to get all your questions answered. Terra 🌎[Easy] Active Addresses 📬 Bounty: Up to 17 LUNA Description: Of all addresses that delegated in Q1 2021, how many active on June 30th? [Easy] New Mirror Assets 🪞 Bounty: Up to 17 LUNA Description: Pick two times from Jan-Jul 2021 when a new asset was introduced on Mirror - was there an increase or a decrease in volume or TVL for other existing Mirror assets when this happened? What does this say about how elastic capital on Mirror is to different asset offerings? [Easy] Terra Fees & Transaction Volume Correlation 💸 Bounty: Up to 17 LUNA Description: How have fees changed over time on Terra? Is this correlated with total transaction volume on Terra? [Easy] Luna Delegation Distribution 🗳️ Bounty: Up to 17 LUNA Description: Plot the amount delegated to the top 10 validators. Calculate the percentage of validators that hold 95% of the delegated LUNA. Would you say that LUNA delegations are concentrated or well distributed? [Hard] Mirror Volume & TVL 💰 Bounty: Up to 34 LUNA Description: On July 23rd, Uniswap announced that it would be blacklisting all mAssets. Over the past two weeks what has the TVL and volume been on Mirror? Did these two metrics show a marked change when or around when the announcement came out? [Elite] Anchor Historical APR ⚓ Bounty: Up to 68 LUNA Description: What has Anchor's historical APR by day and by week been since launch? Hint: Find the borrow rate by block (refer to Anchor docs on how to calculate this) and aggregate it. You get 2 weeks for elite bounties - the reward is also twice that of a hard question as a result. View all Terra Bounties 🌎 Bounty: Up to 76.50 LUNA Description: Answer one of these top analytics questions from the community and receive up to 76.50 LUNA as a reward. 🦄 Uniswap[Easy] Weekly TVL Breakdown 📊 Bounty: Up to 9.59 UNI Description: For the past 10 weeks, what has been the week over week change in TVL for Uniswap in total? Show this for the top 5 pools by volume (ranking determined by most recent week?) [Hard] Pool Positions Dashboard 💧 Bounty: Up to 19.55 UNI Description: Is there a way to see all active positions from all LPs for a given Uniswap V3 pool? What are 3 ways to visualize this effectively? View all Uniswap Bounties 🦄 Bounty: Up to 19.55 UNI Description: Answer one of these top analytics questions from the community and receive up to 19.55 UNI as a reward. 🌀 YearnFree Square Question 🔲 Bounty: Up to 1,000 USDC Description: Provide any interesting insights on Yearn. The top 5 dashboards will earn 1,000 USDC. These will be judged by a council that includes other community members and the Flipside team! Comparing Yearn Vault Strategies 🏦 Bounty: Up to 750 USDC Description: Select two of the available strategies; define and visualize the returns each has generated over the past 30 and 90 days; and compare their performance. Provide at least one paragraph to explain why one performed better than the other. Returns on the ‘Generic Leverage Compound Farm’ strategy 🚜 Bounty: Up to 750 USDC Description: The USDC yVault has a ‘Generic Leverage Compound Farm’ strategy that earns a return by supplying liquidity to Compound, using flash loans for additional leverage. What return in Comp has it earned over the past 30 days and how much in flash loans has it used to earn this? View all Yearn Bounties🌀 Bounty: Up to 1,000 USDC Description: Answer one of these top analytics questions from the community and receive up to 1,000 USDC as a reward. ☊ NervosCreate A Godwoken Account On The EVM Layer 2 Testnet 2️ Bounty: Up to 1000.00 CKB Description: Nervos supports the use of Ethereum compatible smart contracts which allow developers to create dApps using the popular Solidity smart contract language. This is done by running the EVM (Ethereum Virtual Machine) in a Layer 2 based execution environment using the Godwoken and Polyjuice frameworks. EVM dApps run nearly identically on Nervos as they do on Ethereum. This, in turn, allows dApp users to continue using the popular MetaMask wallet without having to install anything new. DApp users who are familiar with Ethereum will feel right at home! Port An Existing Ethereum DApp To Polyjuice 🚢 Bounty: 7500.00 CKB Description: In this tutorial you will learn how to port an existing browser Ethereum application to run on Nervos' EVM compatible Layer 2. The eventual goal of Polyjuice is 100% compatibility with existing EVM smart contracts. However, this goal is still being worked on, and there will always be a few differences in the setup of the development environment and the tooling and frameworks that are used. View all Nervos Bounties ☊ Bounty: 7500.00 CKB Description: Answer one of these analytics questions receive up to 7500.00 CKB as a reward. Wallfair 💸Connect To Ethereum Wallet & Associate User Account To Ethereum Address 👛 Bounty: 700.00 USD Description: This is a PoC task in which we want to enable Ethereum wallet ie. Metamask in context of Wallfair client, obtain Ethereum address from injected YieldHand ✋Create Basic Iteration Of SubGraph For YieldHand Options Market Contract 📝 Bounty: .04 ETH Description: YieldHand is building an options marketplace protocol that has OTC sell orders and allows prospective buyers to search the listed orders/offers and purchase options directly from sellers which they can later exercise based on a filtering system on the UI. The dApp that interfaces with this contract will use The Graph (consuming data from the web app UI via an API) to query for ACTIVE/non-expired option sell orders. 🏆Bounty Submission of the Week 🏆Welcome back to our Bounty Submission of the Week! In this week’s edition, we’re giving our Uniswap bounties some love in the form of a dashboard from MarneeSeaweed. This submission focuses on Uniswap pools — specifically the differences between the top pools on Uniswap V2 and those on V3. As MarneeSeaweed notes in this submission, the top pools in V2 often included stablecoins and wrapped Ethereum, namely USDC-WETH and USDT-WETH. And, as we can see in the table below, meme coin pairs like SHIBA and STARL weren’t too far behind. On V3, meanwhile, stablecoin pairings have doubled down on their dominance. The top five pairs on V3 feature stablecoins paired with wrapped Ethereum, or paired stablecoins.

MarneeSeaweed had more insights to offer, so be sure to check out the submission here. Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries: Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: If you liked this post from The Bounty Brief , why not share it? |

Older messages

Flipside Roundup August 6

Friday, August 6, 2021

Solve Yearn bounties and see the best submissions from this week!

The Bounty Brief #16

Friday, July 30, 2021

Yearning for more bounties? We've got you covered 💰 🌀

Flipside Roundup July 30

Friday, July 30, 2021

Solve Yearn bounties and see the best submissions from this week!

Flipside Roundup

Friday, July 23, 2021

Best data analytics from this week and how to get started with Uniswap bounties

The Bounty Brief #15

Friday, July 23, 2021

A storm is coming...⛈️⚡🌩️

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏