The Diff - Globalized Talent and the Brand Grab

You're on the free list for The Diff. Subscribers-only issues you missed this week:

Thanks for reading The Diff. If you're enjoying it, please subscribe. (And if you'd like to subscribe, but you're not in a financial position to do so right now—in school, between jobs, running a pre-funding startup—please reach out and we'll work something out.) Globalized Talent and the Brand GrabPlus! Developing Vietnam; Liquidity, Discount Rates, and Theft; Shortages; Pigs and OPEC; Statistical Privacy

Welcome to the Friday free edition of The Diff. This newsletter goes out to 24,067 subscribers, up 35 since last week. In this issue:

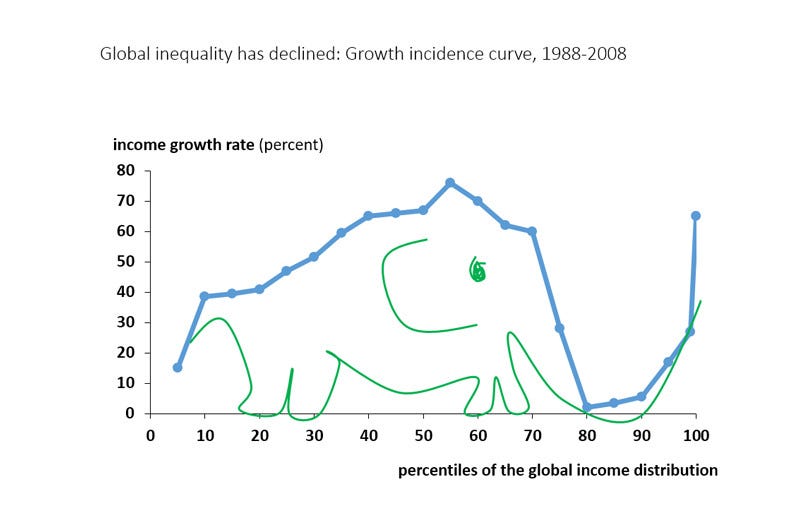

Coming next week: Central Bank Week! We'll be looking at a famous crisis from the inside, central banks' centuries-long effort to turn land into money, quantitative easing, and how modern financial history begins in 1998. Globalized Talent and the Brand GrabGlobalization is a paradoxical force. At the outset, it opens up a huge number of new experiences and opportunities: someone might use a website from the Netherlands to buy a ticket on a plane made near Seattle to visit Paris, which they'll take pictures of using a phone made in China (but designed in California), to be uploaded to a social network run out of Menlo Park. Somehow the cheapest way to get that experience involves sourcing talent and capital from multiple continents, surmounting culture clashes and language barriers in order to deliver a result that is, in the end, astonishingly cheap. But over time, globalization becomes a force for homogenization: yes, you can go to Paris, where you have the choice of no fewer than 73 McDonald's locations; you'll be using some of the same products wherever you go, because some global markets have few global winners, and they're winners just about everywhere. But the long-term upshot of that is a different kind of counter-homogenizing force: if countries converge economically in the aggregate, they have to diverge in the specifics, because becoming a rich country means having exports that other countries can't easily compete with. When countries escape middle-income status, it's because they sell something the rest of the world can't produce. This can involve winning a market from legacy sellers—the United States used to make a lot of TVs, but that production got outsourced to Japan, and from there to Korea and later China. But often, it involves building something completely new that either hasn't been made elsewhere or can't. Globalization-driven homogenization also takes place at the level of the work that people do, in addition to the products they consume: the classic way for a country to go from poor to not-poor is to shift from agriculture to light industry, specifically the sort where low labor costs make countries more competitive. As a result, Japan in the 50s looks a lot like South Korea in the 60s, which looks similar to China in the 80s, Malaysia in the 90s, and Vietnam in the 2000s. As these countries mature, though, they end up with very different economies. This is easy to see in the manufacturing sector, but it's starting to happen in services, too, and this creates a very interesting world. The place to start is a look at the famous Elephant Graph of changes in global incomes: For the 10th through 70th percentiles, globalization was great: they were poor, and many of them joined the middle class. For the top 10%, it was also great: they're the sorts of people who worked for (and owned stock in) those globally dominant companies, and the switch from national to global markets was very good for them indeed. And for that 80th percentile or so, the American, European, and Japanese middle class, it was a tough bargain: much of their consumption got cheaper, but housing, education, healthcare, and other nontradables got more expensive. In real terms, they stagnated. In services, global competition has been harder: there are language barriers, and scale is harder in a service economy. (You can reduce the cost of building a car or a plane by an order of magnitude, but it's hard to get that kind of efficiency improvement from nurses, waiters, personal trainers, therapists, live musicians, or other service jobs.) Meanwhile, success in many of these fields is bounded by the cost of finding customers. The value of Yelp, Google Maps, Angi Inc, and Thumbtack is a testament to this. The services market isn't static, though. Some parts of it have a manual labor component that's very hard to automate—it's hard to beat the human hand for density of sensors and manipulators, especially when hands are a legacy technology around which basically all this labor has been designed. But other kinds of service jobs are closer to symbol manipulation, the sort of thing that humans and computers are both good at, and that humans plus computers are much better at. The newsletter business is an interesting example: I read good newsletters written in Singapore, Portugal, Japan, China, Croatia, India, and France. Which means that I'm competing with a global talent pool—most of the people who learn a second language for job opportunities will learn English. I'm not alone in this global consumption/global competition pattern: Netflix, the Wall Street Journal, Activision, and basically every other media company now competes for attention globally, too. And unlike manufacturing, global services competition doesn't start a a race to the bottom, but as a broader search for the top: part of the reason Netflix has been able to raise prices so consistently is that it's hard to get a version that's 80% as good but 10% cheaper, so the best you can get is either a) a version that's much cheaper and much worse, or b) a version that's at a similar price range and more targeted. Superstar economics are unforgiving! And for Netflix, this is not necessarily dire: they're partly in the business of bundling, and more specifically in the business of creating country-specific bundles that work for each market. So direct competition in any market is a challenge, but it's also free market research done by someone with worse tech infrastructure and a smaller budget. Netflix can't afford to lose everywhere, but its ideal growth strategy is, at any given time, to be taking highly informative market share losses in multiple markets, so it can learn how to dominate them later. The shift to remote work has made in-person collaboration a little less necessary, and has made asynchronous management more common. This has been absolutely fantastic for FAANMG employees who move to cheap parts of the country and keep their Silicon Valley-level compensation, but once you're working with someone in South Dakota, you might start to wonder about all the latent talent in, say, South America. The first stage of a shift to remote is a wider distribution of previously hired workers within a given country, but the next stage will be a wider distribution of future workers in every country. The growth strategy in a globally competitive services market is not a land-grab; a global market in talent is too big, and too liquid, for any company to corner. Instead, it's a brand grab. Distribution is still a limiting factor, and a global market makes it more competitive. So bigger companies will end up owning more of it. Better remote collaboration technologies end up cutting economic barriers to trade in services the way lower tariffs and cheap container shipping cut economic and legal barriers to trade in physical goods. And they'll end up having a similar effect on labor and capital markets: better results for the middle of the global income distribution, since selling to the entire world will be easier—and even better results at the top of the distribution, where collecting a percentage of each of those sales will be even more lucrative. Programming NoteI'm pleased to announce that The Diff has added Jack Wiseman to the team. He'll be working with me on several things, both doing research for posts and working on some other exciting projects. Scaling a one-person business is a very interesting task, because the only increments of growth are 0% or at least 100%. Fortunately, there's a backlog to work on. Stay tuned! Here's a quick intro from Jack:

ElsewhereDeveloping VietnamThe Economist highlights Vietnam's economic growth ($) in recent decades, which has been remarkably steady: it was one of a handful of economies that actually grew in 2020, for example. They're using a template that has worked in other places, including the transition from state-owned companies to another model:

These conglomerates have been a feature in Japan, Korea, and India (but didn't play such a dominant role in Taiwan). It seems counterintuitive that they'd be more efficient than industry-specific companies, but there's a possible explanation: one of the limiting factors for economic growth is an understanding of how to run a business. The US didn't develop anything resembling modern management and accounting until the railroads made it necessary and the telegraph made it possible, and for a country that's operated under some form of command economy, good management skills might skew more towards understanding how to work around regulations (or having a good relationship with regulators). By identifying companies that are unusually well-run, and growing them, the state is essentially subsidizing a massive part-time MBA program that also turns a profit. Liquidity, Discount Rates, and TheftIn yesterday's issue, I wrote about how e-commerce marketplaces have made organized shoplifting more profitable ($) by creating a liquid market for cheap consumer products. There's an interesting echo of that in this story about hackers who break into email accounts and only steal gift cards, which they can sell at 80 cents on the dollar online. One striking thing about this scheme is that it's so patient: there are more ways to profit from breaking into an email account, but there are few ways that are as easy to miss (and as hard to attribute to an email breach). As the hacking industry matures, its discount rate drops, and more participants are willing to aim for steady returns rather than big but hard-to-repeat one-time hauls. ShortagesVox has a good overview of supply chain issues this year, which may bleed into Christmas. Some of them are new, or variable—lumber futures are back down, but now other goods are out of stock, and the chip shortage rolls on, shutting down more of GM's production. At a very high level, shortages can only persist if there's some combination of:

The longer they persist, the more option #3 seems like the most likely one; if consumer spending has ratcheted higher, but shipping companies and warehouse operators don't think it's permanent, the result is insufficient capacity. Noisier supply can be a temporary issue, since just-in-time inventory is equivalent to leverage, and magnifies the impact of disruption. But the long lag time for building new shipping equipment, and the limited pace at which efficiencies can be wrung out of existing infrastructure, is a liklier problem. Which makes it a race: if inflation picks up sustainably, it will be hard for countries to justify generous fiscal policies that lead to higher spending. But if shipping capacity starts to grow first, then such inflation is more likely to be transitory, and the net result will be that faster and higher-capacity shipping will lead directly to higher economic growth. Pigs and OPECIn its heyday, OPEC was mostly famous for keeping oil prices high, but aside from political actions, they also aimed to keep oil prices stable. The OPEC theory was that while expensive oil was good for cartel members in the short term, volatile oil would make other countries switch to more efficient vehicles and alternative energy. This has been happening, although not because of anything OPEC had control over. And it's something other cartels worry about, too. I've mentioned before that China has a strategic pork reserve, and has used it to buffer volatility from the African Swine Fever epidemic that killed half of China's pigs in 2019. Now Chinese pork producers are suffering ($, FT), because production is back up but tastes have changed. It's a good warning to sellers of volatile commodities: high prices create temporary profits, but they can also lead to permanent shifts. For previous thoughts on China and African Swine Fever see here ($) and the "More-Pigs-Backed Securities" section here ($). Statistical PrivacyPrivacy in online communications is never absolute, because the whole point of communicating is to violate your own privacy in a controlled way. Everyone is bad at statistical thinking, so we tend to be very poor judges of what's risky to say, and what's risky not to delete. This has been a problem for Twitter, because Twitter users know they're accumulating a portfolio of explosive liabilities over time; use the site for ten years, and you've made jokes that were probably very funny a decade ago and are now a little less acceptable. (Or you made them to an audience of a dozen, but suddenly discover that your comedy stylings have an audience of thousands and they're all booing.) Twitter is working on tools to make this easier, including hiding older tweets and hiding likes, follows, and other metadata. It remains a statistical form of privacy, since a determined person can find the old tweets, and screenshots persist for a long time. But that's part of risk management: making something inconvenient is easier than making it impossible, and that's often enough to accomplish 90% of what needs to be done. You’re on the free list for The Diff. For the full experience, become a paying subscriber. |

Older messages

Longreads + Open Thread

Saturday, August 28, 2021

Games, MBO, Espionage, Manchukuo, France, Fracking, Banks

Warby Parker and EssilorLuxottica: Irresistible Force, Immovable Object

Friday, August 27, 2021

Plus! Cutting the Apple Tax; Messaging; China and Security; Cyber Risk and Coordination; CEO Training

Longreads + Open Thread

Saturday, August 21, 2021

News, Tutoring, Inequality, Chips, Bank Risk, Bank Founding, Energy

The Dividend Futures Disaster Revisited: Anatomy of a Very Bad Trade

Friday, August 20, 2021

Plus! What's Big on Facebook; OnlyClothed?; Elite Overproduction as Risk Aversion; A Second Cleantech Boom; Chip Consolidation

Longreads + Open Thread

Saturday, August 14, 2021

Risk, Reverse Engineering, Perspective, Software, Creators, Mortgages, Big Business

You Might Also Like

Are these the two best trading hours?

Saturday, January 11, 2025

Brand New Genesis Algo ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌭 America gets the works

Friday, January 10, 2025

The US added a lot more jobs, TSMC posted strong results, and plumbing the depths | Finimize Hi Reader, here's what you need to know for January 11th in 2:57 minutes. The US economy ended the year

A Page From Uber's Playbook: Disrupting Social Media Marketing

Friday, January 10, 2025

Read the whole story here ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Design Your Dream European Getaway

Friday, January 10, 2025

Enter to win a chance to win a $20000 trip to Europe for free. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📉 Bonds saw a selloff

Thursday, January 9, 2025

Global investors dumped government bonds, UK shoppers got a break for Christmas, and Encylopedia Britannica became an AI company | Finimize Hi Reader, here's what you need to know for January 10th

Could private student loans help you?

Thursday, January 9, 2025

Find out if you qualify and compare rates today. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🏆 The Demi Moore of it all

Thursday, January 9, 2025

Plus, workshops on estate planning and taking control of your money. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦾 Anthropic looks jacked

Wednesday, January 8, 2025

Claude's AI startup flexed a new valuation, China sought to nudge shoppers, and a wild plot to smuggle drugs | Finimize Hi Reader, here's what you need to know for January 9th in 2:57 minutes.

3 reasons to buy life insurance

Wednesday, January 8, 2025

Make 2025 the year you protect your loved ones Why you should get life insurance now A decreasing bar chart Affordable rates Life insurance premiums typically increase with age or changes in health.

Eight days in and things are already changing

Wednesday, January 8, 2025

plus Tomdaya + birdwatching ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏