First 1000 - 💻 Atlassian (Jira)

💻 Atlassian (Jira)A deep dive on how $1B of capital and a perfectly crafted M&A engine created $40-50B of market cap for Atlassian!Hello Folks 👋, By: Ruchin Kulkarni

Atlassian is a Software Development and Collaboration company driven by a mission to ‘unleash the potential of every team’. Today, Atlassian's products comprising Jira, Confluence, Trello, and Bitbucket, among others, are used by 15M+ users at 230,000+ companies worldwide, bringing home a whopping $2B+ revenue in FY2021. Here’s how Atlassian and its founders Scott and Mike bootstrapped a business from 0 to 1,000 to 10,000 customers and eventually set up the most unique “acquisition-led growth” engine the world has ever seen! 💩 Starting with a big terrible idea... the first 10s of customers Like several legendary startups before it, Atlassian started with a self-proclaimed terrible idea. Scott and Mike were fans of a Swedish software product that helped companies manage and run their internet infrastructure (like servers). It was built by a team renowned for writing great software but one that did not feel the need to offer customer support. The big idea? Providing third-party support services to customers of this company who were primarily in the US, from Australia. Sound like a recipe for disaster? It was! 🙈

They realized that the Swedish product didn’t have any documentation for developers and customers to use. So they wrote the documentation themselves and published it on the internet for FREE! The hope was that the documentation would serve as a wedge to gain mindshare amongst customers of the software! But not unlike most hacks, it both worked and backfired at the same time. The documentation the pair wrote was so good, that customers who did reach out, didn’t need support services to solve trivial problems - the bread and butter of the support services industry. Instead, Atlassian had opened Pandora’s box of the hardest possible customer support requests timed at the most ungodly hours!

With the combination of long service times (most requests took several hours to solve), and below modest pricing of $300 per successful solve (yes, they only got paid if they were successful), Scott and Mike were struggling to make ends meet! 👶🏻 The birth of Jira and the journey from 100 to 1000 customersEven as they built a services company, Scott and Mike’s true passion remained in building software, not supporting it. This passion manifested as a host of internally developed software tools that they wrote to help make their services business much better. An app to put documentation online, a Content Management System (CMS), a way to track their website visitors online, an email archiving tool, and amongst others, an issue tracking system called Atlassian Support System (they renamed it years later when a friend pointed out the abbreviation 😅) As they built these internal tools to help streamline operations in their own “internet-based” business, the duo had an aha moment! They realized that the scaffolding to build internet businesses just didn't exist in the 2000s. The tools that ran their business could benefit 1000s of their peers building on the internet. To begin with they decided to productize and sell their internal issue tracking system - ASS (yes, that was the name of their first product 😅), which was the guts and plumbing for what we now know as Jira. To begin with, Atlassian marketed Jira as a simple issue and bug tracking tool for software developers. Why software developers?

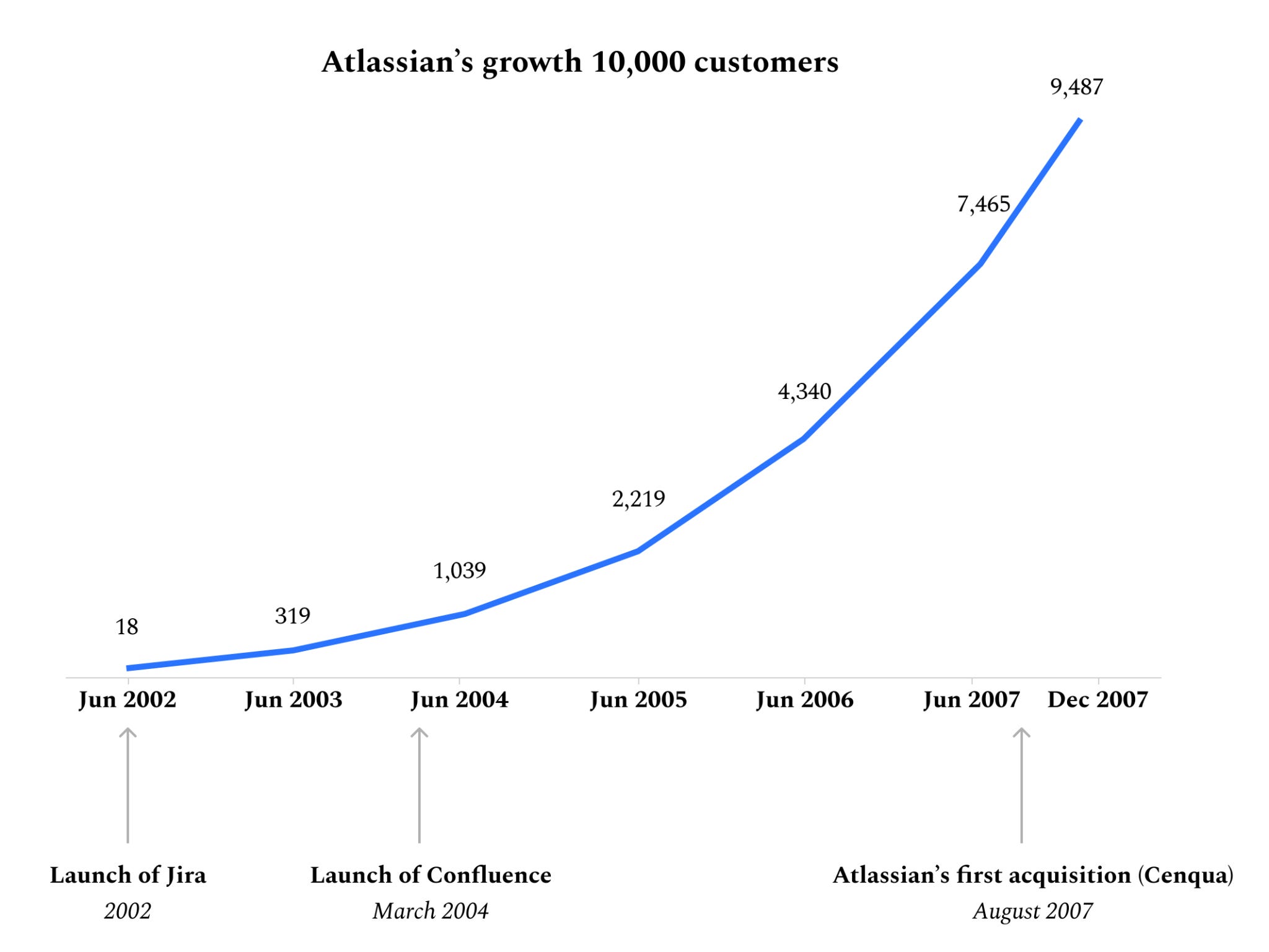

Within the first year of launch, Atlassian scaled to 300+ customers, within the next year the company grew over 3x to 1000+ customers. Here’s what worked: #1: Getting drunk at conferences! 🍺 Atlassian recognized that a large chunk of potential customers aggregated at tech conferences - like the JavaOne conference in San Fransisco. However, booths cost anywhere between $20-50k - something Atlassian couldn't afford. Being the hacky 22-year-olds they were, Atlassian employed some guerilla tactics ahead of a popular session called “Java posse”. Prior to the event, Scott and Mike trucked in about 15 to 20 cases of beer for attendees and slapped Atlassian labels on them.

Atlassian's conference beer parties! #2: Make your customers your billboard 👕 Atlassian soon turned into an apparel company shipping about 10,000 tee-shirts to customers around the world. But there was a catch. Only the customers who bought the most expensive version of our product got a T-shirt.

Atlassian shipped 10,000s of T-shirts in its early days and now runs a full-fledged e-commerce apparel store! 🤯 https://shop.atlassian.com/ #3: Always be marketing 🔄 Using every opportunity to sell Atlassian went as far as marketing themselves and their culture on their 404 not found and 500 pages on their website! #4: Make everything into a campaign - even recruitment 👔 Atlassian marketed their employees relentlessly and even turned recruitment into an opportunity to run a marketing campaign.

They limited recruiters to a ceiling of 4 candidates sent or they wouldn’t do any more business with them. 📈 Going multi-product! Scaling past 1,000 to 10,000 customersAt the onset of 2004, Jira was a breakout product in what looked like a larger and larger market! The product had grown past its initial use of developer bug and issue tracking and is increasingly being used by other teams such as marketing, design, and operations teams for project management. This is when Atlassian took an unconventional bet. Conventional wisdom dictated that if you have a winning product (Jira), it would be a mistake to divert focus away from it to build a whole new product. But Jira’s viral success with other teams and use cases beyond issue tracking had the founders intrigued.

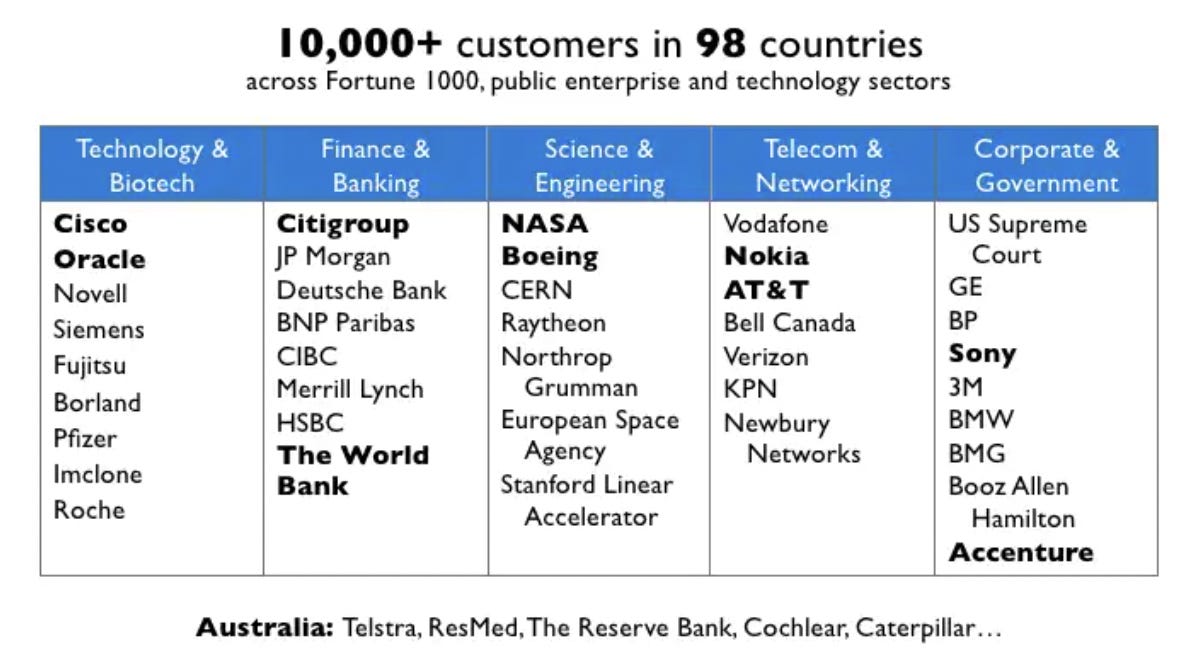

The combination of Jira and Confluence changed the growth trajectory of Atlassian. By 2007, Atlassian had~10,000 customers in close to 100 countries. Within a short span of time, Atlassian found its way into the toolkits of the largest companies in the world - Cisco, Oracle, Citigroup, Nokia, AT&T, you name it.

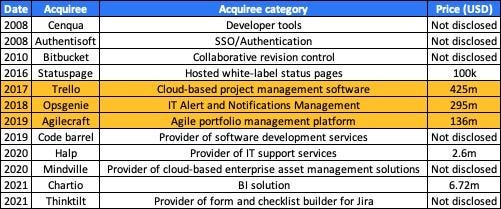

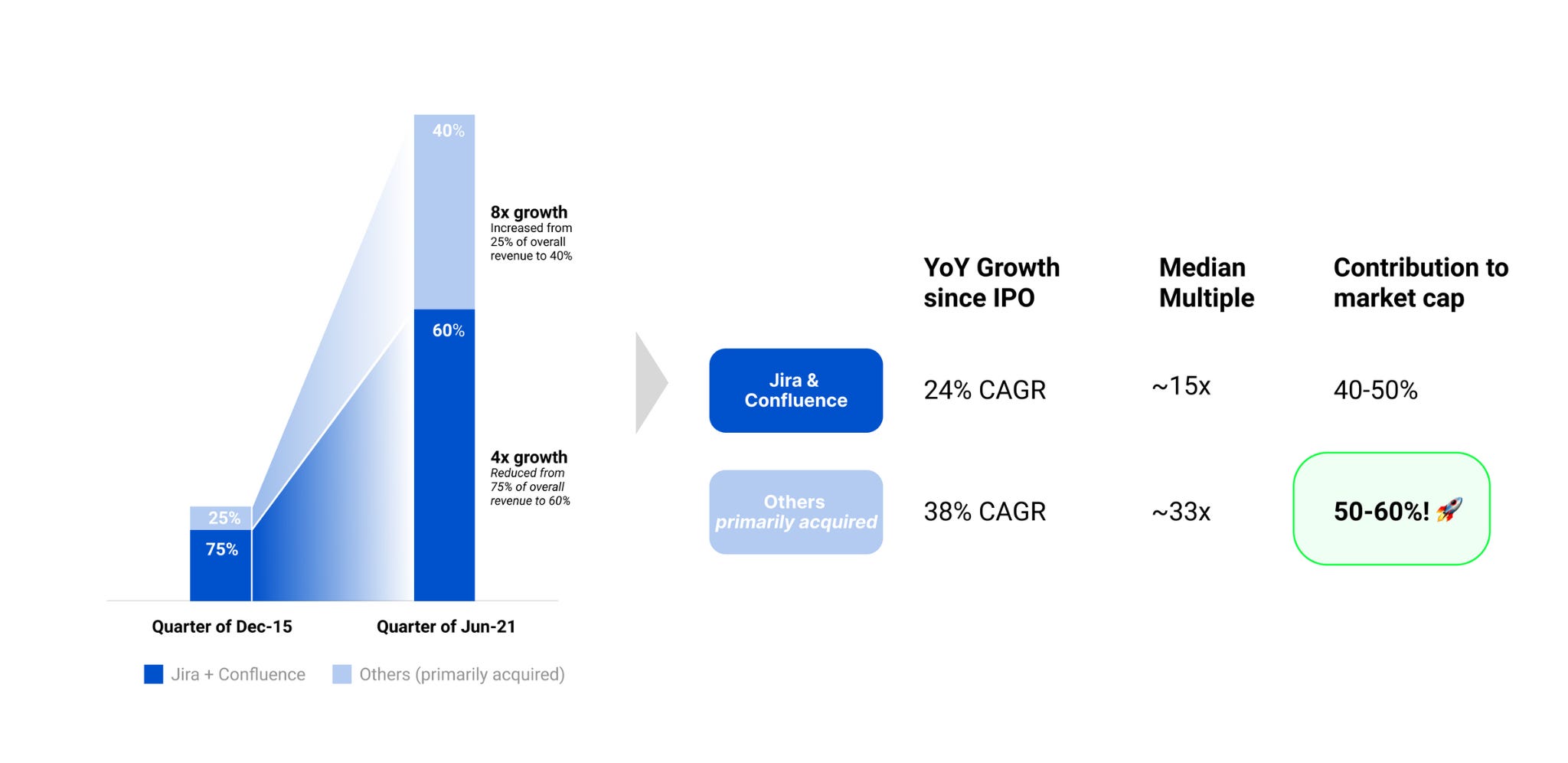

🚀 Acquisition-led growth and the path to $85B+ market capPowered by the early profitability around flagship products like Jira and Confluence, Atlassian was aggressive in bolstering their early product lines with acquisitions. Authentisoft for SSO & Authentication, Clover + Crucible for code coverage and review, and Fisheye for accessing repositories. Fast forward 14 years, the company has invested north of $1B, across 18 acquisitions and 12 investments to fill product gaps (speed to market), enhance capabilities (talent and IP) and expand markets. What's even more interesting is the M&A engine’s contribution to Atlassian's topline - 25% leading up to the IPO to 40% as of today. The effect of acquisitions on Atlassian’s growth rate is even more astounding.

Borrowing from Jamin Ball’s latest analysis on public market multiples for high growth (30%+ YoY) companies vs. mid growth (15-30%) companies, it isn’t unfair to claim that somewhere between 50-60% of Atlassian’s $85B market cap finds its roots in acquired assets! Acquired assets as 50%+ of Atlassian's market cap! Sources: Atlassian, Clouded Judgement 🤿 Deep dive: How Atlassian became the most successful acquirer of assetsAtlassian’s acquisition playbook has 4 carefully built out components:

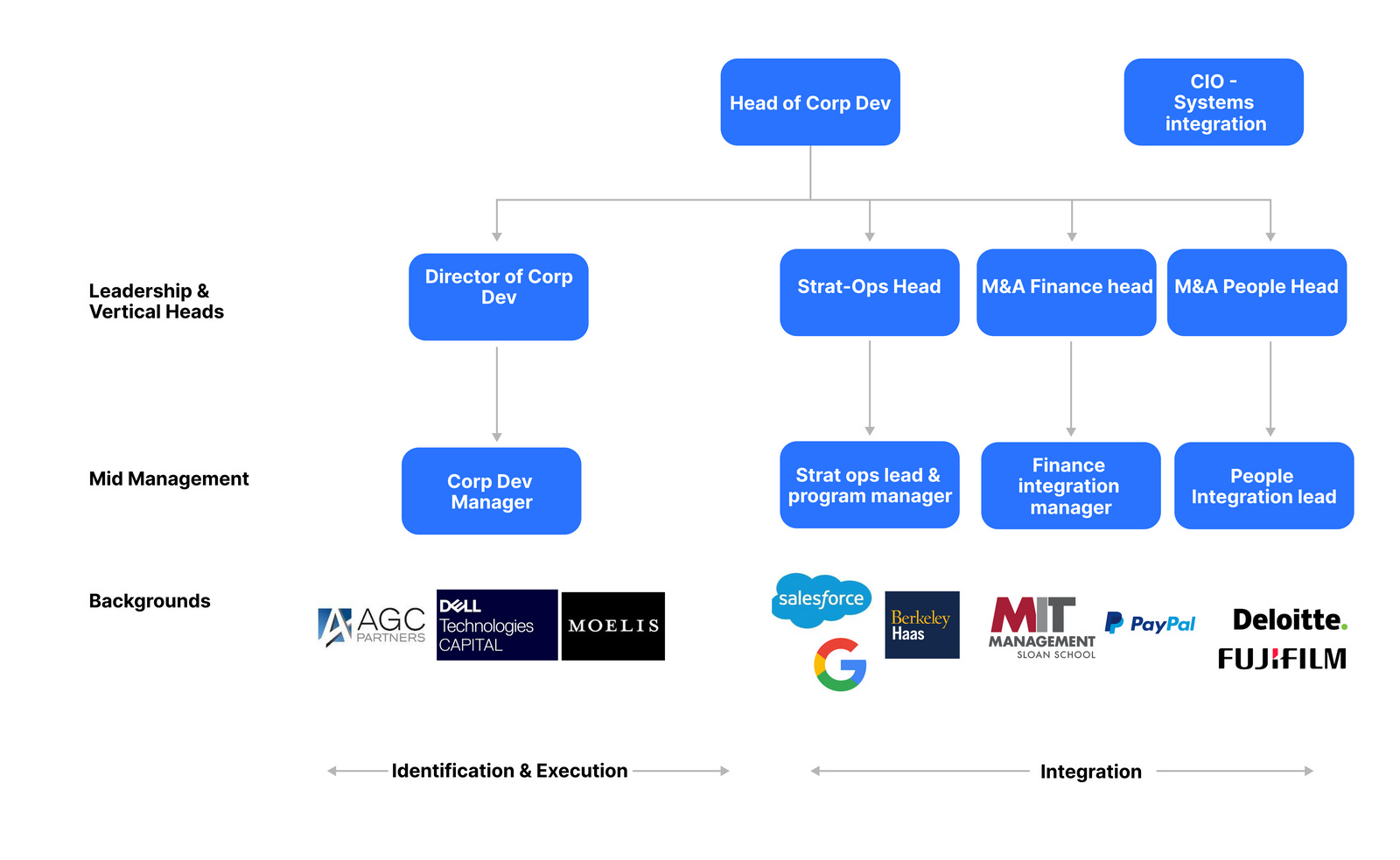

Many of Atlassian's acquisitions are borne from a need to Transform existing products and Augment reach to adjacent areas thereby giving the customer a one-stop tool. These requirements flow from agile feedback loops generated at the customer level, championed by product owners, and masterfully executed by the M&A vertical - a small but powerful unit reporting directly to the Co-CEOs.

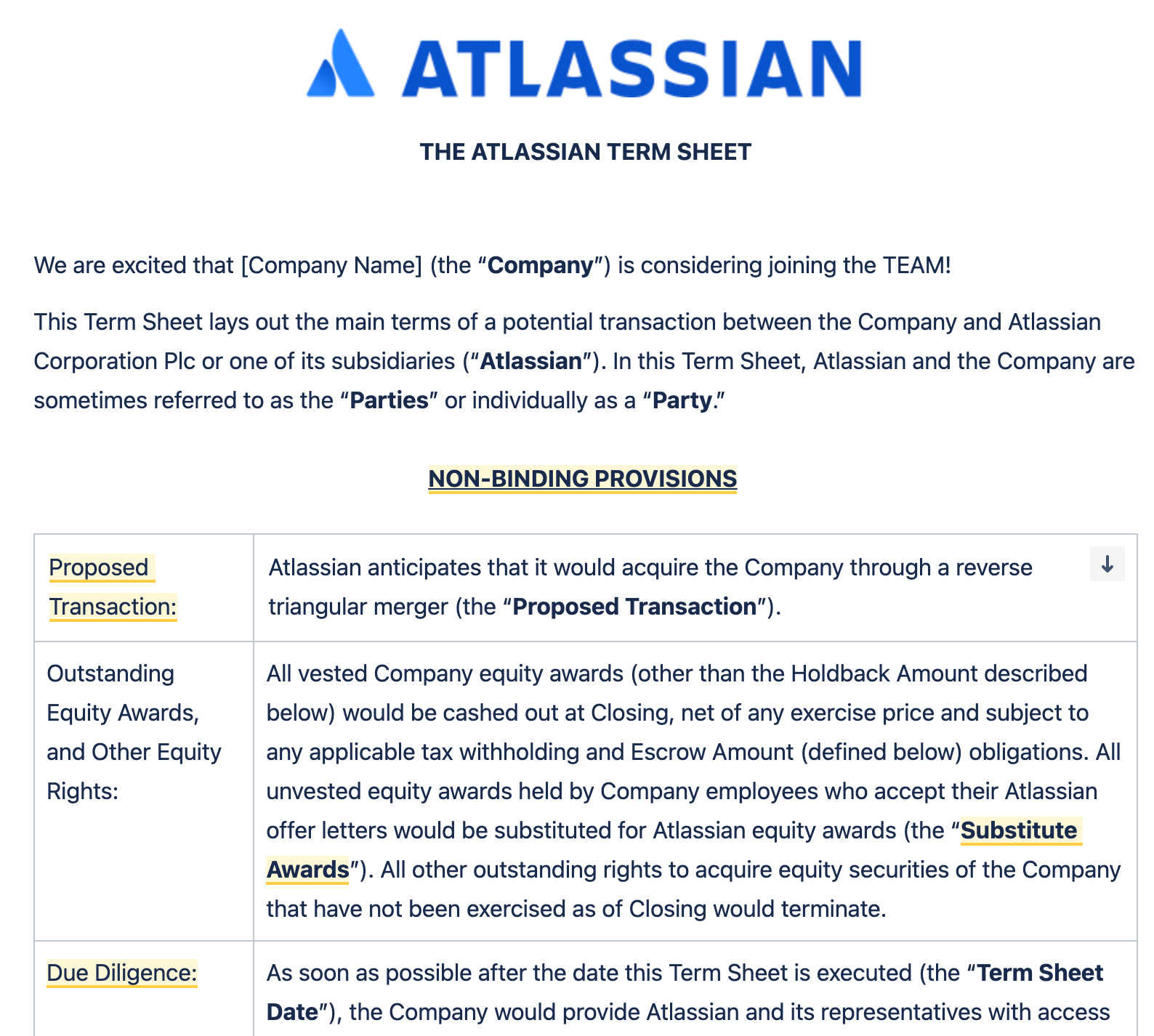

An unprecedented move in 2019 saw Atlassianopen-source its M&A term sheet thereby making the process fairer and more transparent. Terms around Escrow funds (indemnification), against senior talent earnouts (linking employee payouts to rigid goals), and special reps (against IP/Legal claims) further position Atlassian as a seller-friendly acquirer.

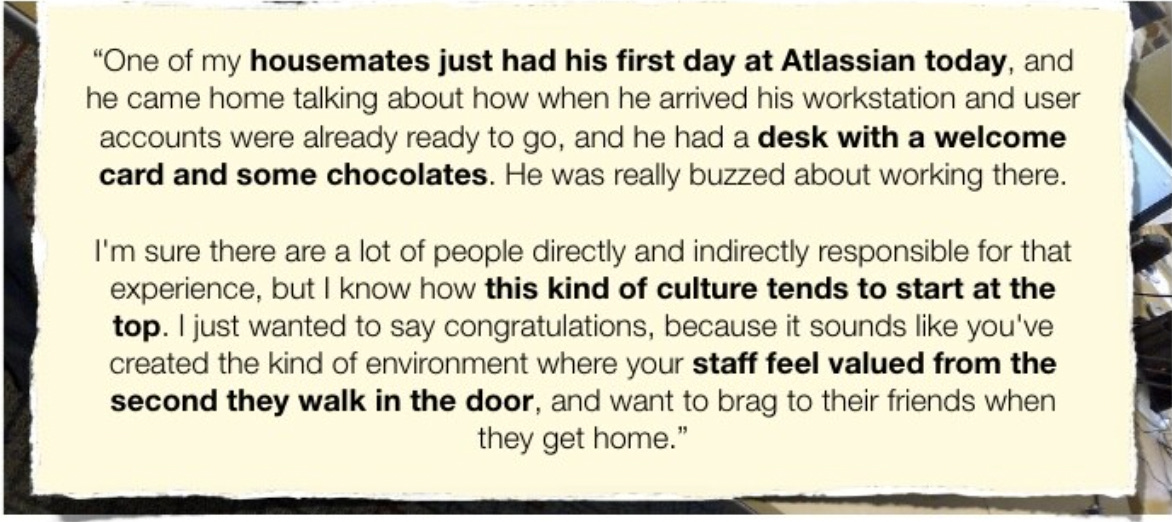

Managing cultural differences and post-acquisition integration are considered as make or break plays in the M&A ecosystem. At Atlassian, a dedicated team, working with playbooks for financial, people, and systems integration aligns the acquiree with the goals & processes of the organization and streamlines an otherwise uncertain transition. Atlassian maps their renowned values to those of a potential acquiree, conducts leadership kick-off summits, draws out product and employee roadmaps, allocates additional resourcing to account for during-integration productivity losses among other well laid out programs to address concerns around integrations.

Atlassian Term Sheet - Publicly available and hosted on (you guessed right!) Confluence And, the team that makes the magic happen... 🪄 M&A and Corp Dev team structure | Source: LinkedIn Imagine the only time I write about a company in your domain you accidentally miss it because of some random email algorithm 💩. |

Older messages

📣 Cameo

Tuesday, September 7, 2021

and getting people to pay you to promote your product.

🧘🏻Calm

Sunday, August 22, 2021

Building a viral product

📅 Superpowered (YC S19)

Sunday, August 15, 2021

How Superpowered used Product Hunt to get hundreds of paying customers?

Juno: The Costco of Student loans

Monday, August 9, 2021

+ Growing through an early adopter community

👟 Nike

Sunday, August 1, 2021

The story of a 7 year pivot, a hostile takeover, and behind the scenes on the creation of one of the most beloved brands in the world. The Nike case study is the best one yet!

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏