Earnings+More - 17 Sep: Weekend Edition no.14

This week the gaming news was dominated by the deterioration in Macau where the new proposals from the Chinese authorities sent an $18.4bn-sized shudder through the valuations of the leading operators. As is obvious from recent actions against the internet giants, Communist Party command and control is back with a vengeance in China and this undoubtedly now extends to gambling activity. Time to scour the charity shops for those Mao jackets. Elsewhere, in the first week of the new NFL season it is really no surprise that proliferating gambling ads should be the subject of much discussion. We also have new analysis on Penn National and on the value of the Scientific Games lottery business. If you were forwarded this newsletter and would like to subscribe, click here: Asian gaming shockXi who must be obeyed: This week’s Chinese government proposals for tighter regulations in Macau knocked a record $18.4bn in combined share price value off Macau’s gaming operators. The new rules will include increased supervision of operators’ daily activities around VIPs and junkets, a raised level of local ownership, restrictions on dividend payments and the reform of sub-concessions licensing, potentially reducing the number of licenses and shortening their terms from the current 20+5-year concession system. Common people: China says the reforms are part of the ‘Common Prosperity Plan’ to reduce the wealth gap in the country. However, writing in the WSJ recently, billionaire investor George Soros’s take on these recent moves was that “the regime regards all Chinese companies as instruments of the one-party state” and this “does not augur well for investors.” Maximus ominous: Deutsche Bank’s top line was that “the meaningful ambiguity” will remain until “further color is provided” or the new gaming law is made public.

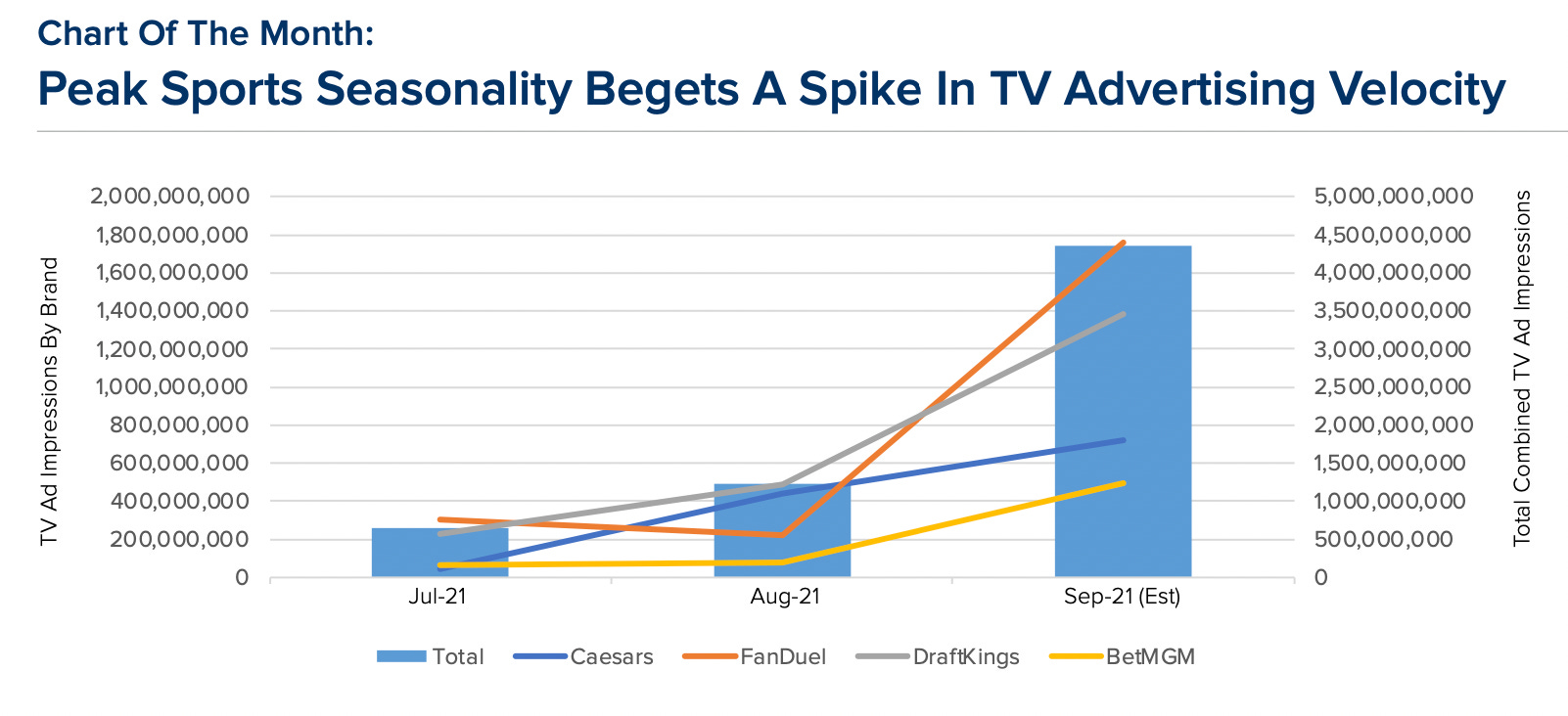

Unknown unknowns: The concession renewal process and related news were always likely to lead to a bumpy period, but for the team at DB the “dominant narrative” currently is “fear of the unknown”. Investors appear to have taken note of other actions on the part of the Chinese government targeting high-profile business sectors in China, including illegal online gaming, while the stop-start nature of the post-pandemic recovery has been frustrating. Shifting Sands: In a note issued in the wake of this week’s events, analysts at Jefferies have downgraded Las Vegas Sands to a hold suggesting the uncertainty around Macau highlights how the company - which divested itself of its Las Vegas Strip operations this year - has left it “without alternative avenues of growth.” “New US license opportunities do not appear to be viable, while the commitment to digital gaming growth appears modest,” they added. The team also lowered their estimates on Wynn Resorts given its exposure to the VIP area which will likely be “materially impacted” by the proposals. BREAKING NEWS: Pontus Lindwall is to leave Betsson after the company issued a statement this morning saying he had “completed the assignment’ set in 2017 to get the firm “back on track.” Betsson said it will now “begin the work of searching for the next generation of international leader”. Note, the news comes in the same week that Betsson was heavily tipped alongside Rush Street Interactive as a potential target acquisition to satisfy the sports-betting ambitions of sportswear apparel firm Fanatics. See Newslines below. The TV advertising debateNow a message from our sponsors: The extent to which the market leaders are willing to hammer home their advantage via the huge potential market spends at their disposal is evident from the recently released iSport TV ad impression data. Looking at the data, the analysts at Eilers & Krejcik point out that FanDuel and DraftKings “have begun to significantly out-advertise” rivals Caesars and BetMGM.

Overwhelming wave: As the E&K team noted, the subject of overwhelming advertising was discussed during a webinar held this week by iDEA and GeoComply which featured Daniel Hartman, the director of the Division of Gaming at Colorado and David Rebuck from the new Jersey Division of Gaming Enforcement. Both warned that a proliferation of ads was gaining the attention of legislators. “They didn’t expect this,” suggested Hartman. Referring to previous experience with the DFS “ad wars”, Rebuck suggested state government s might feel the need to step in if the free-for-all on ads didn;t abate:

Rebuck also suggested the promotional offers were another area of concern, suggesting that many consumers don’t understand the requirements of the offer and warning that a state such as New Jersey could go back to a system of having to give pre-approval for all promotions.

Wagers.comThe first features from Wagers.com are now available via LinkedIn. This week Scott Longley takes a look at the 888-William Hill acquisition: now that it has landed its transformational deal with Hills could this mean a downgrading of the company’s US ambitions? Jake Pollard meanwhile looks into the potential reasons for licensing setbacks for operators and where future US regulations might be headed. Penn National initiationHinge and bracket: Wells Fargo issued an initiation note on Penn National suggesting the debate for investors now hinged on how effective the company would be in leveraging Barstool Sports and, over time, theScore media assets to further the sports-betting and igaming proposition and driving omni-channel activity. The analysts noted that it was a mixed picture:

Going back to my roots: As with the other big land-based operators, Penn has fared better in igaming, whereas the DFS operators have outperformed in sports-betting. ”Given Penn’s gaming roots, we expect that over the next 12–18 months, (it) will focus on improving its iGaming product/tech stack, with a goal to gain share by both cross-selling its sports users (via Barstool, and eventually, theScore) as well as tapping into its brick/mortar casino database.” Scientific Games lottery business updateNumbers come up: Scientific Games this week offered some insight into what potential buyers of its lottery business can expect to get for their money, highlighting its “infrastructure-like” profile with a no.1 position in instants, a defensive business model and long-standing customer relationships. Jefferies noted the earnings forecasts for FY21 and ‘22 with revenue rising from $1.04bn to $1.19bn and EBITDA expected to hit $466m in FY21 and $498m in FY22. The team at Truist suggested this puts Scientific Games on track to reach a $5bn valuation for the company with the potential for “meaningful upside.” Results round-upSazka: Group GGR was €1.26bn, up 94% YoY and adjusted EBITDA rose 97% YoY to €397m. The majority of the company’s retail operations in Czech Republic, Austria and Italy have been open throughout the period while online has also grown strongly. Pandemic restrictions have been gradually lifted throughout the period, including in Greece. The company said current trading is now around or about 2019 levels. DatalinesNew Jersey: GGR was down 8.4% vs. Aug19 and down 5.2% MoM to $262.4m, icasino was up 29%YoY but down 4.6% MoM to $113.2m. Sports Betting GGR increased 31.5% vs. Aug19 and was down 5,34% MoM to $52m despite a 14.9% monthly rise in handle to $664.7m. The handle amount represented a YoY drop of 50bps and the first negative handle comparison YoY outside of the pandemic shutdowns and since NJ launched sports betting in 2018, DB explained. OSB revenue was down 4.9% to $48.2m and land-based betting revenue dropped 10.6% to $3.8m over July. Hold rates were 7.8% vs. 5.9% in Aug20, LTD in New Jersey has been ~7.0%, while the YTD completed events hold stands at 7.6%. Michigan: Mobile betting generated $15.9m of the state’s total GGR of $17.5m. Online wagering handle was up 2.3% MoM to $192.3m and compared with $188m in July. Mobile hold was down ~210bps at 8.3% MoM. DraftKings leads in market share with 31.9% vs. 28.4% in July, FanDuel dropped to 24.8% vs. 29% in July and BetMGM was third with 22.7%. In revenue terms FanDuel accounted for c30% of mobile GGR share, DraftKings was second with c28%. Online casino GGR was up 5.3% sequentially to $97.2m, brick and mortar casinos generated GGR of $112.2m, a 6.4% drop vs. Aug19 and MoM. DB noted that Michigan along with fellow online casino-regulated jurisdictions New Jersey and Pennsylvania “continue to lag the broader regional gaming complex by a fairly large margin”. BetMGM, FanDuel and DraftKings are the top three icasino brands on a monthly and YTD basis. Iowa: GGR was up 13.1% vs. Aug19, up 21.8% YoY but -7.8% MoM to $145.1m in August. Sports betting GGR dropped 14.3% to $6.6m MoM although handle was up 21.1% to $108.4m. The launch of mobile registration in the state earlier this year was well received and wagering spend on and LTM basis is tracking at c$44. Indiana: GGR was up 10% vs. Aug19 and -8.9% MoM to $209.3m, the 10% rise was c410 bps below DB’s +14.1% estimate for spend per tracked visitors. Sports betting was down to 5.2% MoM to $16.5 and handle was up 10.9% vs. July to $215.6m. YoY this was a rise of 68% and hold was up 190 bps on the same basis. Margins were 7.7% vs. 8.2% LTD, which was 130 bps down MoM. Per adult spend on sports betting is tracking at c$53, on mobile DraftKings leads the market with 38% share, FanDuel is second at 27% and BetMGM is third at 13.4% handle share. William Hill is fourth with market share of 8.6% vs. 4.5% in July. Missouri: GGR came in at $152.6m, a 1% rise on Aug19 and +15.9% YoY. Visitation rates were down c21% but spend per visitor was up c28% vs. Aug19. On a sequential basis GGR was down 8.8%, visitation rates and spend per visitor were also down c7% and c2% respectively vs. July. The St. Louis market, including both Missouri and Illinois casinos, generated $84.2m in GGR a 5.6% drop vs. Aug19 and -7.6% vs. July. Missouri casinos in the Kansas City market recorded a 4% rise to $58.1m on 2019 and -9.2% versus July. Massachusetts: GGR was up 8% to $92.4m vs. Aug19, a rise of 30.1% YoY but down 3.5% MoM. Wynn Resorts’ Encore leads in the state with $57.9m GGR, $6.1m above DB’s $51.8m estimate. NewslinesFanatical: Fanatics is rumored to be in talks with Rush Street Interactive and Betsson with a view to acquiring either company to drive its entry into the US sports betting scene. RSI is the frontrunner according to Action Network and Fanatics is also weighing up whether to make a play for the $3bn ESPN-branded sports-betting rights package the media giant is looking at setting up. RSI offered no comment and Betsson did not respond to enquiries. Getting previous: Perhaps burnt by the failure to secure a license in neighboring Arizona, PointsBet has moved (vey) early to secure a market access partner in Texas. The company has signed an official sports-betting partnership with MLS team Austin FC just in case Texas should look at regulating sports-betting any time. Getting specific: Rush Street Interactive has announced a hyper-local podcast and audio broadcast initiative which involves various city specific ‘CityCasts’ that will air on weekdays across multiple platforms, delivering news, analysis and wagering insights. Richard Schwartz, CEO of RSI, said the CityCasts played to RSI’s “hometown sportsbook” appeal. They are already live in Chicago, Detroit, Pittsburgh and Philadelphia. Cut to the chase: Paysafe has appointed Zak Cutler as CEO, North America iGaming. Cutler is a former DraftKings executive and will report directly to Paysafe group CEO Philip McHugh. Indigo blue: IGT has added the Indigo Sky Casino in Oklahoma to its roster of cashless payment clients. IGT will implement a phased rollout of its Resort Wallet and IGTPay modules at the resort, the group added that Oklahoma has the second-highest concentration of gaming machines per capita in the US. What we’re promotingReputation Matters: UK Gambling’s Future At Stake will be taking place on Tuesday 2 November at the Ironmongers’ Hall in the City of London. The event will consist of panels discussing the sector’s positioning as it enters a crucial phase of the Gambling Act review process. The event is headlined by John O’Reilly, Rank chief executive, who will provide the keynote. For ticket information, visit the EventBrite page. What we’re writingSportradar’s float gives us true data insight: For BettingUSA. Are we there yet: The European gaming sector gnaws at its Covid chains. For iGB. What we’re readingPay back: “And that money the league once spent on lobbying against gambling? This season, the N.F.L. is getting it all back. And then some.” Playing deep: Sports betting will be embedded into the NFL experience this season. What we’re listening toThe Gambling Files: TL;DR episode two. Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

10 Sep: Weekend Edition, no.13

Friday, September 10, 2021

Catena Media buys i15 Media, Caesars and 888 analyst reaction, Arizona sports-betting launch, MGM Resorts International conference Q&A, US gaming outlook, sector watch - crypto +More.

9 Sep: 888 confirms William Hill buyout

Thursday, September 9, 2021

888 buys William Hill, OPAP H1, Macquarie online update +More

8 Sep: Sports data takes the stage

Wednesday, September 8, 2021

Sub-head: Sportradar IPO, Genius Sports Q2, M&A round-up, Entertain analyst note, Jefferies sports-betting survey, Fitch Asian gaming forecasts +More

Welcome to Earnings+More

Sunday, September 5, 2021

Thank you for signing up for Wagers.com Earnings+More

You Might Also Like

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The

End 2024 with a BANG💥 (Huge GIVEAWAY!)

Tuesday, December 24, 2024

Over $12K in gizmos & gadgets up for grabs View in browser ClickBank Hi there, We've got something totally different for you today, some good value fun (with no-strings-attached) to wrap up

Survey: Tech VCs ride wave of optimism

Tuesday, December 24, 2024

Crypto headhunter turns VC; unicorn valuations are stampeding; Nordstrom family inks $6.25B take-private for chain Read online | Don't want to receive these emails? Manage your subscription. Log in

The Daily Coach's Picks: 10 Recommended Books of 2024

Tuesday, December 24, 2024

These books promise to help empower your journey of growth and transformation.

Here's everything retail media network experts are asking for this holiday season

Tuesday, December 24, 2024

If retail media network experts could write a letter to the North Pole, here's what they'd ask for. December 24, 2024 Here's everything retail media network experts are asking for this

Hack offline word of mouth

Tuesday, December 24, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

🎯 Stop Planning Your Goals Like An Amateur

Monday, December 23, 2024

Here's how to actually crush 2025 while everyone else is nursing their hangover... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏