Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #256

What's 🔥 in Enterprise IT/VC #256Supersizing 🍟 of Seed + the race to be 🥇 + bigger is not always better

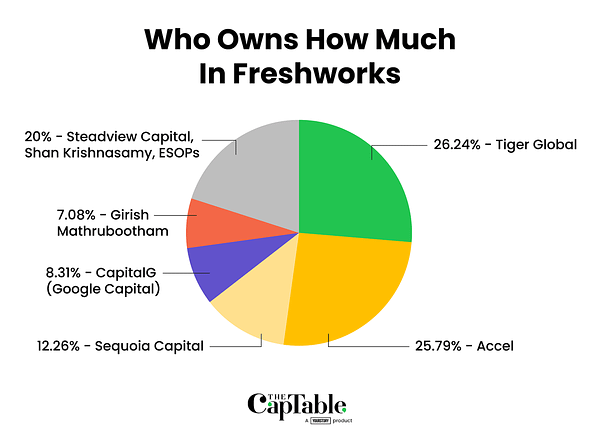

Congrats to FreshDesk, a customer support platform, on its massive IPO, now worth over $12B, and also creator of over 500 millionaires in India 😲! However, the big news this week is Greylock’s announcement of its $500M seed fund, yes seed fund! This has had every VC and founder chatting nonstop over twitter, texts, and calls about what this means moving forward.    Greylock @GreylockVC 1/ We at @GreylockVC are excited to announce we’ve raised $500M dedicated to seed investing. This is the industry’s largest pool of venture capital dedicated to backing founders at day one. https://t.co/j7RDGCv6mQBefore I share my two cents on how this impacts the world of VC, let’s take a step back and look at the market. Using FreshDesk as an example, look at these numbers below: Accel was first in and backed the 🚚 up over time and then Tiger was next doing the same - both gobbled up as much ownership as possible. Their stakes are worth over $2.3B 🤯 each and the next largest shareholder, Sequoia, has 1/2 the ownership that the other firms who were in first do.   As I’ve always said… And here’s why:

To be clear, this does not mean that bigger is better or $20M is the right number for founders. In fact, I would argue that too much 💰 too early can kill a company.  What we have is the supersizing of venture from exits to growth rounds to “seed” rounds to fund sizes. And within this context, the earlier you are, the more you can own and the less you pay relative to other rounds - that’s it. So what’s a seed firm to do in this market? How should founders think? Semil from Haystack lays it out and important to read the 🧵   Samir Kaji from Allocate nails it  For the seed firms not entering the $400-500M “seed” arms race where seed isn’t really seed, my advice is simple - be first and specialize or be first and write smaller checks and get in the best deals. Every other strategy will get wiped out. Being first means partnering with founders and not investing in companies. It means taking technical risk which I would argue in today’s world is not that high versus what it was 20 years ago or unless you’re investing in biotech or other science projects. It also means writing a much bigger check on day 1 as even these day one rounds are no longer $1-2M but $3-6M. It also means your fund size does not have to be $400-500M but it has to be $125-250M. And founders, if you think you’re getting a $20M seed check from Greylock, I can assure you the chances are slim. Not much has changed as many of these firms have always written these checks to their repeat founders and are just relabeling as massive seed funds. For those underdog founders, the ones we love to partner with, you have plenty of great day one or first check partners to choose from and bigger is not better!   Partner with a firm whose interest is 100% aligned with yours to help deliver the best next round possible without conflicts, who has the time to spend on day one founders versus investors looking for companies and also invest in Series A + B rounds, who specializes in your zone of expertise, who can help you with all of the other business functions so your sole goal can be getting to product market fit faster, and one who will be patient before pushing you for ARR! As always, 🙏🏼 for reading and please share with your friends and colleagues! Scaling Startups

Enterprise Tech

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Older messages

What's 🔥 in Enterprise IT/VC #255

Saturday, September 18, 2021

Gitlab - focus on community and don't go enterprise too early = 152% Net % Retention and S-1 Filing

What's 🔥 in Enterprise IT/VC #254

Saturday, September 11, 2021

What does the day one launch of an $8.5 Billion developer first company look like and why developer experience matters?

What's 🔥 in Enterprise IT/VC #253

Saturday, September 4, 2021

📈 The future of enterprise software is ☀️ - MongoDB, Asana, Okta - 🦄 or 🐲

What's 🔥 in Enterprise IT/VC #252

Saturday, August 28, 2021

❄️ and Salesforce earnings 😲 - eventually you have to grow into your valuations and performance matters

What's 🔥 in Enterprise IT/VC #251

Saturday, August 21, 2021

APIs + developer tools for the win 💪🏼: Postman and Apollo at combined $7.1B of value 🤯 - Postman's dev first flywheel

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏