6 Reasons Why the Success of Bitcoin Is Inevitable

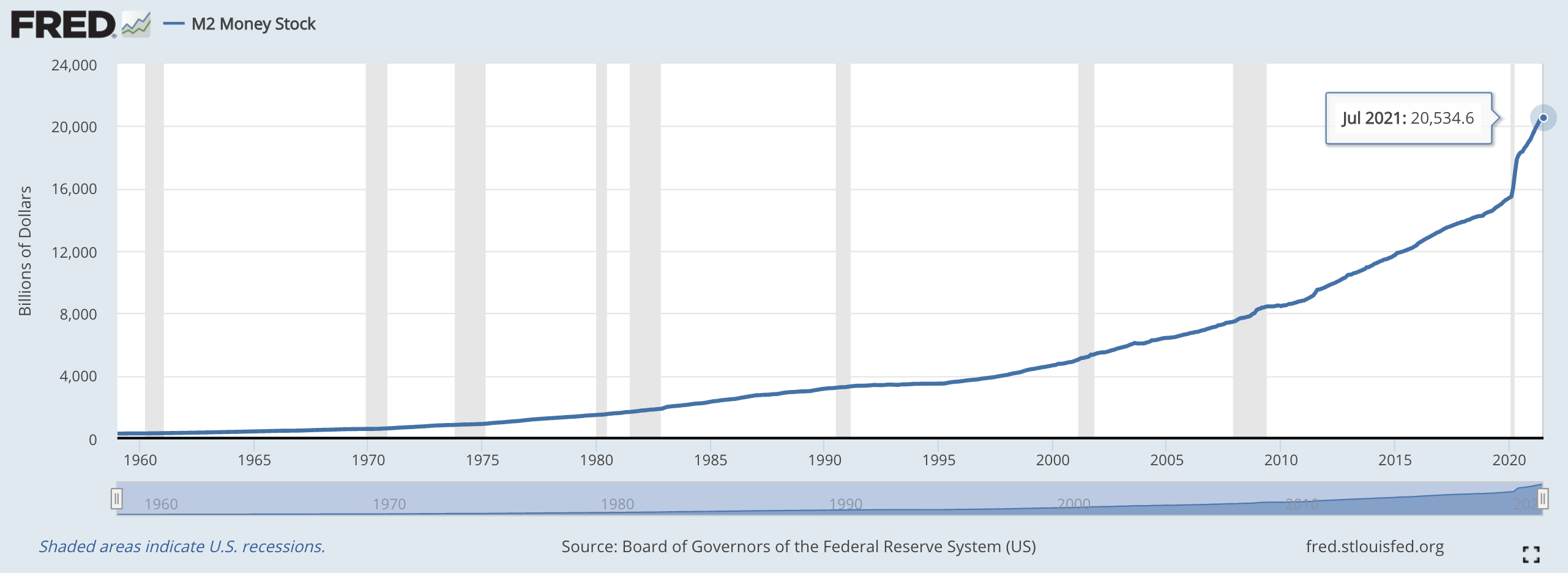

6 Reasons Why the Success of Bitcoin Is InevitableNo force on earth can stop an idea whose time has come.Written by Sylvain Saurel - In Bitcoin We Trust Bitcoin's success continues to grow block by block. In September 2020, Bitcoin reached the 100 million user mark. One year later, Bitcoin has just passed 125 million users. This growth has been boosted by the great monetary inflation we have been facing since April 2020. Despite the willingness of the powerful in the current system to do everything to fight against the inevitable success of Bitcoin, the Bitcoin revolution will accelerate in the coming months and years. Bitcoin fulfills the great need that has emerged since the beginning of the COVID-19 pandemic: to have hard money that allows you to resist monetary hyperinflation in a censorship-resistant way. De facto, it is only a matter of time before Bitcoin adoption eventually explodes like the Internet explosion of the early 2000s. To those who ask me why I keep saying that the success of Bitcoin is inevitable, I will give them 6 essential reasons in what follows. Hard money > Weak MoneyBitcoin is hard money. A limited supply of 21 million units no matter what. Inflation in the supply of newly issued BTC that tends to zero over time and a programmatic monetary policy that protects Bitcoin users from the arbitrariness of humans. No one can decide in his or her corner to change the monetary policy of Bitcoin. Everything is done by consensus in the Bitcoin system and no one has any interest in changing the rules that make Bitcoin the hardest money in the world. The properties of Bitcoin protect you and allow you to save the fruits of your labor without risk to your future. This is something that people have lost the habit of doing since Richard Nixon unilaterally established the current system in 1971. Bitcoin is to be contrasted with fiat currencies which are weak money. For those who are offended by this assertion, you only need to look at the evolution of the supply of the US dollar in circulation to understand why what I am saying is a fundamental truth: Over 30% of all US dollars in circulation have been printed out of thin air by the Fed in the last eighteen months. This has de facto devalued the wealth of all those who cannot afford to hold anything but cash. And that is the majority of the earth's inhabitants. Hard money like Bitcoin will eventually win out over weak money. Decentralization > CentralizationIn the current monetary and financial system, everything is centralized. A minority of people not elected by the people make decisions that have negative impacts on the vast majority of the Earth's inhabitants. You have understood that I am referring to central bankers whose probity can be questioned. Only recently, it was reported that the personal fortune of Jerome Powell, the Chair of the Fed, has soared over the last eighteen months, during which the Fed has printed virtually unlimited amounts of US dollars. I'm talking about Jerome Powell, but the situation is the same for the other members of the Fed. On top of that, there is the problem of censorship which allows governments or private bankers to censor your transactions for totally arbitrary reasons. In the current system, you are not really in control of the fruits of your labor. The powerful give you the illusion of control, but in the end, you have to obey their rules. Bitcoin wins because it is decentralized and leaderless. Bitcoin belongs to me. It belongs to you. Bitcoin belongs to everyone. No one can stop you from becoming a node in the Bitcoin network to be your own bank. Decentralization is better than centralization. Privacy > SurveillanceThe centralization of the current system allows the powerful people who control it to monitor you. The forthcoming arrival of CBDCs (Central Bank Digital Currencies) will make it even easier for them. The ultimate goal here is to gradually make cash disappear. I have nothing to hide. I'm sure you don't either. But do you want all your financial transactions to be monitored to create a complete profile of you? I don't think so. You want to be able to use the fruits of your labor as you wish without having to answer to anyone. That means embracing a digital currency like Bitcoin that makes your privacy a priority. Once a neglected issue, privacy has become a real focus for the general public. This is a good thing, and it will drive the adoption of Bitcoin in the years to come. Truth > DeceptionBitcoin is the truth because every user can check for himself what the truth is at any time. Anyone can run their own node on the network to check whether the Bitcoin currency policy is still being followed. You can see all the transactions that have taken place on the Bitcoin blockchain since its creation. Bitcoin is the opposite of the current banking system, which is opaque and has allowed bankers to take advantage of their clients for years. Since the early 2000s, banks have been fined over $330 billion in all kinds of ways. This is huge, but it is only the tip of the iceberg. The reason the banks have been fined so much is that they have embezzled much more money than that. The damage to the people of the world is immense. This banking system that de facto excludes hundreds of millions of people around the world is a total disappointment. Bitcoin fixes this by offering you a superior alternative. Freedom > OppressionOnce you have the private keys associated with your BTC, no one can stop you from using it as you wish. This has incredible implications for your life. You are free to live your life on your own terms. You no longer have to fear the oppression of corrupt rulers who would confiscate your wealth. People are looking for freedom all over the world and Bitcoin will meet this expectation in the future. So you will not be surprised to see that more and more people will opt for the Bitcoin plan in the future. Bitcoin is already a plan A for millions of people around the world. El Salvador's adoption of Bitcoin as its official currency is a sure sign that the future belongs to the Bitcoin nations. They will change the course of their history by making an incredible transfer of wealth. Future > Past

I love this quote from Victor Hugo which perfectly sums up the situation of Bitcoin since its creation and for the future. The idea of hard money belonging to the people has come. The success of this idea will not be stopped by any force on earth. Ray Dalio thinks that regulators and governments will kill Bitcoin if it gets too big. He is right, but he is wrong about the outcome. Bitcoin cannot be stopped. Its success is inevitable because Bitcoin is part of the digitalization of the world. The world of the future will need digital hard money. That hard money is Bitcoin. The past, represented by fiat currencies and even their digital versions (CBDCs), will have to give way to the future. You can't fight change. The best thing to do is to adapt to make the most of this new world that is coming. This is what more and more former opponents of Bitcoin are doing, as they come to recognize its superiority. Final ThoughtsBitcoin is part of the direction of history. A story where people are taking back the power over money. This trend, which began in the early 2010s, cannot be stopped. The benefits of Bitcoin are countless and it now seems impossible that Bitcoin will not succeed in its revolution. The big question is whether you want to be a part of it now or wait to get on board in 10 or 15 years when Bitcoin will have surpassed the market cap of gold. It's up to you as always. In Bitcoin We TrustLearn how to earn…Become part of our community.Follow our socials.Subscribe to our podcast.Subscribe to this publication.

If you liked this post from Cryptowriter, why not share it? |

Older messages

DAPP Spotlight: EMANATE!

Thursday, September 30, 2021

DAPP Network's community project spotlight for this week is Emanate! The Emanate team just announced they'll be using DAD's bridge to launch an erc-20 version of EMT on Ethereum. DAD's

Bullshipples: An Uplifting Story

Thursday, September 30, 2021

The Uplift World team put into action a brilliant vision. They dream where few dare. EOSIO's Delegated Proof of Stake opens doors to so very much. Metaverse developers have been waiting for fast,

Cryptocurrency - Just Another Asset Class?

Thursday, September 30, 2021

“Let's change the world, let's lift it / Let's take it and awake it …” - Wayne Visser The internet is inseparable today from our daily life. The history of the internet started in the 1960s

Unique Network- The Most Important NFT Project In Polkadot

Thursday, September 30, 2021

After Ethereum the NFT crowd moved to Solana. Lots of Solana NFT Projects have picked upstream. The Cardano CNFTs are doing pretty well too. Recently Fantom launched its new marketplace called Artion.

Bitcoin is the Riskiest Kind of Asset Except for all the Other Kinds

Thursday, September 30, 2021

You're buying bonds guaranteed to lose money and telling me bitcoin's the bad idea?

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏