Cryptowriter - AotC - The Final Countdown

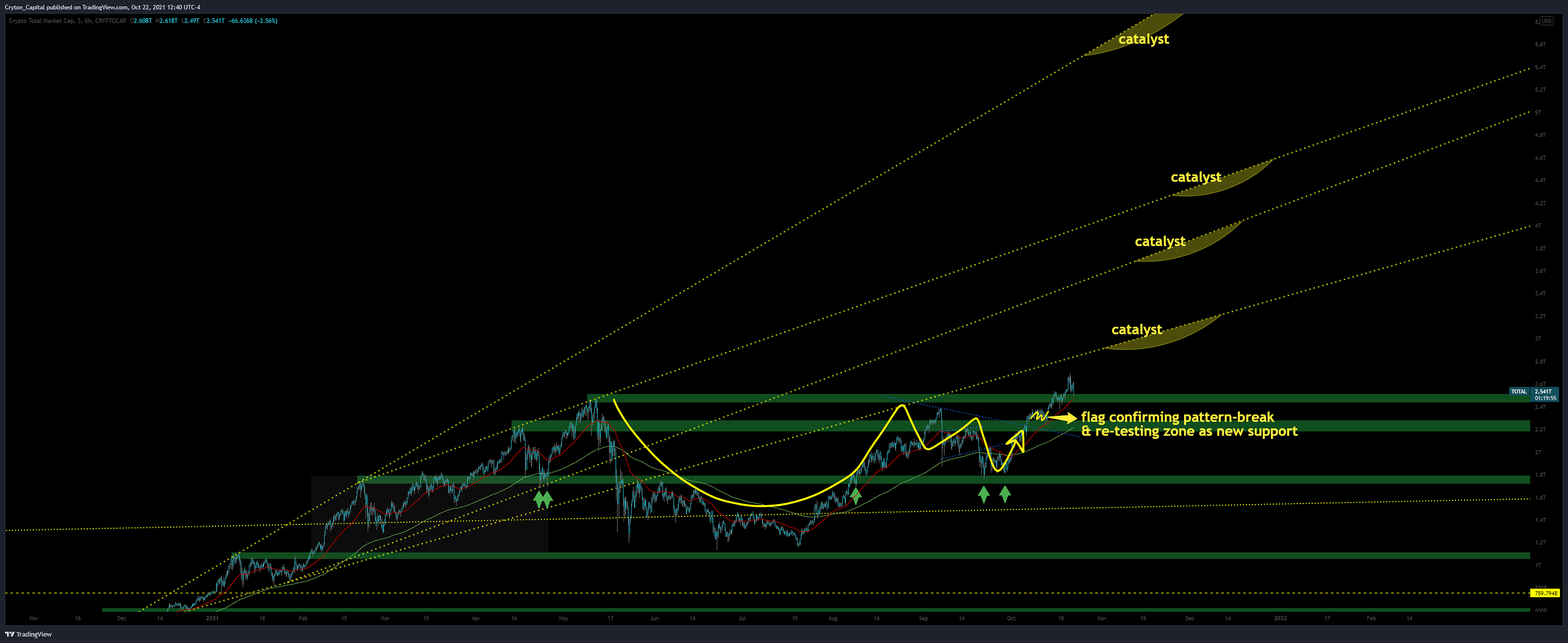

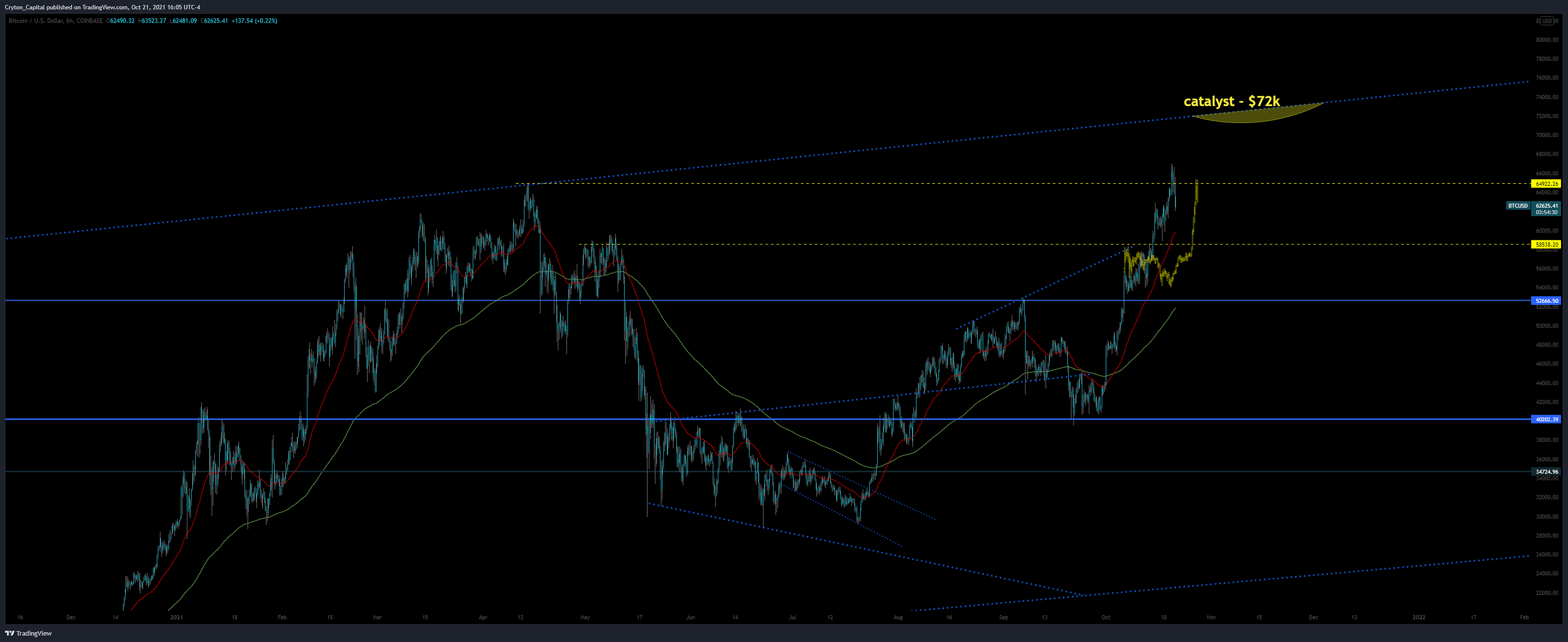

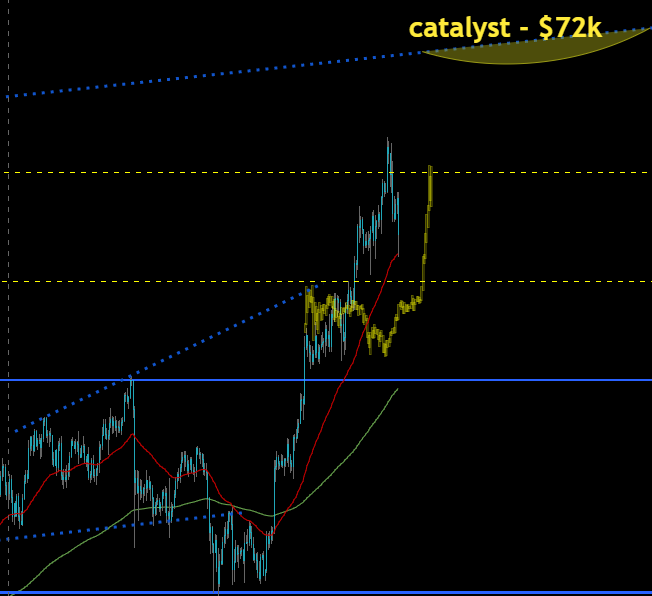

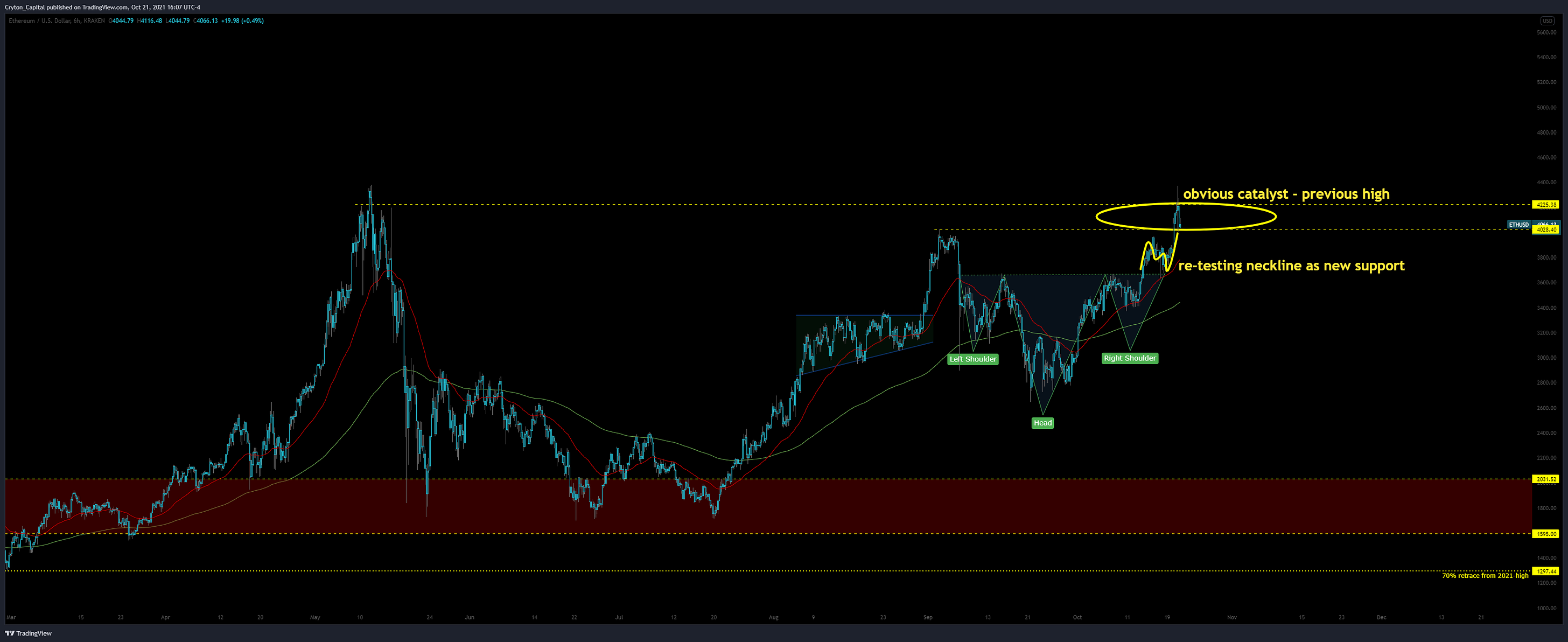

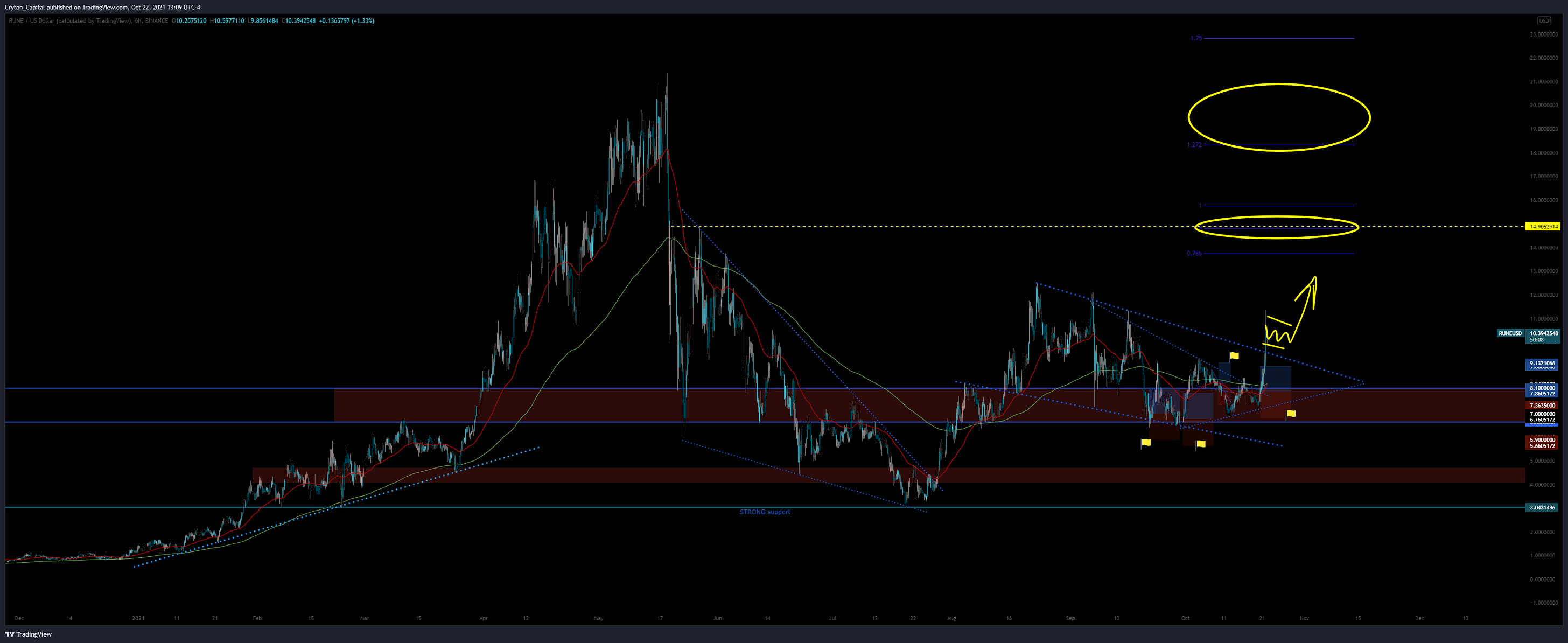

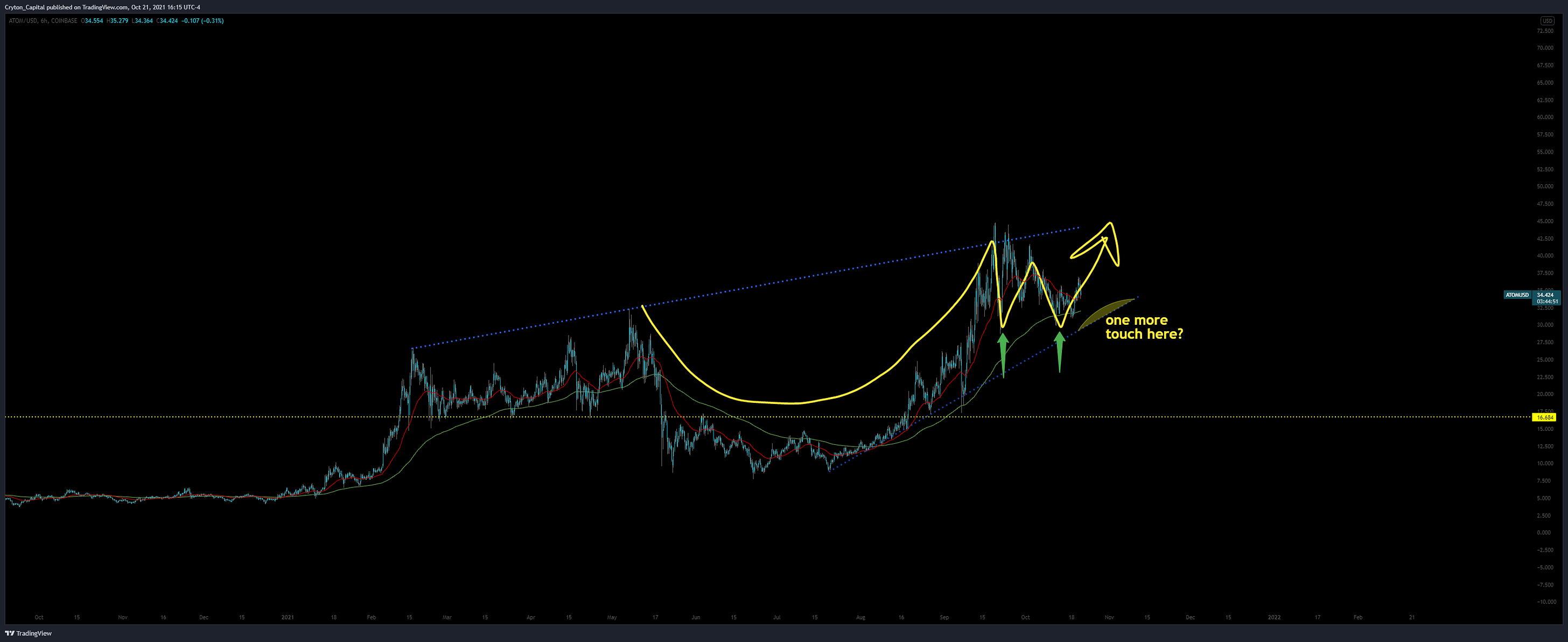

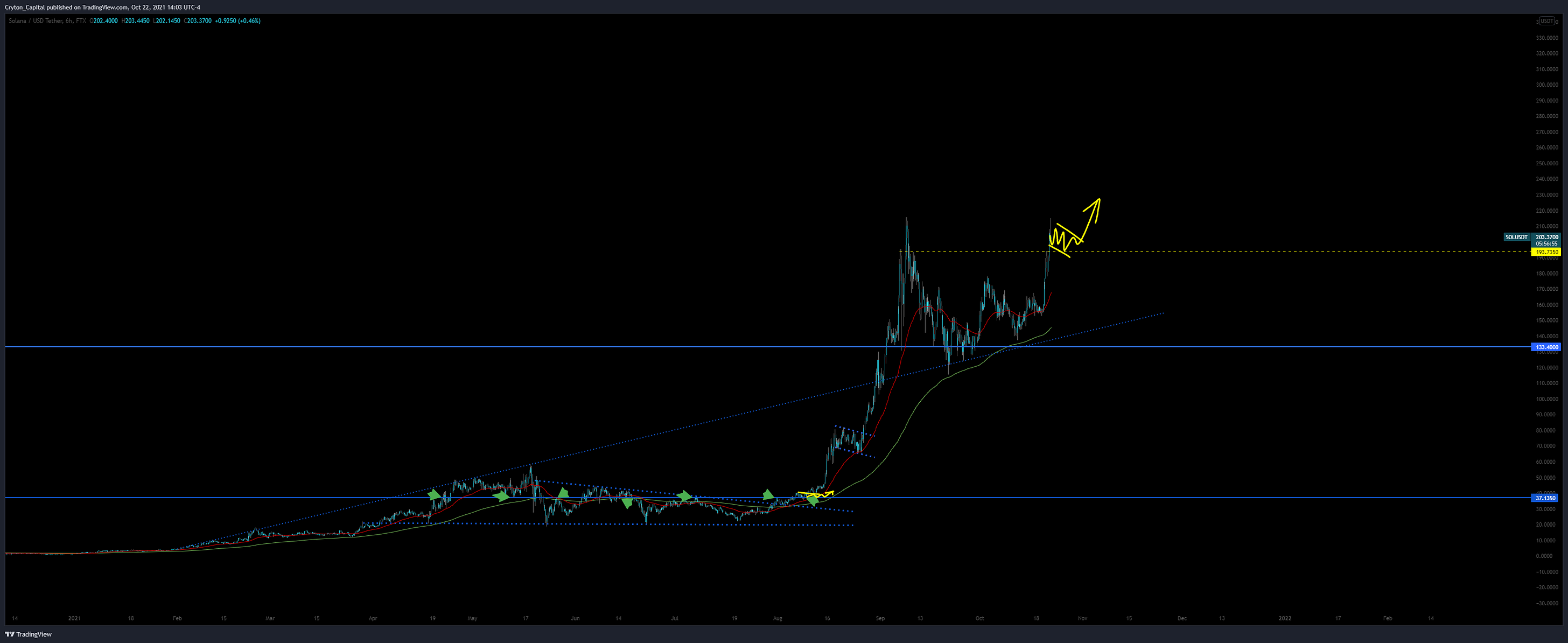

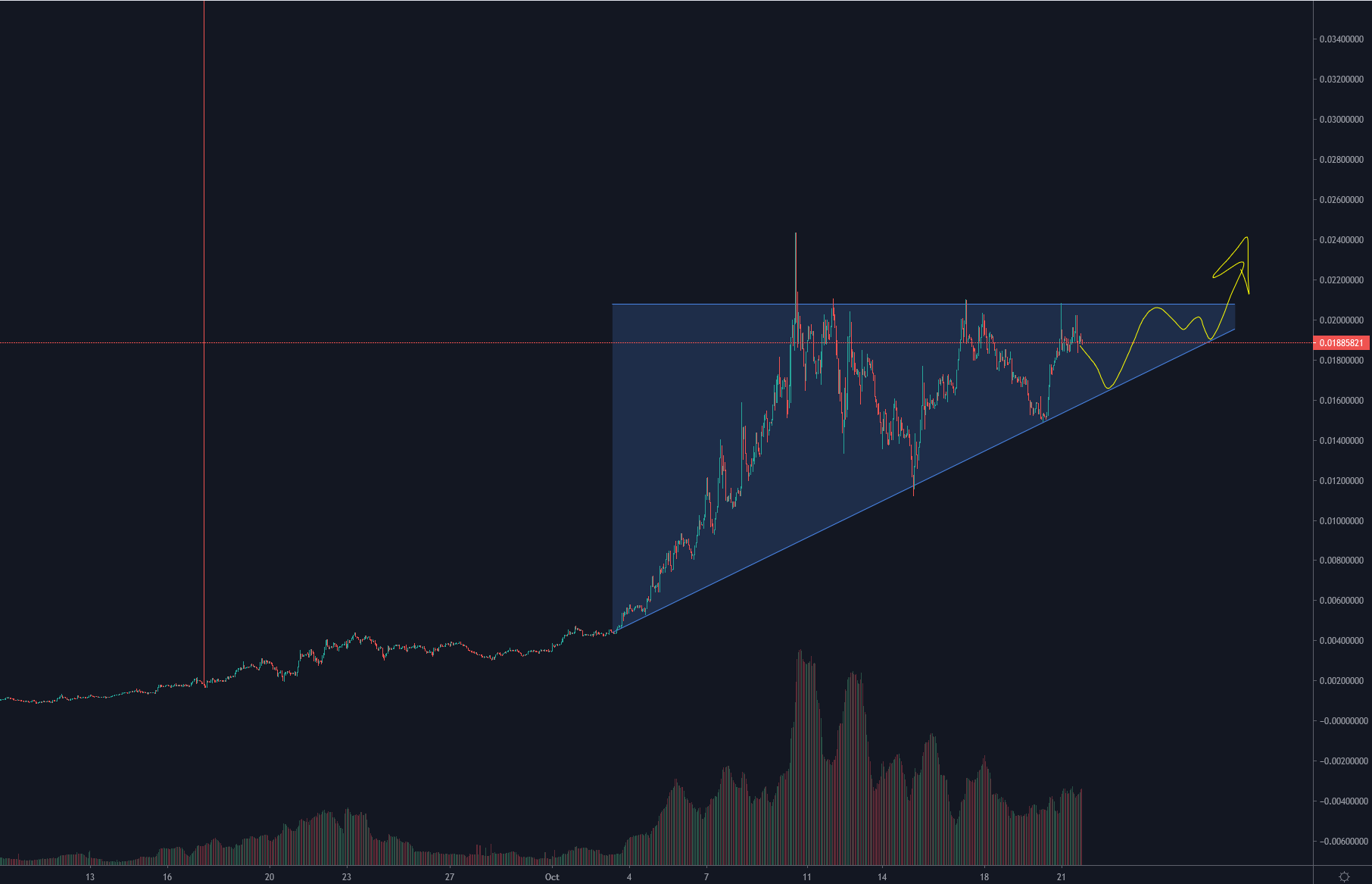

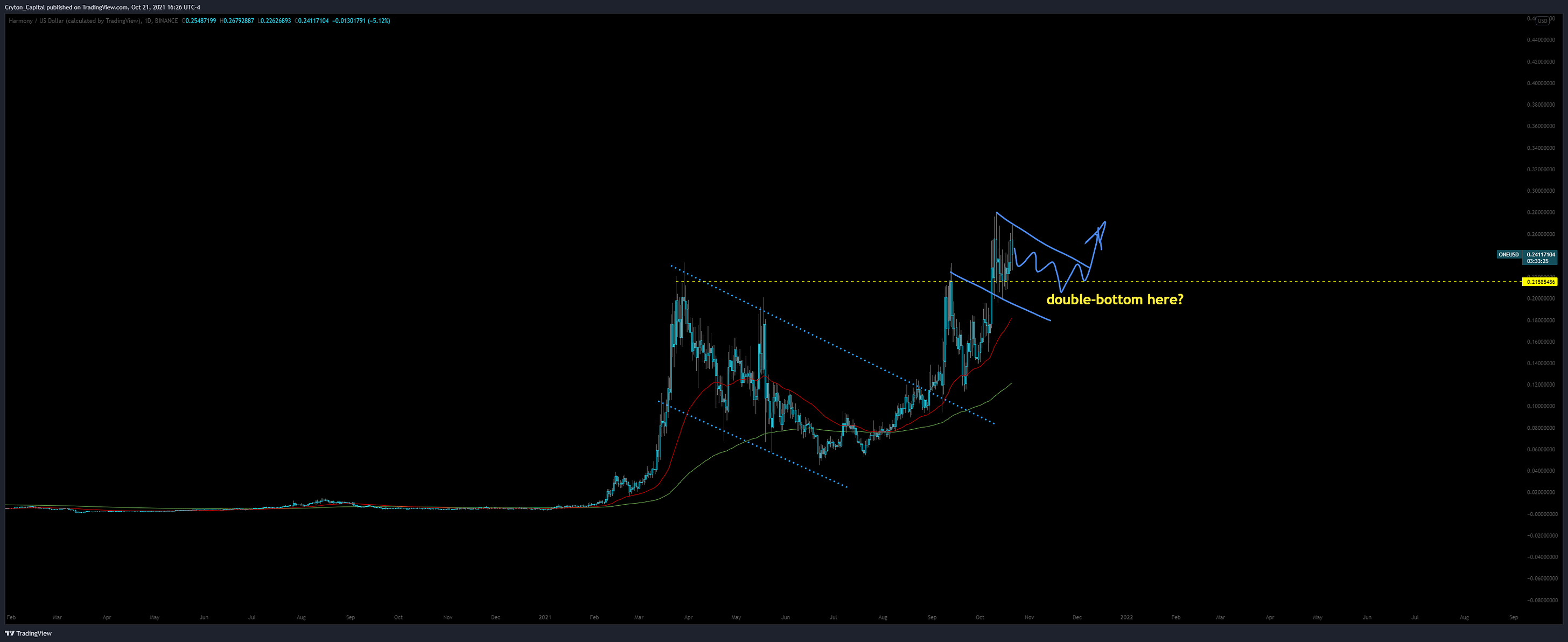

Welcome back!This week we’ve reached a new all-time-high (ATH) on BTC as well as many cryptos across the board! The final leg up of this cycle is imminent, and we’ve got continued market strength displayed more clearly than ever, and market-wide. We’re looking to finalize our positions at this point, as it is unwise to actively trade during the final leg up in any crypto bull cycle. Swapping in and out is for times of market stagnation, when you’re trying to catch small gainz where you can get them, such as trading between the boundaries of a range. The final leg up is no time for that. It’s “buckle up and hang on” time. Which of course comes directly after “park yourself in what you have attained the highest conviction in during the preceding months the market gifted you for ample research” time. So lets look at how we can set ourselves up for success during this period; we’ll start with a general market overview: Total Market Cap - 6H - click to view:Here we have the total MC chart. We broke above ATH on this chart (as could be expected with new highs on most major crypto “blue chips”), and we’re looking at 4 main catalysts: the first at about $3T total MC, the next at about $3.8T total MC, the next at about $4.4T, and the last at probably the $6.2T area. These yellow target areas will get slid up and down the Trendlines depending on where price hits them which will depend on the percentage of impulsive vs. corrective market movement en route to each area. My current “best guess” at total MC for the final leg of this cycle is between 6-8T total MC. You can expect market-wide pullbacks around these outlined areas, before the run resumes. If you’re daring enough to trade, these are opportunities. For the vast majority? I would recommend the set-and-forget method. BTCUSD - 6H - click to view:Similar to the Total MC chart, we have BTCUSD above - the 6H chart - and we have an incoming catalyst around $72k BTC. I don’t think the market will consolidate much before reaching this mark. After this mark is reached, we will likely pull back and re-test previous local highs (the will-be double-top area) of $64k before proceeding toward $100k. Price pretty much moved as I outlined it would in my Oct 6th episode, albeit with a slightly smaller pullback: Result: See you at $72k. ETHUSD - 6H - click to view:Here we also got almost exactly what I laid out in my Oct 6th episode: Result: Catalyst 2 tagged perfectly, and with the classic retest-of-neckline-as-new-support that I’ve outlined numerous times in previous episodes of AotC. That turned out to be the value buy, as we never really got the full Right Shoulder that I expected. Sometimes in overly-bullish market conditions, the patterns don’t have time to complete, which is what we saw here. What’s next for ETHUSD? Price discovery. It’s open-air & near boundless headroom for ETHUSD after the this expected dip caused from reaching previous ATH completes. We will chart it as it comes. DeFi Index - 6H - click to view:Here we see new highs on my custom-built DeFi index. I believe we’ll be making a mini bull-flag here, retesting said highs as new support (catching the trend here?), then moving violently higher. DeFi, I believe, stands to benefit the most from this final leg. Specifically anything that offers a lending market, but we’ll touch on that later. LUNAUSD - 6H - click to view:LUNA has always been a difficult one to chart. I don’t really know what’s going on in this area price-structure wise, but I believe it’ll probably do a quick re-test of the 50EMA before moving up to the next catalyst around $77. From there, $110 or so. RUNEUSD - 6H - click to view:RUNE - the one that will ensure WAGMI. We had a beautiful flag form, re-testing that red area of S/R. I took 4 long positions around this area, as it danced along it, all outlined in my screenshot above: 1st long on re-test of the zone as new support, 2nd long on a double-bottom that formed, 3rd long when we impulsed up and formed what I thought was going to be a Bull Flag (I was wrong), and 4th long when we broke back above once more. All ended up being in perfect timing with the recent move up & out of the flag. I’ve had this flag outlined in many AotC episodes, so it was well known to my readers, so hopefully many of you followed suit on taking some positions within it, and if you’ve learned anything from AotC, hopefully those positions were clustered around similar areas as my own. ATOMUSD - 6H - click to view:My analysis for ATOM from Oct 6th episode still looking relevant here. Cup & Handle of sorts, with a potential incoming 3rd-touch on the containing USTL & 200EMA (about $32ish) before breaking the overall structure to the upside. SOLUSD - 6H - click to view:SOL looking good for a nice little Bull Flag here before moving higher with the rest of the market. It, along with ATOM, is sure to become (if not already) a crypto “blue chip”. I believe SOL will one day be well over $1,000 ea, actually, but I can’t really say if that’ll happen during this cycle. Price action is hard to analyze at these levels having run up so hard rendering much of the previous price structure unusable for analysis. If you’re looking for cheaper alternatives, check out MATIC and FTM, which I will go over in a later episode. FTM specifically is interesting to me, and I believe holds some benefits over even SOL. SPELLUSD - 6H - click to view:SPELL still stands to soak up more of the DeFi market than it already has, esp. if the DeFi Index climbs as violently as I believe it will. Even though SPELL has moved up tremendously since my pointing it out as a small-cap gem at $0.003, it’s truly does have the potential to run up harder due to the incredible revenues that the protocol is generating. It’s only been around a few months, and it’s already generating 2x the revenue of MKR… Quite insane, when you think about it. TVL skyrocketing, cross-chain x4+, and with Dani speaking of tying it in with Popsicle Finance, it’s still a buy for me even at these prices. Dani is the man, and a powerhouse at consistently shipping improvements to what he builds. I’m estimating maybe $0.08-0.12 SPELL this bull run, but hard to tell. For the short term, my best guess is it’ll follow the trajectory of the yellow line above, and when this Wedge breaks long, it'll be fireworks once more. Reader Request - WAXPUSD - 6H - click to view:WAXP perfectly tagged our last target area, and now we’ve formed a bit of an Inverse Head & Shoulders pattern. I believe we’ll break above, get a re-test of the neck-line, then a run back up to recent local high. Probably a small flag will form either directly below (coil up for a squeeze above), or above (re-testing previous high as new support). From there: Fib Ext. level 1.272 will be in view, which is appx. $0.67. Reader Request - ONEUSD - 6H - click to view:ONE is a reader request, and a crypto I’ve seen mentioned quite a lot lately around CT lately. TA-wise, this looks good for a retest of previous-high-as-new-support (perhaps a double-bottom at that level to fill out the flag), then a break higher from there. Reader Request - VRAUSD - 6H - click to view:VRA looking exceptional here. Nice Cup & Handle type pattern completed & price has moved above. Same as ONE, we’re looking for a re-test of the previous high as new support before continuing to pump along with the rest of the market. The opportunity here is not to be ignored.I stated that last time, and will repeat it once more. In fact, I’m just going to copy and paste from my last episode… I feel this needs to be heard again, and it’s relevant more now than ever: We’re looking at a launchpad almost market-wide, setting the stage for the end of the year. However, don’t allow the dollar signs you have in your eyes right now shroud you from remembering the level of blood that CAN occur in crypto. Take advantage of what we have, here and now, to the fullest extent you can… but plan for the long haul at the same time. Especially if you got rekt in May’s dip. Remember: If you only promise yourself that you’ll do what “successful” investors do once you’re already successful, that day will likely never come. Keep yourself protected, don’t overleverage, make a plan, and stick to it. Until next time! Cryton Cap Disclaimer: Cryton Capital is not a registered investment advisor, legal advisor, tax advisor, or broker/dealer. All investment / financial opinions expressed in any-and-all posts on this page, including screenshots & captions, are from the personal research and experience of the owner, Mr. Chris Cooper, and are intended to be interpreted as educational material only. Although best efforts are made to ensure that all financial charts and commentary are as up-to-date as possible, there may be times where price moves beyond key levels before the chart can be posted. Alas, this is part of the fast-paced financial sector and cannot be avoided. Also, occasionally unintended errors and/or misprints may occur. Follow Me.Learn how to earn…Become part of our community.Follow our socials.Subscribe to our podcast.Subscribe to this publication.

If you liked this post from Cryptowriter, why not share it? |

Older messages

Could Unicove.com become the My-Ether-Wallet of EOSIO?

Friday, October 22, 2021

Unicorn: a mythical animal typically represented as a horse with a single straight horn projecting from its forehead. Sometimes use as a term to express, something that is highly desirable but

Bitcoin Adoption Accelerates in Africa, Driven by the Need for a Fairer System

Thursday, October 21, 2021

Bitcoin is already a necessity for millions of people on the African continent.

Terra (LUNA) is Now More Investor-Attractive after the Columbus Upgrade, Here’s Why

Wednesday, October 20, 2021

Change is the only constant. In crypto, this happens at dizzying speeds, and you can be left behind. Ethereum and Cardano might be development-active, but Terra is also up there given its ambitious

4 Interesting Features of the Terra (LUNA) Blockchain

Wednesday, October 20, 2021

Bitcoin might be the most important innovation after the internet, according to Roger Ver. But what about stablecoins? If anything, without stablecoins—algorithmic or off-chain—the market would be

Round 20 Cryptowriter NFT Engagement Winners!

Wednesday, October 20, 2021

Each week we reward our readers for high-quality comments and general engagement with our Cryptowriter publication. Learn more about the NFT engagement rewards HERE. Top 10 Most Engaged Users The top

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏