DeFi Rate - This Week in DeFi - October 22

This Week in DeFi - October 22This week, Polygon pays $2m bug bounty, Jupiter Exchange launches and Synchrony raises $4.2m for Solana, and Mudrex indexes DeFi for retail

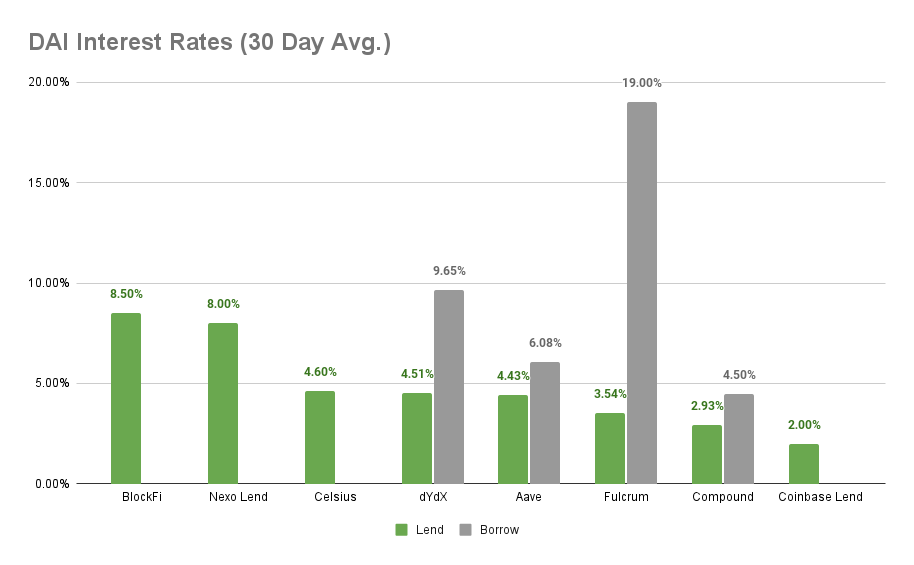

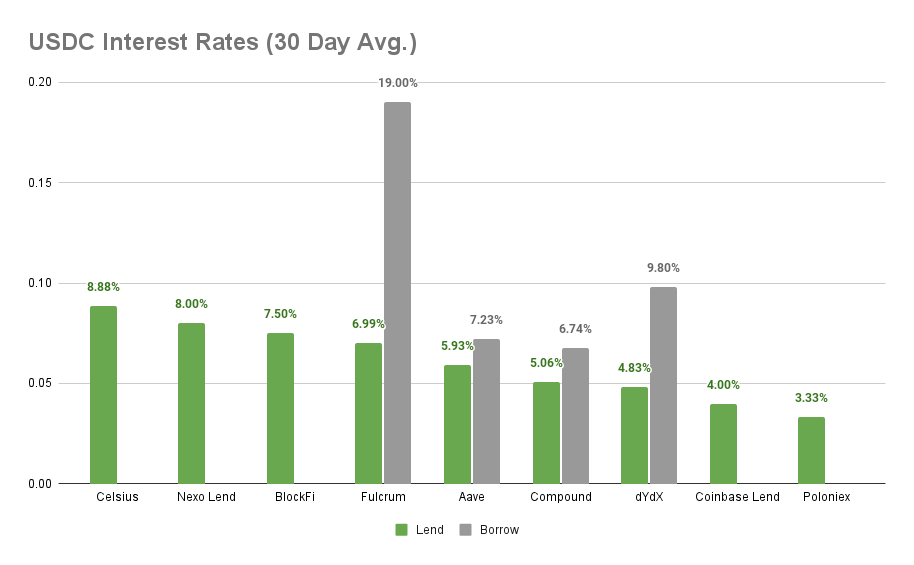

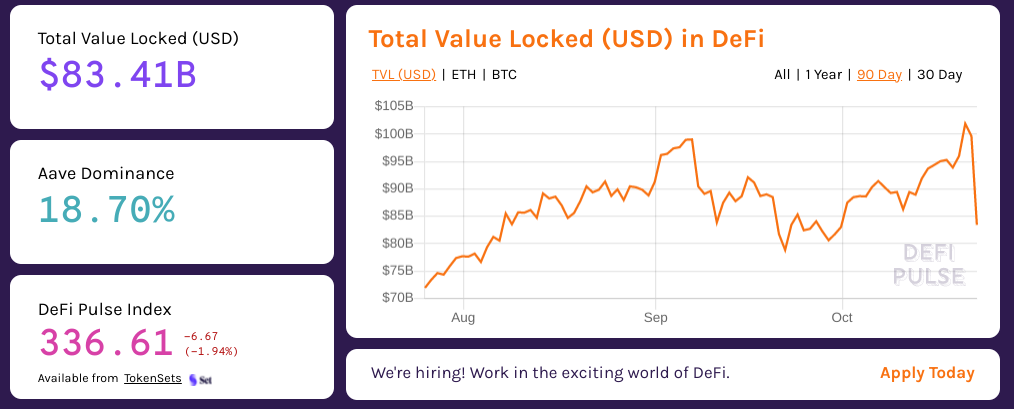

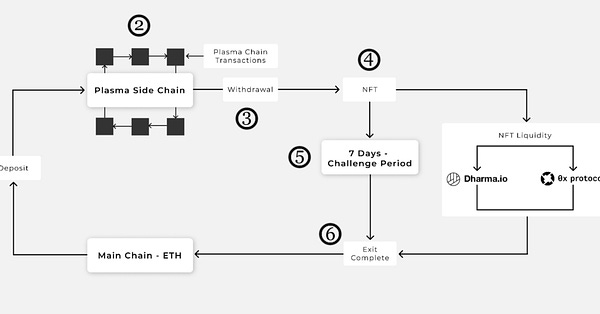

To the DeFi community, This week, Polygon paid it’s maximum bug bounty, $2 million, to white hat hacker Gerhard Wagner after his revelation that up to $850 million was at risk using an exploit in the Polygon Plasma Bridge. The vulnerability has been patched, and the $2 million bounty appears to be the largest amount ever paid for such a service.   Jupiter Exchange launched on Solana, the first AMM liquidity aggregator exchange in the Solana DeFi ecosystem. Jupiter will route swaps through the pools with the greatest liquidity across all major AMMs on Solana, reducing slippage for token exchanges and improving the UX for Solana users.  Jupiter Aggregator @JupiterExchange 1/ Jupiter is now live! We are @Solana's first on-chain swap aggregator. Our goal is to provide the best rates by routing across all major liquidity markets, while giving users and developers the best swapping experience in all of DeFi. Try us out at https://t.co/PA52QKiPSh🔥 https://t.co/P6x8tN4slWAlso in the Solana realm, Synchrony raised $4.2 million to develop its copy-trading protocol, led by Sanctor Capital, Wintermute Trading, and GBV Capital. Synchrony will allow users to follow investment strategies from throughout the Solana ecosystem. Synchrony will also collect and organize data on successful trading strategies, bringing improved market intelligence to the growing Solana DeFi scene.   And SF-based asset manager Murdex launched a new slate of Coin Sets, allowing traditional retail investors to invest in baskets of DeFi tokens and even some NFT collections. The retail focus of the Coin Sets could help bring significant additional exposure to DeFi tokens and the ecosystem overall, and are another step on the road to deeper integration between traditional finance and the DeFi economy. A big week for DeFi on Solana, and proof that bug bounties really do work, while top coins like BTC and ETH are marking new all-time highs. Not bad! There’s no sign of the appetite for DeFi investments slowing down, from the VC stage right through to retail investors that want to buy indexed DeFi assets in a more familiar stock-like format. The competition is really heating up for Ethereum-based DeFi, but the magnitude and reasonably straightforward nature of the now-patched Polygon exploit show that there are still a huge number of kinks to work out within DeFi and L2 protocols, particularly when it comes to bridging from one to another. Many solutions use locked tokens that represent tantalizing targets for hackers, and time delays are only so effective at preventing exploits if they remain undiscovered for long enough. The progress of the entire crypto landscape over the past year has been nothing short of astounding, but in some ways it’s starting to feel like we’ve moved backwards, too - the crush to release before the competition and win innovation races has taken a toll on both UI and UX in many instances, and while smart contract audits are becoming table stakes, they’re far from a catch-all when dealing with such new infrastructure. The best opportunities for high-conviction ‘set-and-forget’ investments are always early-stage and at the periphery, and are always a wild ride. But don’t forget to tread carefully, as the value you capture early on in such projects is closely related to being ahead of the ‘unknown unknowns’ that can tank otherwise promising ideas on short notice. The most important rule still remains “Don’t invest more than you can afford to lose.” If done well, and with patience, the opportunities in crypto are as limitless as the stars. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 12% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8% APY Cheapest Loans: Compound at 4.5% APY, Aave at 6.08% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 8.88% APY, Nexo Lend at 8.00% APY Cheapest Loans: Compound at 6.74% APY, Aave at 7.23% APY Top StoriesDune now integrates with Binance Smart Chain!MonoX Deploys Public Mainnet on Ethereum and Polygon NetworkFormer ConsenSys exec raises $6.15 million to build crypto staking protocol ObolTrueUSD Landed on FantomStat BoxTotal Value Locked: $83.41B (down -13.4% since last week) DeFi Market Cap: $135.76B (up 5.44%) DEX Weekly Volume: $14.36B (down -8.0%) Total DeFi Users: 3,604,700 (up 1.72%) Bonus Reads[Christopher Harding – The Defiant] – If Crypto Regulation is Inevitable Then Let’s Get Smart About Adapting to It [Brooks Butler – Crypto Briefing] – MakerDAO Team Recovers 63 ETH for Rightful Owner [yyctrader – The Defiant] – Ape Diaries: Yield Farming in the Fantom Zone [0xy Moron – Bankless] – Can crypto solve climate change? [Anthony Sassano – The Daily Gwei] – Free Stuff - The Daily Gwei #360 If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - October 15

Friday, October 15, 2021

This week, Sushiswap goes mobile with Celo, Morningstar Ventures invests $15m in Elrond, and pNetwork and Alchemix gear up for V2s

This Week in DeFi - October 1

Sunday, October 10, 2021

This week, Fireblocks wants in on Aave Arc, Polygon users overtake Ethereum, R3 is building for DeFi, and SocGen bank wants DAI for bonds

This Week in DeFi - October 8

Sunday, October 10, 2021

This week Fei launches V2, DominantFi comes to Polygon, Visor Finance colab with Perp Protocol, and Stripes gets $8.5m for interest rate swaps

You Might Also Like

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏