The eCoinomics Team - October 2021, #4

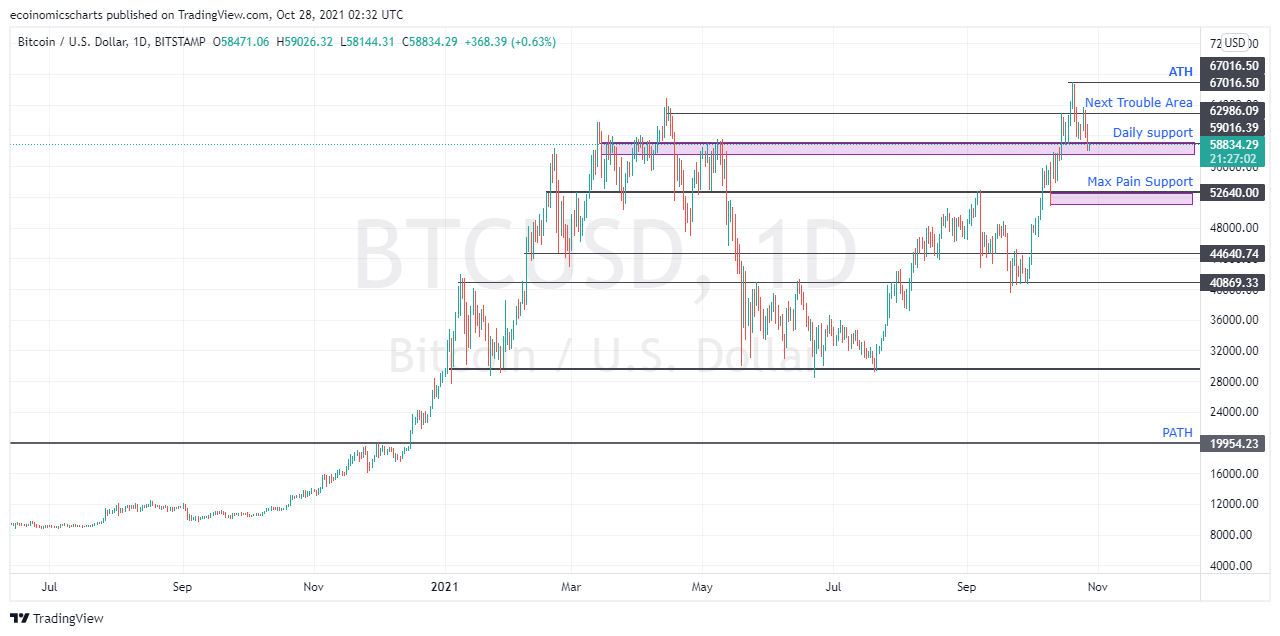

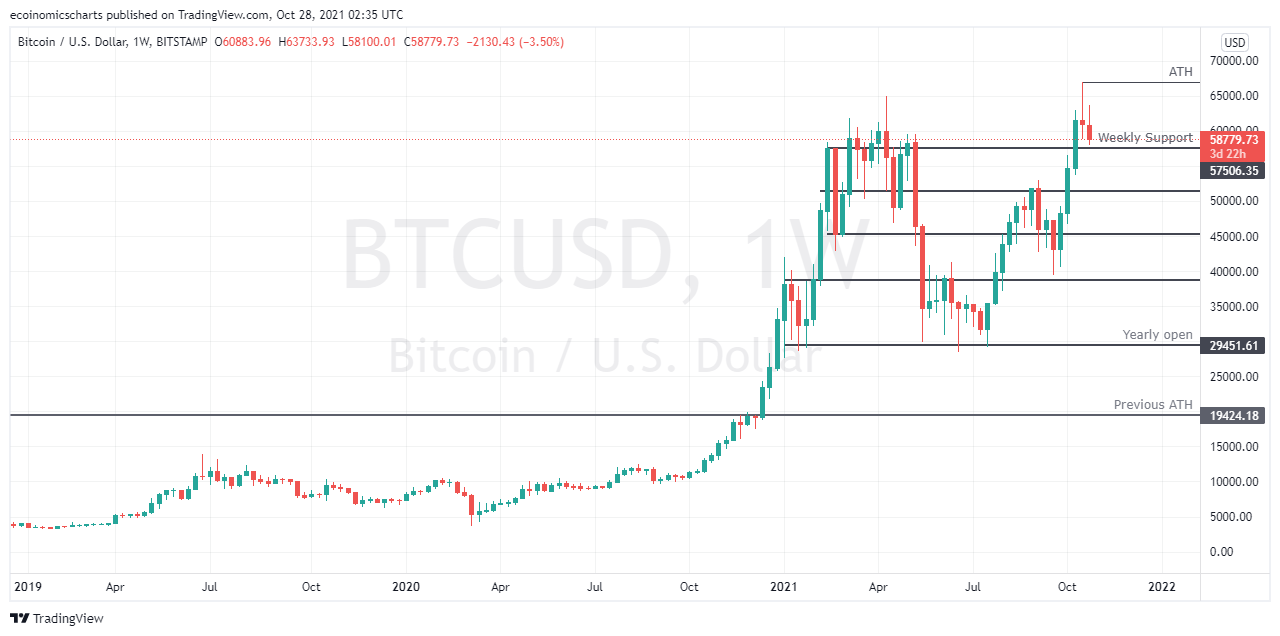

October 2021, #4This week we discuss BTC/USD and ETH/BTC price action, Bitcoin ETF explained, and Zoom-In on The Graph (GRT) and Akropolis (AKRO)This Week. 1. Bitcoin/USD. Ethereum/Bitcoin price analysis. 2. Bitcoin ETF explained. 3. Zoom-In: The Graph (GRT) and Akropolis (AKRO) Dear reader, Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are here with us for many more issues. When we thought about writing a weekly newsletter, we weren’t thinking about an audience. It was more about reminding ourselves to stay the course and not act against our sober minds once money was on the line. It’s a reminder not to FOMO or be afraid to take a trade because we fear price might dump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics. We discuss macro technical and fundamental analysis away from low time frame noise that helps build a long-term trading mentality. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section. These are essentially letters to ourselves and we hope you can gain some useful insights every time you read them. You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter every Thursday at 10 PM WAT. Follow us @avogroovy, @oloye__ If you missed any of the Twitter live sessions, check out the podcast at https://linktr.ee/cryptoroundupafrica The eCoinomics team. Bitcoin/USDBitcoin returns into charted territory. Last week for the first time in the history of writing this newsletter, we had to use a fib extension to determine where price may create new resistance if it moons. Price didn’t do that, it returned to charted support and currently trading around $58000. We had a theory before that if the news of the first Bitcoin futures ETF going live doesn’t send price to a new ATH, chances are it may result in a huge sell-off due to the news getting front ran by retail whose aggressiveness is not rewarded. Bitcoin avoided that fate but the news did get priced in before the event and it had just enough gas for a new ATH creating new optimism. Bitcoin is currently trading above weekly support of $57000 and a weekly close above this price may send us back to uncharted territory. Bitcoin bullish structure remains intact until $52000 is flipped to resistance. So that area becomes our “Max Pain Support.” In short, we are looking for a weekly close above the current weekly support of $57000. This is a good area to enter new longs for Bitcoin traders. If that area gets flipped, then we are punting buy bids at $52000ish. ETH/BTCEthereum continues to show strength v its Bitcoin pair. It flipped the 0.065BTC level and it has held as support. We are already seeing lots of movement in alts as traders try to preempt a market rotation if BTC continues to trade in its new channel. Ethereum still hasn’t made a new ATH v its USD pair, meanwhile SHIB is mooning and recently flipped Doge as the most valuable shit coin. This is paradoxical. The rotation is taking a piss. Tiktok traders are jumping ahead of the queue and GenZ is giving everyone a middle finger. It was supposed to be BTC-ETH-Large caps-Mid caps-Small caps-Shit coins-Ponzis. Now everyone is asking what is the next SHIBA? Hopefully, Ethereum retakes its rightful place as the next to make a run and the rotation resumes. As long as it doesn’t lose current support, things look good for Ethereum. On its USD pair, as long as we don’t lose $3000 support, the bullish structure stays intact, although we expect buyers to step in around $3600 if a sell-off were to occur. The next trouble area is the previous all-time high of $4300. Alt season still coming soon… 2. Bitcoin ETF ExplainedBitcoin exchange-traded funds ETF has dominated the crypto news cycle recently. That begs the question of what is an ETF? An ETF is an exchange-traded fund asset that is traded in an intraday. Basically, a fund that can be traded like every major stock on stock exchanges like the New York Stock Exchange (NYSE), NASDAQ or CBOE. A Bitcoin ETF brings Bitcoin to big markets and helps BTC gain more institutional exposure. This further solidifies Bitcoin position in the global market. An ETF gives traders from within the traditional financial market access to a regulated product that tracks Bitcoin’s price movement, not Bitcoin itself. Traders trading through brokerage accounts will be able to have indirect exposure to Bitcoin and trade it like any other fund. Mainly an ETF serves as access into the traditional capital market where big capital resides thereby allowing Bitcoin-related stocks/companies access more liquidity and enabling tax documentation filings from brokerage accounts. It is important to state that an ETF only grants exposure to track the price and performance of Bitcoin without owning any. Therefore it is simply a way to buy or sell Bitcoin without owning it directly in a custodial or non-custodial crypto wallet. There are two types of ETFs: Futures based ETF and Spot based ETF. Futures ETF means the ETF invests into a derivative usually the CME Bitcoin futures contract. A futures ETF allows you to get intra-day price and end of day Bitcoin price exposure. However, you only own exposure to the derivatives price movement and make or lose money base performance of Bitcoin without owning Bitcoin. An example is the recent Valkyrie Bitcoin ETF that went live on the New York Stock Exchange. Spot ETF is slightly different from the futures because it tracks the price of actual bitcoins instead of the CME price. The central theme of this type of ETF is also to allow institutional players to have exposure to the price of the physical asset even though they do not own it. The ProShares Bitcoin linked fund launched recently already has over $1 billion in management and is the quickest ETF to reach that threshold, per Bloomberg data. This shows there’s huge institutional interest in getting exposure to Bitcoin-related financial instruments. 3. Zoom-In: The Graph (GRT) and Akropolis (AKRO)This week, the tokens on our spotlight are The Graph (GRT) and Akropolis (AKRO). After the Market Structure Breakdown (MSB) in April, GRT has been consolidating for months and finally started to trend upward before Bitcoin pulled back affecting its imminent breakout. GRT has the tendency of making parabolic moves as we witnessed at the beginning of the year. This time it may have to slowly grind its way back up. As of the time of writing, the price is at $0.97. Minor resistance at $1.19 and this level could be broken with an increase in buying volume. Significant resistance at $1.67 as this level has proven to be a supply zone and sellers have stepped in each time price approached the zone. If the price gets rejected, $0.87 has acted as a solid support zone and buyers will likely step in here, the price also doubles as Point of Control (POC) using the volume profile indicator. Akropolis is printing tight daily candles which is a sign of accumulation and next comes distribution. AKRO can move very parabolic within a short period but this time it is slowly grinding its way up and choppy. The price sits at $0.0333. Little resistance at $0.041 which we expect the price to break before the real battle is at $0.050 which is a significant supply zone where we expect a lot of traders to take profit as there is significant trading volume there and the level has been rejected on a few attempts already. If we get a rejection, $0.02700 is a support area to bid and bulls have to defend for a bullish continuation. It is important to note that the altcoin market is still mostly dependent on what bitcoin does and the overall state of the market. If bitcoin remains relatively stable then we expect the spotlighted coins to perform well. The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to trained finance professional before making any investment decisions. If you liked this post from eCoinomics Newsletter, why not share it? |

Older messages

October 2021, #3

Thursday, October 21, 2021

This week we discuss the Bitcoin and Ethereum price action, part 3 of our trading system series, why alts are losing momentum to Bitcoin and spotlight Binance coin (BNB) and Polkadot (DOT)

October 2021, #2

Thursday, October 14, 2021

This week we discuss the Bitcoin and Ethereum price action, part 3 of our trading system series, why alts are losing momentum to Bitcoin and spotlight Binance coin (BNB) and Polkadot (DOT)

September 2021, #5

Thursday, October 7, 2021

We discuss price action and expectations for Bitcoin and Ethereum, part 1 of trading systems, how the China FUD is different this time, and Zoom-In on Axie Infinity (AXS) and Fantom (FTM)

October 2021, #1

Thursday, October 7, 2021

This week we discuss the Bitcoin rally, Ethereum price action, part 2 of trading systems, E-naira postponement and Zoom-In on FTX Token (FTT) and Curve DAO Token (CRV)

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏