Bankless DAO Weekly Rollup #27: Tokemak Proposal | MetaFactory "WGMI" Merch

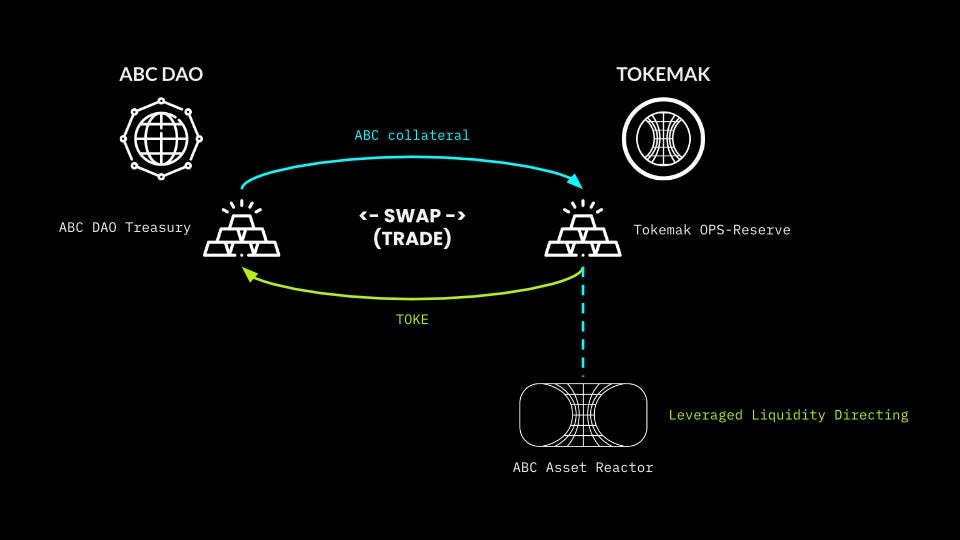

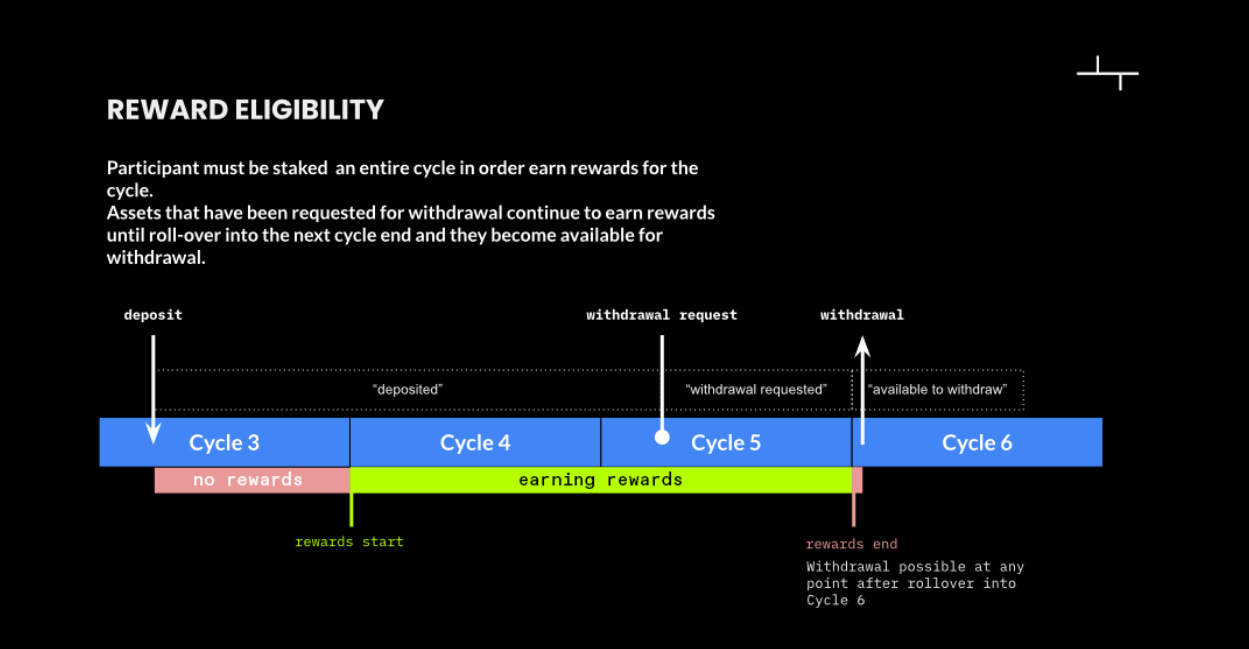

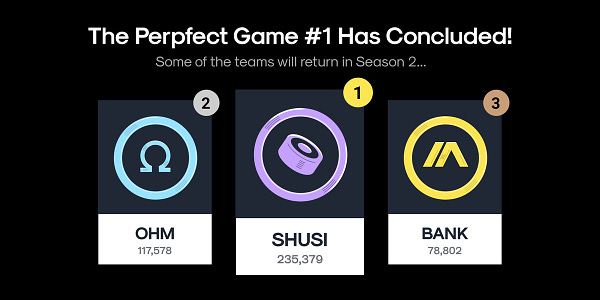

Bankless DAO Weekly Rollup #27: Tokemak Proposal | MetaFactory "WGMI" MerchCatch up with what happened this week in the BanklessDAO.🎂🎉 Happy half-birthday BanklessDAO! My how we've grown and matured in our short time in the metaverse! What bDAO has accomplished in a mere six months should give everyone pause for celebration. Well done! And for a birthday present, who doesn't like to receive money? BanklessDAO certainly does, as its treasury is very healthy. With the DAOpunks epic mint last week the treasury will be receiving 26.64 ETH in shared revenue! To further treasury diversification, this week we highlight the TokeMak liquidity and market-making protocol. Please read closely, as there's currently a Snapshot pending to integrate BanklessDAO with Tokemak to increase BANK's liquidity. With all of that and so much more, please sit back and catch up on all that happened this week in the BanklessDAO. Authors: BanklessDAO Writers Guild (EthHunter, siddhearta, hirokennelly.eth) This is the official newsletter of the BanklessDAO. You are subscribed to this newsletter because you were a Premium Member of the Bankless Newsletter as of May 1, 2021. To unsubscribe, edit your settings here. BanklessDAO Weekly NFT Showcase 🔥Our NFT showcase features ground-breaking art from Alfred Swahn - from Bankless Monroe to Diamond Hands, none of these NFTs are WORTHLE$$. 🧑🎨 Artist: Alfred Swahn 🏦 Auction Type: Open Edition 200/200 💰 Price: 0.02 ETH While some may argue fiat is on its way to being worthless, this vivid animation certainly is not. This NFT is an on the nose visual metaphor for staying rich through crypto. Marilyn Monroe is going Bankless! With her token-drop Bankless earrings, this pioneering icon will be a welcome addition to your pop-art NFT collection. 🏦 Auction Type: Competitive Auction 💰 Price: 0.5 ETH Reserve Price. Rounding out this NFT collection is a stunning representation of HODL till you die. There's nothing skeletal about this visual feast. Community Highlights👕 MetaFactory "WGMI" Merch Drop “Composability is to software as compounding interest is to finance.” - Chris Dixon on Bankless Interoperability is dope. Money Legos make these games we play possible, and it all adds up too: WGMI. Designed by Crypt0xWife, this premium hoodie and tee will add vibrance and color to your day, and encourage you to keep building. 👨🎤 DAOpunks hit 100 ETH in NFT sales in less than one week! The artists behind this project are amazing and the punks are truly beautiful! These DAOpunks will withstand the test of time, becoming a very powerful utility inside the DAO ecosystem. The DAOpunks public treasury will be providing grants to those seeking fulfillment in full-time DAO life, furthering the success of the punks' ecosystem. We often talk about the flywheel effect - and this is a perfect example of this multiplying force. Congrats on 100 ETH traded and the eventual blue checkmark from OpenSea. Come say hi in the Discord and gain access to the vibrant community of people actively living the DAO life. With a great roadmap and a bright future, we head West.   🥉 BanklessDAO finishes in 3rd Place in Perpetual Protocol's Trading Competition. Perpetual Protocol recently held the Perpfect trading competition. In total, 2,858 participants took part in the event on Perp v2 Testnet, making it the most popular trading competition Perpetual has ever held! Record attendance boosted the available prize pool to 150,000 PERP! On average, opening a position on Perp v2 costs around 1,281,224.39 Arbgas, which would be around $5.765 USD worth of ETH on the Arbitrum mainnet. If the same trade happened on Ethereum L1, it would cost $267 USD worth of ETH under current conditions. ($4500 ETH and 100 gwei gas) With close to instant confirmation, the trading experience on Perpetual Protocol has never been this close to parity with a CEX. During the 7 day event, $480M of trading activity was generated, with the most action on the final day of competition.   What's New🧠 Crypto Sapiens Podcast: Building DeFi primitives - Leighton Cusack, Mkkoll and Gio Leighton Cusack, Co-founder of PoolTogether, and community advocates Mkkoll and Gio, join us to introduce the crypto-powered savings protocol and its role in creating accessible onramps to DeFi for new users.  Catch up on the latest publications from the BanklessDAO Editing and Publishing Arm (EPA). Have a piece you would like to contribute to the blog? Submit it here.       ❤️ GM to a new social media site, gm.xyz Social media is a very powerful tool used by many to do nefarious things. We all know Zuck recently stole the term "Meta." Well, the future is now, and GM just launched a new web3 social media site built on ETH. Matterhorn just opened the BanklessDAO community there! Check it out and Sign-in with Ethereum.  Justsomebonsai🌸 @XRXS17 I came across the builders of @gmdotxyz recently due to a shared love of bonsai by @zenft_ They reached out to see if I would be interested in helping with a bonsai community on their platform so I checked it out.....this is what I found 👇Mochi Protocol is a cross-chain, autonomously governed, decentralized stable currency protocol fully-backed by a wide variety of crypto assets. It offers governance-free listing and condition-based stable currency minting. It also aims to provide the most capital efficient over-collateralized loans to users. Mochi unlocks productivity with a diverse variety of collateral and yield bearing assets to unlock new value and accelerate DeFi innovation. They have recently listed the latest round of supported tokens, including BANK. Learn more by taking a deep dive into the white paper.   Get Involved💰 Let's Go Bananas with Coordinape: Another round of Coordinape is upon us. It is time for L1 and L2's to take part in a next-level compensation structure to reward their fellow contributors for their work. The allocation of GIVE shows that you value their contributions and allows for direct compensation of tasks accomplished in real time. Use /coordinape form-request in any channel to sign up. 😎 The AdFUNistration: BanklessDAO's Administration of Fun hosts a number of low-stakes high-fun activities to allow DAO members to meet, hang out, and recreate. Stay tuned for more information about November's Bankless Hold-em Tournament, learn how to play Dungeons and Dragons in the D&D&D, or take to the pitch for a crash course in the Bankless Rocket League. 🥷 Fight Club Education Pilot: Introduction to Venture DAOs: The Fight Club is hosting eight to ten webinars on venture DAOs and venture capital. If you are interested in learning more and want to become a "certified DAO capitalist," be sure to sign up 🌅 Another TradFi job Bites the Dust: The way is DAO and the direction is West.   🙏 Sponsor: UMA — Diversifying DAO Treasuries. DAO Better. The Tokemak ProtocolAuthor: EthHunter The world of Defi is always changing and the pace is increasing at a rate that is nothing short of parabolic. Every week there is so much advancement in tech and protocols that it's a full time job to keep up, nevermind have time to effectively allocate your digital assets and resources to the correct place. Learning about all the technical terms and how they affect your bottom line is a heavy lift. We all have BANK and we want to put it to work. 💪 BANK looks to improve both its usability and stability. As of now, it suffers from factionalized liquidity across Uniswap, Sushiswap, and Balancer. This leads to price volatility and slippage that impacts the trading. Icedcool’s proposal to integrate with Tokemak would improve the stability of the BANK token and this article sets out to unpack the Tokemak system and how it could impact the future of BANK and the people who own its liquidity. Overview of Tokemak and the TOKE assetTokemak is a decentralized liquidity providing protocol, enabling users to both provide liquidity and control its destination. The process involves two main participants, Liquidity Providers (LP), and Liquidity Directors (LD). The LPs role is quite simple: they supply the capital and tokens to the Tokemak ecosystem in the form of individual Token Reactors (BANK, OHM, ALCX, etc.) and/or Genesis Pools (ETH, USDC), earning yield in the form of Tokemak’s native protocol token, TOKE. Liquidity is important for enabling high-volume trades without causing large price slippage. Being a LP is super simple. Just make a single-sided deposit into the Token Reactor and start earning TOKE rewards. There isn't an easier way to make your assets work for you today. An additional advantage of being an LP is that you can also use the TOKE rewards to become a Liquidity Director. Liquidity Directors stake TOKE into the individual Token Reactor and vote how that liquidity gets paired with the Genesis Pools and to what exchange venue it gets directed. LD's also earn a yield in the form of TOKE. There is no minimum threshold for the amount of TOKE you need to vote, so the strength of your vote is only dictated by the amount you hold. This is what you call “Tokenized Liquidity,” where each token represents one unit of Liquidity in the Reactor that your TOKE is staked. bDAOThe way to start the process for BanklessDAO, would be through a token swap. The BanklessDAO treasury would swap the equivalent of $3,000,000 in notional value of BANK for the exact same value of TOKE. This swap would diversify and increase the value of our treasury with TOKE, giving us exposure to the accrual value of TOKE. The size of the swap is important too. This amount would give the bDAO a large vote with our TOKE holdings, establishing us as a powerful Liquidity Director and allowing effective movement of BANK liquidity to where the DAO sees fit. For example, when the cycle opens to decide where to direct BANK liquidity, the bDAOs TOKE holdings give the ability to move the inventory of the protocols BANK supply, proportional to the amount of TOKE held in relation to the total TOKE in the vote. Subsequently, the BANK that Tokemak now holds would diversify its treasury and would back their platform, minimizing risk to single-sided BANK stakers. It also serves as a last resort supply to make the LPs whole if something were to happen. One main component that makes Tokemak appealing is the fact that a “T asset” can be traded for its original asset at a 1:1 value at any time. tAssetstAssets are what Tokemak issues to you when you add liquidity with your asset into the Reactors. When you deposit an asset (BANK) Tokemak gives back tBANK. Token Reactor deposits give you a 1:1 ratio of tAssets that are your claim on the underlying deposited assets. If you deposit 1000 BANK, you will receive 1000 tBANK tokens. Keep in mind you’ll need these tAssets to withdraw your deposited assets as they represent your amount of the capital in the Reactor. Additionally, the wallet that holds the tAssets will be the wallet to which TOKE rewards are paid out to. One exciting integration would be to have acceptance of tBANK as collateral, unlocking the ability to borrow against it. All the while still collecting the TOKE rewards for having the BANK deposited in the Reactor. The above graphic describes how depositing assets to earn farming rewards works within Tokemak’s Cycle system.

Why TokemakTokemak has set out to be the broadband moment of liquidity in Web3. Single-sided liquidity means that you don't need to have the equivalent value of another asset like ETH or USDC to create a liquidity pool. Tokemak uses a manager contract to handle the balancing of the liquidity provided to the exchanges. It also handles the pairings as it pulls the other side of the pair along for the ride. The ETH or USDC it is paired with is supplied from the Genesis pool. When providing liquidity for Uniswap, the manager contract pulls the correct amount of ETH to correctly pair with the BANK/ETH UNI LP pool and deploys the capital. Future plans are to offer more pairs, including some pretty next level algorithmic stablecoins. Thus, giving bDAO the ability to not only move liquidity around, but also select which pairs they would like it to be provided for. Tokemak also mitigates Impermanent Loss (IL), a problem of many of the current LP providing protocols. Especially in volatile markets, the threat of IL is real. The Tokemak protocol accomplishes this through a bunch of IL mitigation techniques at the network level that pushes the residual IL risk to different participants in the system. Using a reserve of underployed capital of all of the underlying assets, the protocol never triggers any market buying or selling. In a case where a significant amount of withdrawals of an asset causes the price to fall, the reserve is used to balance the reactor. Thus mitigating global losses to the protocol, containing it to each local reactor. Governance on SteroidsThe TOKE holders have the governance POWER. By doing so, it moves the whole process towards decentralization. At the beginning of the protocol, the first participants to get reactors were set to a community vote where TOKE holders picked the first five genesis Token Reactors, which included FXS (Frax), ALCX (Alchemix), TCR (Tracer DAO), OHM (Olympus DAO), and SUSHI (Sushiswap). By the bDAO taking part in Tokemak, we would not only have the ability to improve liquidity, but also the power to direct the future of Tokemak. The Tokemak voting power is not only a thumbs up and down model, but the TOKE holders can allocate as much or as little as they want to any vote. This would be for both the bDAO holdings and the community TOKE holders as well. This wouldn't be exclusive to voting only on BANK liquidity, but all the liquidity in any Reactor if you so choose. For example: You have 1000 TOKE at voting time:

The bDAO will also start to see what “good liquidity” looks like. To quote one of the founders of Tokemak, Liquidity Wizard; “It is as much of an art as it is a science.” We will have tons of data from Tokemak as well, with the ability to easily track them. How much BANK went to an allocated destination? How much trading volume was there per unit of liquidity and how much friction was there getting in and out of BANK? Overall, was it a good place for liquidity? Only time and running a Tokemak Reactor will tell. The path forward with PCAsProtocol Controlled Assets (PCA) are fees that the protocol has earned by providing liquidity to the specific AMMs. They internalize the rewards and tokens for their service into the treasury, and pay the LPs and LD’s in TOKE. This both diversifies and builds the reserve of Tokemaks assets, and gives the governance tokens to the people using the protocol. Because the aim is decentralization, the TOKE holders will be in control of the PCA and will be able to vote on future usage. TL;DRThe Tokemak Protocol is a very cool DeFi 2.0 tool that will be used in many money lego systems in the near future. This is the future of decentralized liquidity in Web3, utilizing products and services that offer interoperability between protocols and providing a much needed service to DAO treasuries by increasing the utility of their tokens and providing asset stability. 🏛 Governance🚨 Snapshot Vote 🚨Execute Swap with Tokemak for BANK Reactor Ignition This proposal would swap $3,000,000 in notional value of BANK for TOKE. The integration of BanklessDAO and Tokemak, would enable the quick and efficient deployment of liquidity, create a token swap opportunity for the DAO to be exposed to the valuation of TOKE, as well as give BANK holders a novel opportunity to single sided stake their bank on the TOKEMAK platform, enabling further liquidity for the BANK token. Proposals in Discussion🗣 Language based channel re-organization Author: DoubleB This proposal would change the structure of Discord to a regional channel structure that is language-based. This would further open up the lanes of communication by those members who feel more comfortable communicating in their native language. Part of this change should also include the onboarding process and asking the applicant to indicate their preferred language. ✍️ WG - Editorial and Publishing Arm (EPA) Proposal Author: nonsensetwice, FrankAmerica, Samanthaj, Ap0ll0517 This proposal is to approve the Season 2 spec for the Editorial and Publishing Arm of the Writers Guild. The Writers Guild actively publishes DAO and crypto-related articles on Mirror and Medium (with possible future platforms to come). Writers across the DAO are submitting articles to the Writers Guild to be published to these platforms, and EPA has been managing the editing, scheduling, publication, and exposure of these articles. In order to successfully fulfill the tasks of this program, we’ll need funds to compensate editors and writers for their efforts with articles, as well as four roles to facilitate this overall process, accounting, editor onboarding and assignment, scheduling and publishing, and coordination. 💰 BanklessDAO Bounty Board Proposal Author: IcedCool This proposal is to approve the Season 2 spec for the bounty board. The bounty board is working to be a major infrastructural component of DAO’s and BanklessDAO, supporting and enabling the coordination of explicit work to labor in an efficient and automated way that allows DAO groups, members and guilds to set work requests in the form of bounties. ⛽️ Gas Reimbursements Follow Up Poll Author: Kouros The original proposal has 86% support with 66 voters in total taking part in this decision. There are some members that have expressed that the gas should be reimbursed in ETH and therefore it is appropriate to open a new poll to see the sentiment on this. If the DAO decides to pay back the gas in ETH to members executing transactions on behalf of Gilds and Projects within BanklessDAO, then this will need to go to Snapshot as the ETH is coming from the main treasury. Author: frogmonkee In an effort to bring clarity and transparency to the governance process, there is currently a first draft of a forum proposal to clarify how and which forum proposals go to snapshot for DAO-wide voting. Keep your eyes out for the second draft of this governance proposal, and be sure to comment so that we all have your feedback on this important process. 🎓 Bankless Scholarship Proposal Author: Advantage Blockchain Advantage Blockchain is proposing to use some of its 1M BANK to provide scholarships to people to enter BanklessDAO with full L1 status. This proposal would essentially create The Bankless Scholarship Program. This proposal focuses on providing more people with access, resources, and opportunity to fully participate in BanklessDAO. Action Items🚨 Vote: Cast your vote for the Tokemak Snapshot proposal. 🏋️♀️ Talent Management Study: Take the BanklessDAO-related Study on Talent Acquisition and management. 🏫 DAOversity Survey: Take the DAOversity by Design survey to enable bDAO to better understand how we can lead the way in diversity and inclusion in DAO life. 💰 Sign up for Coordinape: All L1 and L2's are eligible for this round. 🏃♀️ Catch up: Review this week's community call notes or listen to the recording. 🙏Thanks to our sponsorUMAUMA helps DAOs build products to diversify their treasury. Most DAO treasuries are imbalanced, holding too many native-governance tokens. By using UMA’s success tokens and KPI options, DAOs can fortify their treasury, preparing for any market while building loyalty. 👉 Join the #bankless Channel in the UMA Discord. 👉 Tell UMA What DAOs you belong to. 👉 Verified Bankless DAO members can earn KPI Options. Go to the Discord to learn more. Meme of the WeekIf you liked this post from BanklessDAO, why not share it? |

Older messages

History of DAOs | State of the DAO #2

Wednesday, November 3, 2021

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

Decentralized Law #0 | October 2021

Wednesday, October 27, 2021

BanklessDAO Monthly Legal Newsletter

Decentralized Arts #10 | October 25

Monday, October 25, 2021

BanklessDAO Weekly NFT and Cryptoart Newsletter

BanklessDAO Weekly Rollup #25 | October 22

Friday, October 22, 2021

Catch up with what happened this week in the BanklessDAO.

State of the DAOs #1 | October 20

Wednesday, October 20, 2021

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏