The Need for Two Types of Payback Period Calculations

Tomasz TunguzVenture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Need for Two Types of Payback Period Calculations

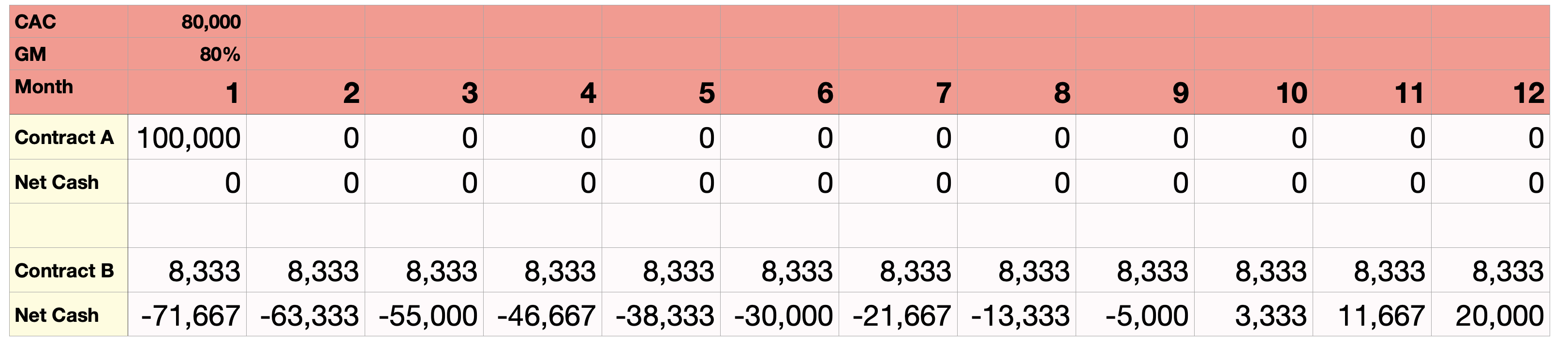

Imagine an AE closes two contracts for $100k ARR. The contracts are identical twelve month contracts except for the payment terms. Contract A requires annual prepayment - all the cash will be paid tomorrow. Contract B relaxes payment terms to monthly payment, 12 monthly installments for the next year. Is the payback period for each contract the same? On one hand, I could plug the numbers into the formula blindly and reply yes, they are identical. But the contracts are substantially different to the company.

Contract A pays for itself today. Said otherwise, Contract A has a payback period of 0 days. All of the sales and marketing dollars invested to obtain persuade the buyer to put digital ink to pdf have been recouped immediately. One couldn’t assert the same for contract B, which takes 10 months in our hypothetical example. For a company with a longer payback, the payback period implicitly assumes a successful renewal to achieve the same positive effect on the company balance sheet. The payback period metric doesn’t capture the difference in the quality of the revenue/cash collections. That may seem like a distinction without a difference but the distinction is an important difference. A startup closing only Contract As will be far more capital efficient than one capturing Contract Bs. Contract As don’t require burning equity dollars to hire more AEs; the company reinvests customer revenue dollars to scale. Let’s take this idea time scale further out: multi-year deals. A multi-year prepay offers even greater benefit to a software company. It’s an interest-free loan from a customer to grow the GTM team. For example, if a three-year contract is discounted the startup’s cost of capital for borrowing is simply the discount amortized over the contract period (eg, 10% over three years or 3.2% per year which incidentally costs less than venture debt). And the company has two years of marginal profit to invest in the GTM. Most startups today prefer to run their sales teams on annual deals to accelerate sales cycles and minimize the risk of clawing back commissions on multi-year deals that churn at some point in the service period. But there is a viable GTM strategy for startups to book multi-year deals with pre-payment, and use that cash to finance GTM growth. Especially if logo churn is low, account expansion is strong, and the sales cycles are brief. Cash collections ought to be considered when calculating the payback period. After all, the point of the payback period metric is to determine when to invest more in sales and marketing. If an account executive can recoup all the cost of customer acquisition immediately, shouldn’t the startup collect those dollars and hire another AE? Today, investors (myself included) use payback period as an efficiency yardstick to compare the relative efficiency of GTM spend from one company to the next. It’s also useful to understand how much risk is involved with payback periods of longer than a year. That’s a useful tool. But it’s divorced from the original purpose of the payback period of determining when to double down on scaling a GTM team. It’s time for two metrics to exist: a cash-flow based months-to-repay and an accrual accounting metric. |

Older messages

The 100x ARR Multiple

Thursday, November 4, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The 100x ARR Multiple The 100x ARR multiple might

Hex - The Best Product for the Technical Analyst

Wednesday, October 20, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Hex - The Best Product for the Technical Analyst

Using the Reversal Mental Model to Invest Better

Tuesday, October 19, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Using the Reversal Mental Model to Invest Better

Spot.ai - The Future of Video Intelligence

Friday, October 15, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Spot.ai - The Future of Video Intelligence co-

The Two Cap Tables of Crypto Companies: What They Are and How They Relate to Each Other

Monday, October 11, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Two Cap Tables of Crypto Companies: What They

You Might Also Like

🗞 What's New: Why AI can't replace my $1k/mo human assistant

Saturday, March 8, 2025

Also: 25+ AI agent opportunities ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #436

Saturday, March 8, 2025

Debating the future of SaaS + what many VCs are thinking... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🎯 Fix your fulfillment, fix your profits

Saturday, March 8, 2025

The answer to higher profits is not always selling more. This is how smart businesses do it… Hey Friend , Most ecommerce founders focus on selling more to increase profits. But what if I told you that

Create a social media strategy in 7 (straightforward) steps

Friday, March 7, 2025

Plus, the latest from the blog and social media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10words: Top picks from this week

Friday, March 7, 2025

Today's projects: Wallpaperee • Chatbox • DesignLit • PH Deck • ChatPro AI • Opencord.AI • NexaAI • GReminders • Springs • crimalin • SuperCarousels • TitleSprint 10words Discover new apps and

Experiment Report: Trying New Things — The Bootstrapped Founder 380

Friday, March 7, 2025

When I talked to Anne-Laure Le Cunff earlier this week, we get into experiments and how to run them effectively. Here's what I've been doing. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📍Why global trade tariffs might actually boost your ecommerce profits

Friday, March 7, 2025

The best ecommerce brands are now using these trade shifts to their advantage Hey Friend , If you think global tariffs and rising costs are bad for your ecommerce business, think again. Yes, some

Checkout.com in the spotlight

Friday, March 7, 2025

+ German AI startups to watch; Klarna edges to IPO View in browser Powered by Deel Author-Freya Author-TomM by Freya Pratty and Tom Matsuda Good morning there, Guillaume Pousaz, the founder of multi-

Google's new AI Mode is a preview of the future of search

Friday, March 7, 2025

The next phase of AI's takeover of search offers plenty of links to the web — but will anyone click? Platformer Platformer Google's new AI Mode is a preview of the future of search The next

🗞 What's New: The gold rush for AI game development

Thursday, March 6, 2025

Also: Play our daily startup-themed crossword! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏