Flipside Crypto - Bounty Brief #31

Hello there, bounty hunters, Hungry for more Sushi? We’ve got you covered. Sushiswap bounties have arrived at Flipside Crypto! And if that wasn’t enough, the new SUSHIPOWAH Hunt should help satisfy your hunger to get involved in Sushiswap governance and help you rack up the SUSHIPOWAH. Get started below. We’ve also got a Solana scavenger hunt opening up today, plus new bounties Check ‘em all out below. ☀️ Solana[Scavenger Hunt] Sunbeam Hunt (stage one) Bounty: up to $25 in SOL Complete the Solana Sunbeam Hunt! 🍣 Sushiswap[Easy] Active Weekly Users Bounty: up to 18.8 SUSHI Show the number of active users (wallets) per week on Uniswap and Sushiswap over the past year. How do these two charts compare? Why might this be? [Easy] Monthly Swap Volume Bounty: up to 18.8 SUSHI Show the total monthly swap volume on Sushiswap over the past year. How has the swap volume changed over time? Do the same for Uniswap. How do the changes in swap volume over time compare in the two DEX’s? [Hard] Monthly Swap Volume Bounty: up to 37.6 SUSHI How does capital move across the Sushi ecosystem? When a user deposits money into the Sushi ecosystem, what do they do with it? Does it sit in a pool? What do users do with their Sushi tokens? What do users do with their xSushi tokens? [Hard] User Journey and Outflows Bounty: up to 37.6 SUSHI Show the number of users leaving the Sushi ecosystem every day (haven’t made a transaction in over a month and have no liquidity provided). Where are these users going? Why might users be leaving Sushi for other protocols? [Scavenger Hunt] SUSHIPOWAH Hunt Bounty: Flipside + SUSHIPOWAH POAP Complete the SUSHIPOWAH Hunt! 🐉 Levana ProtocolFree Square Question Bounty: up to 200 UST Provide any interesting insights on Levana. These will be judged by a council that includes other community members and the Flipside team! Meteor Shower Participants Bounty: up to 200 UST For those who bought and participated in the Levana Meteor Shower, is there a relationship between their participation and their LUNATIC degen score? 🌎 TerraCrypto-Cosmology, Part 1: Wormhole Bounty: Up to 800 UST As Wormhole has added Terra support with the Columbus 5 upgrade, analyze the initial activity: how many users are engaging, what tokens are they receiving vs sending? Which destinations/sources are most popular? What is the adoption rate, i.e. how rapidly are users choosing to use Wormhole over the Terra-specific Bridge? Anything else you observe of interest? Burn, Baby, Burn (Elite Edition) Bounty: Up to 800 UST Using at least two metrics of your choice (transaction speed, volume, price action, wealth concentration…possibilities abound), assess the market impact of the LUNA burn. As well, make a data-driven forecast around how the resulting UST supply is likely to affect the Terra ecosystem (and the wider crypto space). 👻 Aave[Easy] Gas Prices and Deposit/Borrow Amounts Bounty: up to .66 AAVE As gas prices have continued to rise, how have average deposit and borrow amounts changed in response? [Hard] Means of Repayment Bounty: up to 1.34 AAVE When people repay their loans, do they liquidate themselves and use collateral growth to do so, or are they paying off their loan with external (to Aave) funding? How does this relate to the collateral's price? [Hard] Will I actually get liquidated tho? Bounty: up to 1.34 AAVE Because of high gas prices, positions that could be liquidated are sometimes not as the expense to do so would not cover the return for doing so. Is there a safe zone for where liquidation happens? How is this related to gas prices? ⚡ THORChain[Easy] Wealth Distribution Bounty: up to 14 RUNE What is the distribution of wealth within the THORChain ecosystem? Show a histogram of the breakdown Hint: use transfers [Easy] Whale Activity Bounty: up to 14 RUNE Among the wallets that own 10k+ RUNE, which pools are they currently LP-ing to? [Easy] Liquidity Bounty: up to 14 RUNE Of the wallets that have supplied liquidity in THORChain pools, what percentage have removed at least some of the liquidity? Hint: use liquidity_actions [Hard] Pool Depth Bounty: up to 28 RUNE What is the current depth of each pool based on the number of LP-ers currently providing liquidity? Hint: use liquidity_actions [Hard] Pool Stats 🔢 Bounty: up to 30.2 $RUNE For each pool, show the following stats by day

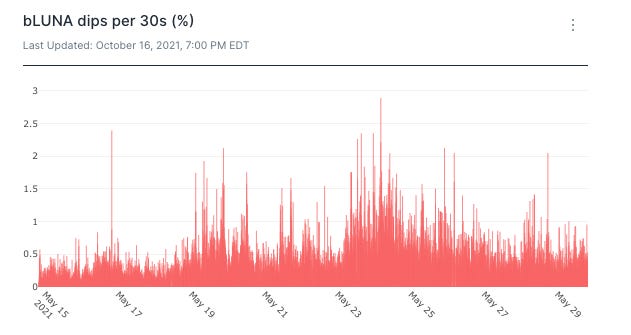

Hint: use daily_pool_stats [Hard] On-ramping 🛣️ Bounty: up to 30.2 $RUNE What is the breakdown of new users on-ramping onto thorchain by chain? Show a breakdown of each wallet’s first thorchain transaction. Which chain are they coming from? Are they swapping for RUNE or for an asset on another chain? Hint: use swaps + transfers [Hard] Affiliate Fees 🪙 Bounty: up to 30.2 $RUNE What Addresses are being used to collect affiliate fees? What are the incomes over time? Hint: use swap_events Read this (https://docs.thorchain.org/developers/transaction-memos#affiliate-fees) and this (https://medium.com/thorchain/affiliate-fees-on-thorchain-17cbc176a11b) to find out how to identify affiliate fees 🏆Bounty Submission of the Week 🏆Welcome back to our Bounty Submission of the Week! In this week’s edition, we’re taking a closer look at Lido data with @jp12__. Specifically, we’re examining This submission focuses not on bETH, but on bLUNA, and how it fared during this May’s crash. As @jp12__ notes, “when Bitcoin crashed from ~$56,000 USD on May 11th to ~$32,000 USD on May 23rd, it triggered a broad market sell-off.” Many users then rushed to get out of bLUNA collateral, instead embracing LUNA and other stable assets. The highest periods of volatility came on May 19th and 24th. The former was likely the result of the initial May 18 price drop. The latter, meanwhile, was likely the result of “a dead cat bounce” that took place the same day. Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries: Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: If you liked this post from The Bounty Brief , why not share it? |

Older messages

Flipside Roundup November 5

Friday, November 5, 2021

Discover new ways to get paid and see the best submissions from this week!

Bounty Brief #30

Friday, November 5, 2021

#LUNAtics, assemble

Bounty Brief #29

Friday, October 29, 2021

Boo 👻 😱

Bounty Brief #28

Friday, October 22, 2021

Get some sushi 🍣 and embrace the God of Thunder ⚡

Flipside Roundup October 22

Friday, October 22, 2021

Discover new ways to get paid and see the best submissions from this week!

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏