Flipside Crypto - Bounty Brief #33

Hello again, Bounty Hunters! Sending out this week’s bounties and scavenger hunts a little early since most of the Flipside staff will be away the next few days celebrating Thanksgiving here in the U.S. Please know that we’re very thankful for all the wonderful analysts and community members here ❤️ 🙌 🦃. And now, onto this week’s bounties. We’ve got a new scavenger hunt and several other ways for you to get paid this week — check ‘em all out below. 🦎 Aglorand[Scavenger Hunt] Algorand Scavenger Hunt Bounty: up to $15 in ALGO Complete the Algorand Scavenger Hunt! 🌎 Terra[Elite] From Wormhole to Terra Bounty: Up to 46.5 LUNA Chart the volume of UST being sent to other chains from Terra using Wormhole. Which chains have seen the most volume of UST sent since the Columbus 5 upgrade? How many unique wallets have sent UST to another chain? What is the growth rate? What is the average amount of UST sent per transaction to each chain? Are there any patterns behind UST being sent to Solana using Wormhole? Hints Use https://docs.wormholenetwork.com/wormhole/overview-liquid-markets Wormhole chain Id’s: Solana - 1, Ethereum - 2, Terra - 3, BSC - 4, Polygon - 5 [Elite] Binance Comparison Bounty: Up to 46.5 LUNA Compare transactions on the Binance Bridge (Ethereum-Binance Smart Chain) to Ethereum-Binance Smart Chain transactions via Wormhole. How do these compare over time? Provide and support a thesis for the relative usage of each and how it might change over time. Use at least two metrics of choice to compare transactions and create at least two visualizations to illustrate your analysis. 👻 Aave[Elite] Health Factors Bounty: up to 7.2 AAVE Calculate stats around health factor per collateral type and/or loan.

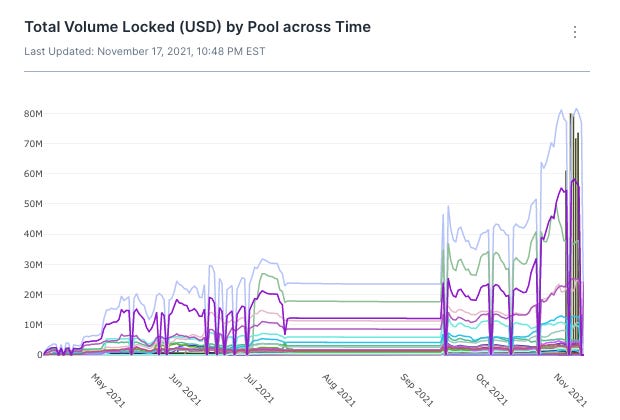

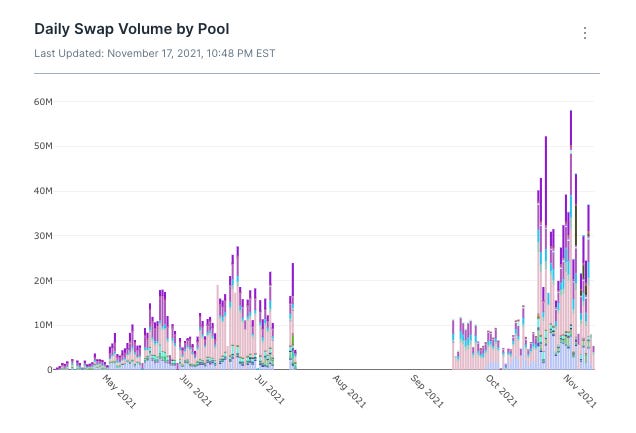

Reference: https://docs.aave.com/risk/asset-risk/risk-parameters [Elite] Risk Parameters Bounty: up to 7.2 AAVE Review the documentation at the link below, then find specific governance actions that modified some parameter. What effect did that have? (For example: One was governance action made UST worthless as collateral -- did that make some users go insolvent? How many users had it as collateral? How many went insolvent afterwards?) Reference: https://docs.aave.com/risk/asset-risk/risk-parameters ⚡ THORChain[Elite] THORSwap Airdrop Bounty: up to 181.81 RUNE What did users do with the airdropped THOR tokens? Did they swap/hodl/LP? Were there any predictors of behavior (e.g. did those that got them from the THORStarter IDO more likely to swap? or were those that were active on THORSwap for a longer time more likely to hodl/LP?) [Elite] Network Shutdown Bounty: up to 181.81 RUNE THORChain was halted from 11/12 - 11/17 and re-started on 11/18. What behavior has been seen since the network re-started? Are people removing liquidity and / or swapping their RUNE for other tokens? How does this flow of activity compare to the days before the network halt? Are there commonalities among the users pulling out of the ecosystem (e.g. have they only recently been involved with THORChain? Do they hold any $THOR / $XRUNE / $VRUNE)? 🏆Bounty Submission of the Week 🏆Welcome back to our Bounty Submission of the Week! In this week’s edition, we’re taking a closer look at THORChain liquidity pool data with some help from this submission from @mintingfarms dives deep into THORChain pools, exploring the TVL and swap volume of various pools on the platform. As we can see in the graph above, TVL has reached new heights in recent weeks, with TVL for the most popular pools peaking at more than $80 million. The BTC-BTC pool led the way, even after falling to $68.9 million at the time of analysts. That’s more than $20 million more in TVL than the next largest pool — ETH-X_RUNE at $45.9 million. Swap volumes, meanwhile have been more variable, with a notable gap arising between late-July and mid-September due in part to the downtime for the protocol. In November, however, as @mintingfarms points out, “volume spiked up to $50 million and reached a new high.” Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries: Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: If you liked this post from The Bounty Brief , why not share it? |

Older messages

Bounty Brief #32

Friday, November 19, 2021

A Lexus Nexus hunt and more than a dozen new ways to get paid 💰 🤑 💸

Flipside Roundup November 19

Friday, November 19, 2021

Discover new ways to get paid and see the best submissions from this week!

Flipside Roundup November 12

Friday, November 12, 2021

Discover new ways to get paid and see the best submissions from this week!

Bounty Brief #31

Friday, November 12, 2021

Fresh SUSHI, coming at ya 🍣 🍱 💰

Flipside Roundup November 5

Friday, November 5, 2021

Discover new ways to get paid and see the best submissions from this week!

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏