The Signal - Regulatory storm gathering

Regulatory storm gatheringAlso in today’s edition: There could be a crypto GIFT, India wants its own SWIFT, Where are the ships?Good morning! When CEOs of major corporations address China, it is with deep respect. The Signal’s favourite, Elon Musk, too, was forced to pay tribute to President Xi’s leadership. But the co-CEO of JP Morgan made an interesting claim. He said JP Morgan would outlast the Communist Party of China. He then said that he can’t say this in China but they’re listening anyway. He apologized a few hours later. Btw, our podcast has been going strong for two months now. Tune in on your daily jog, drive to the office, or even as you WFH-ers have breakfast in bed. We promise it’ll be music to your ears.

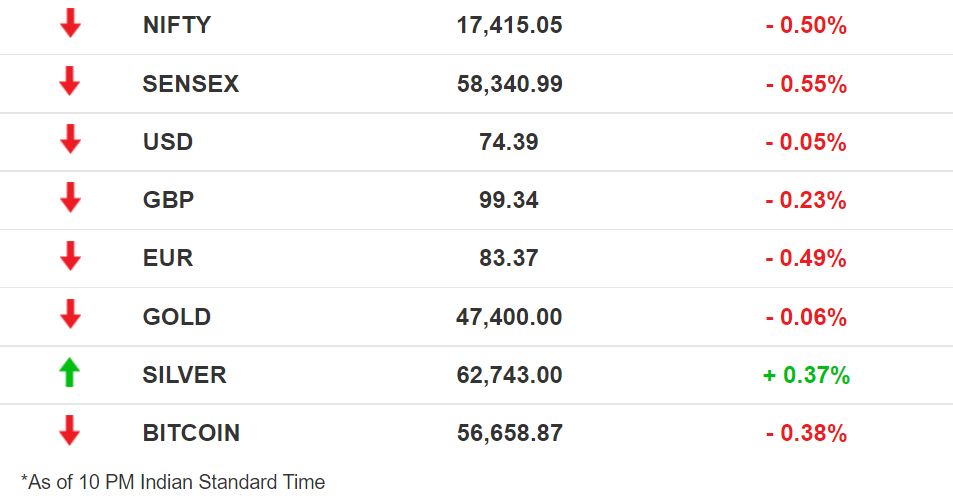

The Market SignalStocks: Despite spending most of the day in the green, benchmark indices succumbed to a late slide on the news of Germany considering a full lockdown to combat rising cases of Covid-19. Trading today is likely to be dictated by the weekly F&O expiry positions, which are typically in line with the market momentum. Blockchain Ok, Cryptocurrency Not OkIndia is finally clearing the murky waters surrounding cryptocurrency regulation in the country. The government is looking to introduce the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 in the winter session of Parliament banning all private cryptocurrencies. Deep in red: Yes, you read that right. However, there are going to be certain exceptions to “promote the underlying technology”, that is, blockchain. The market didn’t take the news well. Cryptocurrencies plummeted by ~25% on Indian exchanges compared to their global counterparts. Bitcoin fell from ₹46,35,371 to ₹33,50,000 on WazirX while Ether, Shiba Inu and Dogecoin were down ~20%. Not as expected: Despite rumours of crypto bans in the country, investors and cryptocurrency exchanges were hopeful that the government would take a positive pivot on the digital currencies. It may yet be allowed as assets. Retail investors are panic-selling their holdings anyway. There was some speculation in the market that the government may let the International Finance Services Centre in GIFT City be a crypto spot. Of course, conditions were to apply. Separately, former Reserve Bank of India governor Raghuram Rajan has called the crypto surge a “bubble”, predicting that most of them will “perish” soon. Elsewhere,   Snakes And LaddersThe world’s largest asset manager, BlackRock, is taking a step back from India. The firm is now pruning its exposure in Indian equities and is gung-ho on China. Just when investors are feeling a bit jittery about India, regulatory changes are creating a headache for hedge funds. Whose game? The sweeping technology crackdown in China had benefited India. In fact, in the September quarter, for every $1 invested into China, $1.5 came to India. But the recent listing debacles, brokerage downgrades, liquidity worries and rate-hike concerns have pulled down Indian stocks. Meanwhile, China is gaining on the back of an improving economy and the Evergrande crisis seeing resolution. The Sebi hammer: Hedge funds in India are uneasy over new Sebi rules. The regulator wants them to sell individual stocks if they exceed more than 10% of their total portfolio. That means if part of their holdings loses value, pushing up the share of performing stocks beyond the threshold, the funds would have to sell the good stocks to bring them within the limit. Beijing is pretty much done with its regulatory crackdown. That means investors may swing back to China. Medium Is The MessageA Parliamentary panel has reportedly suggested that India should set up a local alternative to the SWIFT global financial messaging system to safeguard domestic data. It has suggested that India develop a network like the blockchain-based Ripple or Europe’s INSTEX, a system the bloc built in 2019 to trade with Iran bypassing the US dollar and sanctions on that country. INSTEX is engineered as a clearing house that settles transactions between the EU countries and Iran. SWIFT is a Belgium-based secure messaging system that global financial institutions use for cross-border funds transfer. Europe has always been wary of the messaging network, which is reputed to be heavily influenced by the US and has attracted flak for it.

China’s Coast Goes DarkGlobal supply chains have another headache as China has blocked public access to ships trackers in Chinese waters citing national security concerns. No signal: With the help of Automatic Identification System (AIS), shipping data companies were able to track ships worldwide and improve port efficiency. But in the past three weeks, the number of vessels sending signals from the country has dropped by nearly 90%. Analysts think AIS is the first victim of China’s new data privacy law, which wants data processing companies to receive approval from the Chinese government before they let information leave Chinese soil. Added hurdle: China is home to six of the world’s busiest container ports. The Chinese coast going silent will create more problems for already strained global supply chains in the upcoming holiday season. The Laws Are Coming For Social MediaIn what could become the biggest assault on social media platforms’ armor, a Parliamentary panel that scrutinized India’s proposed personal data law has recommended that they be treated as publishers, The Economic Times reported. The Joint Committee of Parliament also wants an independent regulator for social media companies. Has company: If made into law, India would join countries such as the US, Australia and New Zealand that are considering tough laws to strip the companies of their “liability shield”. Step up: India bringing social media platforms on a par with publishers has far-reaching implications. It will not only open up the platforms such as Meta, Twitter and Instagram to defamation and libel laws but also increase the responsibilities of and resources needed by them. Clubbing them with publishers would mean they will be bound by a key provision in the laws governing elections in India. Currently, the onus is on the Election Commission of India to flag the content on social media and the platforms themselves only have to abide by a voluntary code. What Else Made The Signal?Capital aplenty: Online used-car platform Spinny has become the newest unicorn after raising $285 million in a funding round. Meanwhile, Softbank may place a bet on fintech startup Justpay in its funding round of $100 million. Dream big: Dream11’s parent company Dream Sports raised $840 million in a funding round that took that company’s valuation to $8 billion. Healthy loan: India has signed a deal with the Asian Development Bank for a $300 billion loan to improve primary healthcare in cities and towns of 13 states. Listing tax: India may tax large foreign investors in Indian startups when the companies list on overseas exchanges. It would start with GIFT International Financial Services Centre. Doorstep banking: As a step forward in financial inclusion, the government is planning to introduce Jan Dhan 3.0 where there will be banking touchpoints every 5 km. Esop rich: Close to 40 startups have bought back stock options worth ₹3,200 crore from their employees since July 2020. Fly again: India would begin normal international flight operations by the end of the year.  FWIWNasa planning Armageddon: Bruce Willis had led a bunch of oil drillers in the movie to an asteroid heading towards earth. The team had to blow the stone apart before it hit our rock and annihilated humankind. Nasa is not going the whole hog but it is sending a spacecraft to crash into an asteroid to see whether they can manage without Bruce Willis. The master is back: Hayao Miyazaki is returning to the studios to make a film. He is 80 now. We recommend you read this profile based on a rare interview with the reclusive Oscar-winning maestro. No turkey? No problem: This year's Thanksgiving feast is set to be America's most vegan ever even though only 5% of the country’s population is actually vegan or vegetarian. Due to high inflation, turkey prices soared up to 20% this year, making people shift to plant-based alternatives. Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Will Zoom end like Skype?

Wednesday, November 24, 2021

Also in today's edition: Oppo joins EV bunch, Mobikwik pulls out, Ambani succession plan.

How Facebook jumped without a hoop

Monday, November 22, 2021

The social media company convinced ECI to settle for a voluntary code instead of new regulations

The murky crypto corner of Indian YouTube

Saturday, November 20, 2021

Crypto legislation will have to address not only trading but also the dubious information flows that drive gullible investors to the market

Paytm wakes up the bears

Friday, November 19, 2021

Also in today's edition: Google to remain rooted in search, Tata to fly one airline, Baking bread

Erdogan miffed at Modi

Monday, November 15, 2021

Also in today's edition: Meta could be as toxic as Facebook, All Mumbaikars get first shot, Short video gold rush

You Might Also Like

MAILBAG! FCS Bowl Games, FBS regular season expansion, and more:

Wednesday, November 27, 2024

Plus, EVEN MORE EXTRA POINTS BOWL PICTURES

Into the black

Wednesday, November 27, 2024

Offshore crypto-gambling is having a moment ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

1 minute to increase your email open rate

Wednesday, November 27, 2024

Every year we bring the highest quality software to RocketHub for an insane BFCM event. This year is no different! BFCM starts now so check the page below for one new lifetime deeaaal drop each day.

Memo: The Distressed Brand

Wednesday, November 27, 2024

The opposite of brand equity isn't no equity; it's brand apathy. View this email in your browser 2PM (No. 1014). The most recent letter was read by 46.1% of subscribers and this was the top

🔍 How Ridge Scaled to 9-Figures W/ Influencers

Wednesday, November 27, 2024

November 26, 2024 | Read Online All Case Studies 🔍 Learn About Sponsorships 2020 influencer marketing was pay-to-post. In 2024 that sh*t no longer works. In 2025 it's going to be about building a

A letter for you

Wednesday, November 27, 2024

Plus, an announcement you won't want to miss... View in browser ClickBank Logo Hi there, Wow. Time sure does fly. Can you believe there's already less than two months left in 2024!? It feels

🎟️The Quest is calling you

Tuesday, November 26, 2024

And why the HubSpot Blog ages in reverse ... View in browser hey-Jul-17-2024-03-58-50-7396-PM Don't write off a scavenger hunt as mere kids' play. A well-designed hunt can move attendees closer

New Pricing & Black Friday Deal

Tuesday, November 26, 2024

Some updates to my lead program for design agencies ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The BFCM Playbook To Millions In Sales

Tuesday, November 26, 2024

Come learn how to crush black friday cyber monday for brands

🦅 The once-in-a-lifetime deal is here

Tuesday, November 26, 2024

The new 𝕏 API costs forced our hand ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏