The Daily StockTips Newsletter 11.30.2021

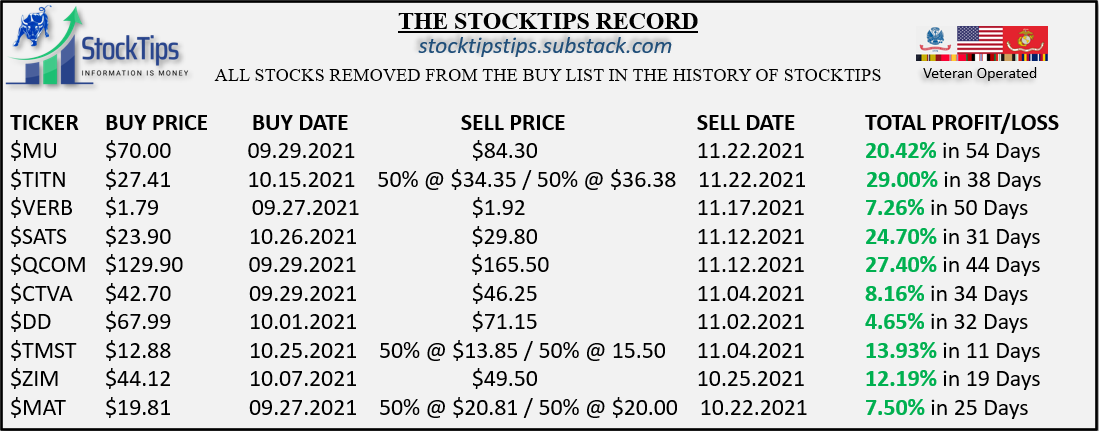

The Daily StockTips Newsletter 11.30.2021I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)Below you will find a list of stocks researched, hand picked & watched by me. I grade, organize, & rank the plays taking into account Risk (R), Value (Va), Growth Potential (G), Intuitional Ownership (I), Volatility (Vo), Earnings History (H), & Market Conditions (M). I then score them, set price targets, & provide a quick thesis about the company. I do not throw stocks up until I thoroughly research them. The way I figure it, I ought not be drawing attention to stocks I'm not confident enough to buy myself. The Stock Tip Report is NOT investment advice, it is strictly to assist you in your own idea generation, & you should always do your own DD. Please read the "Important Disclaimer" at the Bottom of this Page.IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.TODAYS OVERVIEW: 1x NEW STOCK ADDED TO THE BUY LIST. 12 Stocks near/at/above the Buy Zone (Waiting to Swing). 2 Stocks (Profiting) Above the Buy Zone. 43 Stocks on the Price Based Assessment Watchlist. 12 Stocks on the Stocks Under $20 List (Read the Warning/Disclaimer). 3 Stocks on the Highly Speculative Highly Volatile List (Read the Warning/Disclaimer). Took Solid Profit from 10 Stocks in the last 2 Months! WE’RE ON YOUTUBE NOW! See HERE & HERE All profit & loss removed from the list will forever be posted below. Please note that the numbers only reflect the difference between the INITIAL buy price & the sell price without credence to the effects averaging down, which I often do. Gains can therefore look much less than what was actually achieved by 1-10%.An average of 15.521% Realized Profit per Stock Sold in an Average of 33.8 Days! These Conditions are Hard to Produce, & but do you Know Anyone Else Killing it Like This?Before you Trade Today: Know the Economic Calendar! StockTips Market Forecast: I expect this earnings season to be forgotten quickly & the uncertainty as a result of supply chain constraints, inflation, worker shortages, & semiconductor shortages will reclaim market sentiment until next earnings season. Valuations are STILL seriously overpriced right now by any reasonable & historic metric. The new omicron variant will only exacerbate this phenomena. HEY HEY! WE’RE ON YOUTUBE NOW! See HERE & HERE I will get around to Cash Secured Puts next. You can bet I’m going to throw in some DD & screening tutorials eventually as well! Hope I don’t teach myself out of businesses! Commentary: Well ladies and gents, I’ve finished my nightly screen & the market is still over pumped in my opinion. Although I’ve added one pick on deck should it drop to the $45’s (In the paid section below [See notes]). Omicron uncertainty seems to be front and center again. Some European countries may shut some stuff down but I don’t see this as a politically viable option in the U.S. … not to venture into what’s right & what’s wrong amid times such as these, but the previously implemented federal mandates are quietly being pushed back until after the holidays, & next election season is already looking like a slaughter for the party in power according to the friendliest of polling institutions. Implementing additional restrictions, no matter your views on the matter, would absolutely turn the political world upside down amid next years midterms. Therefore I do not think the White House will go there. There is quite a bit retail traders ARE NOT paying attention to amid the Omicron distraction. For example, the Fed Chair is testifying today, inflation number’s come out on December 10th (will be here before we know it), Congress still needs to raise the debt ceiling … & soon, & poor Chinese economic conditions are lingering behind world economic stage. At this time we know that in store sales on Black Friday were dramatically below the 2019 numbers, albeit higher than 2020. We also know that online Black Friday sales underperformed, but just by a little. But what of Cyber Monday? Well, the post sales analysis isn’t in yet. You can bet I will be waiting for it! As to my picks below, remember that we snagged them at a value already. My methodology since I began this newsletter is to add reliably/historically profitable companies, trading at a sector/industry relative value, on a pullback of little to no consequence, favored by intuitions, under favorable economic conditions. Thusly, if they were good buys when I added them, the ones in the red are great buys now in my opinion. So if you missed the pumps earlier, many of them are back in the buy zone! And I’m certainly jealous. Note that the overwhelming majority of the picks below were chosen with existing economic conditions in mind (minus Omicron). And the good news is, & you might be confused as to why I call this good news, the futures look awful right now. Indeed if I can buy even more value, I consider this good news! As stated in the previous paragraph, Asian & European markets are dumping & the U.S. futures concur. Now its time for expectation management. Its been two days … two trading days. For many retail traders two bad market days can seem as though they are two weeks. All to often they’re looking at their phone as if somehow they’re in control of things. Well we aren’t in control. This is why I let the market tell me what to research & what to buy. Personally I’m going to ignore the noise, set my alerts on average down price targets (If I’m lucky they will ring true), & go about my day as I always do. Of course I don’t average down unless I’m down 10% so take that for what its worth. Averaging down too early can harm your ability to substantively average down when you really need to. So I’m always careful how I go about such business. For you margin fans out there be careful! Margin for me is for exceptional circumstances. Finally watch for companies to roll their short term corporate bonds (offering longer term bonds to both raise money & buy back the old ones that are due to expire sooner) while the interest rates are still low. This is a smart move! Expect more & more companies to adopt this strategy. Shareholders may not like it in the short run, but in the long run such a simple move could pay big! Significant News Heading into 11.30.2021:

Insider Buying Activity at Market Close: NOT Awards, NOT Compensation, but BUYING! PAID CONTENT BELOW:

Remember: I Search for Historically/Reliably Profitable Companies, Trading at a Sector/Industry Relative Value, on a Pullback of Little to No Negative Consequence, Favored by Institutions, & Under Favorable Assessed Future Economic Conditions. The reason the below section is paid content is these gems are really tough to find & take quite a bit of research to justify addition to the list! I’m a very picky fella & I don’t like to lose! . ... Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 11.29.2021

Monday, November 29, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

The Daily StockTips Newsletter 11.26.2021

Friday, November 26, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

Give the gift of StockTips Newsletter

Thursday, November 25, 2021

Dear StockTips Reader, Thank you for being a subscriber to StockTips Newsletter this year. This holiday season, consider giving the gift of a paid subscription to a friend, family member, or colleague

The Daily StockTips Newsletter 11.24.2021

Wednesday, November 24, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

The Daily StockTips Newsletter 11.23.2021

Tuesday, November 23, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

You Might Also Like

🇨🇳 The US is out, China is in

Tuesday, March 11, 2025

Citigroup's forecast for US and Chinese stocks, Lego stacked bricks, and Boeing's investigation | Finimize Hi Reader, here's what you need to know for March 12th in 3:10 minutes. Citigroup

The Under-the-Radar Threat to Your Retirement

Tuesday, March 11, 2025

Nearly half of older adults are burdened by bad debt ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

15 Years Since We Bought Our Toxic Asset

Tuesday, March 11, 2025

In a new Planet Money plus episode, former Planet Money hosts David Kestenbaum and Chana Joffe-Walt look back at a pioneering series that sought to explain a major source of the 2008 financial crisis.

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏