Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #266

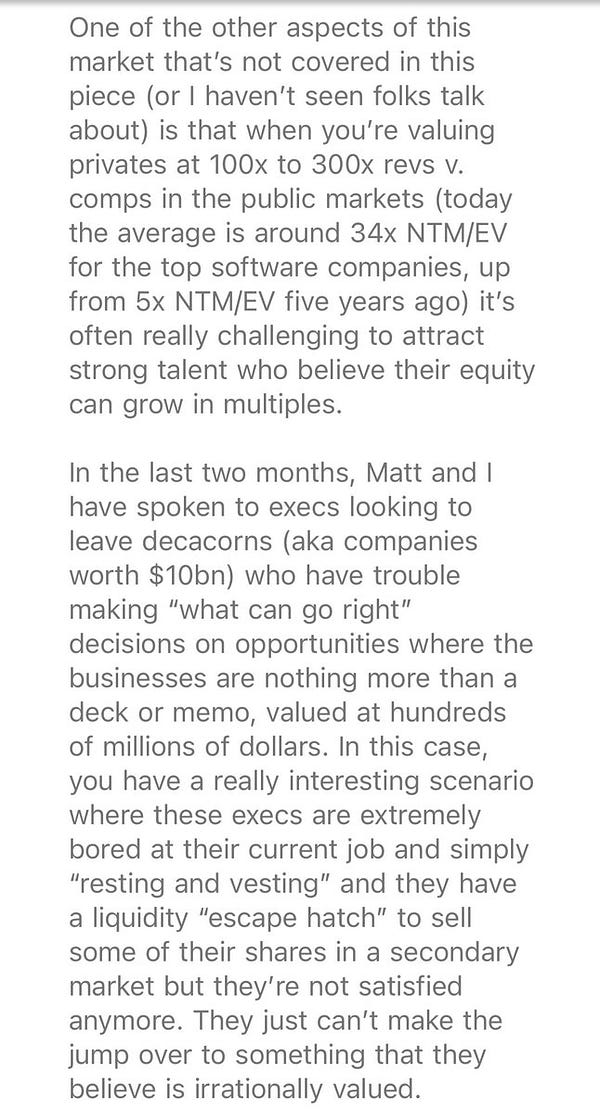

The pace is only accelerating for startup funding, and it’s hard to keep up with the deal flow, private valuations, FOMO, events, crypto madness and everything else in between. Looking at my Twitter feed, chatting with investors about each new insane round of funding after another, and watching the sky fall 📉 for lots of SaaS stocks can be enough to drive one absolutely insane. Fortunately for now, as I look at my current portfolio and talk to other investors what’s happening in the public markets is still divorced from the private markets. Valuations continue to be incredibly robust and there seems to be no slowing down. To that end, I was meeting with an emerging manager the other day, and he asked me what’s next for boldstart especially as it relates to $400M seed funds and intense competition at every stage. And my answer was this:  While the advice sounds basic, it does allow me and boldstart to focus on the signal from the noise. By knowing what you love to do, you can easily say NO to everything else that does not fit your focus. This means you can really focus on the 5-10% of founders and new opportunities that really matter, the ones who equally want to partner with you on their journey. I’ve always told our LPs, I never want to wake up feeling pressure to put money to work and only want to take enough to execute on our strategy. Here’s a slide from our annual meeting which was held a couple of months ago with respect to every VC investing in seed and how we stay focused and calm: In addition, as one raises more capital it becomes easier and easier to start paying higher valuations upfront, to write bigger checks upfront, and fall into the trap of as long as I own X% and if this is huge, it doesn’t matter what entry price I pay. Yes, for now it’s working for many but in the long run things will adjust. You will also F*^# up and miss out on some opportunities but by staying focused, you should hope that you will partner with more winners than ones you missed out on. Just from this past week alone I can name 2 companies we passed on by staying in our swim lane but at the same time, we are incredibly 🔥 up for the founders we did partner with. You can’t win them all and you can’t invest in everything so constraints force you to focus. Before you raise your next fund as an emerging manager, think long and hard about what your swim lane is. It’s different for everyone and should take into account understanding your own super powers, what you love to do every single day, how you like to work with founders, focus, strategy on leading vs. co-leading, firm building - solo vs. partners, etc. But one common theme is to not take too much money as it can cause lots of bad habits. As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

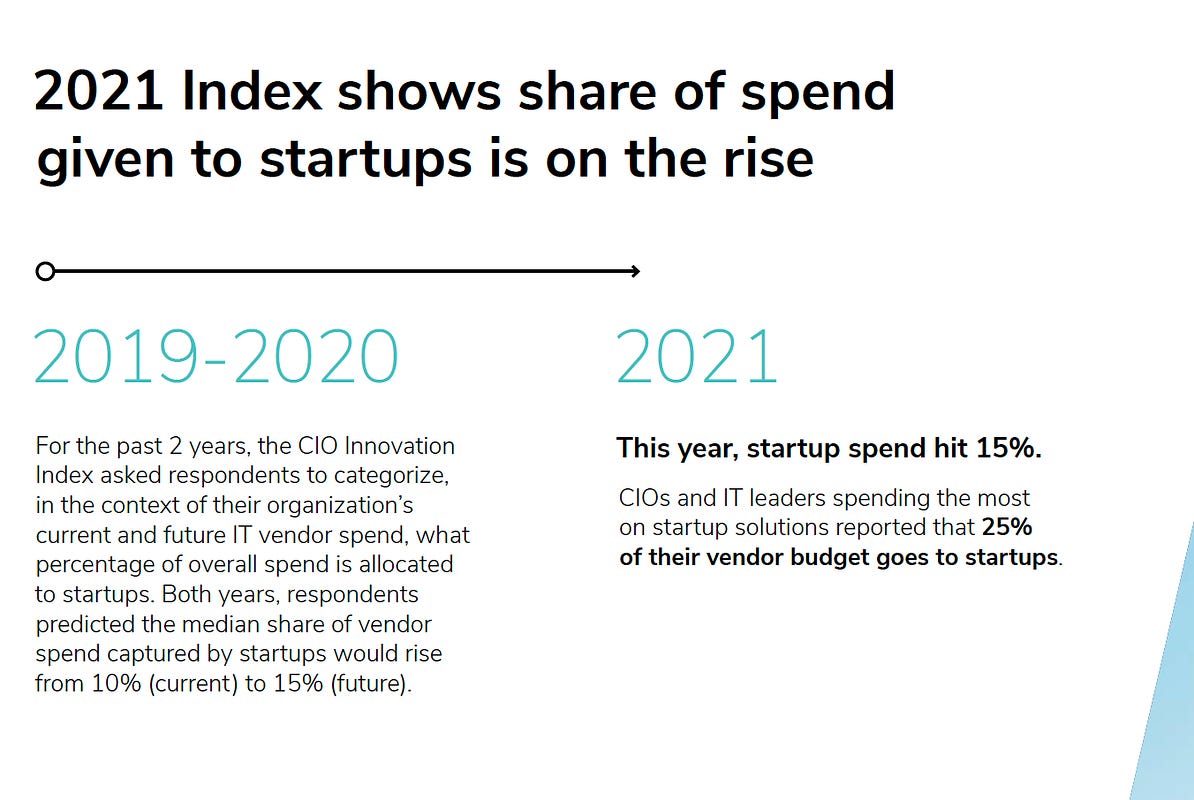

Enterprise Tech

Markets

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Older messages

What's 🔥 in Enterprise IT/VC #265

Saturday, November 27, 2021

🎢 Strap it on for a bumpy next couple of months - but opportunity abounds in the long term + fun matters

What's 🔥 in Enterprise IT/VC #264

Saturday, November 20, 2021

The impact of lofty expectations for investors and founders

What's 🔥 in Enterprise IT/VC #263

Saturday, November 13, 2021

Going down the crypto 🐰 hole...

What's 🔥 in Enterprise IT/VC #262

Saturday, November 6, 2021

Breaking down HashiCorp's S-1 + playbook for building a massive OSS company + The 🐮 Case for Cloud Native and Infra

What's 🔥 in Enterprise IT/VC #261

Saturday, October 30, 2021

🤯 ☁️ + 73M developers on Github with 84% of Fortune 500 using

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏