Drone Delivery: Accelerating to Inevitable

You're on the free list for The Diff. Subscribers-only posts you missed this week:

Thanks again for reading The Diff. If you'd like full access, sign up today. Coming attractions: next week is Conglomerates Week for The Diff. You'll learn about a REIT that turned into a power tool company and then a healthcare business, a formulaic approach to acquisitions that yielded a 17% annualized return over two decades, a growth model for software investing that's similar to Y Combinator in terms of sample size but the opposite in every other way, and about how to financially engineer your way through multiple cycles of media disruption. Drone Delivery: Accelerating to InevitablePlus! Media/Software Synthesis; The Working Capital Accelerant; Klarna Fills in the Gaps; Younger SPAC Targets; Consumer-Facing DeFi

Welcome to the Friday edition of The Diff! This newsletter goes out to 25,342 subscribers, up 15 from last week. In this issue:

I've been interested in conglomerates for a long time; in high school I wrote a history paper on the age of the conglomerates, and during my research I discovered that one of the great conglomerateurs, James Ling, was still running a company. I called them up, Ling called back, and I got to talk one-on-one with someone who had pioneered tracking stock, masterminded numerous recapitalization tricks, and had been ignominiously expelled from his company.¹ Later today on Callin I'll be talking about Ling-Temco-Vought, the golden age of conglomerates, and what we can learn from them today. Drone Delivery: Accelerating to InevitableOne of the great illustrations of the sunk cost fallacy is the extreme frequent occurrence in which a one-pound burrito is delivered point-to-point by means of:

Of the ~2lbs of CO2 emitted in a three mile version of this little transaction, 99.6% are spent on moving a person and a vehicle, while the other 0.4% are devoted to moving the food. The cost breakdown is harder to estimate, but a big chunk of it is paying a person to maneuver a fairly large vehicle around other rather large vehicles, all to deliver something comparatively tiny. There is, in other words, an inflated cost involved in using cars to deliver small packages. While that's most salient for food delivery, small errands are a plausibly larger category. It's hard to ballpark how big they are, because many errands are part of a trip—stopping by a drive-through on the way home from work adds a few hundred feet to a trip that was already going to happen. But plenty of small convenience purchases do involve a quick road trip, with its attendant costs. This situation is temporary. Soon enough, autonomous drones will be the dominant way to deliver small payloads—lunch, a snack, coffee, medication, household products (yes, your emergency toilet paper roll will be flying directly to your door), batteries, band-aids, that one dowel for your new Ikea dresser that you could swear you saw just a minute ago, etc. Basically any small payload that needs timely delivery can be sent more efficiently by a drone than by a car, and now that companies doing delivery have material market share in the overall errand business, and are sensitive to their unit economics, adoption can happen fast. Alphabet's Wing is a fascinating case study in how autonomous delivery drones can work as a product: Wing had done 100,000 deliveries since launch as of late August, and the latest number from Wing is over 130,000 deliveries, in their current markets of Australia, the US, and Finland. There are several categories that work especially well for drones:

Autonomous delivery drones end up unbundling food and ambiance, which can have some interesting effects on dining. It's helpful for the ghost kitchen business, of course, especially since drones require a smaller physical footprint for pickup than humans driving cars. But it also means that it's easier to order dinner from one place, dessert from another, and drinks from a third restaurant.² Helsinki has picnic spots in parks where people can get food delivered. This ends up having further effects on cities and real estate. To the extent that Starbucks is not a bank, it's a real estate company that specializes in buying access to frequent foot traffic from coffee consumers. If drone delivery gets as fast as going a block or two out of the way, or spending a few minutes in line, it radically reduces the return from better real estate. (Starbucks will still do fine here: part of the magic of their app is that they replace a series of $2-5 credit card transactions with $25 card top-up transactions; adding a few points to the margin on a series of small purchases adds up, and a company with a loyalty app can also use push notifications to guide customers towards making orders at favorable times and prices.) Drones affect another kind of space, too. I've written before about how drone delivery creates new property rights, and it's becoming an actual problem. One drone delivery company can manage its routes to avoid collisions, but if there are dozens of companies it becomes a problem. Enter the InterUSS Platform, a protocol for communication between different networks of autonomous drones. Since there's a lot more three-dimensional space than two-dimensional space, and since drones take up less space than cars, it will be a long time before there's anything resembling a drone traffic jam, but it won't be long before drones from one company need to ensure that they're not colliding with drones from another. As part of building a protocol for drone delivery, Wing offers OpenSky, which lets drone owners request access to airspace without manually filling out paper forms. And collisions bring up the topic of safety: do we need more objects falling out of the sky? There are two components to this:

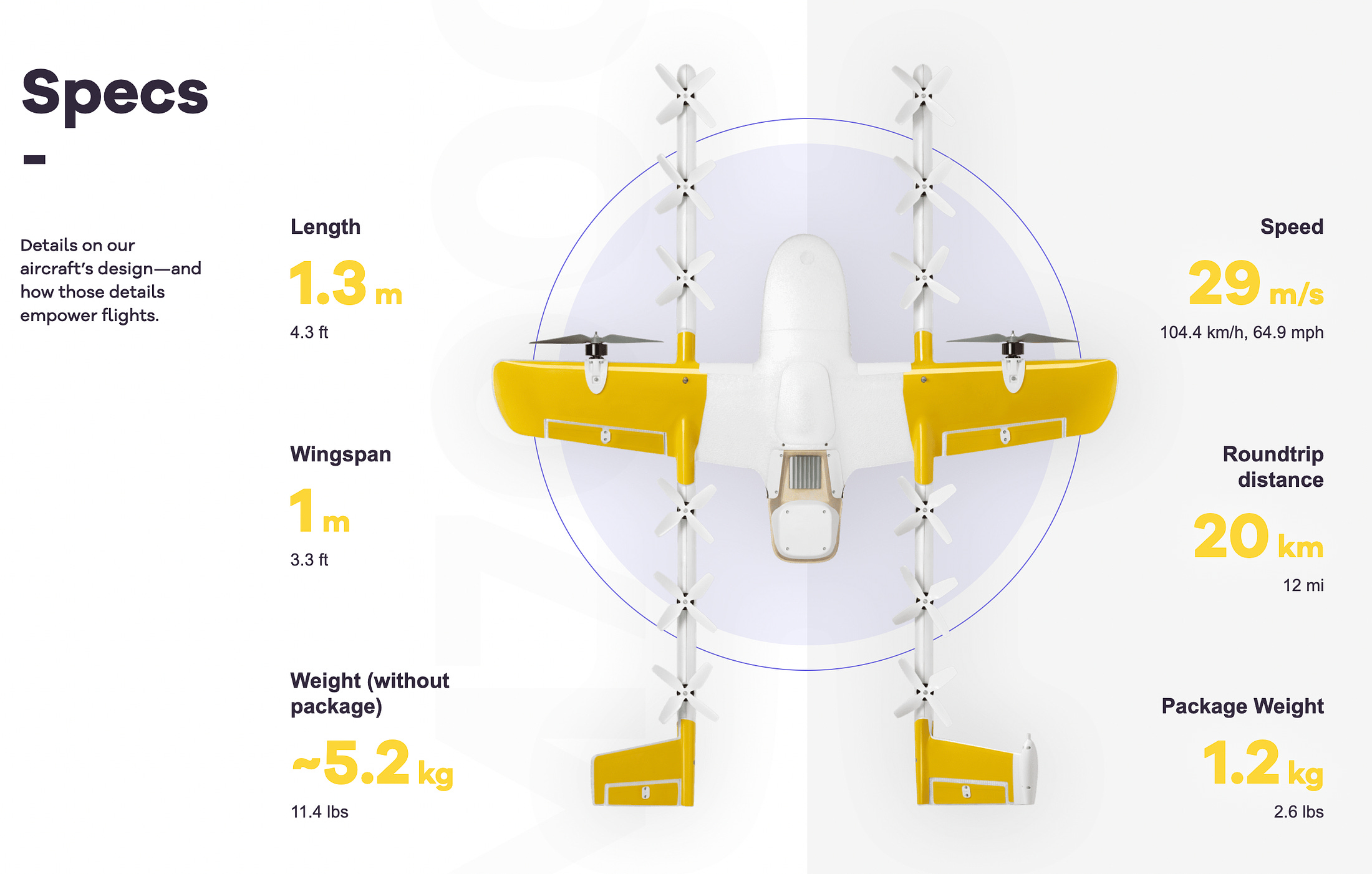

Aviation has a long tradition of prizing redundant systems (and people who violate that norm learn why the hard way). But that's a probabilistic approach, and any time odds that round down to zero collide with a rapid increase in sample size, there are unpleasant surprises. But the other safety dial to turn is to reduce the weight of drones so that even an uncontrolled descent is not especially high-risk. The Wing drones are 11.4 lbs, or 14 lbs with packages; this doesn't eliminate risk, but significantly mitigates it. Delivery drones share a go-to-market strategy with voice search, the Apple Watch, the Roomba, and Tesla: the product is cool as a gimmick but turns out to be useful, too. There's just something intrinsically appealing about dealing with a mild inconvenience by summoning a flying robot to fix it for you. But once that's happened once or twice, it becomes weird to consider summoning a human being, at a higher cost in terms of money and environmental impact, to do basically the same thing. So if you think getting a drone delivery is something you’d brag about, best to do it early during the brief period where drone delivery is available but not a proasic modern convenience. There are a few possibilities for long-term drone economics. The most obvious right now is that drone-specific companies will build fleets and work with multiple counterparties. Retailers could do it themselves—Amazon started the hype early by talking about a delivery drone in 2013. At the time that Amazon announced it, their proposed five-pound payload covered 86% of the items the company delivered, and they planned half-hour delivery times. Eliminating substantial delivery costs is appealing to any retailer. On the other hand, the fixed cost and operational uncertainty makes this a tricky bet: if the cost of drone delivery starts high and falls rapidly with scale, it's an open question whether retailers will capture the scale or whether it will be pure-play delivery networks. Walmart has been investing in drone delivery companies, with deliveries to some customers in Arkansas. This is another instance of brick-and-mortar retailers being indifferent to whether their real estate consists of retail stores, showrooms, or fulfillment centers; whatever the most cost-effective way is to generate demand and then fulfill it will determine how the location gets used. What drone delivery ultimately does is weaken the car bundle. Cars are useful for commuting, errands, and long-distance travel, and for some set of consumers, errands are the last marginal reason to choose owning a car over not. Interestingly, this is a case where an external change in the logistics business can actually benefit some of the companies that don't participate in it; fewer car owners can mean more demand for Uber and Lyft. (If you would spend $5k/year on owning a car, and you replace that with $4k/year in Uber and Lyft spending, you come out ahead—but so do the ride-sharing companies.) A lot of this is dependent on the unit economics of the drone delivery business, which remain somewhat opaque. Manna, which uses human-operated drones, says its delivery costs are 90% lower than drivers. Even if that's not a fully-loaded cost, it does imply that drone delivery can achieve lower marginal costs than the traditional kind. And while the drone companies have to build fleets, a disadvantage relative to gig economy businesses that can rely on the existing stock of cars, but many of the components of drones have favorable experience curves. Once drones have reasonable incremental margins, a decent safety record, and consumer adoption, the main problem to solve for is capital. And capital for growth businesses has never been more abundant. Further reading: for earlier thoughts on changes in delivery logistics, see this piece on cargo blimps. (Disclosure: I own shares of Amazon.) A Word From Our SponsorsHere's a dirty secret: part of equity research consists of being one of the world's best-paid data-entry professionals. It's a pain—and a rite of passage—to build a financial model by painstakingly transcribing information from 10-Qs, 10-Ks, presentations, and transcripts. Or, at least, it was: Daloopa uses machine learning and human validation to automatically parse financial statements and other disclosures, creating a continuously-updated, detailed, and accurate model. If you've ever fired up Excel at 8pm and realized you'll be doing ctrl-c alt-tab alt-e-es-v until well past midnight, you owe it to yourself to check this out. ElsewhereMedia/Software SynthesisEnterprise software companies have increasingly started adopting metrics that line up more closely with consumer companies: Nu (written up on The Diff here ($)) cites daily active user numbers in addition to more traditional borrowing and lending metrics, and Freightwaves is either a logistics trade magazine with software or a software company with a small media company attached. The latest instance of this is Salesforce getting exclusive access to some content from Vox's business podcast. Churn for an enterprise subscription product is basically inevitable once it gets to the point that customers are actually calling or emailing to cancel, but one of the forward indicators is a decline in usage. And as a product gets more mature, churn inevitably becomes larger relative to net growth. So they start looking for all the incremental ways to slightly reduce churn, one of which is to give a subset of customers one more reason to log in. The Working Capital AccelerantStripe has published some stats around its Stripe Capital service:

It's easy to get caught up in worrying about how rapidly alternative lenders are growing, but at least in the SMB space there's a lot of ground to make up: the cost and regulatory structure of the US financial system makes it fairly easy for individuals to borrow for consumption, and for large companies to lean on debt in order to return more capital to shareholders. Small businesses have been comparatively under-served, and now that payments offer both a lower-cost way to reach them and data to underwrite the loans, a large gap is being rapidly filled in. Klarna Fills in the GapsKlarna now offers a browser extension to let people borrow from them even for purchases from merchants who don't use Klarna. This doesn't perfectly line up with the general economics of Buy-Now-Pay-Later, which are partly driven by merchant subsidies since the loans increase purchase size. But it does mean that for merchants that don't use Klarna, Klarna will now have data to show them how much incremental business they're missing. I previously wrote about this kind of strategy, including Affirm's version, here ($). Younger SPAC TargetsCrunchbase crunches the data and finds that among venture-funded companies the median traditional IPO is for an eleven-year-old company, while the median SPAC deal is for a company that's just eight years old. Some of this is because of disclosure differences; SPACs can include forward projections, while regular IPOs generally shy away from this, and the younger a company is the more interesting its future is relative to its past. In one sense, SPAC investors suffer adverse selection, since the companies they're investing in aren't going public the usual way. But in another sense, SPACs compete with late-stage growth rounds as a way to provide capital to companies that a) are at a point where they need outside funding to grow, but b) aren't at the point where current financials speak for themselves. And given how many sophisticated investors have moved into the late stage VC space, it's a category with a vote of confidence. Consumer-Facing DeFiCoinbase is offering a DeFi yield product to non-US investors. This is not one of the Ponzi-esque DeFi products offering 100%+ annual yields that will blow up at some point; Coinbase's yields were "between 2.83% and 5.39% in October," per Bloomberg. That's a low enough rate that the yields can be subsidized by actual returns from lending to speculators, which is not zero-risk but is at least something that can survive in actuarial terms. Two of the big implicit taxes on the developing world's middle class are 1) inflation, which tends to be an ongoing material cost outside of the developing world, and 2) a banking system that provides poor returns and charges high fees for small savers. Giving people a dollar-denominated savings vehicle with a yield that doesn't round to zero is a significant benefit for small savers in poor countries around the world. Diff JobsThe latest roles from companies in the Diff Jobs network:

If any of these look appealing, please reach out. And as we get closer to the end of the year, we're happy to chat with people who are not actively looking at the moment but are planning their next moves in 2022. 1 This call was early evidence for the U-shaped theory of cold intros: if you're famous, you can probably get an email back from whoever you want. If you're a nobody, cold intros are low-cost, but the person you're reaching out to will probably be flattered and get back to you. It's only in the middle stage where you cold-email someone and they wonder why you aren't being introduced through a mutual acquaintance. 2 A benefit for the consumer, but not necessarily for the ones who really enjoy fine dining; the more expensive the restaurant, the more their economics are driven by high markups on drinks. Teetotalers who enjoy excellent food have been receiving a nice subsidy. On the other hand, labor and location dominate the cost structure and both of those have more flexibility. You’re a free subscriber to The Diff. For the full experience, become a paid subscriber. |

Older messages

Longreads + Open Thread

Saturday, December 4, 2021

Ride Hailing, Portnoy, Bridging Finance, Insecure Chips, Bad Trades, Failing GPA

BuzzFeed and the Platform Squeeze

Friday, December 3, 2021

Plus! The Great Unclogging; The First-Party Data Gold Rush; Open Data; Bitcoin Loans; The Arms Race; Diff Jobs

Longreads + Open Thread

Saturday, November 27, 2021

Japan, Altman, COBOL, China, Factors, Geoengineering, LTV, Mistakes

What Happened to all the Diamonds in the Rough?

Friday, November 26, 2021

Plus! A Different EV Network Effect; Supply Chain KPIs; The Underwriter's Loop and Cyber Risk Insurance; Pro-Regulation Tech; Local Chips, Global Companies; Diff Jobs

Longreads + Open Thread

Saturday, November 20, 2021

Speed, Glucose, Enron, Philanthropy, Sewer Robots, Fracking, SoftBank

You Might Also Like

A Page From Uber's Playbook: Disrupting Social Media Marketing

Friday, January 10, 2025

Read the whole story here ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Design Your Dream European Getaway

Friday, January 10, 2025

Enter to win a chance to win a $20000 trip to Europe for free. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📉 Bonds saw a selloff

Thursday, January 9, 2025

Global investors dumped government bonds, UK shoppers got a break for Christmas, and Encylopedia Britannica became an AI company | Finimize Hi Reader, here's what you need to know for January 10th

Could private student loans help you?

Thursday, January 9, 2025

Find out if you qualify and compare rates today. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🏆 The Demi Moore of it all

Thursday, January 9, 2025

Plus, workshops on estate planning and taking control of your money. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦾 Anthropic looks jacked

Wednesday, January 8, 2025

Claude's AI startup flexed a new valuation, China sought to nudge shoppers, and a wild plot to smuggle drugs | Finimize Hi Reader, here's what you need to know for January 9th in 2:57 minutes.

3 reasons to buy life insurance

Wednesday, January 8, 2025

Make 2025 the year you protect your loved ones Why you should get life insurance now A decreasing bar chart Affordable rates Life insurance premiums typically increase with age or changes in health.

Eight days in and things are already changing

Wednesday, January 8, 2025

plus Tomdaya + birdwatching ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤩 Nvidia takes the stage

Tuesday, January 7, 2025

Nvidia headlined in Vegas, the Pentagon added to its companies blacklist, and an unexpectedly amazing beach destination | Finimize Hi Reader, here's what you need to know for January 8th in 3:11

It’s time to get rid of debt

Tuesday, January 7, 2025

Here's how to find the right debt solution for you ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏