State of the DAOs #5 | Beginnings of the In-DAO-strial Revolution

State of the DAOs #5 | Beginnings of the In-DAO-strial RevolutionYou're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.Gm and welcome to DAO life! This week we take a look back at the evolution of the modern company and draw parallels between the Age of Steam and the recent emergence of DAOs as capitols of capital. Just as the railroad facilitated the rapid transfer of money and labor that led to a boom of economic activity, DAOs unlock new methods of human coordination that may prove to solve the most pressing challenges we face today. Next, we share the TL;DR on the latest DAO ecosystem takes and thought pieces, making it easy for you to cut through the noise and stay up to date on the world of DAOs. This is the current state of the DAOs. Authors: BanklessDAO Writers Guild (Jake and Stake, hirokennelly.eth, FreedomFighter, Alvo von A, Cheetah, theconfusedcoin, Adi G, siddhearta) This is the official newsletter of the BanklessDAO. You are subscribed to this newsletter because you were a Premium Member of the Bankless Newsletter as of May 1, 2021. To unsubscribe, edit your settings here. 🙏 Thanks to our Sponsor: Beginnings of the In-DAO-strial RevolutionOn the VOC, ConstitutionDAO, and Capital Capitols Joint-Stock Companies, LLCs, and RailroadsIn 1602, the Dutch East India Company (in Dutch, Vereenigde Oost Indische Compagnie or VOC) received a state-sponsored monopoly to be the sole firm to trade with Mughal-era India. The company was scoped to be a 21-year venture, have limited liability, and was subsequently traded on the Dutch stock exchange founded in 1611. This company would eventually become the model for chartered firms (state-sponsored monopolies) everywhere. This was quite a departure from the way business had typically been done. Up until that point, and for some time after, most firms were small, family enterprises; not large, joint-stock companies. These new firms allowed large sums of money and labor to be concentrated and they could amass more resources than any individual or government could. The result was an entity that could weather risk. The VOC had a more reliable supply chain and could control the pricing of goods it brought back to Europe, effectively forming a cartel. These chartered companies created information networks that were impossible for an individual actor or family enterprise to create, and their access to capital made them resilient to losses in the event of piracy, shipwrecks, misconduct, or mismanagement. The VOC became a global superpower in its own right and by 1669, was the richest private company the world had ever seen. It employed armies, built military bases, and made trade agreements with nations until it began to decline (1730) and was repatriated in 1796. Note the importance of “limited liability” for joint-stock companies. Formalized in France in 1807, limited liability joint-stock businesses were allowed, such that partnerships could be made with transferable shares. These shares granted ownership in the company, but limited the liability of inactive partners (shareholders). This meant that the state could not jail or confiscate the property of inactive business owners in the event of bankruptcy. If the active owners mismanaged or misbehaved, all the inactive shareholders could lose was their investment. While this is common today, at the time, it was a radical new innovation that allowed strangers to pool money together for long-term enterprises. Limited liability joint-stock companies democratized business ownership, allowed money to more easily circulate, improved liquidity, and created robust organizations. Along came the steam locomotive. The paradigm-defining technologies of the 1800s were the steam locomotive and the railroad. When one town was connected to another via railroad, the economic activity of both municipalities multiplied. Investment in railroads came primarily from local business owners and governments. Why? The cheap transport costs expanded markets, increasing both profits and taxes while setting the stage for industrial manufacturing. The problem was the expense. Railroads needed large, up-front investments to fund construction, and the profitability of railroad operators would not be seen until years after they had been established. Companies were the answer. Companies allowed for the quick formation of capital and they were entities that would eventually see those profits. Previously, these chartered companies were rare and the process to obtain a state-sponsored monopoly was time-consuming, but the demand for railroad charters outpaced the rate at which governments could issue them. As demand for these charters increased, governments were more lenient when awarding them. In 1844 in Britain, the Joint Stock Companies Act allowed companies to be incorporated by simply registering — without the need for a special charter. Meanwhile, in the U.S., states were in fierce competition with each other to attract businesses, progressively loosening the requirements for incorporation. The gradual permissionlessness of incorporation combined with the limited liability of joint-stock companies allowed more people to invest, leading to the concentration of capital, fractionalized ownership, and numerous resilient organizations. These railroad companies also served to develop financial markets. From The Company (John Micklethwait, Adrian Wooldridge):

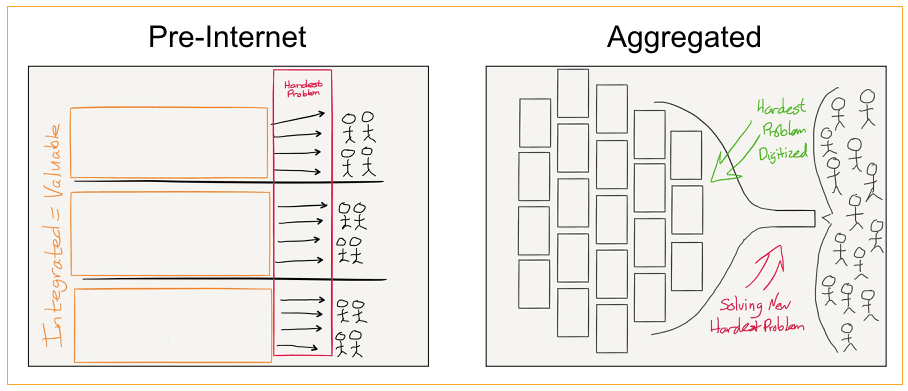

The evolution of the modern company was a crucial driver of economic development. As governments continued to reduce the requirements for creation, companies distributed ownership and concentrated both liquidity and labor. This was a coordination mechanism that ushered in the democratization of business, developing financial markets and strengthening national economies. As Peter Drucker said, "It was the first autonomous institution in hundreds of years, the first to create a power center that was within society, yet independent of the central government of the national state." Fast-forward to the present, and we’re seeing a similar pattern in cryptoassets. Scarce, Permissionless, Digital AssetsCrypto enables scarce, permissionless, digital assets to exist. Let's break this down: Scarce. The scarcity of cryptocurrencies is determined by the code running the protocol. This can be implemented through mechanisms like Bitcoin's 21 million supply cap & proof of work algorithm or Ethereum's gas market & fee burn. Scarcity is born out of the blockchain, the digital ledger. Scarcity (plus demand) is what gives crypto value. Permissionless. The permissionless nature of crypto defines access to this scarce asset — access to the ledger. Everyone has read/write/execute access to this public database, but each user can only manipulate the value they own. There's no tampering with other people's funds and there is no gatekeeper telling you how to use your assets. This characteristic gives people agency to move value through the network. This is what enables self-sovereignty. Digital. Several characteristics flow from the digital property of crypto, but the one I want to focus on here is low distribution costs. This is how these scarce, permissionless assets flow. On the internet, the costs of replication and the costs of distribution (of media) trend towards zero. This is because there is no paper, no truck, and no distribution center needed to send an email (or a meme). If everyone has a computing device, the cost of distribution is equivalent to the cost of electricity used. Pre-internet, demand is constrained by geography, making the creation and distribution of supply the most important problem to solve. Post-internet, digital distribution is effectively zero, supply is commoditized, and the aggregation of demand becomes the new “hardest problem”. Pre-internet, distribution was the bottleneck. Post-internet, distribution is free.

Right now, the cost to send cryptoassets is much more than zero, but I expect the costs to decrease and tend towards zero due to scaling developments (modular blockchain design and scaling roadmap, zk-rollups, sharding, etc). Combine these three properties and you get the rapid velocity of capital. Now people can permissionlessly send their capital in whatever way they wish, as quickly as a new block is created. How do these factors play out in the current environment? Alongside the impact of traditional money markets and the growth of the creator economy enabled by NFTs, it’s worth noting the development of new vehicles for like-minded people to allocate their funds and find community: DAOs. DAOs, Capital, and the United States ConstitutionThere are many kinds of DAOs: social DAOs, investment DAOs, media DAOs; the list goes on. Each has its own focus, but they all have similar characteristics. Given that crypto allows for the rapid transfer of assets, DAOs can serve as a vehicle for that capital. But not just financial capital. DAOs allow for the rapid concentration of:

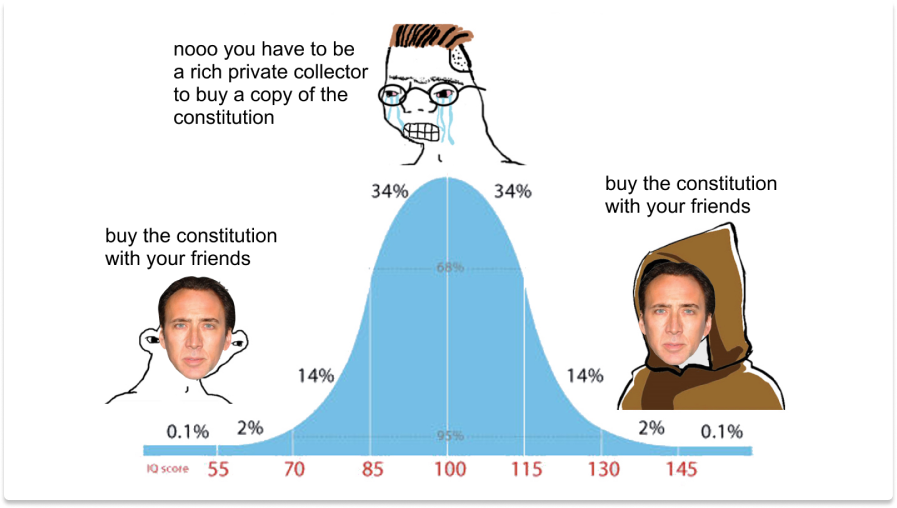

DAOs create a Schelling Point (a natural focal point) for these different types of capital to flow towards. Be it labor, money, or culture, strangers will converge upon DAOs to spend this capital based on alignment with their interests. These new coordination points are magnets for time, money, and energy. If we take all these characteristics together, the properties of the modern company and the properties of DAOs are undeniably similar. Both distribute ownership, both improve the velocity of capital concentration, and both are robust organizations. The difference is that DAOs are supercharged by the internet, increasing permissionlessness and liquidity by an order of magnitude. Where companies are power centers instantiated in the nation state, DAOs are power centers instantiated in the internet. Take ConstitutionDAO: a DAO organized to purchase a copy of the United States Constitution when it was auctioned at Sotheby’s on November 18th, 2021. This DAO, helmed by a small core of contributors, garnered over $40 million USD of donated Ether in under 7 days and set Twitter alight with "#wagbtc" posts ("we’re all gonna buy the Constitution"). The rapidity of capital concentration was astonishing and the memes, chef's kiss, were 🔥:   ConstitutionDAO had all the components mentioned above:

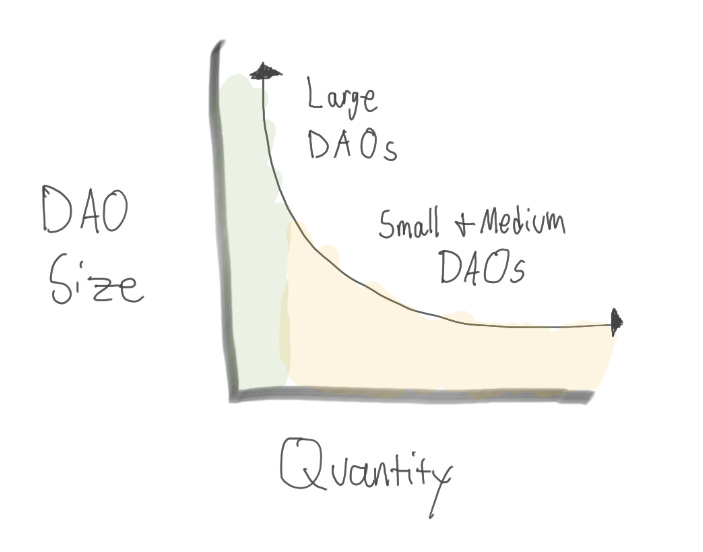

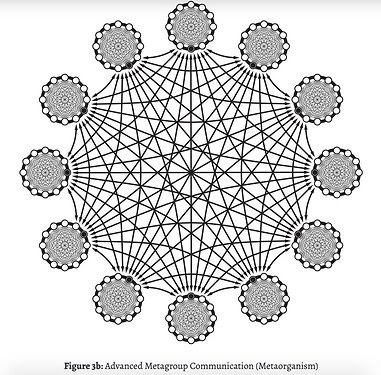

Did I mention much of the core infrastructure was put together in three days? ConstitutionDAO went on to lose the auction — a transparent accounting system means rival bidders can see your max offer — but this is an impressive example of what DAOs, and crypto, can achieve. How will DAOs Evolve? DAOs as CapitolsThe concentration of these resources was enabled by the internet and the evolution of DAOs will be shaped by the internet as well. Some factors I'm thinking about are culture and size. Culture is born of humans and, consequently, emerges in wildly different ways. Culture, no matter how it unfolds, will affect the way DAOs operate and affect each community’s goals. This, though, is somewhat unpredictable and will not be explored in this piece. A more predictable consideration is size. On the internet, scale is part and parcel of success. When distribution is free, the companies that survive will be the ones that can scale their services and beat the competition. Network effects (and businesses) create natural monopolies. My prediction here is that DAOs will follow similar trends as the internet: there will be a few very large DAOs and there will be a long-tail of smaller DAOs (imagine group chats with a shared bank account). Each becoming its own internet society with its own culture, money, mission, and governance structure. Each becoming its own "capitol of capital". A big factor is the fluidity of labor. When people can easily move in and out of internet communities, they will spend the most time with the communities that resonate most deeply. I suspect DAO size will follow a power law distribution, much like large internet companies or crypto protocols. (Think BanklessHQ’s Protocol Sink Thesis or Ben Thompson's Aggregation Theory). And yet, the very large DAOs will have problems that smaller DAOs will not. It's easy to manage a group chat of 3-5 people. It's much harder to coordinate large crowds of crypto natives. Larger DAOs must find ways to scale up their operations without collapsing under the gravity of their success. As DAOs get bigger, they attract more attention and, subsequently, more members. On the surface this looks great. More token demand means it's easier to bootstrap funds, but more members also means more coordination friction. DAOs will have to lean on their strengths (decentralization and culture) to scale up governance in conjunction with their size. Thus, larger DAOs will have to move governance on-chain to deal with these problems via permissionless methods — zk-rollups and more DAO tooling are helpful here. One strategy is to reconstruct how DAOs are organized. I like Frogmonkee’s brain dump here. The idea is to create a network of working groups to handle particular projects and talent pools (guilds) to source human capital. If there’s a Dunbar’s number equivalent for online communities, eventually, some of these working groups/guilds must become their own DAOs (or subDAOs), further moving on-chain. This raises some questions on governance/ tokenomic design, but these are solvable problems. (Orca, Colony, and Aragon are a few projects aiming to solve big-DAO problems). Keep in mind, size can be measured in human, financial, and social capital. Not all DAOs should have many members. Membership will be determined by the alignment of DAO goals and the capital members can provide, whether that is skills, money, or memes. Ultimately, I suspect that the growth of the DAO ecosystem will depend on problems that need the rapidity of capital concentration that DAOs facilitate, just as the modern company grew and proliferated in tandem with the railroad. Could some future catalysts be sustainable energy & electrification, artificial intelligence, 3D printing, AR/VR, or vaccine research and manufacturing? New approaches to human organization, like the modern company, do not immediately come to mind when we think about technological innovations. And yet, the company shaped the last two centuries, catalyzing the development of railroads, financial markets, and other technologies too numerous to name. Now humanity has unlocked a new coordination tool: DAOs. This technological shift will reorganize the world around us and usher in a new era of financial sovereignty and social collaboration. This shift will shake the earth and transform the world around us. Actions steps📖 Read The Digital Culture Revolution ⛏️ Dig into Ultra Scalable Ethereum 🎧 Listen 82 - Investing in the Future | Cathie Wood, Chris Burniske, Yassine Elmandjra 🙏 Sponsor: Yearn Finance- DeFi made Simple. DAOs at a Glance

Messari Report: Crypto Theses for 2022Although we are still searching for a commonly accepted definition of a DAO, we can loosely define a DAO as a blockchain-based, digitally native, open-membership community comprised of individuals focused on a shared mission who use a token to govern themselves, allocate capital, and incentivize contribution, while creating a cohesive normative framework and culture that encourages new ideas, hard work, and self-exploration. Among other things, DAOs:

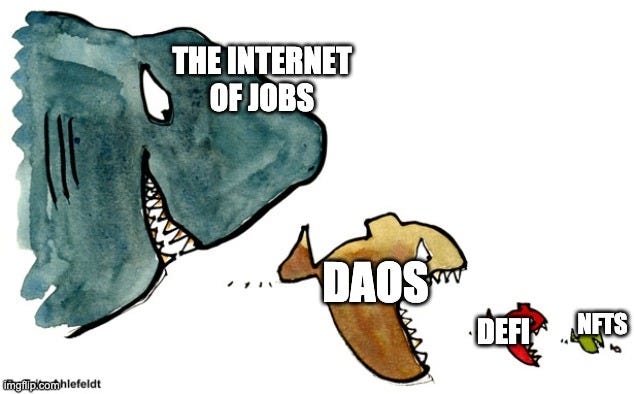

DAOs may be one of the most important innovations made possible by crypto. But more than that, DAOs will outgrow their cryptoverse silos and emerge to the mainstream to challenge the incumbent views on economics, politics, and social relations. Understanding the power of DAOs will position you to profit both economically and socially from a world where these new organizations move away from the periphery and are firmly centered in our every day lives - this realignment is closer than you think. The **Internet of Jobs** is hereAuthor: Kevin Owocki It will not be long before NFTs, DeFi and DAOs, supported by the power of blockchain technology, collectively form something new that will radically shift people's lives: the Internet of Jobs (IoJ). This is already starting to take place within DAOs, such as BanklessDAO, where people can find opportunities for various skills and can start earning. However, this is just the start. The total addressable market is 7.7bn people, and one by one they will ditch their traditional jobs for the IoJ. Why? Because the IoJ is:

The IoJ is already spreading in the crypto-space, and it won't be long before it envelops the wider world. Here are some examples of IoJ creations:

As the IoJ continues to grow, there are many more examples of how important infrastructure and benefits will be unbundled from legacy employment systems and reincorporated into the IoJ. Imperfect Union: How ConstitutionDAO Lost its WayAuthor: Drew Millard & Kevin Munger ConstitutionDAO’s failed bid for the historic artifact provides important lessons to guide future endeavors in Web3. The ability to build the DAO & mobilize human, financial and social capital in such a short amount of time contributed to the mission’s allure, but the hastiness also resulted in a number of shortcomings. Real-time publication of total funds raised, which helped as a marketing tool, has been criticized as an advertisement of the hard cap that any would-be competitive bidders had to contend with. Further, the original US constitution is controversial in its discussion of ethnic minorities and the founding group lacked diversity as well. The DAO’s administrators were committed to doing right by their community, pushing for rapid reimbursements to anyone who wanted them. However, the median donation to help purchase the manuscript was $206.26, and these smaller contributors had their refunds eaten by Ethereum gas fees on the way out. Such a set up alienates interested parties with fewer financial resources. While not representative of the group’s intentions, these elements can be seen as preserving “the power of the old order”. Looking past these deficiencies, the decentralized & community-focused nature of DAOs combined with emerging technologies can emancipate people and shift the distribution of power in society. People want change and that’s a good thing. Conversations about how to make Web3’s tools accessible and financially viable for members of BIPOC and LGBTQ+ communities are happening. ConstitutionDAO did make history and the story represents an example of memefied mobilization. However, simply buying an artifact is a weak departure from making something that can last. “We need to move fast and build things.” The Case for Why DAOs Should Register as Legal EntitiesAuthor: Mark Lurie Hundreds of DAOs have formed in recent years managing billions of dollars. They have transformed human organization by eliminating the need for governmental pressure to ensure compliance. This is positive and reflective change considering how traditional organizational structures function. Analogous to the boom of transistor usage in every human activity, DAOs have bloomed in every sector. More importantly, due to the incorporation of the monetary and governance rules in the code, persons from across the globe can work together with assurance of fund security. Code quality has evolved rapidly and is well-tested in the present day. Since DAOs live in the physical world, a legal wrapper around them would prove useful for two reasons:

In contrast to current legislations which require filing of bylaws or registering names in records, DAO membership works on an anonymous token-bearer system. Such a system is not envisaged by any laws across jurisdictions. Ecosystem Takes

Decentralized Governance StructuresAuthor: Joey Santoro 🔑 Insights: While blockchain has enabled transparent decision-making, DAOs are auguring the next level of human organization. However, DAOs have often struggled with balancing development speed and protocol security. Mirroring the three arms of a sovereign, here are three governance approaches to optimize the balance at different layers:

How to SubDAOAuthor: Coopahtroopa 🔑 Insights: "Many have predicted that DAOs will eclipse centralized organizations - eventually becoming bigger than countries, companies, and other entities that exist in the world today." If you are considering creating a subDAO, here is some advice:

Culture in Progress: Building On-Chain Social CapitalAuthor: Crypto, Culture, & Society 🔑 Insights: Crypto-powered Web3 allows creators and influencers to get paid for their work - free from the typical exploitative arrangements found within the arts. Finally, artists and creators can fully realize the profits from the means of their production - all using the transparency afforded by the blockchain.

18 Trends That Will Shape Our Careers in 2022Author: Nick deWilde 🔑 Insights: With the economy and work-culture changing rapidly, 18 of the internet’s sharpest thinkers reflect on emerging trends from this past year and how they might shape our careers in 2022. Here are some:

The article goes on to further talk about how companies are adapting to hybrid work, the importance of time management, the power of communities and the rise of side hustles. A must read to get an inkling on where you should focus to develop your career. A Big Test for DAOs: Honing New Compensation and Contribution PracticesAuthor: Spencer Graham 🔑 Insights: To realize their potential, DAOs should develop the capability to evaluate individual contributions in a bottom-up fashion and provide dynamic compensation programs. DAOHaus advocates for a framework that prioritizes flexibility of member participation to:

DAO Spotlight: HumanDAOhumanDAO is a social impact DAO, setting out to create a public good. Their mission is purposefully broad and yet quite focused: to improve lives through crypto. Over two billion people in underserved communities live on less than $5/day. humanDAO is creating opportunities in crypto for these communities to earn 2-10x that amount, all while creating profound new revenue streams for their community and investors. humanDAO uses blockchain technology to safely and securely connect people to crypto-assets they do not have the means to access with their own income. The rise of blockchain gaming and the metaverse has unlocked new gaming models such as play-to-earn (P2E). P2E models offer gamers the chance to win or farm in-game tokens held on open blockchains. One hurdle for people to play these games is usually the initial investment required to buy the P2E NFT’s/ tokens that allow participation in the game. This is where humanDAO comes in — humanDAO buys these assets (NFT’s / Tokens) and lends them to people to play, giving them access to opportunities to earn cryptocurrency without the upfront cost of investing. The players keep the bulk of the earned rewards (70%). The humanDAO also has managers who will train and onboard newcomers to the metaverse. These managers will get 15% of the earnings while the remaining balance of 15% will go to humanDAO. It’s a win-win. For humanDAO, P2E assets are a quick win and the start of the journey. Their north star is to improve lives for those in underserved markets using the technological innovation of crypto and Web3. Learn more about the humanDAO and how you can contribute by joining their Discord. Get Plugged In🗺 Live DAO DirectoryThis is a free, long term, data-stewarded directory for DAOs. It's built with diverse community cooperation and participation, which aims to enable greater understanding of the emerging DAO ecosystem, allow for more interDAO communications and awareness, and increase visibility and accessibility of joining a DAO. State of the DAOs - Newbie Friendly EventsEvent HighlightsBanklessDAO - Permissionless Conference - Tickets just went on sale for one of the biggest DeFi conferences! Over 5,000 people will be attending in total and every two weeks 250 more tickets unlock. Once 250 tickets are purchased, registration closes and you’ll have to wait until the next release. Speaking of the next release, your next chance is on October 1st and prices are currently at $316. Speakers include our very own Ryan Sean Adams and David Hoffman, as well as many others. Join us on Tuesday - Thursday, May 17 - 19, 2022 in sunny Palm Beach, Florida for the event. 🧳 Job Opportunities

🙏Thanks to our sponsorYearn FinanceYearn Finance is an emergent and evolving experiment in decentralized collaboration. It has no papers of incorporation, no headquarters, nor even a list of names and locations for its contributors. Yearn is a team of generous, big hearts. We care deeply for each other, DeFi, and the world. That means Yearn will not merely be a world-changing DeFi protocol, but a blueprint for the next stage of human coordination. 👉 Learn more about the Yearn DAO and how you can contribute by visiting our notion. 👉 Chat with Yearn contributors in our Discord. 👉 For more in-depth information about yearn finance see our documentation. If you liked this post from BanklessDAO, why not share it? |

Older messages

Decentralized Arts #17: Sports and NFTs

Tuesday, December 14, 2021

BanklessDAO Weekly NFT and Cryptoart Newsletter

Bankless DAO Weekly Rollup #32: DAO Dash, Season 3 Planning and Time to GIVE

Saturday, December 11, 2021

Catch up with what happened this week in the BanklessDAO.

Decentralized Arts #16: Art Basel Miami

Tuesday, December 7, 2021

BanklessDAO Weekly NFT and Cryptoart Newsletter

BanklessDAO Weekly Rollup #31: BANK on Polygon, Season 3 Planning, and Gitcoin Grants

Saturday, December 4, 2021

Cath up with what happened this week in the BanklessDAO.

State of the DAOs #4: The Future of DAOs

Thursday, December 2, 2021

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏