The Signal - Wall St eyes discount sale in China

Wall St eyes discount sale in ChinaAlso in today’s edition: Bleak Xmas for the US, Vi is up and ringing, Boeing's loss is Airbus' gain, Biggest pile of debt everGood Morning! Reddit is going the IPO way. The self-proclaimed front page of the Internet has filed for a public offering but confidentially. To break it down, no details about its operations or the size of the offer or the valuation of the entity will be known publicly until close to the actual issue. We wonder how the meme traders, who found relevance on the message board, will treat Reddit? Btw, our podcast has been going strong for two months now. Tune in on your daily jog, drive to the office, or even as you WFH-ers have breakfast in bed. We promise it’ll be music to your ears.

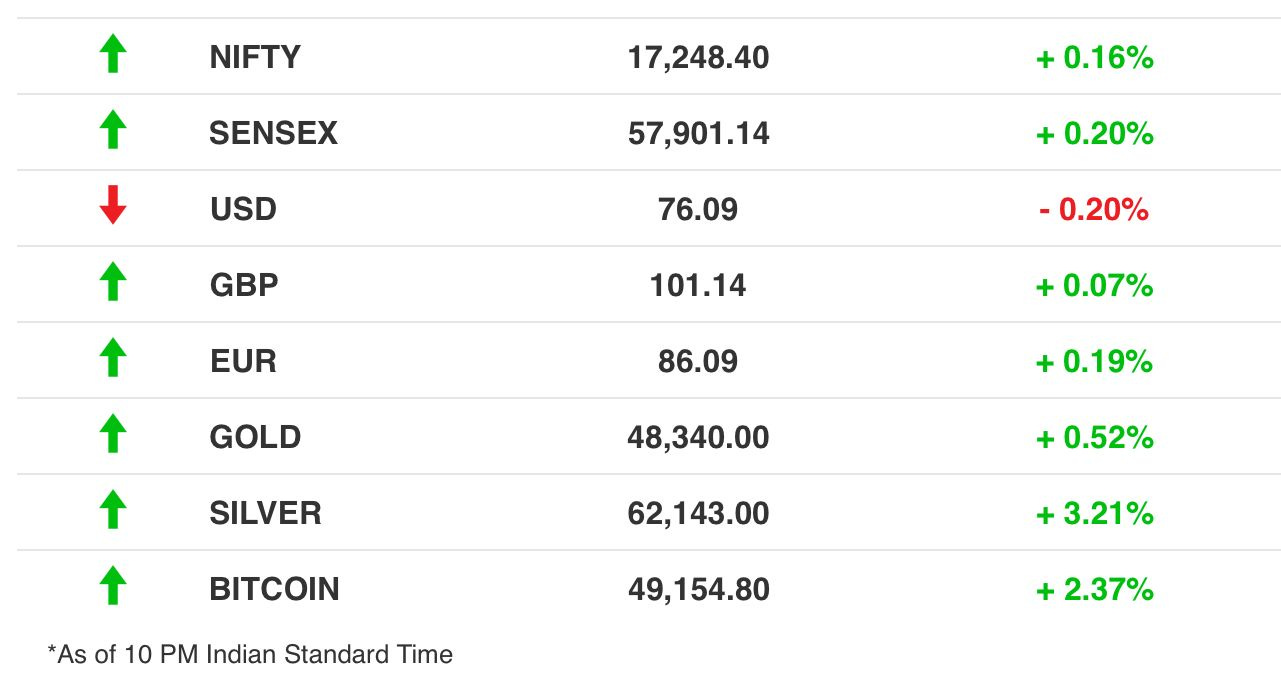

The Market SignalStocks: Indian indices followed cues from global markets and broke a four-day losing streak to close in the green. US markets gained after the Fed Reserve said it would likely raise rates three times next year. Reliance Industries, Infosys and Mahindra and Mahindra led the gains in Indian markets. The broaders markets underperformed, however, the small and mid-cap indices ending lower than their previous close. Omicron Blows Away Yuletide WarmthThe US is witnessing a Covid-19 surge ahead of Christmas. The virus is now raging through states in America’s Midwest and the Northeast. In numbers: It’s clocking ~120,000 cases a day on average. Total deaths have crossed 800,000. Only 61% of Americans are fully vaccinated. Spoiler? It’s looking ominous. Delays galore: Apple has delayed its previous RTO date (February 1) indefinitely and temporarily closed three of its stores. There won't be any Broadway shows, while college exams have shifted back online. Hospitals and companies such as General Electric have temporarily suspended vaccine mandates but masking rules have returned to New York and California. No lockdowns: Even as its handling of the pandemic comes under scrutiny, the Biden administration is putting its eggs in the testing and vaccination basket, with no lockdowns on the horizon. Joe’s got midterms on his mind. Across the pond: It’s not looking good in the UK. Football clubs and universities are struggling with outbreaks, while France is tightening travel restrictions from the UK. Unsurprisingly, Christmas might be a less social affair this year too. Wall Street Spots A Bargain In ChinaChina was a disaster zone for many investors a few months ago. Now it is looking like an end-of-season sale. Bubble burst: Stocks across the world surged during the pandemic but a government crackdown broke the back of equities and bonds in the world’s second largest economy. The result is that it now lags global peers by a wide margin. Wall Street’s marquee investors such as BlackRock, Goldman Sachs and UBS are turning bullish on Chinese stocks. Valuations are so low that JP Morgan is predicting the MSCI China index will climb 40% in 2022. Too juicy: After a year of wielding the regulatory hammer, China is expected to become accommodative next year, easing up on crackdowns and the central bank injecting liquidity. The real estate market crisis that began with Evergrande’s inability to service loans, remains a concern. A US ban on several companies, including drone maker DJI, would also limit investors’ options. So will continued disruptions due to Beijing’s Zero-Covid policy. Yet, Wall Street may look at it as too good an opportunity to pass up. Out Of The Maw Of BankruptcyThings may finally be looking up for the debt-ridden Vodafone Idea (Vi). India’s third-largest telecom company is planning to spend $2 billion (₹15,000 crore) on beefing up its network infrastructure and service. The management said at an investors call that promoters Aditya Birla Group and Vodafone UK could infuse equity by March 2022. Back From the Dead: The company was buried under ₹1.94 lakh crore debt and reported a loss of ₹7,132 crore in the September 2021 quarter. Vi also lost over 64 million customers in the past two years. After the government threw a lifeline to telecom companies with a four-year moratorium on airwaves, Vodafone has got a second wind. It’s been servicing its debt on time. It raised tariffs by up to 25%, bolstering revenues. Experts say next in line could be a raise in broadband tariffs.

Global Debt Mountain Tallest Since WW-IIThe year 2020 brought us the pandemic and with it a pile of debt. Global debt surged to a record $226 trillion last year. This figure should wrinkle your forehead because it is the biggest increase since World War II. While public debt soared, private debt looked reasonable. What went wrong? Well, Covid-19. As the pandemic struck, governments pulled out all stops to protect citizens, shutting down economies and confining people to their homes. Millions lost their jobs and thousands their lives to the virus. Governments had to support their citizens with free food, medical care and often with living expenses. They could do that only by borrowing. Heavily. Tense times: The federal and state governments in India too spent money on free rations for the poor, medical care for the sick, free vaccination, and support for essential services. As a result, India's debt to GDP ratio climbed too, prompting rating agency Fitch to maintain India's outlook at negative. Airbus Wins The Year-end RoundQantas Airways is switching sides. In a blow to Boeing, Australia’s flag carrier will replace its domestic fleet with 134 Airbus planes. This is a significant move for an airline that once had an entire fleet of Boeing 747s. SIA too: Singapore Airlines (SIA) will also switch its fleet of Boeing freighters with Airbus aircraft. Freighters are much in demand after the pandemic disrupted global supply chains. SIA is buying Airbus’ newly launched cargo version of its wide-bodied A350. Show stopper: Boeing has modified its 777X wide-bodied jet into a freighter, which attracted a lot of attention at the Dubai airshow last month. Yet, the European aircraft manufacturer gave its US rival a run for its money at the show. While Airbus landed over 400 orders for commercial aircraft, Boeing had to be content with a fourth of that. What Else Made The Signal?Golden weddings: So many people have gotten hitched (2.5 million wedding ceremonies) since November that Indian gold imports have hit a six-year high of 900 tonnes. All in for chips: The government has a plan to set up fab units in the country. And it’s putting money on the table. It remains to be seen if companies will bite. High stakes: Edtech startup Byju's is in talks with multiple blank-cheque companies for a US listing. If it doesn’t work out, it may go for an IPO in India. No cryptic view, this: IMF chief economist Gita Gopinath has said that it is better to regulate cryptocurrencies than banning them. Ups and leaves: Swiss bank UBS is shutting down its India office, moving its investment banking business offshore. Bagged: Atomberg has got $20 million from investors at Jungle Ventures. This puts the firm's valuation to $45 million. Hollow? The legal age of marriage for women in India has been pushed to 21 from 18. But activists are divided. FWIWRap Messiah: Not all heroes wear capes. They sing. Turns out US rapper Logic's 2017 song 1-800-273-8255 may have helped save a *lot* of lives. Suicide helplines were busier after the artist performed it at 2017 MTV Video Music Awards and the 2018 Grammy Awards. That’s a bragging right worth having. Glory Days: And just like that, Bruce Springsteen is rich by $500 million, even trumping his colleague Bob Dylan. The 20-time Grammy winner has reportedly given the rights to his song catalogue to Sony. This involves his recorded work and songwriting. All worth his 50-year career, we say. Milestone: Talk about domination. That Minecraft is popular is no secret. It's hit another landmark. A decade after launch, the video game has totalled one trillion views on YouTube. Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Elon can’t stop Musking

Thursday, December 16, 2021

Also in today's edition: RBI's tough love for shadow banks, Tatas wish they had Lakme, ITC open to splitting up, MAGA rock

Bitcoins are running out

Wednesday, December 15, 2021

Also in today's edition: India to age soon, Inflation shrinks products, Apple nears $3 trillion market cap, Meta wants to own everything Meta

Internet’s on the wire

Tuesday, December 14, 2021

Also in today's edition: Ocean's bounty, Online rainbow, Omicron spreads, No fun flying

Robots take over Korea

Monday, December 13, 2021

Also in today's edition: AI to moderate Meta's Metaverse, Hackers get a golden bug, Hold on to your Lego

Consequence of sound

Saturday, December 11, 2021

What Clubhouse tells us about the state of social audio moderation

You Might Also Like

1 minute to increase your email open rate

Wednesday, November 27, 2024

Every year we bring the highest quality software to RocketHub for an insane BFCM event. This year is no different! BFCM starts now so check the page below for one new lifetime deeaaal drop each day.

Memo: The Distressed Brand

Wednesday, November 27, 2024

The opposite of brand equity isn't no equity; it's brand apathy. View this email in your browser 2PM (No. 1014). The most recent letter was read by 46.1% of subscribers and this was the top

🔍 How Ridge Scaled to 9-Figures W/ Influencers

Wednesday, November 27, 2024

November 26, 2024 | Read Online All Case Studies 🔍 Learn About Sponsorships 2020 influencer marketing was pay-to-post. In 2024 that sh*t no longer works. In 2025 it's going to be about building a

A letter for you

Wednesday, November 27, 2024

Plus, an announcement you won't want to miss... View in browser ClickBank Logo Hi there, Wow. Time sure does fly. Can you believe there's already less than two months left in 2024!? It feels

🎟️The Quest is calling you

Tuesday, November 26, 2024

And why the HubSpot Blog ages in reverse ... View in browser hey-Jul-17-2024-03-58-50-7396-PM Don't write off a scavenger hunt as mere kids' play. A well-designed hunt can move attendees closer

New Pricing & Black Friday Deal

Tuesday, November 26, 2024

Some updates to my lead program for design agencies ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The BFCM Playbook To Millions In Sales

Tuesday, November 26, 2024

Come learn how to crush black friday cyber monday for brands

🦅 The once-in-a-lifetime deal is here

Tuesday, November 26, 2024

The new 𝕏 API costs forced our hand ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin Drops to $93K as Long-Term Holders Take Profits

Tuesday, November 26, 2024

Plus Saylor Buys $5.4B More Bitcoin Setting New Record at $97860

🕵️ 50%, then 35%, then 20%, then nothing

Tuesday, November 26, 2024

Steal Club BF offer is live :)