Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #271

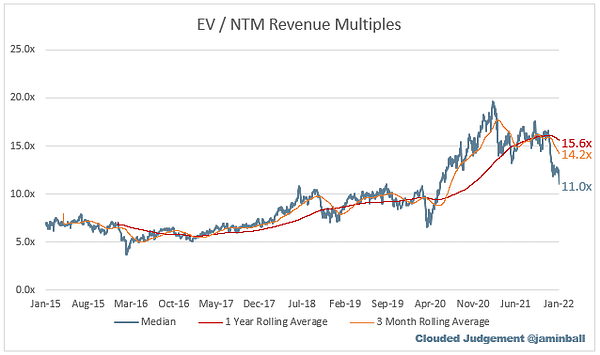

What a start to 2022!  From CNBC - Wisdom Cloud ETF down 27% since November! While it was a tough week marketwise, we’ve had a great run and this was to be expected given the rising inflation and prospect of interest rate hikes. As you can imagine, I am as bullish as ever and we are continuing to invest in new founders and projects as many of the best founders only start companies in the worst of times. That being said, I want to make sure that founders don’t hit the panic button. Against this backdrop, I had a couple of conversations this week with founders on the pluses and minuses of preemptive rounds. In particular, a few were considering taking preemptive rounds from suboptimal partners due to fears of a massive correction in valuation and funding interest. While we can’t predict the future and a bird in hand is often better than few in the bush, here’s how I’d summarize: For:

Against:

When making a decision here’s a simple framework I like to use: Instead of optimizing for all of the inbound VC interest, let’s work backwards and tell me what your dream scenario would be in terms of partner (individual first, firm second), round size, and dilution. If your preemptive choice checks all of the boxes, then the decision is easy. If not, then you have a lot more 🤔 to do. There is no hard and fast rule and for each founder I’m sure there is a different psychology and cost/benefit analysis. In my experience, the founder/investor/partner relationship matters the most and should trump all else. So while tempted to take great terms for an easy raise from a suboptimal partner, I’d think twice before doing so. Yes, this market is not great but remember this, VCs are never responsible for the success of a company, but they sure have been responsible for the demise of many a company. Choose your partner wisely and don’t panic. Keep building and stay the course. As always, 🙏🏼 for reading and please share with you friends and colleagues. Scaling Startups

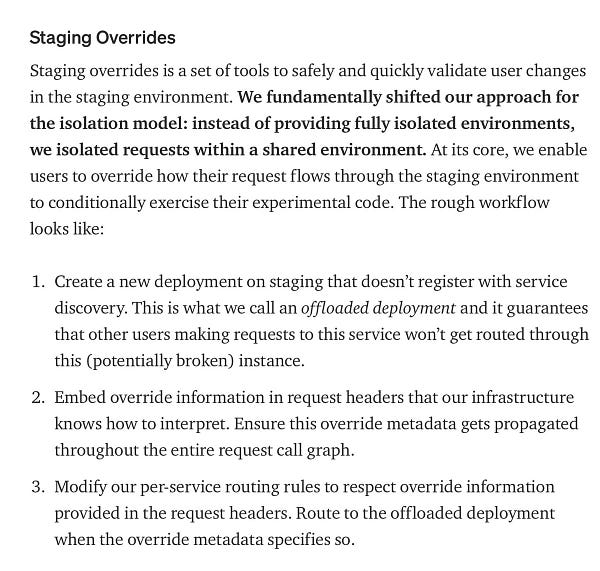

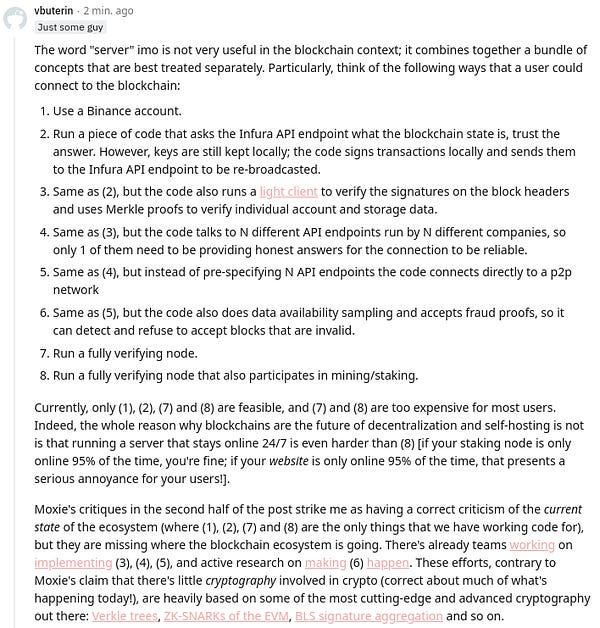

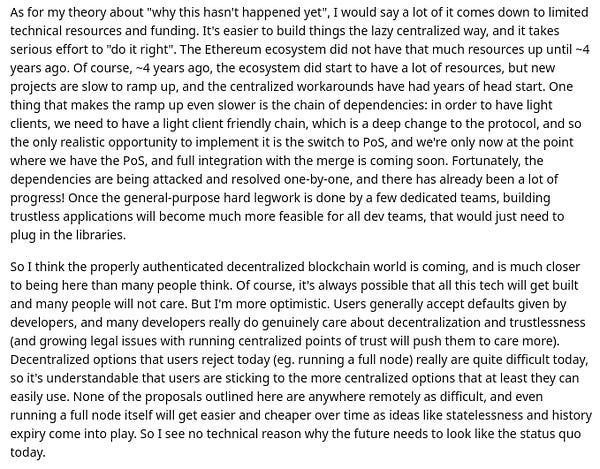

Enterprise Tech

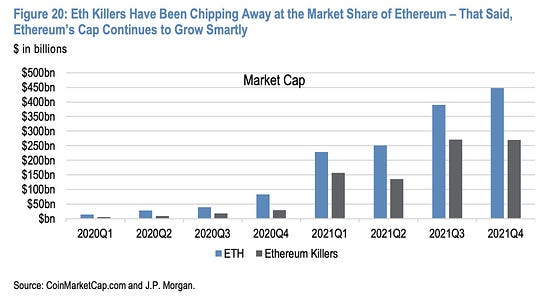

Markets

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Older messages

What's 🔥 in Enterprise IT/VC #270

Saturday, January 1, 2022

Happy New Year 🥳 - 7 themes from 2021 + 4 macro predictions for 2022

What's 🔥 in Enterprise IT/VC #269

Saturday, December 25, 2021

Happy Holidays 🎄! A time to reflect, recharge the 🔋, and think about talent

What's 🔥 in Enterprise IT/VC #268

Saturday, December 18, 2021

Open source infra on 🔥 with 🪳 + Sysdig rounds...on flip side, lessons learned on how too much 💰 too early can kill a company...

What's 🔥 in Enterprise IT/VC #267

Saturday, December 11, 2021

The Rise of a D2E (Developer2Enterprise) Juggernaut - MongoDB

What's 🔥 in Enterprise IT/VC #266

Saturday, December 4, 2021

How I stay sane in an insane world - hint, it's hard 😃

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏