Accelerated - 🚀 Is YC squeezing out seed funds?

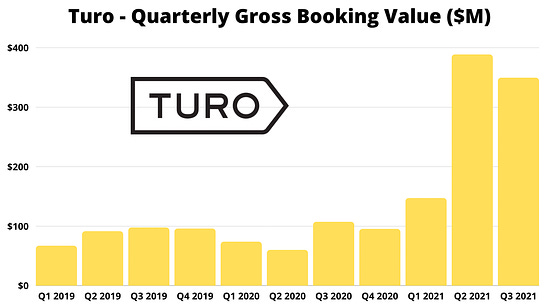

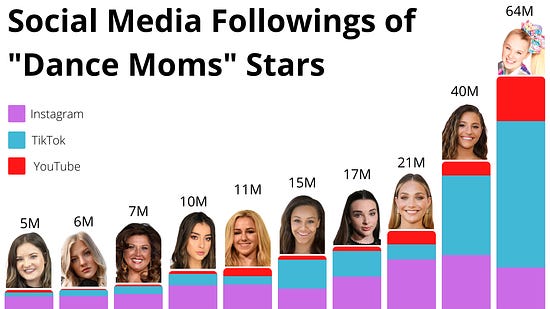

Turo, a P2P car sharing marketplace, publicly filed to IPO this week - and the S-1 gave us a first look at the company’s metrics. The headline? After a tough 2020 (6% revenue growth), Turo crushed it in 2021. The company saw a 3.6x YoY increase in bookings for the first nine months of the year - it should comfortably cross $1B in bookings with Q4 results. COVID has been a boon for Turo, especially as many consumers started traveling again last year but didn’t feel comfortable taking flights. Two-thirds of Americans have taken a road trip during COVID, with an average of 2.5 trips each! ICYMI - last Monday I published a comprehensive guide to navigating the VC recruiting process! I wanted to share it again this week because you’ll notice a bunch of new VC jobs + internships below - and I’m hoping this will be a helpful resource for those of you applying 😊 news 📣💰 YC makes a new deal. Accelerator Y Combinator made a major change to the investment terms for startups entering the program. Historically, YC invested $125k for 7% of the company. Now, YC is adding an additional $375k on an uncapped SAFE with an MFN (most favored nation) clause. Basically, this means that the $375k goes in at the lowest valuation of the next round. This allows YC companies to unlock more capital earlier on, but may hurt other seed investors seeking ownership. 🎮 Take-Two buys Zynga. This week marked the largest acquisition in video game history! Take-Two Interactive, which is known for PC and console games like Grand Theft Auto, is buying Zynga for $12.7B. Zynga makes mobile games like Words with Friends + games within social apps (e.g. FarmVille on Facebook). Mobile gaming has been the fastest-growing segment in the industry, and Zynga’s team will lead the effort to bring Take-Two’s games to mobile. 💻 Checkout startups soar. E-commerce has been on a tear during COVID, and so have the startups powering online shopping. This week saw two huge fundraises in this category: one-click checkout startup Bolt, and Checkout.com. Bolt raised $355M at a $11B valuation - the company makes checkout seamless for consumers while reducing fraud for businesses. Checkout.com raised $1B at a $40B valuation to power its “one stop shop” for processing payments worldwide. Bad news for Netflix fans - the company is yet again raising prices on plans in the U.S. & Canada. The standard plan will now be $15.50 per month, up from $11 in 2019. Side note: every time this happens, I wonder - are we all at fault for shamelessly mooching accounts from friends, family members, and S.O.s? I used to think of Netflix as a fairly price inelastic product: even if prices went up, the company wouldn’t lose many customers. Netflix was one of the only options in streaming, and had a much bigger content library than any of its competitors. Now that there are so many streaming services, and Netflix continues to lose shows from major networks, I wonder if it’s more vulnerable to churn… what i’m following 👀How to “think like a VC” when evaluating job offers at early stage startups. 20+ years after the Beanie Baby bubble crashed, a look at the people who are collecting and authenticating the toys. Nikita Bier’s 🔥 thread on lessons learned building consumer social apps. VCs have a new challenge in diligencing web3/crypto startups: pseudonymous founders. It’s the data analysis no one asked for! I crunched the numbers on social media followers (across Instagram, TikTok, and YouTube) for each main cast member of “Dance Moms” - and I was pretty surprised by the results. If you have no idea what I’m talking about, here's a primer: “Dance Moms” was a reality show about competition dancers (and their moms) that aired on Lifetime from 2011 - 2019. At its peak, the show had 2.5M viewers - but for most seasons, it was closer to ~500K. By all measures, “Dance Moms” was a niche show. But if you spend time on TikTok or Instagram, you’ll see the “Dance Moms” cast members everywhere. They’ve all built significant followings on social media - even those who left in the early seasons have 5M+ followers. A few are extremely influential among Gen Z: JoJo Siwa (who was on the last season of DWTS), Kenzie Ziegler, and Maddie Ziegler are household names among this demo. It seems unbelievable that a niche show could birth so many stars, especially given that most of them have become much more popular after “Dance Moms” ended. JoJo Siwa was on the show for two seasons - how many of her 64M followers found her from it? But I think this will become an increasingly common phenomenon: the next generation of stars will kickstart their careers in niche forms of traditional media - whether that’s a minor reality show or a popular family vlog on YouTube. But they’ll truly break out and stay relevant by building a much bigger audience on social media. I’m fascinated to see what media properties become “career accelerators” for Gen Alpha. What should I be watching today to find the next generation’s stars? Comment below to let me know ⬇️ jobs 🎓Cowboy Ventures - Team Members (Various) Leland - Strategy & Ops*, Community Manager (Bay Area, Utah, Remote) Roblox - Corp Dev Analyst (Remote) Contrary Capital - Chief of Staff, Investment Team (Remote) Flexport - Senior Associate, Flexport Ventures* (SF) Retool - Biz Ops (SF) Snowflake - Corp Dev & Ventures Associate* (San Mateo) P33 - Associate (Chicago) Tend - Associate Digital PM (Nashville) Rhapsody Venture Partners - Associate (Boston) Amex Ventures - Investment Analyst (NYC) Techstars - Investment Analyst, Associate (NYC) *Requires 3+ years of experience. internships 📝Lerer Hippeau - Investment & Platform Interns (Remote) Curated - MBA Business & Strategy Intern (Remote) OnDeck - Startups Intern (Remote) Costanoa Ventures - Summer Fellows (SF) Slack - Product Design Intern (SF) Plaid - New Business Intern (SF) Hivemind Capital - Investment Intern (NYC) Uber - MBA Strategic Ops Intern, Uber Health (NYC) Snap - SMB Business Ops Intern (NYC) Drift - Marketing Intern (Boston) puppy of the week 🐶It’s a first for Accelerated! 2022 is all about the metaverse, so we’re sharing a virtual puppy: Bruiser. Bruiser, who is named after Legally Blonde’s Bruiser Woods, lives in Roblox’s Paris World. He belongs to Meagan Loyst, an investor at Lerer Hippeau - you may remember her “Metaverse 101” post from last week’s newsletter! Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Announcing Accelerated's VC recruiting guide!

Sunday, January 9, 2022

Plus, a look at Twitter's newest feature 👀

🚀 Can you ~manifest~ fame?

Sunday, January 2, 2022

A deep dive on Emily Uribe, the biggest celebrity you've likely never heard of.

🚀 Special Edition: My Favorite Content from 2021

Monday, December 27, 2021

Three books, newsletters, Twitter accounts, and TikToks I loved this year!

🚀 E-comm roll-ups: 2021's hottest trend?

Sunday, December 19, 2021

Welcome to the second week of holiday posts! As a reminder - given there's less news this time of year, I'm covering trends from 2021 and things I hope to see next year. Last week, I shared

🚀 My biggest misses of 2021

Sunday, December 12, 2021

It's my "anti-portfolio" of predictions - 5 things I got wrong this year!

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏