LeXpunK Army Deploys | Decentralized Law #3

Dear Crypto-Legal Observers, Those familiar with the blockchain industry know that crypto regulations are incredibly complex. These regulations involve different areas of the law, ranging from civil liability and intellectual property to corporate structures and securities laws. But when inspiration strikes, regulatory frameworks often fade into the background. Some people jump right in, armed only with their idea, eventually achieving success and generating significant profits. Questions often arise once a project is on solid footing: is all of this lawful? How can I convert cryptocurrency to fiat? Am I in compliance with the tax authorities? At this point, many projects contact a crypto-lawyer and discover that a considered legal approach would have ensured a smoother deployment. Other creators do consider seeking legal advice before the launch of their project, but find that such advice can be incredibly expensive. Crypto projects are often run by international groups and therefore require global, multi-jurisdictional strategies, which can make costs prohibitive. Even well-funded crypto projects are often unaware that it is possible to obtain legal guidance at the outset. This situation creates severe obstacles for the growth of our industry and may well be preventing some truly innovative ideas from coming to fruition. The LeXpunK movement, funded by a consortium of leading DeFi protocols, tackles these issues by preparing open-source legal materials and guidelines for use by entrepreneurs and developers when launching blockchain-based businesses. LeXpunK also provides a place for builders and lawyers to cohere as a community, to advocate for clear and equitable rules, and to assess legal risks. The importance of such community-driven initiatives is highlighted in Decentralized Law’s interview with SydLauren. SydLauren is the the L3X Ops Commander within LeXpunK, where she serves as the main coordination layer for the LeXpunK Army. In her interview, she provides a compelling vision for what collaborative legal efforts can achieve for the crypto-legal space. Also in this issue of Decentralized Law, we review international regulations relating to crypto derivatives, discuss the legal implications of owning assets in the metaverse, analyze the current state of cryptocurrencies in Latin America, and summarize news and articles from across the cryptoverse. Although this newsletter may help to familiarize readers with the legal implications arising out of blockchain technology, the contents of Decentralized Law are not legal advice. This newsletter is intended only as general information. Writers’ opinions are their own; therefore, nothing in this newsletter constitutes or should be considered legal advice. Contact a legal expert in your jurisdiction for legal advice. Contributors: BanklessDAO Legal Guild (eaglelex, lion917, hirokennelly.eth, COYSrUS.eth, Trewkat, MDLawyer, DDD123, Terumask, Cheetah) This is the official legal newsletter of BanklessDAO. You are subscribed to this newsletter because you were a Premium Member of the Bankless Newsletter as of May 1, 2021. To unsubscribe, edit your settings. 🎙 InterviewSydLauren Deploys the LeXpunK Army to Fight for Builders

As a Brooklyn Law 1L, I joined a student incubator for coding and innovation, an offshoot of the NY Legal Hackers Organization. I was quickly immersed in legal tech and saw a potential for a career in creative lawyering. I wasn’t shy in finding my niche—networking is in my nature—but I had to carve it out for myself. It’s very encouraging to see law schools offering courses at the nexus of the crypto-economy and the law, but my tenure in law school was just a bit too early to enjoy the benefits of the current environment where there are actual opportunities to call yourself a #cryptolawstudent. In 2018, during the height of the ICO-boom, I attended a fireside chat with former SEC Chairman Jay Clayton (funny enough, I met him on the train at Times Square after the event heading back to Brooklyn and pitched him my law Note). At the time, he claimed that cryptosystems needed to adapt to current securities regimes as opposed to the securities markets adapting to the emerging tech. It was a seminal moment for me—it was obvious that work needed to be done; more participation and education was needed between regulators and industry leaders. It was then that I decided that finding a way to help address the intersection of cryptosystems and law as part of my career was imperative. For the rest of law school, I spent as much of my time as possible outside of the classroom attending crypto-related events, studying, and writing on crypto and blockchain applications. I helped form the official Brooklyn Law chapter of Legal Hackers—which was also Legal Hackers’ first official student chapter—and interned at Coinbase’s Legal Department and the Legal Working Group of the Wall Street Blockchain Association. These opportunities have resulted in some truly incredible relationships and the ability to forge amazing connections in cryptolaw quite early in my career.

LeXpunK was developed to bring builders, lawyers, advocates, and users together under the shared ethos that regulatory and policy initiatives that affect DeFi should value openness, transparency, and decentralization; more specifically, we are a builder and community-first group that works in the interest of spontaneous crypto-native communities. As part of that mission, a major focus in our first six months has been finding decentralized funding models that can encourage lawyers and developers to come together, build in public, open-source the work product, and still get paid for this effort. “Open-source-lawyering” is a concept very foreign to most lawyers—and, aside from our recent efforts, there is no funding for it. Through our bounty program—generously funded by the Yearn, Curve, and Lido communities—we have been able to encourage lawyers and developers to work together in new ways while still getting paid for their time. We use Coordinape to help score each others’ contributions and we encourage participants to work on Github so that anyone can use and improve the resulting work product.

My title is L3X Ops Commander, a full-time position that I started in October 2021. I moderate our channels and Working Groups, recruit Army members, ideate new work products, and keep current work moving and “on mission.” My role requires me to be very “member-facing”—so, although I spend a good amount of time working on our deliverables myself, I also stay active on Telegram all day working with the Army.

That is a really great question. It is our responsibility to stay plugged into the builder ecosystem and anticipate the need for legal thought/reasoning. At LeXpunK, we focus on delivering legal work product—such as contract templates, standard policies and disclaimers, and model governance charters—that will be useful in practice to the communities we interface with. Legal guilds and organizations typically produce content meant to be read and used by other lawyers. ****IANAL****sentiments set in quickly for non-JDs and the thought-leadership remains siloed in the legal field. Bridging the language gap between devs, lawyers, advocates, and users—stewarding our mission—through our work products and conversations, is not an easy feat. Change is not accomplished alone. We have a fantastic group in the Army who frequently ping me with new ideas and directions, which makes my job a lot easier, however, once we start building—we are focusing on the harder questions. When calls for our various Working Groups go for more than an hour, and I remind our members that all the work that we are doing is funded work, it’s truly inspiring to hear that some of our contributors are not “in it” for the funds, they’re motivated by our mission and how they’re expanding their own knowledge base from the work we’re producing.

We are closely integrated in the builder-ecosystem; as noted before, Curve, Lido, and Yearn supported and funded our initial slate of proposals. Representatives from their communities remain active in our channels and are instrumental in our decisions for rapid-response initiatives. The LeXpunK Army includes some of the most technically proficient practitioners in the space, many who contribute to other grass-roots, crypto-advocacy/cryptolaw driven groups, which allows for collaboration from all ends of the ecosystem. Many well-known, but traditional, crypto advocacy groups publish guidance papers, reports, and commentary, calling for regulatory clarity or share policy recommendations. We feel we are uniquely positioned by embracing autonomous lawyering: law is a public good and should be available in an open-source environment. We are developing new legal standards and protocols for DeFi developers to utilize in building projects. In some ways, we’re building a new lexicon that incorporates technical functioning of a cryptosystem to best fit existing regulatory regimes. We are building composable governance pieces to form industry standards. To my knowledge, we’re the only group that functions with an autonomous lawyering ethos.

Right now, we have five active working groups, noting many have BanklessDAO member contributors! Since launching our funded proposals in October, we’re focusing on DAO Structure & Risk Mitigation (specifically in our DAO Defense WG, DAO Model Foundation Structure WG, and DAO Coop WG), Policy/Legal Position Papers (MiCA Commission’s Proposal) and Model Legislation/Regulation (SEC Disclosure Proposal). Our DAO Structure and Risk Mitigation groups are drafting model forms, whether it be a model Joint Defense Agreement through which DAO contributors can set the stage to share legal counsel even though they do not work for a single company, innovating co-op legal engineering for DAO members, or drafting Caymans and offshore model agreements, and providing supplemental explanatory guides and resources for organic use. Our MiCA WG is comprised of top crypto lawyers from the EU who are drafting a guidance paper to clarify MiCA’s problem areas. They are looking into the distinction between investment tokens, payment tokens, and utility tokens by providing guidance on terms "issuer," "issuance" and potential for hybrid use tokens. They are also analyzing "asset-referenced payment tokens" and understanding whether non-custodial DeFi protocols would undergo the rules on crypto-asset service providers. Our SEC Disclosure Proposal is crafting an offering exemption coupled with a disclosure framework to provide a basis for issuers seeking to make token distributions in a compliant way. We’re also drafting Safe Harbor X which will serve as a carve out to this proposal (our draft is currently out and we are seeking feedback!) Suffice to say, autonomous lawyering takes time. We’re looking forward to rolling out these deliverables by the end of Q1. Expect Us!

In the near term, following the roll out of our active Working Group deliverables, we are positioning ourselves to focus on more public goods efforts for DAOs and DeFi communities. We also have interest in funding proposals with an English/Common Law thesis, along with IP dedicated groups, and “legal tools.” As we grow, we will be building out our partnerships with other similarly situated, grass-roots organizations. LeXpunK is just over six months old, with over 200 members in the Army, spanning the globe. As I noted myself in 2018, and as many knew prior, as the crypto-economy continues to soar and builders develop ground-breaking projects, there will always be room for open-source, collaborative efforts. At LeXpunK, we will continue to secure the relationship between builders and lawyers so that we can ensure a viable and legitimized ecosystem. 🏛 RegulationISDA and Crypto are the Next Financial Unlock

Author: COYSrUS.eth The International Swaps and Derivatives Association (ISDA) recently published a paper on the development of contractual standards for crypto-based over-the-counter (OTC) derivatives. A derivative is a financial product, the value of which is linked to an underlying asset (such as an option to purchase BTC on a certain date at an agreed price). Exchange-traded derivatives, such as BTC futures and options, are standardized "off the shelf" products that can't be varied or tailored. OTC derivatives, on the other hand, allow parties flexibility to tailor a transaction to their particular objectives. For example, if you are paid in BTC but have obligations in ETH, you could hedge your pricing risk by entering into a derivative (a swap) that would pay out on the settlement date if BTC had declined sufficiently relative to the price ETH (on the other hand, if the price of BTC had increased relative to ETH, you could end up having to pay your counterparty). You could also enter into a swap for speculative purposes—if you think the flippening is definitely happening in 2022, a BTC/ETH swap would be one way to profit on that view if it turned out to be correct. Having access to OTC crypto derivatives, particularly when combined with automated smart contracts that can do the calculations, will provide traders and investors with a much broader range of investment strategies. Streamlining with ISDA TemplatesStandard contractual documentation from ISDA will be key to driving the availability and development of OTC crypto derivatives. ISDA creates templates that parties can use for the terms that will apply on their obligations to each other and how they may change over time, how and when payments and deliveries must be made to each other, and other terms such as close-outs and netting, contract termination, and disputes. The parties are free to vary the standard terms, but starting from a template streamlines their negotiations and reduces the risk of protracted disputes. Instead of having their lawyers wordsmith every bit of boilerplate, the parties instead can focus on the key economic terms of their transaction. Automating for EfficiencyISDA laid the foundation for crypto derivatives in 2019 with the publication of guidelines for using smart contracts in derivatives. The focus, however, was on derivatives on traditional underlying assets such as foreign exchange and not on cryptoassets. Derivatives are heavily dependent on conditional logic and formulas that are well-suited to automation. For example, if one party fails to deliver or pay as required, the other party may have the right to terminate or close out the contract. The contracts have detailed provisions for exactly which events have consequences and how and when the parties must pay or deliver to the other as a result of an event. Oracles can be established in advance in a distributed ledger to provide external data (such as the bankruptcy of one of the parties) to enable the smart contract to determine whether a particular event has occurred so that the contract code can perform as agreed. Automating the performance of derivatives may reduce costs and the risk of human error in derivatives and is a critical step towards the development of crypto OTC derivatives; however, the guidelines also recognized that some complex legal provisions may be difficult to automate. As the industry and technology develop further, the reliability of transaction data and protocols on valuations should continue to mature and promote more automation. Standardizing ISDA for CryptoISDA is now planning to bring together industry participants to establish standardized contractual terms for derivatives that reference a cryptoasset as an underlier. The standard terms will have to take into account the multiple technology and market-driven events that could disrupt a crypto derivative, such as hard forks, airdrops, cyberattacks, regulatory changes, and availability of reliable pricing data, as well as the valuation of assets needed for determining payments, close-outs, and collateralization. Since there is generally no single venue for trading of a specific cryptoasset, pricing can be less reliable and subject to manipulation. Other issues to consider are the impact of price volatility, transaction fees, interaction with ISDA templates and master agreements, and using cryptoassets as collateral. ISDA plans to focus on native cryptoassets such as BTC and ETH in 2022 and consider other assets and asset-referenced assets (such as stablecoins like DAI) in 2023 and beyond. Disruptive PotentialThe development of standardized terms for crypto-based derivatives, when combined with automation of performance through smart contracts, has the potential to fundamentally disrupt financial markets. However, the uncertain regulatory environment, particularly in the U.S., remains a stumbling block, and has led to centralized exchanges such as FTX, Binance, and DYDX refusing to offer derivatives to U.S.-based customers. As interest in these products continues to grow and the infrastructure continues to mature, it seems inevitable that both decentralized globally available protocols and regulated centralized platforms will find innovative ways to meet investor demand. ⚖ DevelopmentsVirtual Real Estate is Not Quite Real Yet

Author: MDLawyer House hunting can be a nightmare. Searching through countless properties, choosing the right fit, signing the promissory note and purchase and sale agreement, getting funding ready and, finally, signing the deed: the entire process can take months. Real estate agents can be helpful throughout the journey and, in compensation, they get a percentage of the consideration paid for the asset. Though the process is often time-consuming, you are the proud owner of a tangible asset once the paperwork is complete. The house hunting process is now predictable for many for physical properties, but such is not the case with virtual real estate. Virtual real estate is made up of digital plots of land and buildings in the metaverse where you can build virtually anything (no pun intended). But there are common misconceptions around ownership of virtual real estate assets, “ownership” of which is denoted by non-fungible tokens (NFTs). Unlike physical property, it’s still unclear what rights an NFT holder actually possesses. What’s a Web3 house hunter to do without the aid of an agent for virtual real estate? Web3 Ownership in a Web2 WorldIn the Web2 era of Second Life and Everquest, the nature of virtual property ownership was straightforward and uncontested. The relationship between software vendors and players was governed by end-user license agreements which granted users the right to use the software, but intellectual or industrial property rights were retained by the virtual world operators. Users who “owned” and developed properties in these early virtual environments were under no illusions as to where the boundaries of ownership actually lay—once the computer was switched off there was no consideration until the next login. If the vendor pulled the plug, the relationship would be over. At the time, NFTs were a technology no one could have predicted. The provenance and ownership information afforded by blockchains brings new possibilities to the concept of virtual land investment. However, the law has not caught up. Most would argue that NFTs can represent someone’s ownership of a virtual asset. I could own an NFT of a virtual museum in a metaverse where I display my collection of digital art NFTs and be confident enough to know that the museum and art are my property, that I can therefore use, exclude others from, or transfer such digital assets, right? Not quite. The legal concept of ownership in a virtual world has a very different meaning compared to a physical asset. While the latter provides rights over both tangible property and intellectual property, which may be separately or jointly owned, with digital assets one can only possess intellectual property insofar as the applicable law deems it to be protectable by intellectual property rights. Moreover, these rights originally belong to the creator, and they may only belong to others if assigned. The NFT Bundle of RightsThe conclusion may be reached is that virtual ownership has in fact not changed with Web3. Most NFTs are intended to merely evidence the identity of the creator of the digital asset (serving as a digital certificate of authenticity) while some may also grant the holder a license to use and enjoy the asset, similar to what the end-user license agreements did. By applying these concepts to virtual real estate, it may be argued that the owner of a virtual plot of land does not actually have any property right associated with that asset. Instead, the NFT holder acquires a certificate (written on-chain) that the plot of land belongs to a certain metaverse platform, and that he/she is granted the right to use and enjoy that plot of land as he/she pleases. It is, in fact, a right to use the intellectual property of a third party. In practice, this means that although I may be the sole holder of the NFT representing a clearly identifiable plot of digital land, I may not be permitted to sell, publish, reproduce, commercialize or allow others to use any of the software associated with such a virtual asset. In this case, the software is the land and I am still the end-user. Our Legal Sandbox Needs Fresh SandIn 2021 alone, metaverse platform The Sandbox grew its user base five-fold, reaching 500,000 wallets, while also having over 30,000 monthly active users. Half of these users spend more than one hour per day in this metaverse. Users are building, creating businesses, and transacting and interacting with each other. In addition, brands are entering Web3—providing professional services and opening virtual stores. With such an influx of users and innovation, the law will have to catch up to the concept of property ownership in the virtual world. It is undeniable that disputes will arise in the metaverse and that legal practitioners will have their hands full sorting through these emerging trends, as unfamiliar disputes will arise seeking resolution from ill-fitting laws. It is unlikely that debates regarding NFT ownership will be front and center, at least concerning those NFTs which reside on decentralized blockchains. However, with our outdated laws, we can expect uncertainty and therefore disputes over intellectual property created in the metaverse will take center stage, which may affect NFT values. New Laws for a New EpochAs with traditional real estate, we would certainly welcome analogous services to acquire virtual real estate. PwC Hong Kong has already acquired a plot of land in The Sandbox to advise their clients who wish to enter the metaverse, and it would not be a surprise if many followed. While users and investors are tempted by the scarcity of virtual real estate, businesses are leveraging the fact that virtual house hunting can be a nightmare for newcomers too. A buyer beware approach may not suit this ecosystem, and the lack of a clear regulatory framework and laws concerning ownership of virtual assets will certainly hamper the efforts of so many to legitimize the metaverse. It’s incumbent upon lawmakers and regulators to provide guidance so that the metaverse can reach universal adoption. Decolonizing Latin America with Cryptocurrency

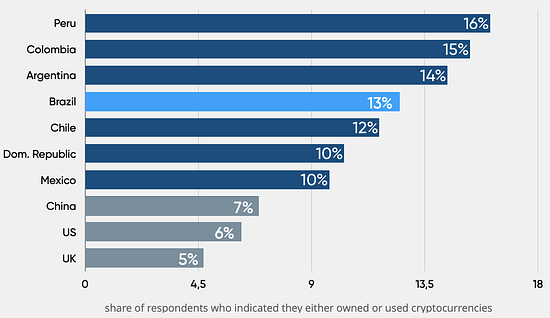

Author: lion917 The first cryptocurrency transaction took place in the United States back in 2010, when someone in Florida negotiated to pay for two pizzas with 10,000 BTC. Cryptocurrency has come so far since those humble beginnings, and thankfully adoption has not been exclusive to the U.S. Latin America and the Asia Pacific countries have led the regional crypto adoption race, posing a challenge to American hegemony over cryptoassets. For example, in 2021, 15% of Columbians indicated that they own or have transacted in cryptoassets, compared to 6% of Americans.

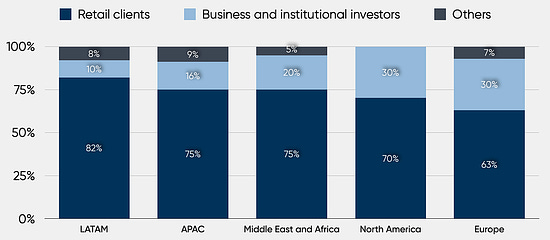

From Colonization to Crypto DominationMost of Latin America was colonized by the Portuguese, British, French, and Spanish until the 19th Century, when it was largely exploited for its labor and natural resources. During the 20th century, the U.S. government used its interventionist agenda to control the region by creating shadow states bound to fail. Today, due to prolonged historical marginalization by the west, Latin American nations lag behind the U.S. and Europe in terms of economic development. However, for the first time in recent history, Latin America has surpassed the western powers in terms of innovation by being far ahead in terms of adopting decentralized finance. Political instability, lack of foreign direct investment, import penetration, and the prolonged pandemic have caused major devaluation of Latin American currencies. For example, the inflation rate in Argentina has been close to 50% during the last three years. Interestingly, Argentina also has the third highest cryptocurrency adoption rate. As countries like Venezuela and Argentina saw their national currencies crumble, the citizens of these nations turned to cryptocurrency as a source of economic security. This observation can lead to the conclusion that a nation’s cryptocurrency adoption rate is inversely proportional to the strength of its national currency. Twitter’s ex-CEO, Jack Dorsey, recently created a controversy by expressing that the U.S. Web3 ecosystem is a venture capitalist enrichment scheme. The involvement of institutional investors defeats the decentralized nature of cryptocurrencies, as retail investors are unable to own the ecosystem built for everyone. According to Figure 1.2, Latin America is the leading region in terms of retail market participants in crypto, and only 10% of the market is owned by institutional investors. The high ratio of cryptocurrency adoption by retail investors as compared to institutional investors is a strong indicator that the spread of crypto adoption is more equitable.

Crypto Popularity Spurs InnovationThe widespread adoption of crypto and the goal of accelerated growth have forced Latin American countries to undertake regulatory innovation. In September 2021, El Salvador became the first nation-state to recognize BTC as legal tender. While this development was embraced by crypto enthusiasts, the International Monetary Fund (IMF) strongly opposed the decision, citing concerns about anonymity and the volatility associated with bitcoin. The El Salvador authorities developed a special “Chivo Wallet” to facilitate crypto transactions, and even gave 30 USD worth of BTC to its citizens as a one-time bonus to accelerate adoption. In November 2021, El Salvador’s President Nayib Bukele stated that the government is planning to build the world’s first “Bitcoin City,” which will be a tax-free region to attract foreign investors. However, a Value Added Tax will be collected to pay for the municipal costs. Such developments will be facilitated through 20 draft laws, such as those authorizing Bitcoin Bonds, which are expected to be worth more than one billion USD and will fund the building of Bitcoin City. Politicians in Argentina, Paraguay, Brazil, and Panama have supported El Salvador’s decision. In December 2021, Paraguay’s Senate approved a bill to regulate the cryptoasset industry. In order to leverage its surplus electricity production, Paraguay introduced a licensing regime for crypto mining activities. The bill will become law after a discussion by Paraguay’s higher law-making body, the Chamber of Deputies, in 2022. In June 2021, a lawmaker from Panama, Gabriel Silva, stated that he is looking forward to drafting a law to facilitate transactions in cryptocurrency. Similarly, Mexico is home to one of the world’s largest cryptocurrency exchanges, Bitso, and one of its largest banks, Banco Azteca, has hinted that they are open to exploring the possibility of facilitating transactions in cryptocurrency. It is important to note that Latin America’s journey with cryptoassets has not been smooth. 91% of El Salvador’s citizens still desire payments in USD, and arguably Chivo Wallet only saw mass adoption because of the signup bonus. In December 2021, 50 complaints were identified by the El Comisionado authority about missing cryptocurrency from various Chivo Wallets. It has also been alleged that politicians support cryptoassets because they facilitate corruption. Besides such allegations, the country’s president continues to make factually unverified predictions. Bolivia is the first Latin American nation to ban cryptoassets and Ecuador is also moving towards strict regulations.  Inclusion by CryptoCryptocurrencies are an excellent alternative for currencies experiencing devaluation. Latin America’s experimentation, adoption, and innovation with cryptocurrencies is indicative of the fact that decentralized finance is meeting the needs of its target audience. Being an instrument of financial inclusion, cryptocurrency is serving the digitally literate (but unbanked/underbanked) population of Latin America. As the research indicates, national governments in Latin America should overcome their insecurities about economic sovereignty and regulate cryptoassets to facilitate innovation and incentivize inclusivity. 🙏 Sponsor: UMA - Making financial markets universally accessible. DAO Better. 🌐 News and Selected Articles

CoinDesk Joins Court Case Seeking Access to NYAG Tether DocumentsAuthors: Nikhilesh De and Lawrence Lewitinn 🔑 Insights:

Explained: India's First Crypto Index and What it Means for Investors in IndiaAuthors: Sunainaa Chadha 🔑 Insights:

ESMA Launches Call for Evidence on Distributed Ledger TechnologyAuthor: European Securities and Markets Authority 🔑 Insights:

Africa: the Way Ahead for the Crypto ParadigmAuthor: Kodzilla 🔑 Insights:

Emmer Introduces Legislation to Prevent Unilateral Fed Control of a U.S. Digital CurrencyAuthor: Office of Congressman Tom Emmer 🔑 Insights:

🧱 DAO Legal ToolsGro DAO Takes Genesis On-Chain

Author: eaglelex An important milestone for every project aiming to have an impact in the crypto industry is the token genesis event. The token is important because it enables execution of the community’s on-chain voting decisions. The level of decentralization of a DAO can be seen in its use, or not, of on-chain governance mechanisms. On-chain voting is a fully decentralized solution but it means that voting members are responsible for gas costs whenever they choose to vote. Off-chain voting on a platform like Snapshot removes the gas hurdle, but it means some centralization must be tolerated because Gnosis Safe signers are acting as a proxy for the DAO community. Most projects distribute their governance token before starting automatic on-chain vote execution. Gro DAO decided on a different approach for their token launch in late 2021. According to Gro, issuing the governance token prior to the implementation of on-chain execution is problematic because critical initial actions, such as implementing a liquidity bootstrapping pool (LBP), can only be approved via off-chain votes. The core team is then responsible for translation of these approvals into on-chain outcomes, which is a somewhat centralized approach. The tricky question therefore is how to implement on-chain governance if no governance token has been issued. Gro solved the issue with a kind of “phantom” token, called xGRO, distributed purely for the purpose of voting on-chain for the first important decisions concerning the DAO. The team distributed xGRO tokens to the Gro DAO in amounts equal to the existing allocations of GRO, including an airdrop for providing liquidity in the protocol, and allocations to key community members and early investors. GRO used the SafeSnap module, which connects Gnosis Safe to Snapshot. SafeSnap enables the outcomes of gas-free offline voting (on Snapshot) to be automatically executed in accordance with those votes. Through the described tooling, the community completed three fundamental votes, which when passed automatically executed the actions approved by the community:

The designed voting process, performed with xGRO and the SafeSnap module, allowed all tokenholders and participants to have certainty, while also making sure that the DAO as a whole retained authority and power. Once the xGRO token had served its purpose, it was rendered useless—unable to be transferred by holders and no longer valid for any governance purpose. ☢️ Action Items📚 Read: The BANK Token - A Legal Assessment👩⚖️ Join the BanklessDAO Legal Guild 🏴⚔ Join LexDAO🐵 Join the LeXpunK Army🚨 Contact your Representatives or Senators🙏 Thanks to our sponsorUMAUMA can help DAOs achieve their goals by incentivizing their community. UMA’s KPI options align incentives and build loyalty through airdropping options tokens, which pay out a variable amount of the protocol’s token depending on the KPI metric being tracked, giving the community a powerful motivator and focussing their efforts to collaboratively achieve the protocol's aims. If the metric is not fully achieved, the residual amount is returned to the DAO treasury. The BanklessDAO Legal Guild has used KPI options to crowdsource international legal opinion on the regulatory space that surrounds DeFi. If you liked this post from BanklessDAO, why not share it? |

Older messages

Decentralized Arts #22: Boson Protocol, Metaverse Apparel & Artist Showcase

Tuesday, January 18, 2022

BanklessDAO Weekly NFT and Cryptoart Newsletter

BanklessDAO Weekly Rollup #37: What the Hell Are Governance Solutions Engineers?

Saturday, January 15, 2022

Catch Up with What Happened This Week in BanklessDAO

State of the DAOs #7: Social Tokens and the Future of Work

Thursday, January 13, 2022

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

Decentralized Arts #21: BanklessDAO Artist Showcase & Super Bowl Rumors

Monday, January 10, 2022

BanklessDAO Weekly Cryptoart and NFT Newsletter

BanklessDAO Weekly Rollup #36: Season 2 Recap, Coordinape & a DAOpunk is born

Saturday, January 8, 2022

Catch up with what happened this week in the BanklessDAO.

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏