Block Breakdown - How to buy discounted ETH

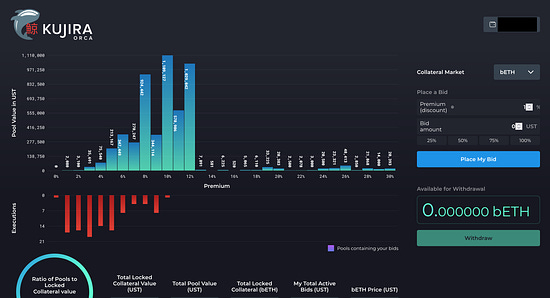

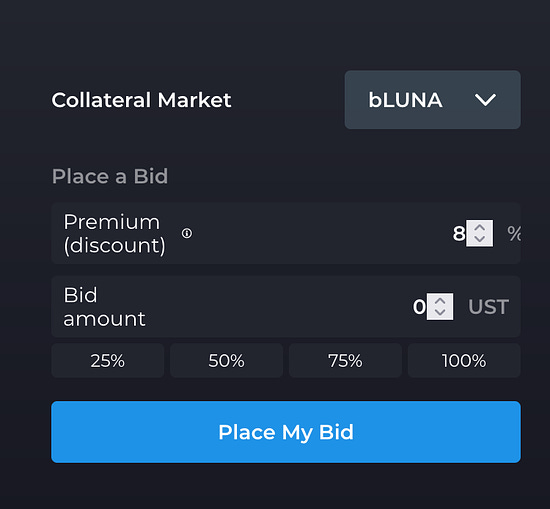

Hi friends 👋 Wouldn’t it be great if you could buy ETH at a discount to the market price? Well you can, if you know where to look. But before we get there, we need to first talk about lending and borrowing. If you have some ETH for example, you might want to borrow against it. You can then either spend the money you borrow, or reinvest it. However, if you do this, you need to make sure that your loan-to-value (i.e the amount you have borrowed compared to the value of your assets) doesn’t fall below a certain level. This is to protect the people that have lent you money, to make sure they always get their money back. If the price of the asset you using as collateral falls sufficiently, your ETH will be sold to pay back the people that lent you money - this is called being liquidated. So now we have a basic overview of how borrowing and lending works, how can we get discounted ETH? Enter Kujira. Kujira, which means ‘whale’ in Japanese, has a mission statement I love: Everyone deserves to be a whale. Their goal is to build apps that help level the playing field for regular users. Their first app Orca, lets anyone participate in liquidation auctions. Kujira is connected to the Anchor protocol, which we have previously talked about as a great way to earn ~20% on your stablecoins. In addition to earning yield on your UST, you can also borrow against Luna and Eth. When the price of Luna/Eth falls and users are liquidated, the liquidated assets are set to Kujira where anyone can bid on them. This is what the Kujira platform looks like. It looks a little intimidating, so let’s break down how it works. Along the X axis, you can see the percentage discount, and the blue bars represent the amount of bids at that level. Each level is called a ‘pool’ and the smaller pools get emptied before going to the next pool. So you can see there is a very small number of bids at the 1 and 2 percent discount level, and the number of bids steadily increases as the discount increases. If a large number of people get liquidated due to volatility in the price, then the lower discount pools will quickly be used up, and the liquidations continue into the bigger discount pools. The red bars indicate how many times that pool has been emptied. So you can see the 10% pool has only been emptied once.....so far. All you have to do to take part is decide how much of a discount you would like, and place your bid. You do this by clicking the blue bar at the discount you want, and you see the discount amount updated. Obviously the higher discount you are asking for, the less likely your bid is to get filled. When you place your bids you will have to pay a couple of small fees (around 1 UST), once to place the bid and another to ‘activate’ it, for reasons that are not clear to me! Then you will see all your live bids at the bottom of the page, and you can withdraw at any time. There is an opportunity cost here, because whilst your bid is active your UST is locked up and is not earning yield, as it could be if it was just deposited in Anchor. If you manage to snap up some cheap ETH or Luna on Kujira, let me know in the comments. Happy hunting whales! 🐳 Jamie P.S. New year, new name. At the start of this year I rebranded this newsletter from Block Breakdown → Block Explorer. What do you think of the change? Better? Worse? Don’t care? 🚨 Disclaimer: This is not investment advice. Everything in this newsletter is for entertainment and education purposes only. Do your own research. You should assume that I have invested in any and all the projects mentioned. In the unlikely event I receive a financial reward for linking to a project, that will be clearly highlighted. If you liked this post from Block Explorer, why not share it? |

Older messages

Where Does Yield Come From?

Monday, December 20, 2021

Hi friends 👋 Unless you have been living under a rock, it has been hard to miss the news - inflation is back. First in the US, inflation hit the highest level in 30 years, and now the UK has followed

What is OlympusDAO?

Thursday, December 9, 2021

The future of money, or a ponzi scheme?

The safest stablecoin yield?

Monday, November 15, 2021

Hi friends 👋 Stablecoins - coins that attempt to maintain a peg 1:1 to the dollar - have been growing exponentially this year and are approaching $100bn in total supply. It is a strange reality that an

Why you should try Arbitrum and Optimism

Monday, October 18, 2021

Hi friends 👋 You have probably noticed that doing stuff on Ethereum can be very expensive at the moment... And this is pricing out many people that don't understand why they should spend $$$ just

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏