🚀 The Great Convergence: why is every social app starting to look the same?

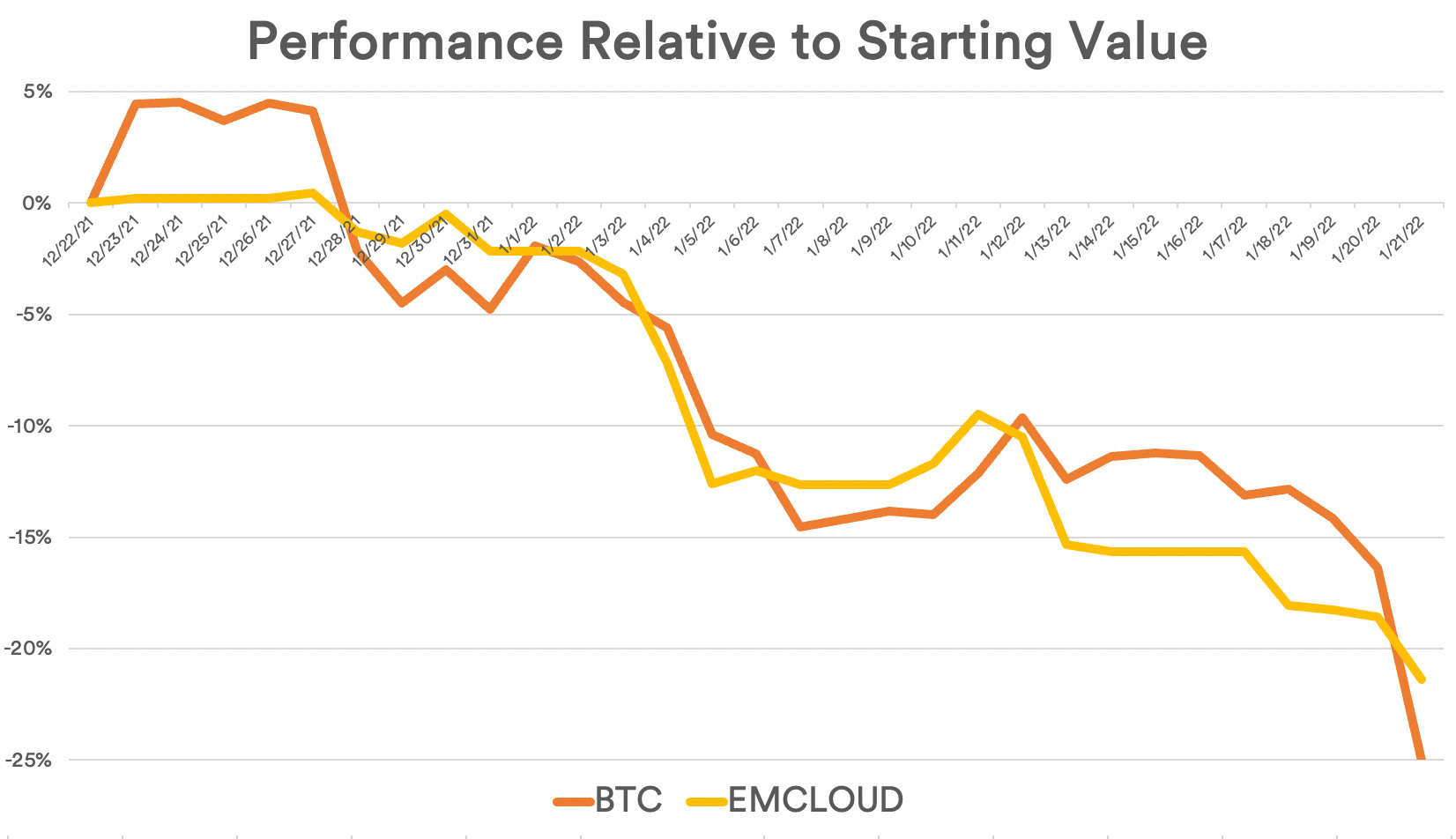

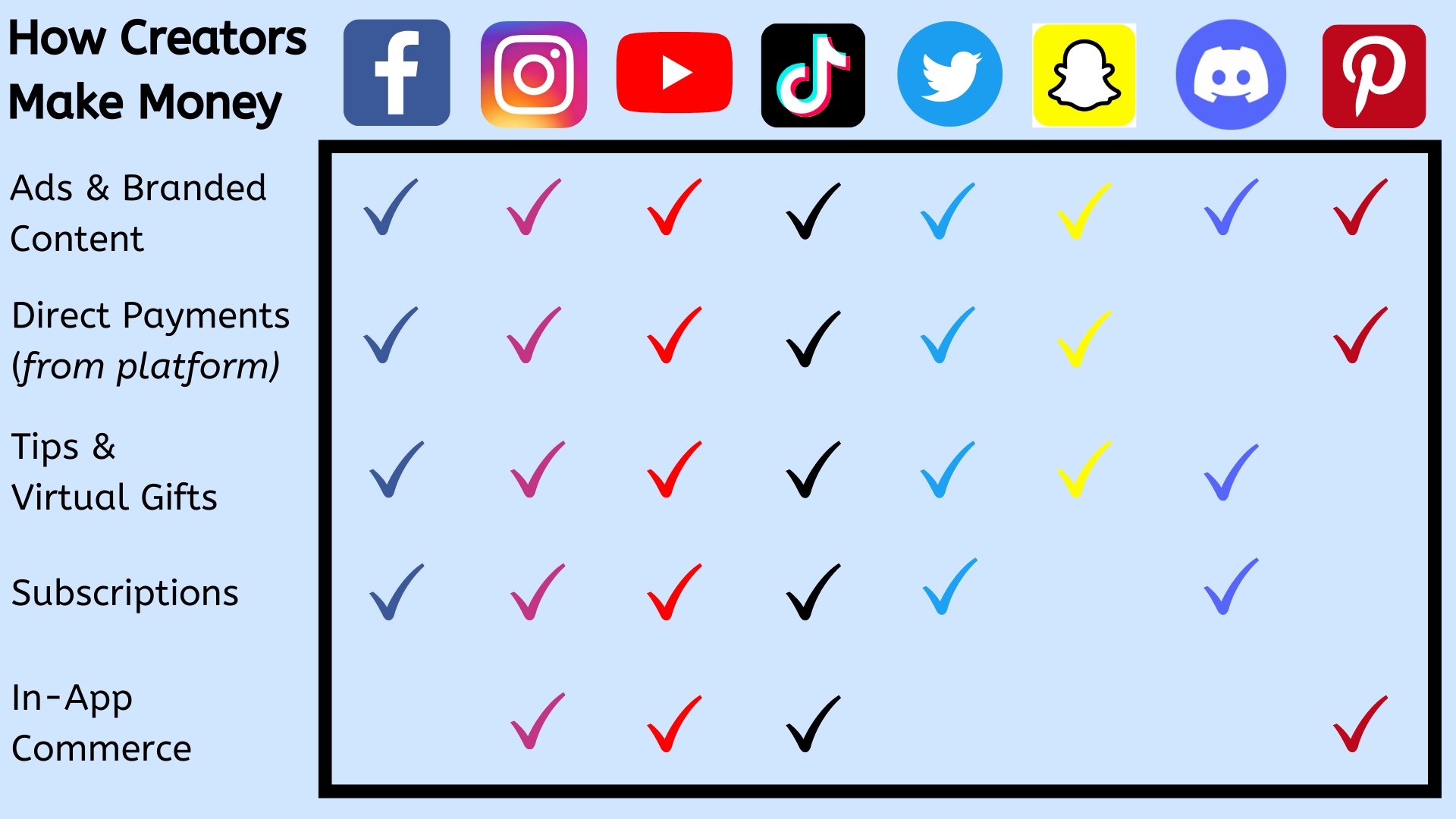

🚀 The Great Convergence: why is every social app starting to look the same?Plus, it's officially market correction season!It was a tough week for investors in pretty much every publicly traded asset…and unfortunately, it’s started to look like a trend 😬 I’m not sure anyone would have guessed that Bitcoin and SaaS stocks (represented here by the NASDAQ BVP Emerging Cloud Index) would be so closely correlated. But both seem to be suffering from a broader market correction, after a few years when it seemed like prices could only go up. What’s causing this? The economy has gotten a bit overheated in the last year, thanks to a prolonged period of zero interest rates and massive government stimulus. Inflation hit a 39-year-high (of 7%) this month - even Chipotle burritos are feeling it. The Fed is now expected to try to cool things down by raising interest rates. As always, it will be a tricky balance between spurring a slight price correction and causing a longer-lasting recession. We’ll see how this plays out! news 📣🎮 Microsoft acquires Activision. In the largest all-cash acquisition in history, Microsoft is buying gaming studio Activision Blizzard for $69 billion. The deal will make Microsoft the third largest global gaming company - Activision has 400M monthly active users across games including Call of Duty and World of Warcraft. Activision’s stock has recently struggled due to internal sexual misconduct allegations, leading some analysts to suggest Microsoft snapped up a deal. 💻 YouTube moves away from Originals. Six years after getting into the content production game, YouTube will stop making original shows and movies. Originals were part of YouTube’s $12/month Premium subscription, but the company has been selling off these shows since 2018 - including Cobra Kai to Netflix! Chief Business Officer Robert Kyncl said YouTube will invest more in TikTok competitor Shorts instead. 🚲 Peloton battles rumors. Peloton stock fell 25% on Thursday after CNBC reported the company was pausing production of its connected fitness devices. A leaked presentation suggested that Peloton has seen a “significant reduction” in consumer demand and needed to control costs. Peloton’s CEO stated that the company is not stopping production, but noted that he’s looking for areas to improve profitability. 🔥 Twitter goes deeper into NFTS. Curious about the hexagons popping up all over Twitter? The company launched NFT profile pictures, but only for premium Blue users (a $2.99/month subscription). Many crypto enthusiasts were already using a picture version of an NFT as their Twitter avatar. This new feature makes it official with a crypto wallet sync. Twitter launched a crypto team in November, and is hiring a senior product leader - there’s likely more to come here! In other crypto news, NFT platform Autograph raised a $170M Series B led by a16z and KPCB. The company partners with brands and celebrities to provide crypto collectibles and experiences for fans. Autograph is co-founded by vocal crypto supporter Tom Brady, who is also on the board of exchange FTX. The company’s drops have included NFTs from Simone Biles, Tony Hawk, Wayne Gretzky, Usain Bolt, and more. what i’m following 👀Amazon is preparing to open its first brick-and-mortar clothing store. A look at the rise of “Dan from HR” - TikTok’s favorite career coach. Mario Gabriele dove into the wild history of Telegram, the encrypted messaging app that survived a rocky ICO but is still struggling to find a business model. A battle is raging over whether it’s appropriate to “cancel” West Elm Caleb for his dating app crimes - this Buzzfeed article (and the the comments) summarizes it. This week brought a big announcement in the creator monetization space: TikTok and Instagram are both testing paid subscriptions. Followers will be able to pay a recurring subscription to access exclusive content from their favorite creators. Instagram is rolling out the feature with 10 U.S. creators (list here), while TikTok has launched a “limited test.” This announcement is part of a broader trend of social apps finally taking creator monetization seriously. Creators used to be on their own when it came to making money - they had to find and negotiate their own brand deals or link out to other platforms (e.g. Patreon, OnlyFans) to monetize their audiences. In the past 18 months, there’s been a drastic shift. All of the major social apps have added features that enable creators to make money in-app: direct payments from creator funds, tips/virtual gifts, and in-app commerce are the most common. However, it’s still not clear what’s driving this flurry of features. Is there a “pull” of consumer demand? Or are social apps just duplicating the same features out of fear of getting left behind? (Remember when everyone launched audio rooms?) I haven’t seen public data yet on how many users are taking advantage of these new features, or how much money creators are making. If you have, I’d love to see it - feel free to send it along! Thanks to Dhruv Patel for sharing his take on this - my conversation with him inspired this! I’m also going to be publishing a longer-form piece on this topic later this week, check out my Twitter to see when it drops. jobs 🎓Correlation Ventures - Investment Associate (Remote) IBM Ventures - Analyst / Associate (Remote) Wireframe Ventures - Content & Community Manager (SF, Remote) Truepill - Associate Product Manager (SF, Remote) Night Ventures - Associate (Austin, Remote) Allstate Strategic Ventures - Associate* (Chicago, Remote) Steel Perlot - Investment Research Analyst (NYC, Remote) Worklife Ventures - Chief of Staff (SF, LA) Revolution Ventures - Associate (SF, DC) Mayfield Fund - Analyst (Bay Area) Step - Finance and Strategy* (Palo Alto) *Requires 3+ years of experience. internships 📝Ohi - Product Intern (Remote) Quizlet - PM Intern (Remote) Coinbase - User Research Intern (Remote) Contra - Community Intern (Remote) Lark - Strategy Research Intern (Remote) Susa Ventures - Summer Fellows (Remote) Pinterest - Sales Intern (SF) Snap - Marketing Insights Intern (LA) Current - Influencer Marketing Intern (NYC) Create - MBA Venture Studio Intern (NYC) puppy of the week 🐶Meet Pepe, a three-year-old Parson Jack Russell Terrier who lives in Germany. He enjoys going for walks in the snow, taking naps, and modeling bandanas (he’s a fashionable guy). Follow him on Instagram @pepe.the.parson! Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Is YC squeezing out seed funds?

Sunday, January 16, 2022

Plus, the TV show that scouted Gen Z's biggest stars!

🚀 Announcing Accelerated's VC recruiting guide!

Sunday, January 9, 2022

Plus, a look at Twitter's newest feature 👀

🚀 Can you ~manifest~ fame?

Sunday, January 2, 2022

A deep dive on Emily Uribe, the biggest celebrity you've likely never heard of.

🚀 Special Edition: My Favorite Content from 2021

Monday, December 27, 2021

Three books, newsletters, Twitter accounts, and TikToks I loved this year!

🚀 E-comm roll-ups: 2021's hottest trend?

Sunday, December 19, 2021

Welcome to the second week of holiday posts! As a reminder - given there's less news this time of year, I'm covering trends from 2021 and things I hope to see next year. Last week, I shared

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏