Accelerated - 🚀 Has Facebook saturated the world?

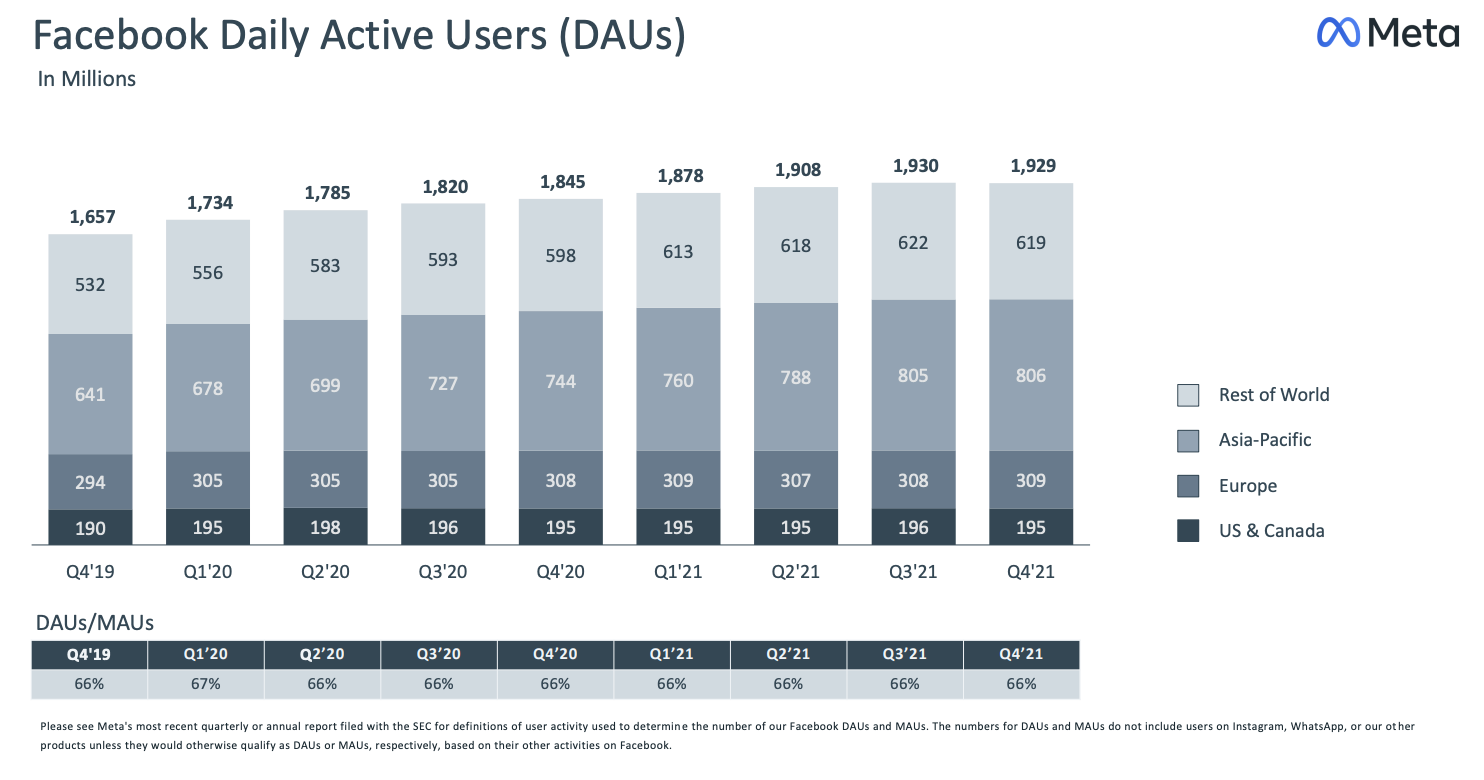

The other shoe has dropped for Facebook - for the first time ever, the company reported a QoQ decline in daily active users. DAU growth has been basically non-existent in North America and Europe in the past several quarters, but Asia-Pacific and Rest of World were still climbing. Now, all growth has ground to a halt. This graph only includes DAUs for the core Facebook app, not IG or WhatsApp. However, DAUs for the Meta “Family” were also nearly flat, indicating that Meta may be the first consumer social company to saturate the global market. Is it all downhill from here? Not necessarily. There’s a few ways Meta could re-accelerate user growth:

news 📣🚘 Cruise opens public rides. Eager to ride in a self-driving car? Cruise, which just raised another $1.35B from SoftBank, is now opening test rides to the public in SF. The company doesn’t yet have the permit needed to charge for the rides, so they’re all free - but the service is limited to 11pm-5am in specific neighborhoods. According to co-founder Kyle Vogt, someone fell asleep in a car on the first day of testing! 📈 Snap makes a profit. This week was an emotional rollercoaster for Snap. The company’s stock saw not only its second worst trading day ever, but also its best day in history - on consecutive days. Why? Social stocks were hammered after Meta reported weak ad revenue due to iOS privacy changes. Then Snap reported its own earnings, surprising investors with its first quarterly profit and strong Q1 guidance. 🚴 Amazon earnings impress. Amazon also reported earnings this week, and casually notched the biggest single-day gain in U.S. stock market history. While the company slightly missed expectations for revenue, it meaningfully beat on EPS and recorded a huge gain on Rivian’s IPO (Amazon owns ~18%). In other news, Amazon is reportedly in the mix to acquire Peloton 👀 💰 Alphabet plans stock split. Alphabet (Google’s parent company) crushed Q4 expectations for both revenue and earnings, with particularly strong growth in cloud services. The company also announced a 20-for-1 stock split - this lowers the price for a single share, making it more affordable for retail investors. It shouldn’t impact Alphabet’s fundamental valuation, but split announcements often lead to a short-term jump in share price (more here).  Wordle was acquired by The New York Times! The word game, built by software engineer Josh Wardle as a gift for his girlfriend, exploded in popularity last month. It now has millions of daily players, many of whom post their results on Twitter. The acquisition price was in the “low seven figures” - and in a rare moment of solidarity, it seems like most of the Internet is celebrating Wardle’s success. what i’m following 👀The TikTok trend every celebrity is doing (Jennifer Garner’s might be my favorite!). Launch House raised a Series A and dropped a 🔥 announcement video. A history of the wordcel vs. shape rotator meme that’s taking over Twitter. Web3, NFTs, and the securitization of the Internet. The debate around Joe Rogan intensified this week, with more artists and podcasters removing their content to protest Spotify hosting Rogan’s podcast. Even Prince Harry and Meghan Markle, who signed a multi-year partnership with Spotify, have now publicly expressed “concerns” about Rogan spreading COVID-related misinformation. ICYMI: this started last week when Neil Young demanded that his music be removed from Spotify if the platform continued to host Rogan’s podcast. Rogan is now facing criticism around both COVID-related claims and past use of racial slurs. This “deplatforming” issue isn’t new - companies that host user-generated content constantly get complaints that a given creator shouldn’t be allowed to post. Trump, who was deplatformed by most social apps following the Capitol riot, may be the highest-profile example. However, this issue plays out on a smaller scale almost every day (think Trisha Paytas, Logan Paul, and Alex Jones). In most cases, platforms respond by attempting to make an objective decision about whether the content violates pre-existing company guidelines. Unsurprisingly, this can quickly get very subjective! It may not be immediately obvious if something qualifies as “hate speech” or “misinformation” - these are judgment calls that are often influenced by someone’s perspective or political views. The Joe Rogan case is even more complex. Spotify doesn’t just host Rogan’s content, but paid $100M to be the exclusive distributor of his show. To some, this suggests that Spotify is implicitly backing Rogan and his views. To others, it’s simply a smart business decision to build a differentiated catalog - it doesn’t make Spotify responsible for Rogan’s content or give the company license to police it. For now, Spotify is holding firm. CEO Daniel Ek publicly released the company’s platform rules, and told employees that Spotify already removed certain episodes of Rogan’s podcast (and others!) that violated said rules. However, he noted that it’s not Spotify’s job to censor content or creators that employees personally disagree with. This can be a slippery slope, as Spotify saw when it enacted and later retracted an artist conduct policy that removed R. Kelly from its playlists. I’m very curious to hear what the Accelerated audience thinks about this - please vote below by clicking on the option you prefer (it’s anonymous!). What should Spotify do with Joe Rogan’s podcast?

As a side note - if this is a topic you’re interested in, Coinbase CEO Brian Armstrong published his company’s guidelines around account removal and content moderation this week. I really liked his framework, and would recommend checking it out! jobs 🎓Zeus Living - Associate Product Manager (Remote) Attentive - GTM Ops & Strategy Analyst (Remote) a16z - Health Investing Associate, Games Deal Partner* (Menlo Park) Emergence Capital - Investment Associate (Bay Area) Radical Ventures - Investor (Bay Area) Cornershop - Strategy & Expansion Analyst (SF) Coast - Biz Ops Associate (NYC) ERA - Program Associate (NYC) Inspired Capital - Investment Associate* (NYC) First Round - Chief of Staff (Philly, NYC) Nauta Capital - Investment Professional (London) *Requires 3+ years of experience. internships 📝Shopmonkey - PM Intern (Remote, San Jose) thredUP - Chief of Staff Intern (Remote, Oakland) Thirty Madison - MBA Interns - Expansion, Sleep (Remote, NYC) Kapor Capital - Summer Fellows (Oakland) JLL Technologies - Summer MBA VC Associate (SF) Gusto - MBA PM Intern (SF) Verily - PM Intern (South SF) Robinhood - Product, Content Marketing, and Social Interns (Menlo Park) M13 - MBA Propulsion (Platform), Venture Associate Interns (LA) Smartrr - Creative Ops Intern (NYC, Remote) Nauta Capital - Investment Analyst Intern (London) puppy of the week 🐶Meet Indy, a 1.5-year-old Bernese Mountain Dog who lives in the Netherlands. He enjoys eating, playing in the mud, and overall just being a happy guy. Follow him on Instagram @berneseindy! Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Are you Super Pumped?

Sunday, January 30, 2022

Plus, a new podcast recaps the week's Twitter drama 👀

🚀 The Great Convergence: why is every social app starting to look the same?

Sunday, January 23, 2022

Plus, it's officially market correction season!

🚀 Is YC squeezing out seed funds?

Sunday, January 16, 2022

Plus, the TV show that scouted Gen Z's biggest stars!

🚀 Announcing Accelerated's VC recruiting guide!

Sunday, January 9, 2022

Plus, a look at Twitter's newest feature 👀

🚀 Can you ~manifest~ fame?

Sunday, January 2, 2022

A deep dive on Emily Uribe, the biggest celebrity you've likely never heard of.

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏