Earnings+More - MGM: ‘We're just getting rolling’

MGM: ‘We're just getting rolling’MGM Resorts International Q4, Betsson Q4, bet-at-home 2022 forecast, earnings in brief, Jefferies’ sports-betting customer survey +MoreGood morning. Heading up today’s roster:

Gimme some lovin’. Sign up here. MGM Resorts Q4

Current trading: While December in Las Vegas was “great”, CEO Bill Hornbuckle warned that January had seen “significant headwinds” due to a lack of group/convention business. CES, for instance, was 70% down on visitation. But weekends remain strong. Instant takes: Jefferies noted MGM had “multiple upside drivers”. The Wells Fargo team said they had a “high degree of confidence in LV fundamentals remaining solid” with the key debate being margin sustainability. Macquarie said potential growth areas included the potential casino license in New York, developments in Japan, BetMGM and the new rewards program. I’m not your stepping stone: Jonathan Halkyard, CFO, said it would be an “understatement” to say the BetMGM team was busy. The remodeling of the loyalty program to MGM rewards was in part about making more of the omni-channel potential (see Hornbuckle below). Corey Sanders, COO, said the current sign-up process for MetMGM customers was “a little clunky”. “There's a 2-step process that we want to see go away,” he added.

Wanna play football for the coach: Noting that Las Vegas hosted the NHL All-Star game and the Pro Bowl last weekend, will have the NFL Draft event in April and, of course, the Super Bowl in 2024, Hornbuckle said “we’ve become America’s most popular sports destination”.

What Hornbuckle said: On whether the record margin improvement can be sustained:

On the benefits of omnichannel:

On the potential for the heavy promo environment in sports-betting to infect land-based:

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. Its industry-leading Superfeed is used by the biggest betting brands in the world including bet365, Flutter and Entain. The content engine powers on-site engagement by delivering impartial expert betting insight for 20 sports in 70 languages. For more information visit: spotlightsportsgroup.com Betsson Q4

We’ll let you know when we get there: Punter-friendly sporting results and ongoing regulatory impacts from Germany and the Netherlands led to a 56.7% drop in Western European revenues to SEK200.1m. The ever-cheerful CEO Pontus Lindwall said the group was “on track to file” its Dutch license application but didn’t provide a timeframe for market entry. “We’ll see when we get the license,” Lindwall added. Keeping the lights on: The Western European downturn had been offset by growth in Latin America and the CEECA region. With regard to the latter, Lindwall said B2B revenues from Turkey remained strong through the quarter despite the Turkish Lira losing 40% of its value vs. SEK. The currency fluctuations “were not helpful”, but Betson’s B2B partner was “keeping momentum high and running healthy operations from impressive volumes,” he said. B2B mining: Betsson is set to launch its Colorado sportsbook by end of Q1 and will then prospect for B2B partners in the U.S. using its B2C offering as a showcase. The launch, however, will be lowkey.

Unsafe harbor: Betsson’s Betsafe brand has been active in Ontario for some time, but Lindwall said it would not be present when the province’s regulated market launch goes live in early April. The Betsson boss didn’t expand on the reasons and said the group “will hand in our application soon and we'll see when we can get our operations going in (Ontario’s) licensed environment”. Bet-at-home 2022 forecastI fought the law: Struggling against various regulatory and legal headwinds, Austrian-listed Bet-at-home said revenues in 2022 would come in at between €50m-€60m while EBITDA would be between a loss-making -€2m up to €2m in profit.

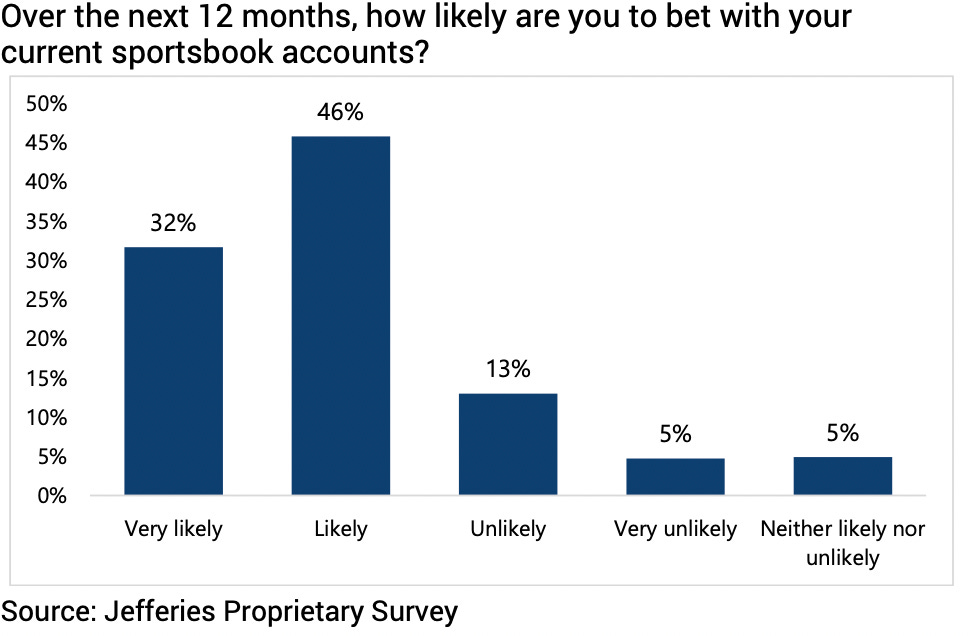

The company has yet to report its Q421 numbers after having to shut down its Austrian-facing business in the face of an adverse legal judgment. Profit warning: In mid-September, it issued a profit warning saying EBITDA losses for the year would be between €10m-€14m. After losing its legal case against compensating customers while operating without an Austrian license, it faced a one-off expense of €24.6m. Earnings in briefMonarch Casino recorded a 90.3% YoY rise in net revenue to $111m in Q4, Adj. EBITDA was up 180.7% to $39m. FY net revenue was up 114.4% to $395.3m and adj. EBITDA was up 218% to $137.2m. CEO John Farahi said the renovations at the Black Hawk Casino, Colorado, were now complete and the group had opened a new sportsbook lounge and additional restaurant capacity during the quarter while trading at the Atlantis, Nevada, continued to be “robust”. Esports Technologies confirmed FY22 guidance of $70m and announced Q122 revenues of c$7.1m and gross profits of c.$2.5m with “substantially all” the revenues generated in Dec21. 2022 forecasts included 10 months of contribution from Aspire Global’s B2C brands acquired in October. The company said it was continuing to work on its esports odds-modeling technology and a patent-pending browser extension to allow live wagering within streaming environments. Mohegan Sun Q122 showed revenues rising 74.2% to $401.9m while adj, EBITDA was up 141% to $97.4m. The flagship property in Connecticut saw a 20% EBITDA rise on Q419 while the overall profit picture was improved by both the performance of the Mohegan Las vegas and the digital operation. The company noted the sports-betting partnership with FanDuel in Connecticut generated $150m in handle and $9,.2m in revenue. Online casino generated $16m in revenue. Mohegan Sun will soft launch the FanDuel co-branded retail sportsbook today (Feb 10th) in Connecticut. Jefferies sports-betting customer surveySticky fingers: Ahead of the Super Bowl, the Jefferies team said the evidence from a commissioned player survey of a ‘stickiness’ around preferred apps might go towards justifying the recent heavy promo spend.

Other key numbers:

NewslinesMask no more: Gov. Steve Sisolak is expected to lift Nevada’s mask mandate amid a nationwide decrease in Covid cases according to the Nevada Independent. A virtual press conference is to be held later today, Thursday, where an announcement is expected. Integrity mission: The International Betting Integrity Association announced the launch of its integrity and monitoring service in the U.S. and Canada with endorsements coming from FanDuel and DraftKings. The IBIA also has secured licenses in Arizona, Colorado, Indiana, Michigan, New Jersey, New York, and Wyoming. Further states are pending. Lounge rider: Fubo Sportsbook will open a mobile betting lounge at the Rocket Mortgage FieldHouse, the home stadium of the Cleveland Cavaliers, as part of the Fubo-Cavaliers partnership that was announced in October. The lounge will not offer retail betting, the Cavs can partner with another bookmaker for a retail offering. Regulated sports betting is set to launch in Ohio by the end of year. A land down under: Endemic esports operator Rivalry has been awarded a sports-betting operator license by the Northern Territory Racing Commission. What we’re readingThe internet turned money into a hobby. On socialCatnip  Dealer  Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Feb 9: Kindred loosens ties with Kambi

Wednesday, February 9, 2022

Kindred, Evolution Q4, Gambling.com trading update, Super Bowl betting forecasts, Wells Fargo sector update +More

Feb 8: Entain strikes an Avid deal

Tuesday, February 8, 2022

Entain buys Avid, Aristocrat debt rating, Everi ecash acquisition, Maryland Jan22 +More

Feb 6: Boyd could be bolder, say analysts

Monday, February 7, 2022

Boyd analyst review, New York & Illinois data, PointsBet's good week, Madison Square Gardens Sports earnings call, startup focus - Low6 +More

Feb 4: Weekend Edition no.32

Friday, February 4, 2022

Penn National analyst reaction, Boyd Gaming Q4, sector watch - streaming, TMX webinar +More

Feb 3: Penn reports ‘in shadow of sideshow’

Thursday, February 3, 2022

Penn National Gaming Q4, Red Rock Resorts Q4, Playtech takeover saga, boom in sports betting TMX webinar, Macau update +More

You Might Also Like

The best books about AI&ML, 2024 edition

Saturday, December 21, 2024

For Your Holiday Reading

How to control your audience

Saturday, December 21, 2024

And turn them into raving fan-customers

$166K MRR - simple employee scheduling tool..

Saturday, December 21, 2024

+ What do you think?

Your SaaS New Year’s Resolutions for 2025

Saturday, December 21, 2024

Here are Your Top 10 New Year's SaaS Resolutions To view this email as a web page, click here saastr daily newsletter Your SaaS New Year's Resolutions for 2025 By Jason Lemkin Thursday,

Presence Over Pressure: Leading with Confidence in Chaos

Saturday, December 21, 2024

We spoke with Jon Giesbrecht, the Director of Mental Performance and Player Development for the Vancouver Bandits, about how mindfulness and emotional regulation elevate performance in basketball,

Our full 2025 outlooks

Saturday, December 21, 2024

Also: Understanding the ins and outs of benchmarking; Where top-performing VCs place their early-stage bets; Read our latest emerging tech reports... Read online | Don't want to receive these

Piggybacking tweak to earn a ROI

Saturday, December 21, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

RIP Seedscout

Friday, December 20, 2024

Some Quick Hits From The Week

🔍 Boost ROI with Micro-Influencers

Friday, December 20, 2024

December 20, 2024 Hey, it's Alex here. We've talked about this before. But, it's worth repeating. You've learned from Olipop's story. 2B+ impressions on TikTok. How? Micro-

3-Day Old Side Hustle + Google Ranking System Exposed!

Friday, December 20, 2024

If you have been following me on Niche Pursuits for the last 10+ years, you'll know that I love side hustles! I love starting and testing new little projects. In fact, that why in every segment of