The Signal - Microsoft just wants to be loved

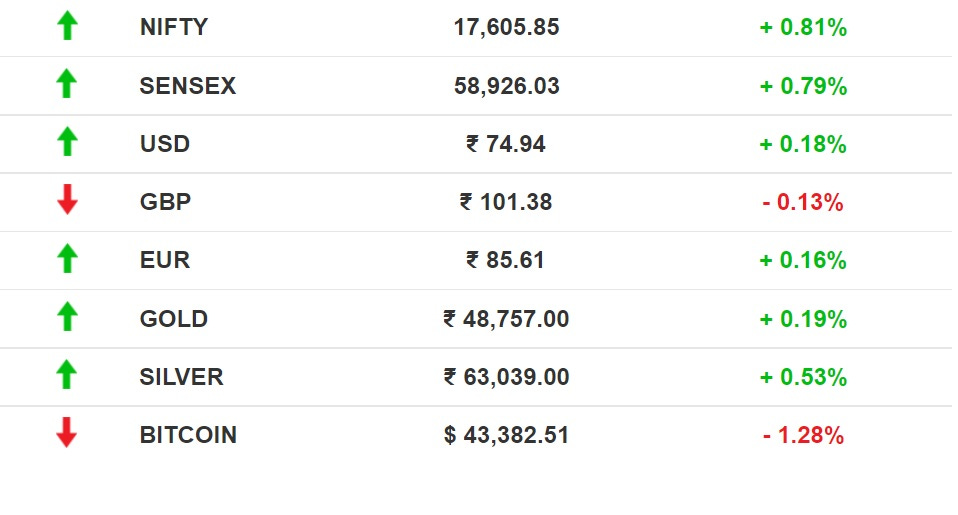

Microsoft just wants to be lovedAlso in today’s edition: RBI keeps rate unchanged; ShareChat consolidates short-video market; Watch out, Netflix; Wine isn’t cool anymoreGood morning! McDonald’s is in the throes of creating a McMetaverse. The fast food giant filed 10 trademark applications for virtual restaurants and virtual concerts. What’s more, virtual McDonald’s outlets will also offer home delivery of real and “virtual goods”. Sounds spiffy, but we aren’t lovin’ the idea of (a) a matrix burger, and (b) placing an order in the metaverse when you can do so faster on a food delivery app. Then again, these are incubatory days for Web3. Millennials don't like to wine and dine anymore, at least in the United States. We also outline the recent ShareChat acquisition. The Indian social media platform is buying MX TakaTak. Is this a win-win situation? Tune in to the latest episode of The Signal Daily. The Market Signal*Stocks: Benchmark indices remained in the green after RBI kept rate unchanged; Realty, banking, power, and metal indices led the gains. Tata Steel was the top Sensex gainer. Microsoft Tries To Be The Favourite ChildWith the likes of Apple and Google increasingly coming under scrutiny over their app store rules, Microsoft is taking a fairer, “principled” approach to its own. The move is largely aimed at avoiding antitrust scrutiny, particularly in the wake of its $68 billion purchase of game developer Activision Blizzard. But that could also mean…changing its business model. On tap: For all you Call of Duty hardcores out there, we have some news for you. Keep playing on your Playstation devices. Political debate free: LinkedIn wants to be loved, and by Gen Z too. Which is why it has begun testing a “no politics” setting for some users in the US. The professional social network is also trying hard to be creator-friendly, with offerings such as video profiles, live video and audio events. RBI Really Wants GrowthThe country’s slowing economic activity is what bothers Reserve Bank of India (RBI) governor Shaktikanta Das the most. Its monetary policy committee decided to keep rates unchanged for the 10th time in a row as growth surpassed inflation as the primary concern. Under-control inflation? While consumer inflation rose, it is largely along expected lines. A repo rate hike would have adversely impacted demand, further impacting economic activity. Following US’ footsteps: Perhaps, the RBI is holding on to see what the Fed will do and accordingly change its stance the next time. The experts in the US are expecting the Fed to raise rates amid a surge in inflation. Warning: Reiterating his stance on cryptocurrencies, Das called it a threat to financial stability. This, even as the RBI is in the process of launching its digital currency. ShareChat’s Long Play For Shortform DominanceMohalla Tech, the parent company of social media platform ShareChat, will acquire MX TakaTak for $700 million. Until now, MX TakaTak competed with ShareChat’s short video app, Moj. The big short: India’s TikTok ban snowballed into an overnight spurt of homegrown short video apps such as Moj, Josh (by DailyHunt), MX TakaTak, Roposo, Chingari, and Mitron TV. Moj has the highest number of monthly active users, followed by MX TakaTak and Josh. The trio also has hefty backers. MX TakaTak is owned by Times Internet; Moj counts Tiger Global, Twitter and Snap Inc. as investors; and Josh has Google, Microsoft, and ByteDance. As for the ones without bottomless funding: Mitron is struggling, Roposo has pivoted to live commerce, and Chingari is dabbling in social crypto with its GARI token.

Disney+ Scores, Hotstar GrowsMuch like Scrooge McDuck, Walt Disney Co. is making a pile of money: the company’s overall revenue rose to $21.82 billion in the quarter. As Covid-19 shut down parks and movie theatres, its streaming service Disney+ brought home the numbers (and money), adding 11.8 million subscribers in the last quarter alone. Hotstar: Disney+ Hotstar, the company’s paid streaming service in India (predominantly), grew by 57% in 2021, ending the year with 45.9 million subscribers. It also showed a marginal increase in average monthly revenue per subscriber in 2021, increasing by 5% from $0.98 to $1.03. With the IPL rights up for grabs, Disney (via Star India and Hotstar) is likely to double down on sports, amid fierce competition. Betting on: Disney+ is throwing everything at audiences to see what sticks. Earlier, this week, it live-streamed the 2022 Oscar nominations in the US. Reality television star, Kim Kardashian signed a deal with Disney’s Hulu in the US. That’s a lot of $$$. There’s also a metaverse plan in the works that the CEO is rather mum about. US Millennials Are Ditching WineWine is the least preferred drink among US millennials. That gives winemakers very little reason to raise a toast. If this trend continues, sales of American wine could tumble to 20% in the next decade (pdf). Untimely intervention: The dip in wine drinking comes at a time when vodka and tequila are finding takers and competing with craft beers and even marijuana. Millennials are a health-conscious bunch. Maybe, that explains why even mocktails are finally having their moment. The reality is that 61% of the US population, including millennials, live paycheck to paycheck. That gives it little room for wine to an everyday tipple when good quality wine is premium. Reckoning: Winemakers realise they need to do something ASAP. So, aggressive campaigns are in the works. Fortunately, the Biden administration wants to break the consolidation in the US alcohol segment so consumers can save hundreds of dollars on their choice of tipple. FYIBNPL is the new black: Zomato is getting into the Buy Now Pay Later game for dine-in and food delivery services. The company also recorded narrowed losses and an increase in revenue for the quarter ending December 2021. Mixed bag: Twitter clocked better revenues and user growth relative to the last quarter of 2020. This growth, however, has not met analyst expectations. Fivefold: Mergers and acquisitions in the cryptocurrency space jumped a whopping 4,846% in 2021, per a PwC report. Tailwinds: India has eased international travel norms for both outgoing and incoming passengers. Sixer: Chinese researchers are set to propel their country towards 6G technology after transmitting 1 TB of data over 1 km in just a second. Part and parcel: iPhone assembler Hon Hai Precision Industry Co. has forecast a welcome reprieve from supply shortages for electronic components. New deal: Binance, the world’s largest cryptocurrency exchange, is investing $200 million in Forbes as the business magazine plans to go public. FWIWDoodle dash: A 60-year-old security guard was bored on his first day at work. And so, he drew eyes on the faceless subjects in the 20th-century Russian painting, Three Figures. The guard now faces prison time, and the gallery has installed protective screens for the remaining works in the exhibition. Take that: With Omicron taking hold, New Zealand had temporarily cut off its borders for overseas citizens and visa holders last month. A politician questioned education minister Chris Hipkins if he’d met with the Covid-19 response minister to grant border exemptions for teachers. Turns out it was a silly question because Hipkins holds both offices. This is why he responded by linking to a popular meme showing two Spidermen pointing at each other. Buzzword car: Cars depreciate in value. Maybe that’s why Italian automaker Alfa Romeo will offer NFT digital certificates to buyers of the Alfa Romeo Tonale SUV. That the car comes in a plug-in hybrid model, and that Alfa Romeo is pivoting to an all-electric line-up clearly isn’t enough. If an NFT can increase a car’s residual value, so be it. Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Reliance has lending dreams

Thursday, February 10, 2022

Also in today's edition: Peloton's dream comes to a halt; Bike sales slow down; Netflix eyes Academy Awards

The funding glut continues 💰

Wednesday, February 9, 2022

Also in today's edition: The fall of Ashneer Grover; Meta's mega troubles; Apple makes music with AI; How do we put nuclear waste to bed?

Celebrities 🤝 NFTs

Tuesday, February 8, 2022

Also in today's edition: Goldman Sachs upvotes Paytm; One vaccine to rule them all? Chinese officials double as VCs

Amazon unearths new billions

Monday, February 7, 2022

Also in today's edition: Jio charts its entry in the metaverse; Fancy a study session on Twitch? Udan fails to take off; No happy ending for GameStop

Westland was a bubble waiting to burst

Saturday, February 5, 2022

It took five years for Amazon to realise that its acquisition wasn't worth the time, money, and effort

You Might Also Like

1 minute to increase your email open rate

Wednesday, November 27, 2024

Every year we bring the highest quality software to RocketHub for an insane BFCM event. This year is no different! BFCM starts now so check the page below for one new lifetime deeaaal drop each day.

Memo: The Distressed Brand

Wednesday, November 27, 2024

The opposite of brand equity isn't no equity; it's brand apathy. View this email in your browser 2PM (No. 1014). The most recent letter was read by 46.1% of subscribers and this was the top

🔍 How Ridge Scaled to 9-Figures W/ Influencers

Wednesday, November 27, 2024

November 26, 2024 | Read Online All Case Studies 🔍 Learn About Sponsorships 2020 influencer marketing was pay-to-post. In 2024 that sh*t no longer works. In 2025 it's going to be about building a

A letter for you

Wednesday, November 27, 2024

Plus, an announcement you won't want to miss... View in browser ClickBank Logo Hi there, Wow. Time sure does fly. Can you believe there's already less than two months left in 2024!? It feels

🎟️The Quest is calling you

Tuesday, November 26, 2024

And why the HubSpot Blog ages in reverse ... View in browser hey-Jul-17-2024-03-58-50-7396-PM Don't write off a scavenger hunt as mere kids' play. A well-designed hunt can move attendees closer

New Pricing & Black Friday Deal

Tuesday, November 26, 2024

Some updates to my lead program for design agencies ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The BFCM Playbook To Millions In Sales

Tuesday, November 26, 2024

Come learn how to crush black friday cyber monday for brands

🦅 The once-in-a-lifetime deal is here

Tuesday, November 26, 2024

The new 𝕏 API costs forced our hand ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin Drops to $93K as Long-Term Holders Take Profits

Tuesday, November 26, 2024

Plus Saylor Buys $5.4B More Bitcoin Setting New Record at $97860

🕵️ 50%, then 35%, then 20%, then nothing

Tuesday, November 26, 2024

Steal Club BF offer is live :)