Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #276

What's 🔥 in Enterprise IT/VC #276Startups like a fine 🍷, the longer arc of success 💪🏼 for some founders

While all of us love to hear about the 🚀 startups who scale from zero to $50M ARR in record time and build in public, the reality is that it is much different for many other founders and investors. I was reminded of that this week when 2 portfolio companies that we funded on day 1 in 2017 finally emerged from stealth. First, Clay officially launched and ended up #1 on Product Hunt this past week. I’m super 🔥 up for co-founders Kareem Amin and Nicolae Rusan and the entire team.   Paul Graham likes to say that product velocity is one of the strongest signs of success and my 1b is hiring velocity is closely correlated because you can’t have 1 without a few more killer engineers. While Clay had all of that out of the gate, what they recognized is the product they were building was much more complex than initially anticipated. In addition with a horizontal product like Clay (feels like an Airtable meet Zapier meets Clearbit) in a rapidly maturing market around low code no code, the team felt it was important to nail some initial use cases to truly differentiate themselves from those around them. While many startups like to build in public, Clay took a different route, building and iterating with a targeted community of users, running a series of tests, before nailing their positioning, “spreadsheets that fill themselves.” Huge congrats as the Clay team has a number of happy paying customers and clearly tapped into a huge market need!  Company #2 is Wallaroo which we also funded at company formation. Wallaroo just announced its $25M Series A led by M12 (Microsoft’s VC arm) and existing investors. While founder Vid Jain saw the future, the markets weren’t exactly ready for him. Wallaroo is the easy button to deploy AI models w/ breakthrough performance, ease + scalability. Here’s more from Venturebeat. And according to Vid in the Wallaroo blog:

Similarly to Clay, Vid had a strong engineering culture and team out of the gate with incredible product velocity. Unlike Clay which is a PLG company, Wallaroo had to brute force its way into a number of Fortune 500 customers, those who had enough models in production and had the scale pain that Vid sought to solve. It reminds me of the old adage that pioneers get arrows in their backs and it’s so hard to create new categories and time early markets. Part of is just surviving and continuing to build and that is what Vid and team did. Just because you don’t find success immediately, it doesn’t mean you won’t build a massive and successful company. While Clay and Wallaroo are still both early in their respective journeys, their quietness and “behind the scenes” approach doesn’t mean they were dead, but intensely focused on finding that right positioning and messaging. Finally, every startup journey is different and there are lots of ways to reach the promised land so founders keep building and iterating and remember sometimes it can take longer than you want. As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

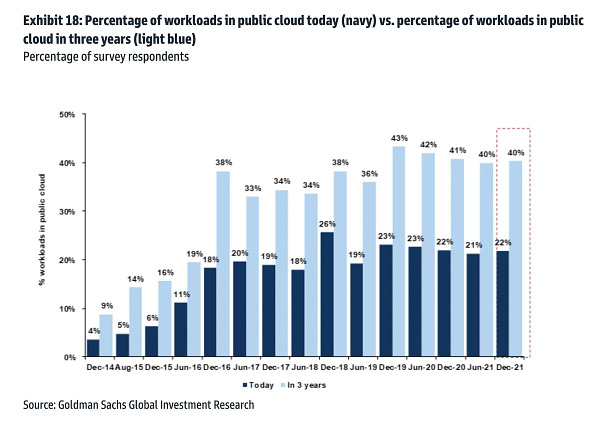

Enterprise Tech

Markets

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Older messages

What's 🔥 in Enterprise IT/VC #275

Saturday, February 5, 2022

☁️ is still on 🔥 + what to look for in journey from OSS project to company

What's 🔥 in Enterprise IT/VC #274

Saturday, January 29, 2022

25 Years in NYC Enterprise Tech and why I moved to Miami 🌴 - 🔥 up to build 🏗️

What's 🔥 in Enterprise IT/VC #273

Saturday, January 22, 2022

Talent in a down market 📉

What's 🔥 in Enterprise IT/VC #272

Saturday, January 15, 2022

Silver lining - enterprise IT spend to continue 📈

What's 🔥 in Enterprise IT/VC #271

Saturday, January 8, 2022

📉 What a start to 2022 but no time to panic

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏