DeFi Rate - This Week in DeFi - February 18

This Week in DeFi - February 18This week, new Castle Island $250m fund, Curve on Moonbeam, Ref Finance raises $4.8m, and Gnosis Safe spins out into SafeDAO

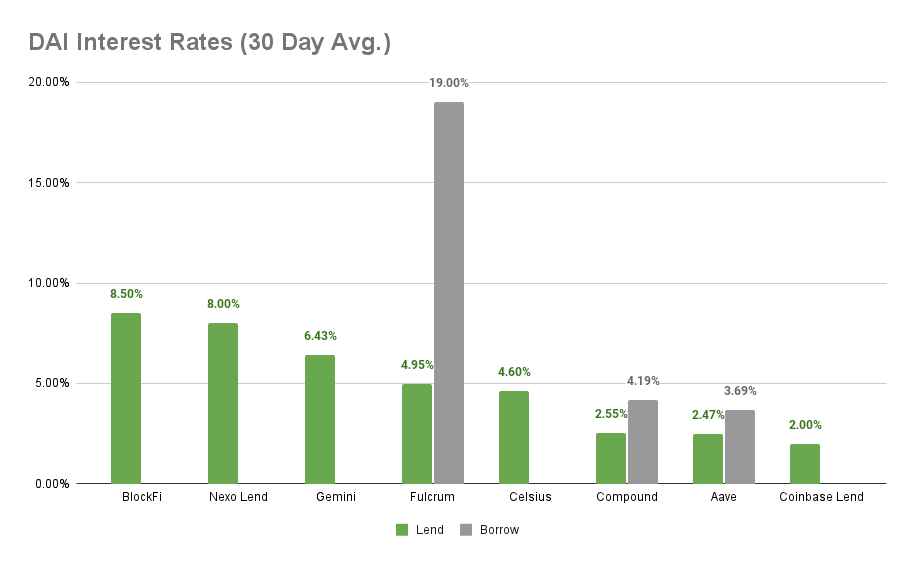

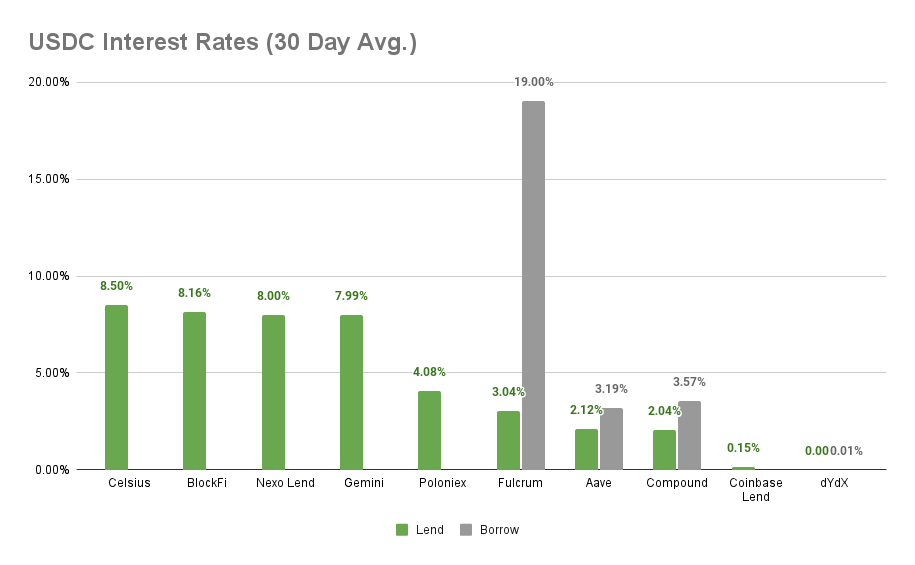

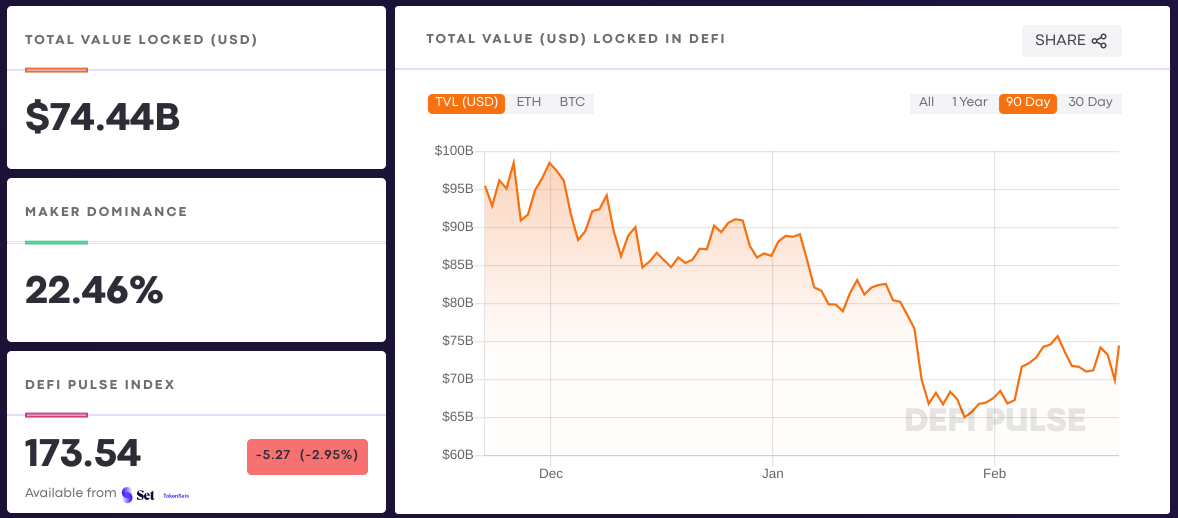

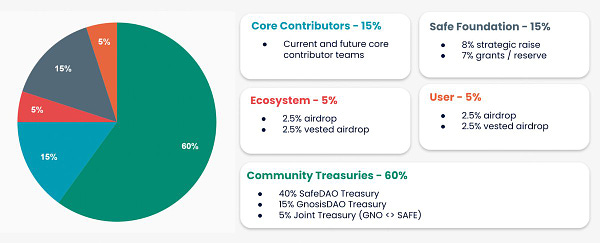

To the DeFi community, This week, Castle Island Ventures announced a $250 million Web3 investment fund and the additon of Ria Bhutoria as general partner at the firm. The new fund will focus on blockchain-based financial services, monetary networks, and internet infrastructure that are expected to be major Web3 themes in years to come.   Curve Finance enlarges its reach again by launching on Moonbeam, the EVM compatible Polkadot chain. Curve is one of the first cross-chain DeFi protocols to come to Moonbeam, and should provide a solid foundation for like-asset swaps on the network.  NEAR-based multiproduct DeFi platform Ref Finance announced a strategic raise of $4.8 million to continue expanding their developer team and building out DeFi in the NEAR ecosystem. Ref currently offers AMM and stableswap platforms, with plans for additional AMM improvements and a lend and borrow protocol later on.   And Gnosis decentralized governance voted to spin out SafeDAO and release the SAFE token via airdrop to users and distributions to core contributors, community treasuries, and the SAFE Foundation. Gnosis Safe contains more than $100 billion in funds across various Web3 projects, making the product a critical piece of public infrastructure that will now be managed by the SAFE holder community.   More than $100 billion held by various DeFi and Web3 projects is a remarkable sum. What’s more, that total represents only that actually raised and held by Ethereum-based projects as ‘dry powder’, indicating a huge amount of runway for the DeFi space that has historically run extremely lean - teams facilitating hundreds of billions in annual volume often consist of a few dozen or less developers, promoters, and coordinators. That total also doesn’t include the billions set aside just in the last year by venture capital firms of all varieties, from crypto-native to those just getting started investing in Web3. Investment in the space has skyrocketed over the past four years, with 2022 shaping up to be another notch higher as money continues to pour in.  The blockchain industry has always had its detractors, but the boosters, at least as measured by skin in the game, have apparently never been more confident that crypto infrastructure and products will be an integral part of everyday life in the not-too-distant future. It can feel like a slow process, but if you’ve made it this far, what’s a few more years? Keep on trucking! Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 3.69% APY, Compound at 4.19% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 8.5% APY, Nexo Lend at 8.00% APY Cheapest Loans: dYdX at 0.01% APY, Aave at 3.19% APY Top StoriesAxelar’s Universal Blockchain Interoperability Network Raises $35 Million to Reach $1 Billion ValuationColorado To Accept Bitcoin For State TaxesSorry, Jack, you can send ETH tips via Twitter nowSequoia Commits to Crypto Boom With $600M FundStat BoxTotal Value Locked: $87.35B (down -14.78% since last week) DeFi Market Cap: $110.24B (down -0.32%) DEX Weekly Volume: $16.07B (down -4.12%) DAI Supply: 9.78B (down -0.21%) Total DeFi Users: 4,395,350 (up 0.72%) Bonus Reads[Bijan Shahrokhi – The Defiant] – Zero Knowledge Proofs Can Save the Metaverse From Becoming a Dystopian Surveillance State [Anthony Sassano – The Daily Gwei] – The Perpetual Buyer - The Daily Gwei #439 [Timothy Craig – Crypto Briefing] – Court Orders Terra’s Do Kwon to Comply with SEC Subpoenas [Jack Melnick – The TIE] – The Cost of Centralization: Stablecoin risk, yield, and structure If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - February 11

Friday, February 11, 2022

This week, Optimism pays $2m bug bounty, Polygon raises $450m in private sale, ssv.network raises $10 million, and new MakerDAO bug bounties

This Week in DeFi - February 4

Friday, February 4, 2022

This week, Kuiper offers DeFi native indexes, Aave executes cross-chain governance, 1inch adds new stablecoin pools, and Dune raises $69m

This Week in DeFi - January 28

Friday, January 28, 2022

This week, SuperDAO raises $10.5m seed funds, BitDAO funds zkDAO with $200m, HAL raises $3m and Aave integration, and new Syndicate DAO tools

This Week in DeFi - January 21

Friday, January 21, 2022

This week, 1inch comes to Avalance and Gnosis Chain, Aave Arc headed to L2, Stader Labs raises $12.5m for staking, and EIP-1559 for Polygon

This Week in DeFi - January 14

Friday, January 14, 2022

This week, NEAR raises $150m, Polygon Zero debuts Plonky ZK advancement, 0x API on Optimism, and DeFi Alliance is now Alliance DAO

You Might Also Like

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏