DeFi Rate - This Week in DeFi - January 21

This Week in DeFi - January 21This week, 1inch comes to Avalance and Gnosis Chain, Aave Arc headed to L2, Stader Labs raises $12.5m for staking, and EIP-1559 for Polygon

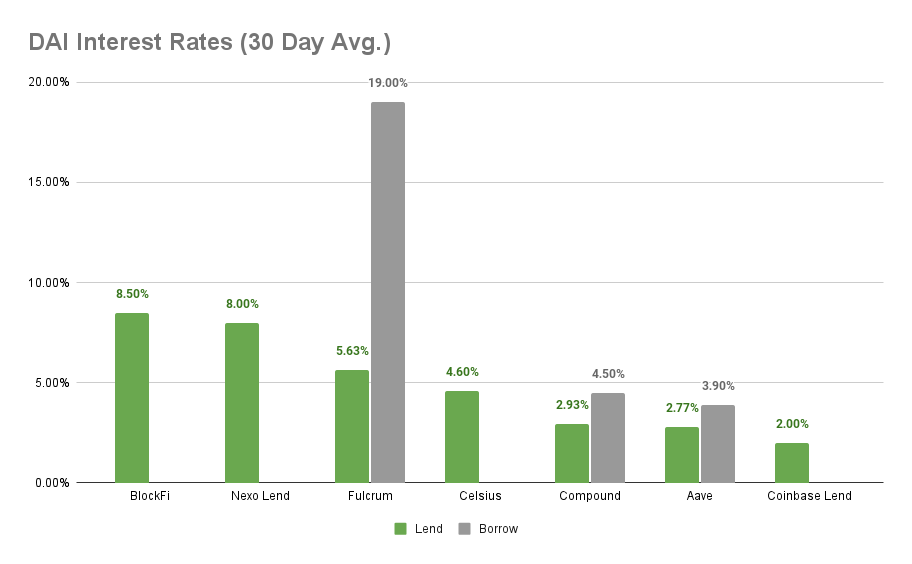

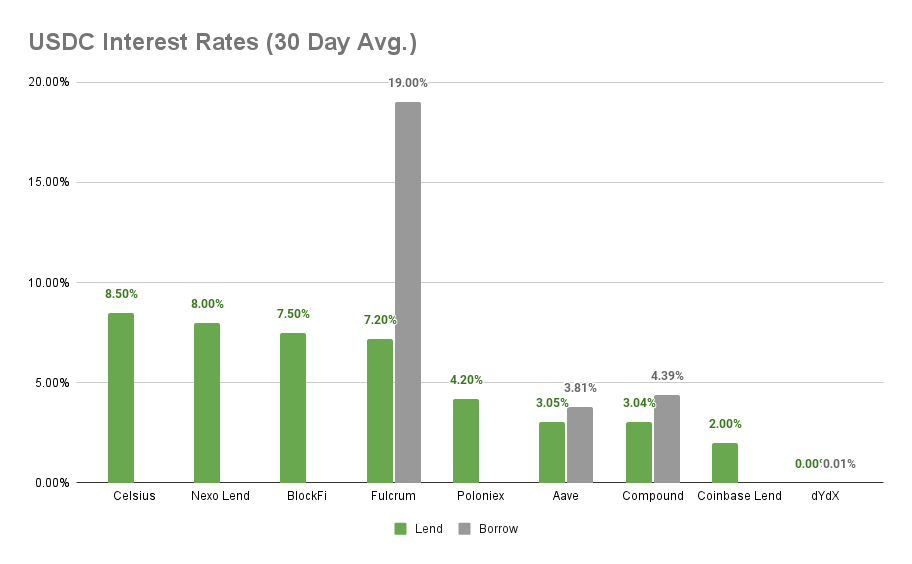

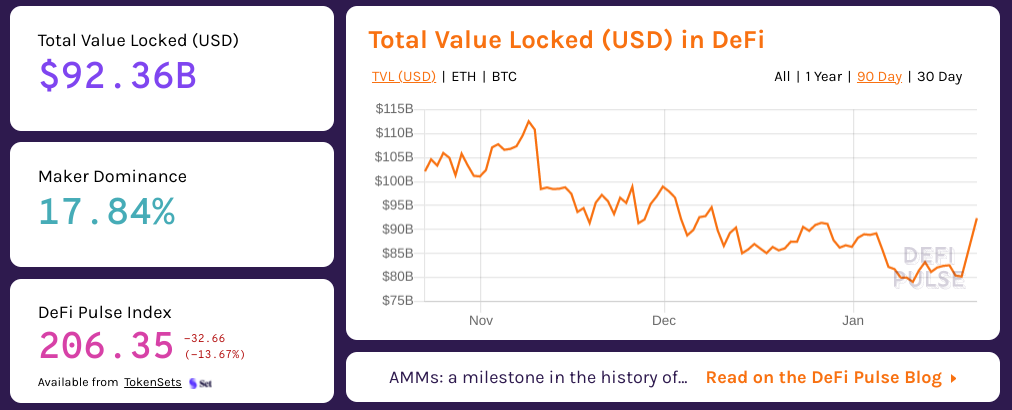

To the DeFi community, This week, 1inch Exchange went live on Avalanche and Gnosis Chain (formerly xDai Chain) to expand DEX aggregation services to more corners of the DeFi ecosystem. At launch 1inch on Avalanche aggregates liquidity from more than a dozen exchange protocols, and 9 from the Gnosis Chain.   Aave Arc, the institutional-focused ‘walled garden’ providing KYC verified entities their own liquidity pool is headed to Ethereum scaling solutions Arbitrum and Optimism after a pair of proposals passed with overwhelming support. The additions will mark some of the first ‘institutional-grade’ DeFi services to be ported to L2 solutions, and should help dramatically reduce transaction costs.   Stader Labs, a staking service provider for the Terra ecosystem completed a strategic private sale for $12.5 million led by Three Arrows Capital. Fund will be used to add staking support for more blockchains including Solana, Ethereum, Polygon, Hedera, and Fantom.  CoinDesk @CoinDesk Staking platform @staderlabs has closed a $12.5 million private sale led by Three Arrows Capital, valuing the Bangalore-based company at $450 million. @thesamreynolds reports. https://t.co/95TU0uj7oQAnd Polygon implemented a number of EIP-1559 upgrades to bring the protocol more in line with its Ethereum parent chain and bring fee burning into the protocol. As with Ethereum, Polygon transactions will now burn a portion of the transaction fee paid by users while delivering more predictable transaction pricing and will reduce the total MATIC supply over time.   Another big week for L2s and competing L1s, with more and more DeFi protocols continuing to expand their reach to every corner of the DeFi ecosystem. In case there were any lingering doubts, the addition of Aave Arc to multiple Etheruem scaling solutions is proof that - at least at the community level - users see it as essential to success to move important services off of the native Ethereum chain. And while some L2s have attracted more TVL or developer interest than others, the field is still very much open for existing players or new entrants to pull ahead of the pack. L2 providers (and many L1s) have paid sizable bug bounties to those identifying production issues that put billions at risk, and cross-chain bridges have been identified as risky points of potential failure. DeFi is getting more mature, but there are clearly still technical and market-based inefficiencies to work through before being truly ready for prime time. As builders continue to branch out into different development environments, it’s also becoming increasingly likely that crypto will have a highly fractured liquidity environment, with cross chain liquidity aggregators likely playing an increasingly important role. In the end, the protocols that see adoption and actual use by large scale institutional and corporate players may have a serious leg up in reaching critical mass and pulling ahead of the competition. Those decisions may not have been made just yet, but the conversations are certainly ongoing. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 3.9% APY, Compound at 4.5% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 8.5% APY, Nexo Lend at 8.00% APY Cheapest Loans: dYdX at 0.01% APY, Aave at 3.81% APY Top StoriesFormation of the Luna Foundation Guard (LFG)OpenSea Acquires Dharma Labs, Welcomes New CTOSolana-Based DeFi Project Hubble Protocol Raises $10MCosmos Connects to Ethereum Via the Osmosis DEXStat BoxTotal Value Locked: $92.36B (down -3.79% since last week) DeFi Market Cap: $125.2B (down -14.2%) DEX Weekly Volume: $19.82B (down -3.74%) Total DeFi Users: 4,377,600 (up 0.70%) Bonus Reads[Brady Dale – The Defiant] – DEXs Sliding into Price War as Uniswap and dYdX Slash Trading Fees [Jack Melnick – The TIE] – A Call to Farms: Dopex, Jones Dao, and the Future of DeFi Options Anthony Sassano – The Daily Gwei] – To Bridge or Not to Bridge - The Daily Gwei #418 [Shaun Martinak & Sebastian Bea – Bankless] – What's taking so long? [Brooks Butler – Crypto Briefing] – a16z Seeks Record-Breaking $4.5B for Crypto Funds If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - January 14

Friday, January 14, 2022

This week, NEAR raises $150m, Polygon Zero debuts Plonky ZK advancement, 0x API on Optimism, and DeFi Alliance is now Alliance DAO

This Week in DeFi - January 7

Friday, January 7, 2022

This week, Aave Arc is live, Serum's IEF raises $100 million, Yearn Finance governance lockups and rewards, and Goldfinch raises $25 million

This Week in DeFi - December 31

Friday, December 31, 2021

This week, Centrifuge and Aave bring real world assets to DeFi, DeBank raises $25 million, and SOS and GAS airdrops for (almost) all

This Week in DeFi - December 24

Friday, December 24, 2021

This week, Rari and Fei merge, the Eth Kintsugi testnet is live, Transak on-ramps for Arbitrum and Optimism, and new security for Compound

This Week in DeFi - December 17

Friday, December 17, 2021

This week, Balancer taps Aave to boost yields, Optimism opens to all devs, Perp Protocol brings LP rewards, and DeFi access via Coinbase

You Might Also Like

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏