DeFi Rate - This Week in DeFi - January 28

This Week in DeFi - January 28This week, SuperDAO raises $10.5m seed funds, BitDAO funds zkDAO with $200m, HAL raises $3m and Aave integration, and new Syndicate DAO tools

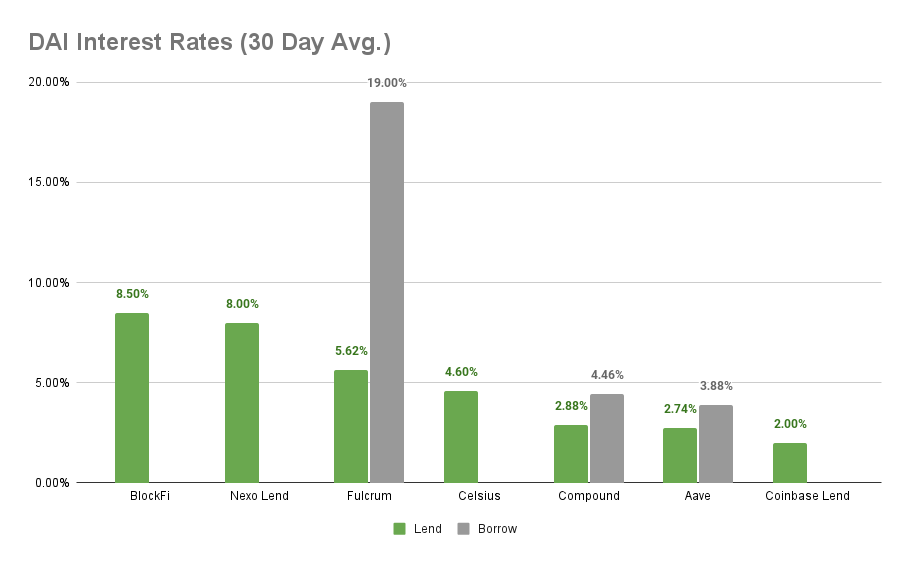

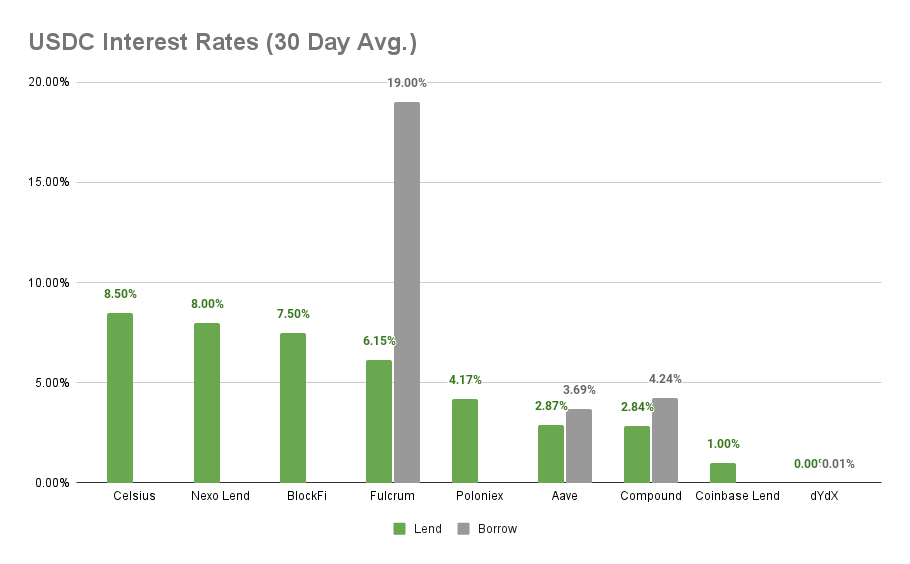

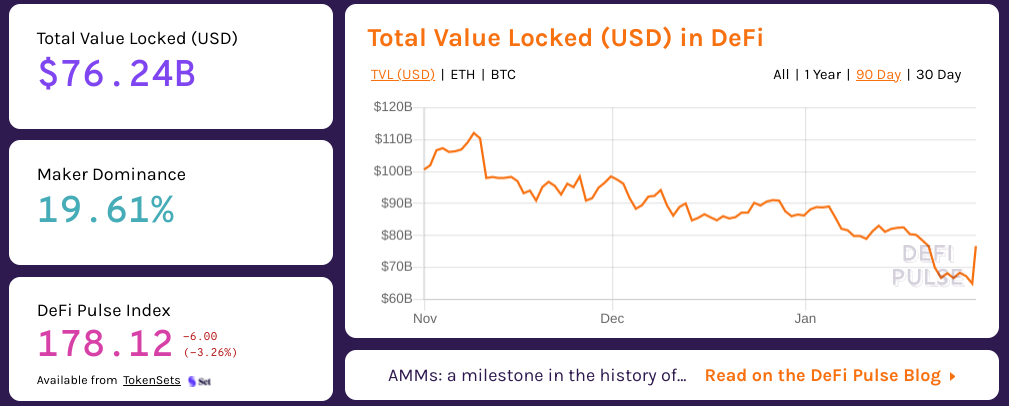

To the DeFi community, This week, SuperDAO raised $10.5 million in a seed funding round, aiming to make it ‘absurdly easy’ for anyone to start and operate their own DAO. The SuperDAO framework will enable DAOs to raise funds via token sales, distribute equity to DAO members, manage a unified treasury, provide a newsfeed to DAO participants, and more.   A proposal to the BitDAO community authored by Matter Labs and Mirian passed, directing $200m in funding to zkDAO to advance the push for zero-knowledge based scaling on Ethereum and beyond.   Blockchain data provider HAL raised $3 million in a seed funding round led by CoinFund to support the growth and development of on-chain data analytics services. Aave users also voted to integrate HAL notifications into the DeFi platform, initially to provide notifications about borrowing position health factors to reduce the risk of liquidations.  HAL.xyz @HAL_Team https://t.co/0hvwH5qqNnAnd Syndicate introduced Web3 investing clubs, purportedly making starting an investing DAO as easy as starting a group chat. Syndicate’s Web3 investment clubs exist as ERC-20 components so they can easily hook in with other DeFi tools and protocols, and are designed to bridge the gap between traditional investing groups and Web3 native investing by offering deposit and share management, generating legal docs, providing investment analytics, and more.  Syndicate ✺ @SyndicateDAO 1/ Today, we're excited to introduce Web3 Investment Clubs, Syndicate’s first mainstream social investing tool built on Syndicate Protocol ✨ It transforms any Ethereum wallet into a powerful investing DAO in seconds for just the cost of gas. https://t.co/SXE5iEBBA2DAOs on DAOs this week, and more about their infrastructure and tooling versus their specific investing or building goals. That’s one way you can tell this cycle is different from the ICO craze that peaked in 2017 - at the time, even the most basic tools beyond the Ethereum protocol level (a much less competitive base layer race back then!) were still under development, even as projects with little more than a whitepaper raised millions. An easier means to make intelligent investment decisions is also an exciting result of these new DAO tooling announcements, increasing the efficiency of non-institutional investors pooling their knowledge and resources by 10 or 100x. These advancements in payroll, share funding collection and distribution, productivity management, analytics, and more should help capital allocators separate the good projects from the bad, while also laying important groundwork for DAOs with even wider ranging goals. Likewise, quiet projects like HAL that materially improve the user experience for everyday users through better data availability stand to have a huge long-term impact on widespread adoption of decentralized protocols. The Aave integration is also a nice example of community governance bringing small but meaningful proposals into the spotlight, allowing them to be prioritized and implemented much faster than in a top-down organization. When you see dozens or hundreds of investing DAOs making positive contributions to the Web3 industry a year from now, think back to weeks like this, when the tools were just being released. DAOs are already experiencing explosive growth, and the recent emphasis on the metaverse and our lives online in general will only accelerate the trend. Have you joined a DAO yet? Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 3.88% APY, Compound at 4.46% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 8.5% APY, Nexo Lend at 8.00% APY Cheapest Loans: dYdX at 0.01% APY, Aave at 3.69% APY Top StoriesFireblocks lights up with $550M Series EUniswap founder's bank account shut down by JP Morgan ChaseIMF urges El Salvador to drop Bitcoin as legal tenderMark Zuckerberg’s Stablecoin Ambitions Unravel With Diem Sale TalksStat BoxTotal Value Locked: $76.24B (down -17.45% since last week) DeFi Market Cap: $102.32B (down -18.27%) DEX Weekly Volume: $19.82B (up 56.91%) DAI Supply: 9.1B (down -1.07%) Bonus Reads[Owen Fernau – The Defiant] – MakerDAO’s Expulsion of Content Team Stirs Debate About Tougher Governance [Fabian Klauder – DeFi Times] – Is 2022 the Year of Cosmos Airdrops? [Anthony Sassano – The Daily Gwei] – Decentralization Matters - The Daily Gwei #426 [Polynya – Bankless] – Why Layer 2s are the future [Chris Williams – Crypto Briefing] – Daniele Sestagalli Projects Tank Amid Wonderland Drama If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - January 21

Friday, January 21, 2022

This week, 1inch comes to Avalance and Gnosis Chain, Aave Arc headed to L2, Stader Labs raises $12.5m for staking, and EIP-1559 for Polygon

This Week in DeFi - January 14

Friday, January 14, 2022

This week, NEAR raises $150m, Polygon Zero debuts Plonky ZK advancement, 0x API on Optimism, and DeFi Alliance is now Alliance DAO

This Week in DeFi - January 7

Friday, January 7, 2022

This week, Aave Arc is live, Serum's IEF raises $100 million, Yearn Finance governance lockups and rewards, and Goldfinch raises $25 million

This Week in DeFi - December 31

Friday, December 31, 2021

This week, Centrifuge and Aave bring real world assets to DeFi, DeBank raises $25 million, and SOS and GAS airdrops for (almost) all

This Week in DeFi - December 24

Friday, December 24, 2021

This week, Rari and Fei merge, the Eth Kintsugi testnet is live, Transak on-ramps for Arbitrum and Optimism, and new security for Compound

You Might Also Like

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏