The Daily StockTips Newsletter 02.22.2022

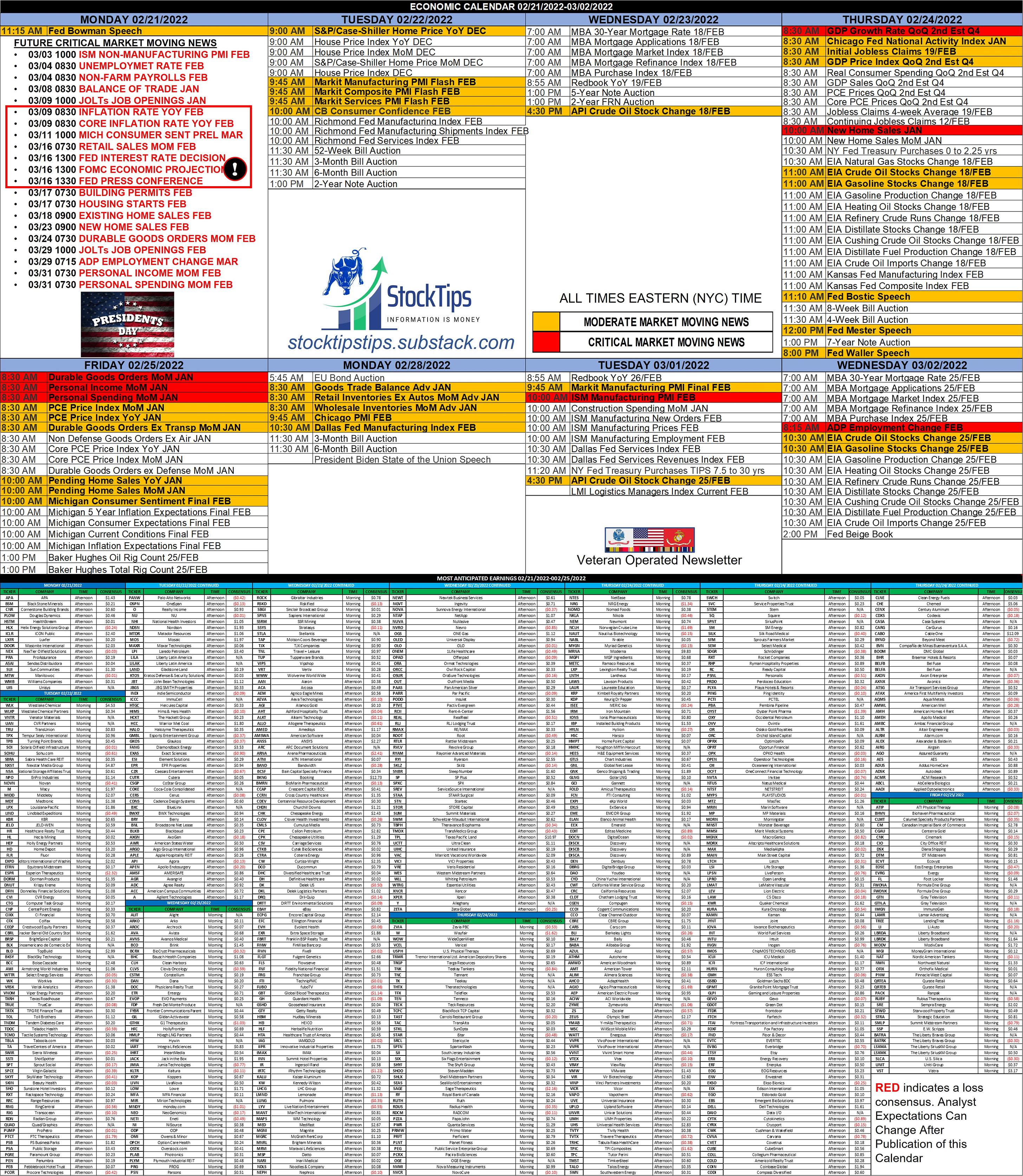

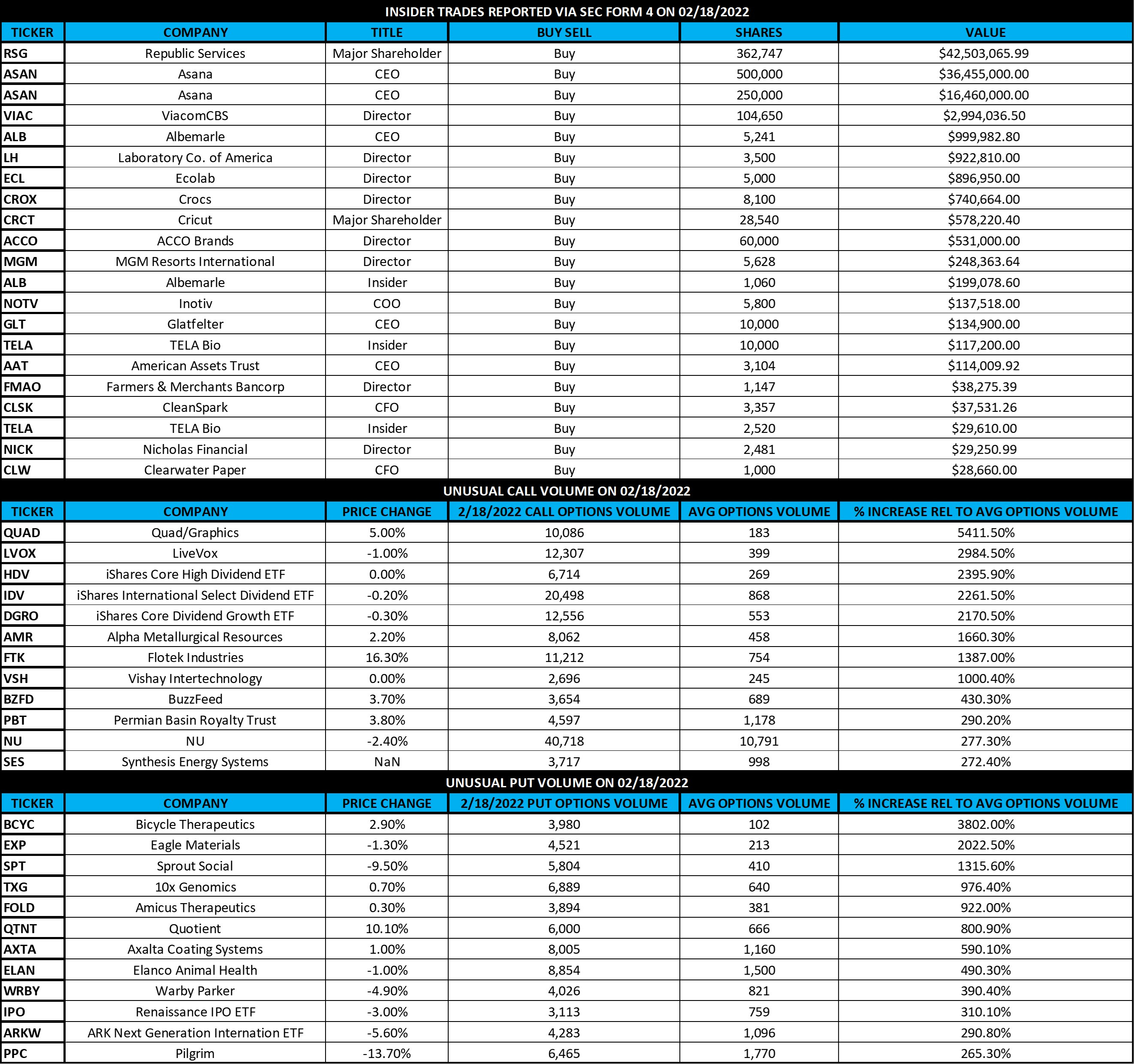

The Daily StockTips Newsletter 02.22.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), Yesterdays Insider Buys & Yesterdays Unusual Call Options Volume.INSIDER BUYS / UNUSUAL CALL VOLUME / UNUSUAL PUT VOLUME TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! TODAY: For you homeowners out there, you get to see how much inflation has affected the market value of your home (national average). Moreover if you Fed Bowman Speech Yesterday, I got ya! Fed's Bowman keeping open mind on possible half percentage point rate hike in March. The FLASH PMI for the Manufacturing, Composite, & Service industries get reported today. But with this whole Russian garbage going on, none of this will likely matter today. Hail Mary of the Day: Sanctions on Russia may have already been priced in for many companies. Lets see! BUY LIST UPDATE: I have fully updated the BUY LIST & the Price Based Assessment Watchlist. RUSSIA UPDATE: What you are about to read may seem “political” in nature. I assure you this isn’t my intent. I’m a realist, I look at things the way things are, not how I wish they were. I give little credence as to what this information means to your favored political persuasion. I trade reality, not ideology. As a result this subject matter may be uncomfortable to those who are ideologically inclined first, & a realist second. I got to give it to ya straight & in a way you can understand the root causes & second & third order effects thereof. I could easily just give you some key observations, thereby telling you what I believe will happen with no supporting evidence as to how I arrived at this conclusion. However I’m a firm believer in showing folks how I arrived at my conclusions, just as I show people how & why I pick every stock on my BUY LIST. Analysis without the methodology of the core facts of how one arrives at a conclusion is NOT actionable information! Its simply believing in whatever I say, & I will NEVER ask you to “trust me … take my word for it.” I received quite a bit of criticism for assessing that Russia would invade this holiday weekend. I predicted earlier that Russia would invade on Sunday after the Winter Olympics. Russia didn’t enter the separatist regions until 24 hours after the closing ceremony. Right time, wrong day. However as markets were closed on Monday, & I successfully predicted a major geopolitical event that will no doubt move markets (When this information was ACTIONABLE for my subscribers), I’d say not bad for a days work! So what happened? Well for those of you who haven’t been paying attention to the news, Putin recognized the separatists areas of the Ukraine & sent troops in as a “peace keeping force.” Of course, THIS DOES NOT MEAN THAT PUTIN WONT INVADE ADDITIONAL AREAS OF THE UKRAINE. However sanctions are now a certainty. Both by NATO & individual countries. President Biden has already signed an executive order forbidding U.S. citizens from investing in the separatist regions, something no American was doing anyway, just as no American nor ally invested in Crimea after Russia invaded in 2014 … which is why Crimean infrastructure cannot support the waterworks to avoid their current drought (Russia doesn’t have the tech to filter seawater). And now we are waiting for additional sanctions to come down from NATO, although it appears, judging by the White House’s response, that there are some disagreements among NATO member states. Likely surrounding fossil fuels. The manner by which Putin ordered the invasion of the Ukraine enables him to have his cake & eat it too. Originally the Biden Administration held off on sanctions as a deterrent to war. However since Putin is now occupying ONLY the separatist areas (for now), & there is so much more of the Ukraine to invade, maintaining the “wait & see” first & “sanction later” doctrine is presenting a problem for NATO. Two NATO states, Germany & Italy, pushed back on sanctioning Russia’s oil & natural gas industry, EVEN when they assumed a wide scale shock & awe invasion was immanent. These states will be even less inclined to support sanctioning Russia’s oil & natural gas now that the argument can be made that Putin “didn’t really invade,” & not a single shot was fired. And the U.S. cannot guarantee Europe a steady supply of energy to help take the sting out of sanctioning Russia as, well I wish I was making this up, the Biden Administration is doing whatever it can to prevent further fossil fuel production … even as he was declaring a Russian invasion (and therefore sanctions) was immanent. With this said, expect Germany to halt/delay the certification of the Nord Stream Pipeline, but also expect Germany to be more hesitant to halt imports on Russian energy altogether. Ladies & gents, the price of oil is certainly going higher unless OPEC opens the flood gates. This grants OPEC nations a hell of a lot more leverage than they’ve had in many years on the geopolitical front. So what do we look for now? Sanctions for one. Which industries are affected, & how devastating will they be? I don’t know yet. HOWERVER TURN YOUR HEAD TO CHINA!! Prior to sending troops into the Ukraine, Putin stacked the deck in his favor with trade agreements with China to help take some of the sting off of possible sanctions. What does this mean? It means China almost certainly enabled Russia to invade the Ukraine … & they knew precisely what they were doing. For Russia to invade without such trade agreements with China, any sanctions against Russian industry would have had more bite to them. So I maintain my “stay the hell away from Chinese equities” thesis. Not for ideological reasons, but for fear the sanction train will turn their way, & the uncertainty alone will make the street more hesitant on Chinese ADR’s. You can bet that China is watching how we react to Russia very closely, & China still has designs on Taiwan. I have little doubt that the political discourse will turn to China as a Russian enabler in the coming days. Anyway I’m proud of my geopolitical analysis as of late. I hope it has provided some REAL value to my subscribers. And for those of you who actioned the information provided, you likely saved or made quite a bit of money. Indeed the information provided was clarity when things were murky, as accurate as could have been given the circumstances, & more importantly you got to trade my analysis first … in many cases well before such things were considered by the news. As time goes on, & you continue to see my credibility on predicting uncertain events, (I never get them 100% correct) confidence in trading the news will become more prevalent to my subscribers. That’s my goal anyway. Key Takeaways:

Headwinds Ahead: I have a responsibility to warn my subscribers that bullish companies are going to be increasingly hard to find in this environment. I therefore owe it to you to scrutinize my picks more than ever as a result of REAL headwinds. The quick turnarounds we were accustomed to in the past are simply not going to happen in this economy. A swing that may take a month or two last year may take a quarter or two this year. Therefore I think it prudent to buy in slow & only average down when it hurts. Most companies remain profitable, but an adjustment in long term valuations & expectations are necessary. I will trade accordingly. Significant News Heading into 02.22.2022:

AVERAGE STATS ON ALL STOCKS ON THE BUY LIST AS OF MARKET CLOSE 02/18/2022 (FINVIZ & YCHARTS)

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 02.16.2022

Wednesday, February 16, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 02.14.2022

Monday, February 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 02.11.2022

Friday, February 11, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 02.10.2022

Thursday, February 10, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 02.08.2022

Tuesday, February 8, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

In times of transition, investors search for reliable investments, like this…

Friday, November 22, 2024

Invest in a time-tested asset ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Lutnick Goes to Washington

Friday, November 22, 2024

The Zero-Sum World of Interdealer Brokerage ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

💔 Google's big breakup

Thursday, November 21, 2024

Google faces a breakup, xAI hits a $50 billion valuation, and lots of manatees | Finimize TOGETHER WITH Hi Reader, here's what you need to know for November 22nd in 3:00 minutes. US justice

A brand new opportunity in the stock market revealed

Thursday, November 21, 2024

Are you ready to join Gamma Pockets? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🏦 The problem with “stress-saving”

Thursday, November 21, 2024

Plus, how to win a free financial planning session. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

John's Take 11-21-24 Climaxes

Thursday, November 21, 2024

Climaxes by John Del Vecchio Sometimes, a climax is a good thing in life. For example, climbing Mt. Everest is exhilarating. It's the climax. I will never know. Doesn't interest me. In other

👁️ Nvidia opened up

Wednesday, November 20, 2024

Nvidia released results, UK inflation jumped, and some really big coral | Finimize TOGETHER WITH Hi Reader, here's what you need to know for November 21st in 3:15 minutes. Nvidia reported record

Get a fresh start on your finances

Wednesday, November 20, 2024

Use code PLANAHEAD to get one month free. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Prepare for a better future, starting today

Wednesday, November 20, 2024

Protect yourself and safeguard your financial well-being. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Tap into this trade today for up to $3k on Thursday

Wednesday, November 20, 2024

Discover the secret to unlocking extra weekly income ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏