Net Interest - Swift Sanctions

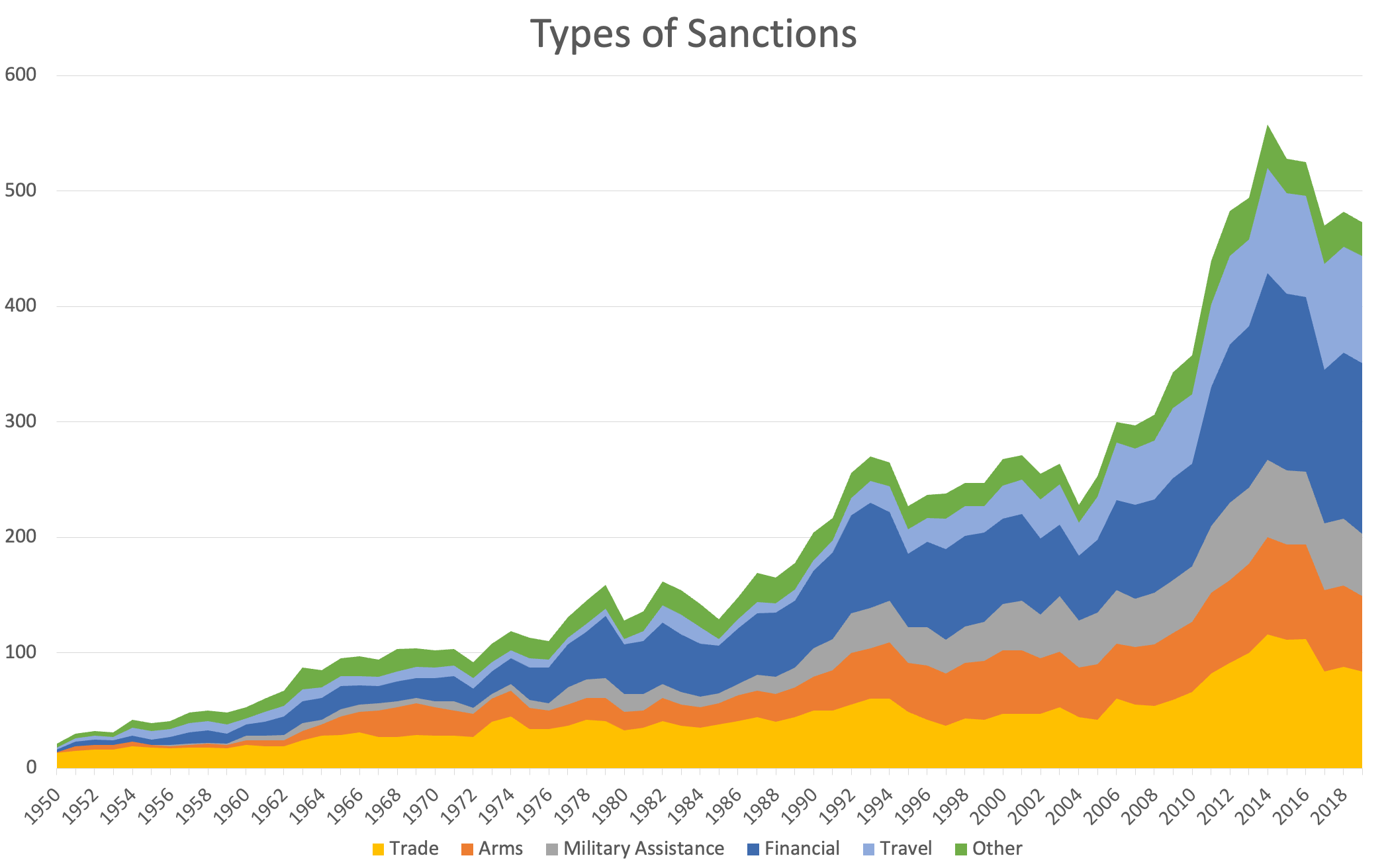

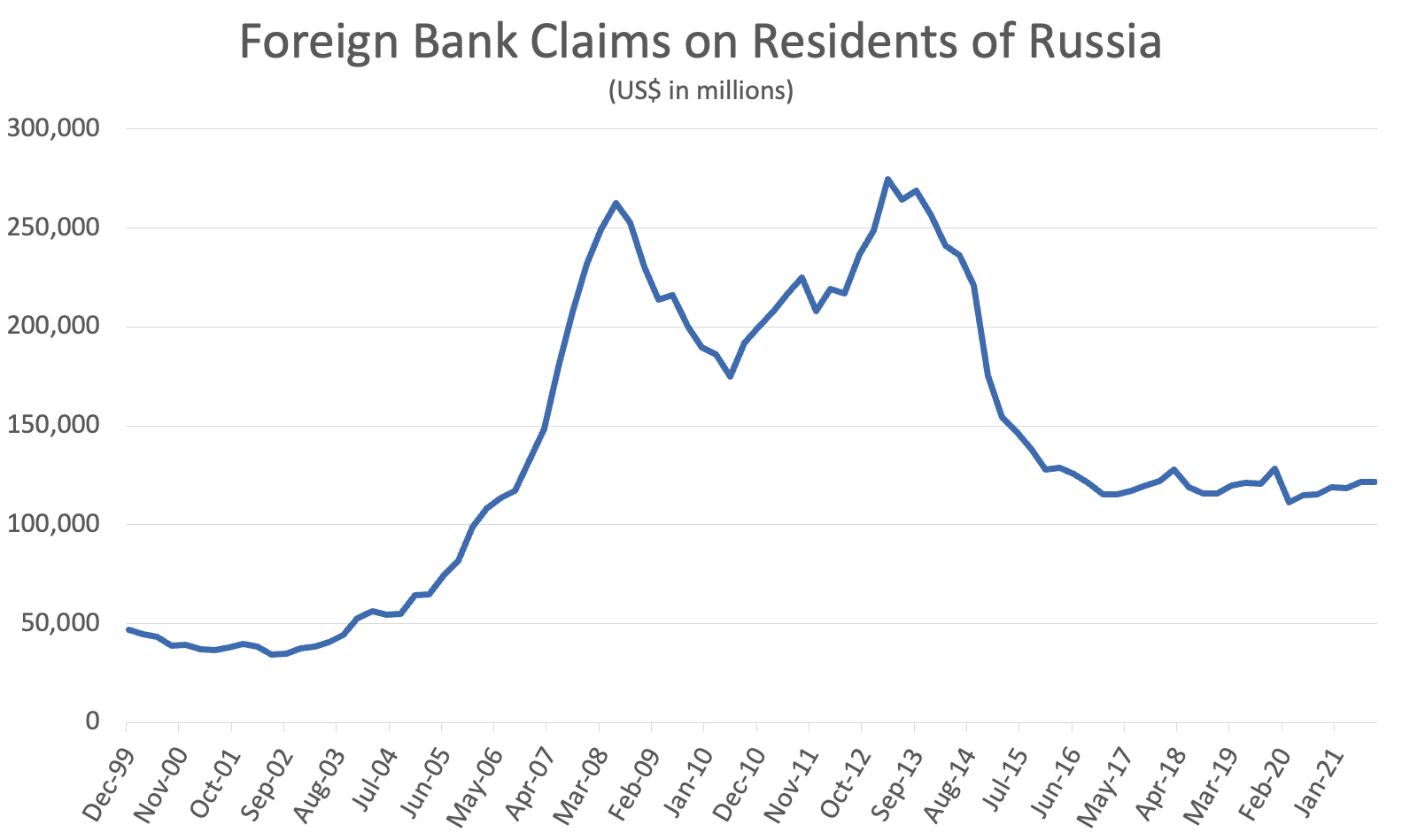

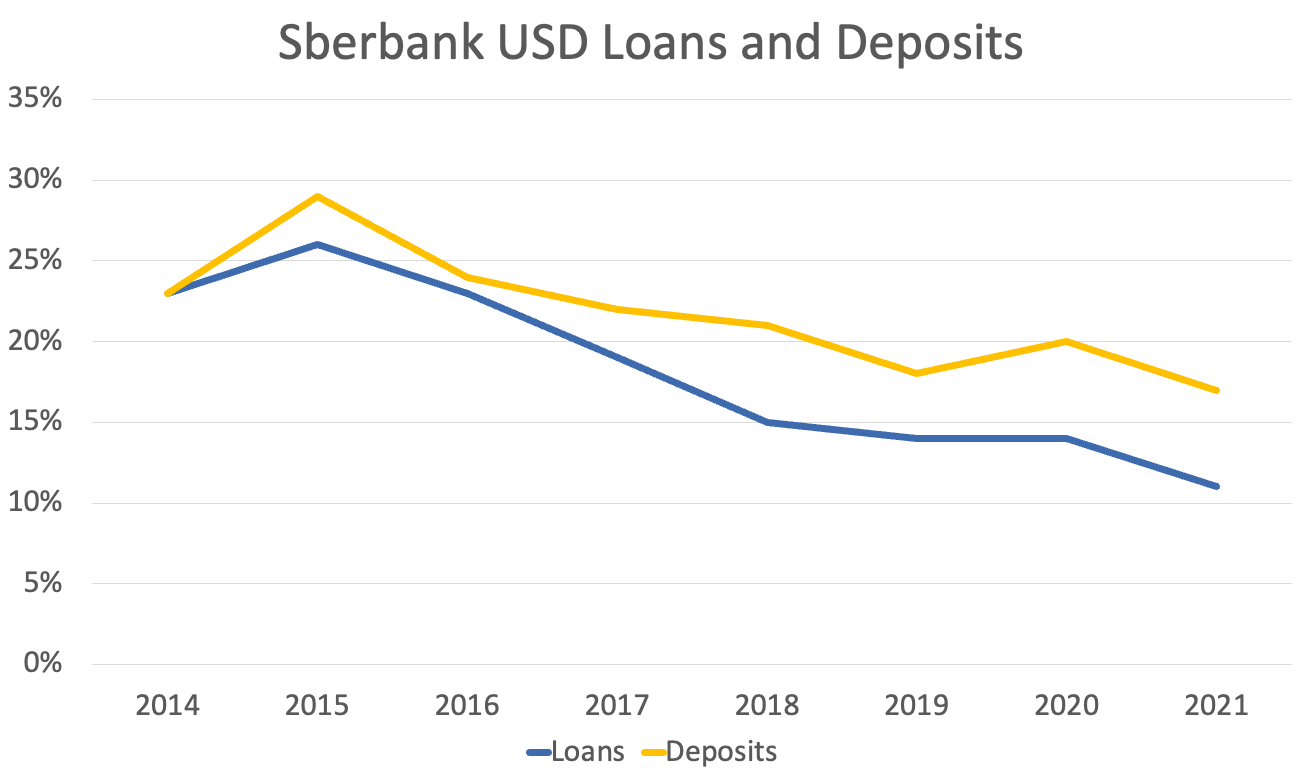

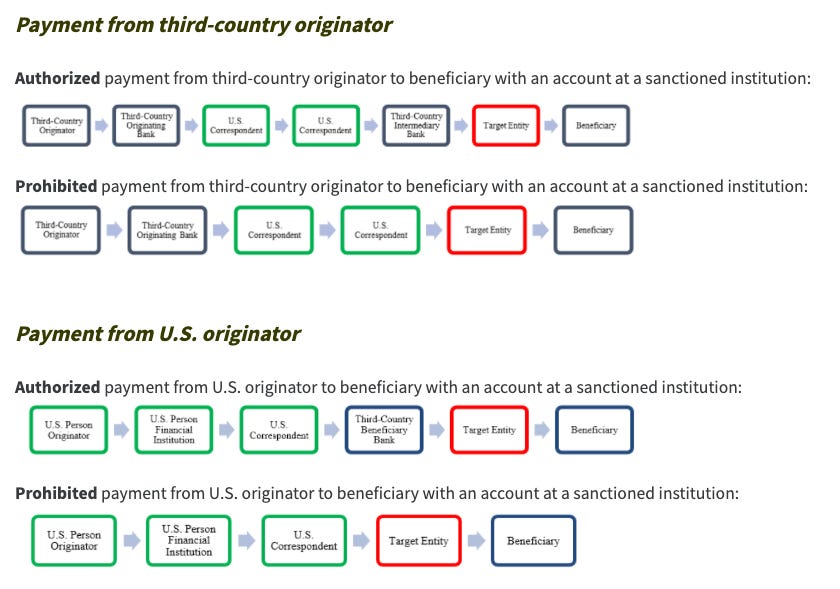

Welcome to another issue of Net Interest, my newsletter on financial sector themes. I’m hosting a call for paid subscribers next week, so if you’re thinking about signing up, now’s your chance – I’m even offering a 7-day free trial! A few years ago, I spent several very pleasant days in Kyiv. It was early summer and the city was bustling. I stayed with a friend in his apartment, close to the city’s main football stadium. He and his wife were proud to show me around; we visited the historic old town, took photos outside Saint Sophia Cathedral and ate lunch overlooking the river. Early yesterday morning, the two of them jumped in their car and started driving west, towards the border. I don’t talk much about geopolitics here in Net Interest; I’m much more comfortable analysing companies than countries. But banks are a special group, with a dual nature. At one level they behave just like other companies, focused on serving customers and maintaining competitive position. At another level, they act as agents of government policy. Normally, it’s domestic policy they’re engaged in. Policymakers around the world have for years required banks under their jurisdiction to lend to certain sectors of the economy. In Brazil and India it might be agriculture; in the US, it’s communities in low- and moderate-income neighbourhoods (via the Community Reinvestment Act). The pandemic took this further, with banks in many countries working alongside governments to distribute relief programmes. Occasionally, banks are also employed to help effect foreign policy – which brings us back to Ukraine. Over the past decade, sanctions have been increasingly used as a tool of foreign policy, and banks are their primary enforcers. Yesterday, the US government announced a raft of “unprecedented and expansive” sanctions against Russia. Chief among them is a set of financial sanctions that seek to impose costs on Russia’s financial institutions and isolate them from the global financial system. The US Treasury estimates that Russian financial institutions conduct around $46 billion worth of foreign exchange transactions a day, 80% of which are in US dollars. Russian banks don’t deal directly with foreign states; they deal with foreign banks. And so, it’s foreign banks whose responsibility it is to carry through the sanctions. Sanctions have a long history, going all the way back to Ancient Greece. They became more popular after the end of the First World War, when the newly established League of Nations created mechanisms to levy sanctions on rogue states. “Apply this economic, peaceful, silent, deadly remedy and there will be no need for force,” said President Woodrow Wilson at the time. “It is a terrible remedy. It does not cost a life outside the nation boycotted but it brings a pressure upon the nation which, in my judgement, no modern nation could resist.” Sanctions require a high level of global interconnectivity to be effective, and their deployment has tracked the rate of globalisation. It is perhaps no coincidence that their emergence at the end of World War I coincided with an historic peak in globalisation. Similarly, they picked up momentum again in the aftermath of the global financial crisis, when globalisation more recently peaked. In the past, most sanctions revolved around trade but increasingly, financial sanctions have become more widespread. Rising concerns in the early 2000s around the damage and suffering that comprehensive sanctions can inflict on innocent civilians led to a reevaluation of how they are used. More targeted sanctions, including within financial services, were viewed as a superior alternative. By freezing assets or limiting financial transactions, financial sanctions stymie economic activity at the source. For the US, as issuer of the world’s reserve currency, they are an especially potent tool. With their more targeted appeal, the use of sanctions ramped up from around 2010. For banks caught in breach, the penalties could be severe. In 2015, BNP Paribas was found guilty of sanctions violations by the US Department of Justice after processing billions of dollars of transactions through the US financial system on behalf of Sudanese, Iranian and Cuban entities. The bank was sentenced to a five-year term of probation, and fined $8.9 billion. It was the first time a financial institution had been convicted and sentenced for violations of US economic sanctions, and the penalty was the largest ever imposed in a criminal case. Russia itself is no stranger to sanctions. Following its invasion of Crimea in 2014, the US and Europe imposed a series of measures. They blacklisted specific individuals, sought to limit Russia's state-owned financial institutions’ access to Western capital markets, targeted the bigger state lenders, and imposed limits on the trade of technology. The IMF estimated that these sanctions cost Russia between 1.0% and 1.5% of GDP by mid-2015. Some commentators argue that as a response to these sanctions, Russia transformed its economy onto a more resilient footing. Its central bank built up foreign exchange reserves to the value of $600 billion, or 40% of GDP, which compares with 9% among European central banks. Moreover, the structure of those reserves shifted, with euros and gold contributing a bigger share than dollars. The use of the dollar in trade and financial transactions also sharply declined, and Russian entities became less reliant on foreign bank loans. That includes Sberbank, Russia’s largest bank, whose US dollar denominated deposits and loans have both been cut materially since 2014. Yet in spite of their reduced exposure to foreign assets, the current sanctions will be very punishing for Sberbank and other Russian banks. Sberbank is being prohibited from maintaining correspondent accounts at US institutions, effectively preventing its ability to transact in dollars. Other banks will be fully blocked, which also includes a freeze on assets. Some people have called for Russian banks to be thrown out of SWIFT, the global financial messaging network, as Iranian banks were in 2012. Yet, according to President Biden, “Right now that’s not the position that the rest of Europe wishes to take.” SWIFT – the Society for Worldwide Interbank Financial Telecommunication – enables banks around the world to communicate about cross-border payments. It was set up in 1973 as an alternative to the Telex system used previously, its initial structure comprising a messaging platform, a computer system to validate and route messages, and a set of message standards. The standards were developed to allow for a common understanding of data across linguistic and systems boundaries and to permit a seamless, automated transmission and processing of messages between users. Today, it connects 11,000 institutions across 200 countries. Importantly, SWIFT is neither a payment system nor a settlement system; it is simply a messaging system. Payments themselves continue to be settled through correspondent banking relationships or national payment systems. SWIFT is structured as a non-profit cooperative organisation, headquartered in Brussels. Shareholdings are determined by a set formula based on each nation’s usage of its messaging services. Usage also determines the number of board directors that each nation is entitled to. As a Brussels-based entity it is subject to Belgian law and so when EU Regulation 267/2012 was passed in 2012 prohibiting financial messaging providers from providing services to EU-sanctioned Iranian banks, it was forced to comply. By itself, this did not preclude transactions being undertaken with Iranian banks – that was covered under a separate part of the legislation – but it would have made transactions slower and more clunky. Back in 2014, Alexei Kudrin, Russia’s former finance minister, forecast that excluding Russia from SWIFT would cause its GDP to shrink by 5%. Given the energy payments it processes, Russia is certainly a big user. With nearly 300 members, it is ranked second by number of SWIFT users after the US. Yet there are a couple of reasons why Europe may not want to cut Russian banks out of SWIFT. First, Western policymakers fear that a competitor to SWIFT could emerge out of Russia and China. In response to its 2014 sanctions, Russia established a domestic financial communications platform known as SPFS (System for Transfer of Financial Messages). It has more than 400 member banks, including several from former Soviet states, and handled a fifth of domestic financial communications at the end of 2020. Like China’s version, CIPS (Cross-border Interbank Payment System), it’s small, but together the platforms could provide at least a regional alternative to SWIFT. Second, not all financial transactions with Russian banks are banned as part of this series of sanctions. In particular, a carve-out has been agreed for energy. President Biden included a specific exemption for energy supplies so wide ranging it even included “wood” as a form of energy exempted. In addition, Russia’s third largest bank, Gazprombank, which processes payments for energy company Gazprom, was excluded from bank-specific sanctions. With Russian banks prevented from maintaining US correspondent bank accounts, a workaround was even proposed by the US Treasury involving “third-country intermediary banks” aka European banks. Given the workflow, it looks like SWIFT will come in handy. The exemption around energy illustrates the trade-offs involved in sanctions. They may be lower risk than a military campaign, but more severe sanctions can inflict pain on the countries imposing them. Disagreement over Russia’s expulsion from SWIFT also highlights another challenge in maintaining unity among the US and its allies. When I last heard from him, my friend was making good progress. What he thinks about financial sanctions is something I’ll have to ask him when he gets out. You’re on the free list for Net Interest. For the full experience, become a paying subscriber. |

Older messages

PayPal, 20 Years On

Friday, February 18, 2022

Plus: MoneyGram, Mortgage Rates, Storm Eunice

Positioning for Rising Rates

Friday, February 11, 2022

Plus: Sculptor Capital Management, Maker DAO, Credit Suisse

Follow the Money

Friday, February 4, 2022

The Story of Swiss Private Banking

The Power Law

Friday, January 28, 2022

Plus: Robinhood, Credit Rating Agencies, Foreign Travel

Great Quarter, Guys

Friday, January 21, 2022

Plus: CBDCs, Insurtech, Bank Regulation

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏