MicroAngel State of the Fund: February 2022

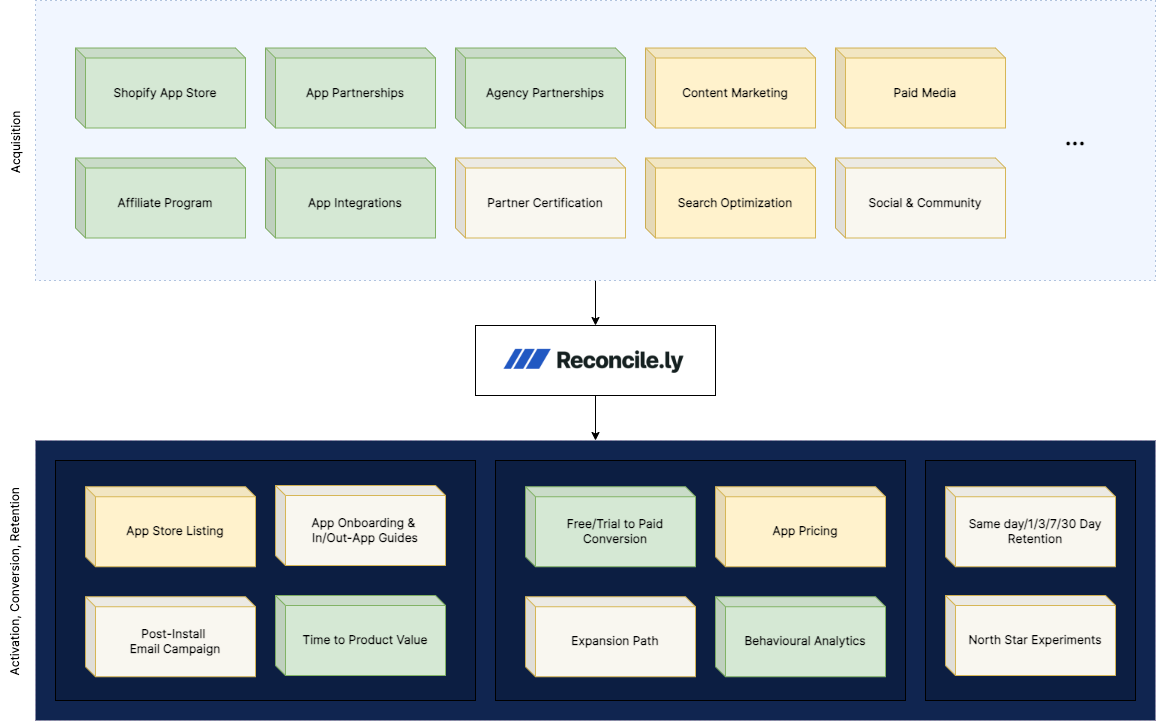

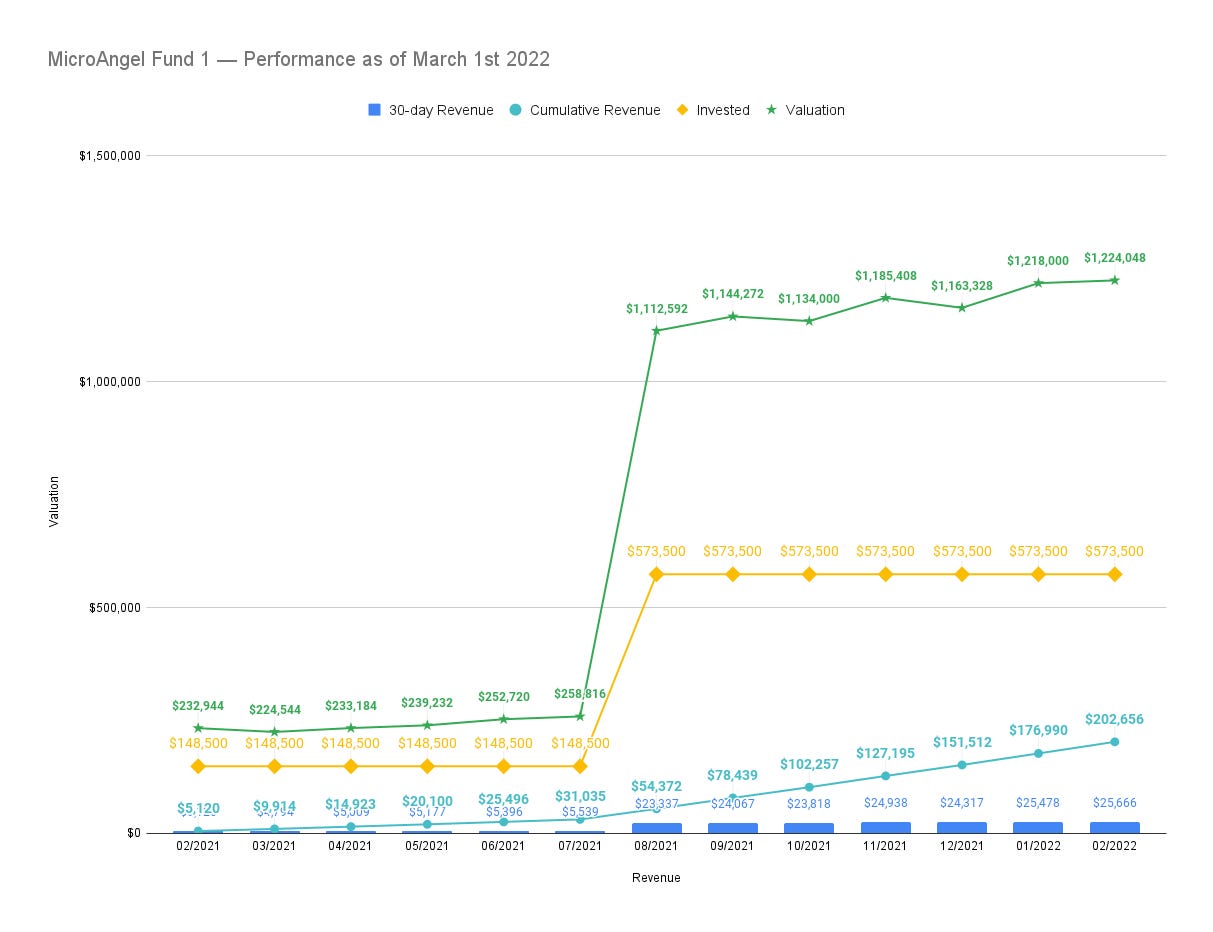

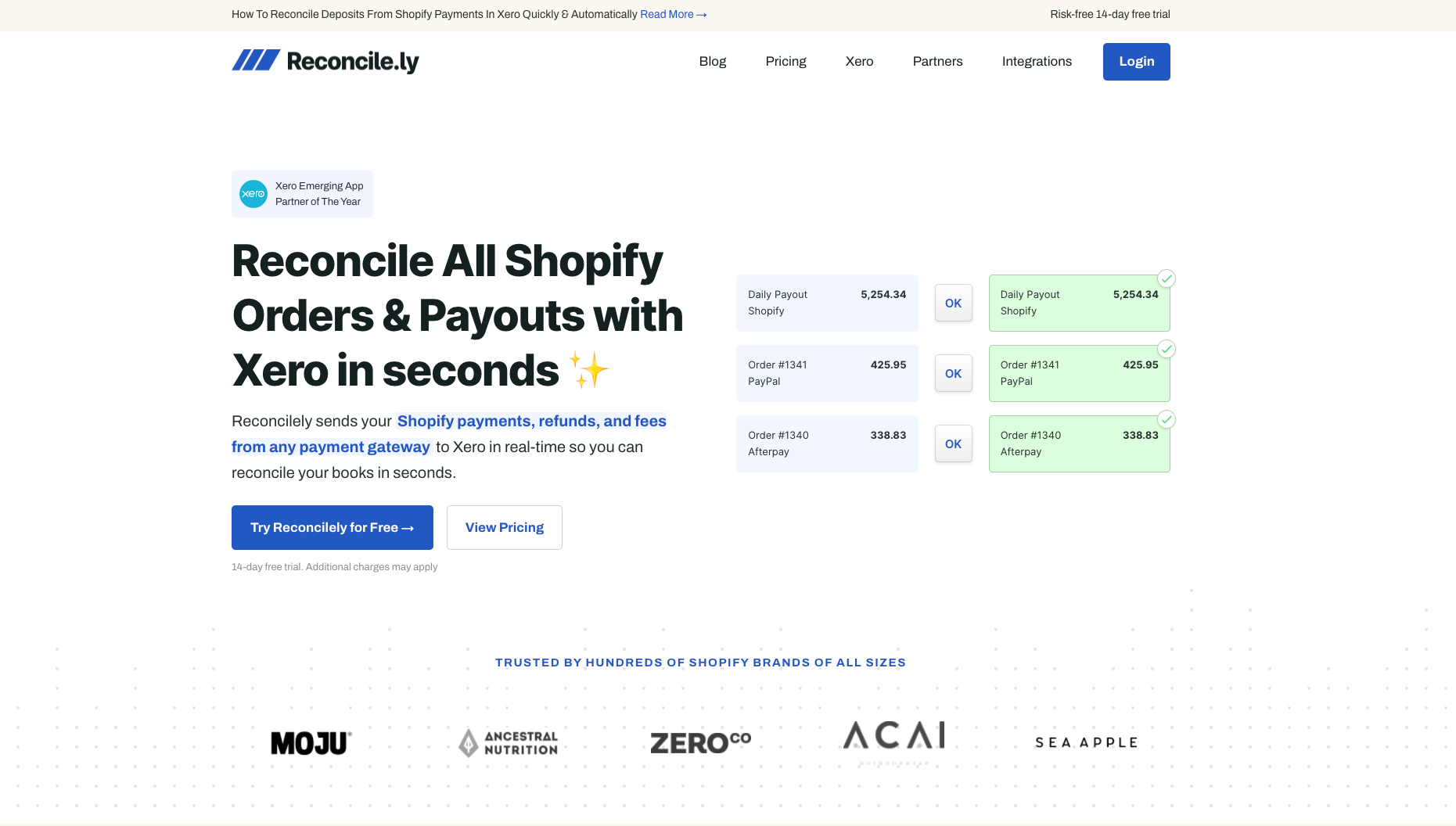

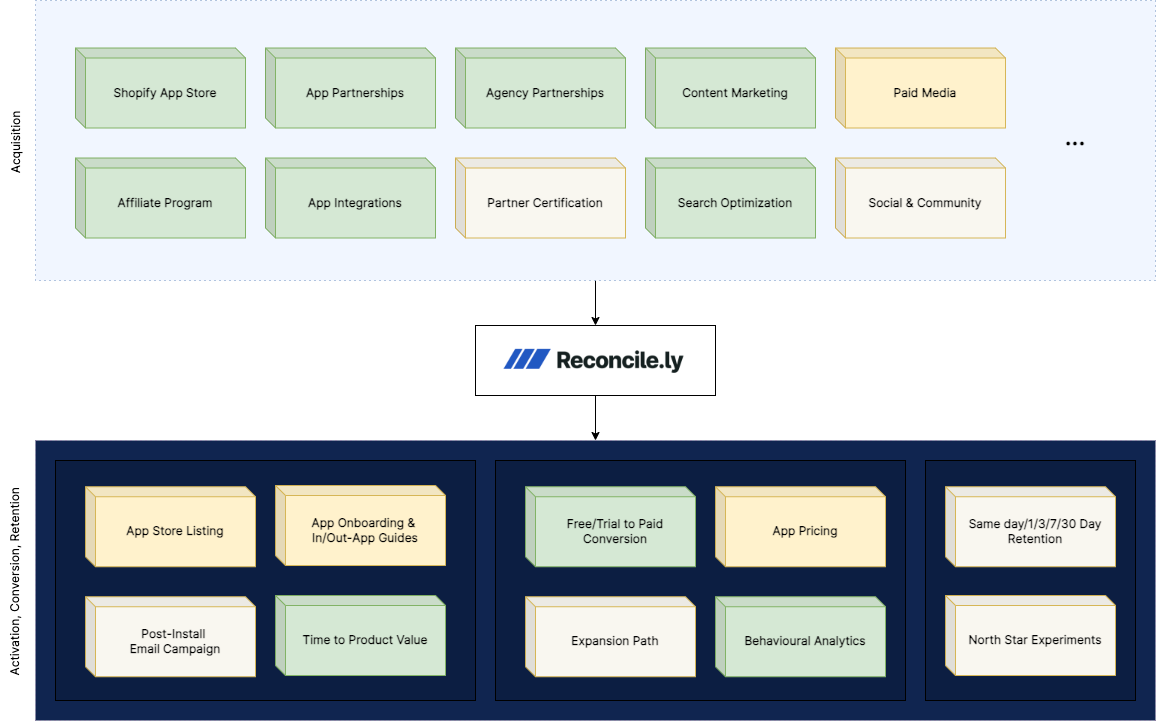

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! MicroAngel State of the Fund: February 2022New Reconcilely website, reached $200k cash-on-cash, new content and outbound sales process. Closing MRR: $25.5kWith the beginning of the year behind us and momentum shifting towards marketing and communications, February has seen the MicroAngel team complete and ship a variety of projects aimed at continuing the Growth kickoff. As I welcomed Eric Eidelberg to the team several months ago, I made the choice to incorporate MicroAngel to create a cap table that would reward my partners and align their goals with mine. While incorporating was certainly necessary for being able to sell equity to new partners, it did complicate things quite a bit for me as an owner-operator who preferred to keep things stupid simple in the back-office. One of the main advantages of incorporating a Canadian company is the R&D claims we’ll be able to make to the federal government. As mentioned previously, there are several recycling mechanisms that exist to extend or literally perpetuate your runway. In more ways than one, it became clear that I could triple-dip between the valuation increases, cash-on-cash returns, and any government funding that we might be able to tack on to the equation, thereby likely extending our ability to recycle nearly every dollar spent on the project, greatly increasing total returns. In that scope, I’ve been trying to understand how much of the work we do is even eligible for this kind of government funding. The advantage it represents is so serious that the result of our claims might justify pivoting some of the operations of the company — and betting even more on R&D rather than marketing — as a means of increasing valuation, earning cash-on-cash returns and making the most out of the available government funds at our disposal. Scientific Research and Experimental Development tax credits can only be claimed if the company has payroll — and the percentage of the payroll that can be claimed is in direct correlation to how much of the work was R&D versus anything else. This also assumes payroll needs to be running. You lose much of the advantage if you operate using contractors — which I do — so the goal is to maximize payroll within Canada to make the most out of a mechanism that could realistically return 70% of our payroll costs. With those grants and tax credits on the horizon, I’ve started scouting an additional engineer to add to the team, with the express purpose of adding firepower to the Reconcilely roadmap and graduating Eric out of it and full-time into Postcode Shipping. Naturally, the bulk of my attention went towards growth as I was excited to follow-up on the creation of new systems that will drive new installs and customer acquisition. Here’s how I visualized my progress last end of month: This month, I put most of my efforts towards activating content marketing, search optimization and paid media. Those efforts were made possible by the launch of a new website built on Webflow, the purpose of which was to modernize the Reconcilely brand, create a more performant website for lead generation, and open the door to content marketing through the launch of an ecommerce accounting blog. Current fund lifecycle stage

Fund Activity

Activity overview in no particular order:

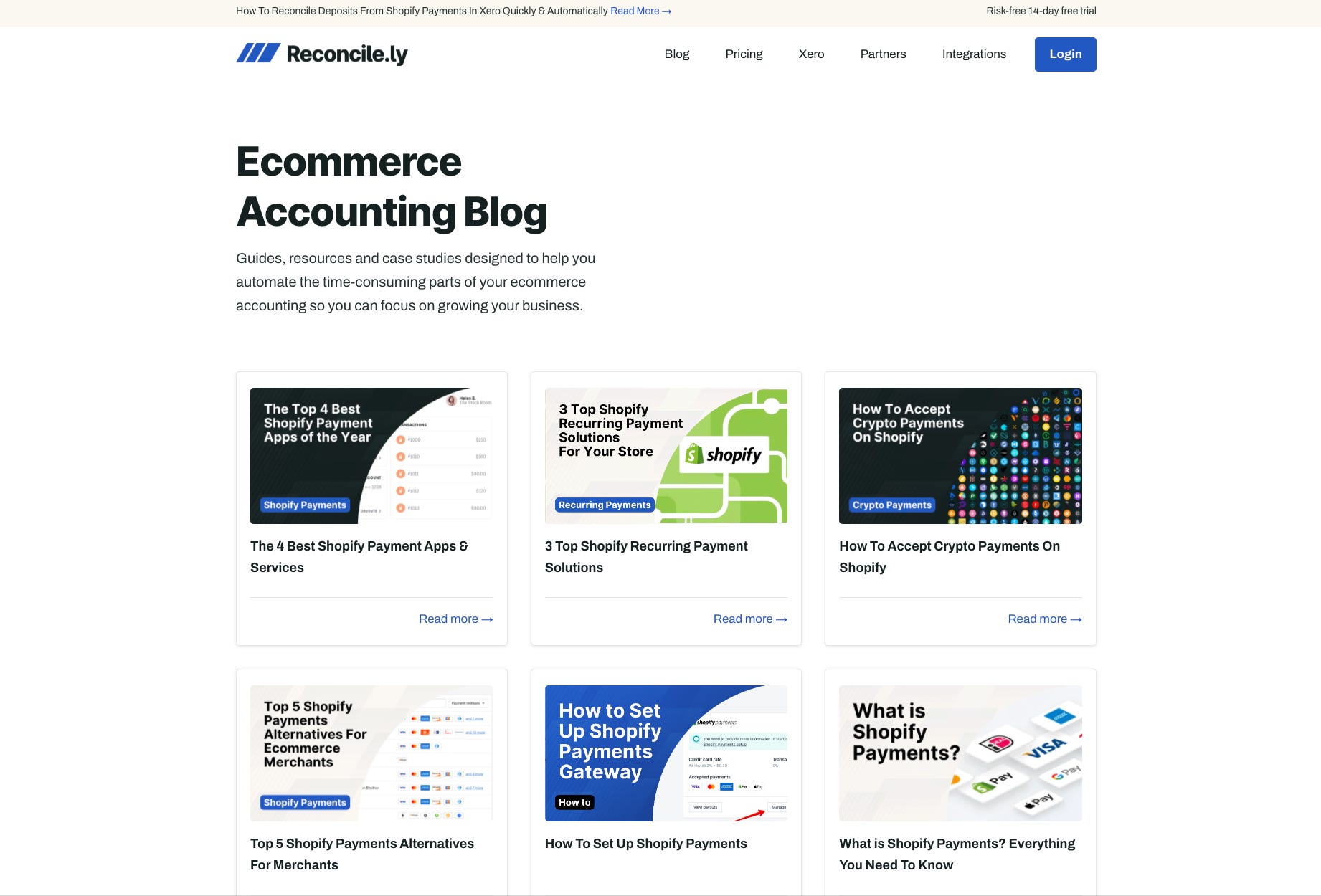

Despite a very busy month on the creative side, lots of energy was spent on infrastructure for big new integrations we’re excited to be working on, as they will have a direct impact on installs and MRR. As Eric focuses on removing any roadblocks ahead of those new integrations, I made great headway on the marketing side. Content productionTo power our new blog, I created a new content production process and, with the help of contractors, released 8 new articles to the blog targeting a variety of long tail keywords relevant to Reconcilely’s organic strategy. Within the current arrangement and at our current pace, I estimate we could probably produce as much as 40,000 words per month. The goal for now is to reach customers that would benefit from our existing product value proposition. As we increase integrations, it will be clear what type of content we should produce and publish to meet customers halfway as they search for our solution. The content production process can be summed up as follows:

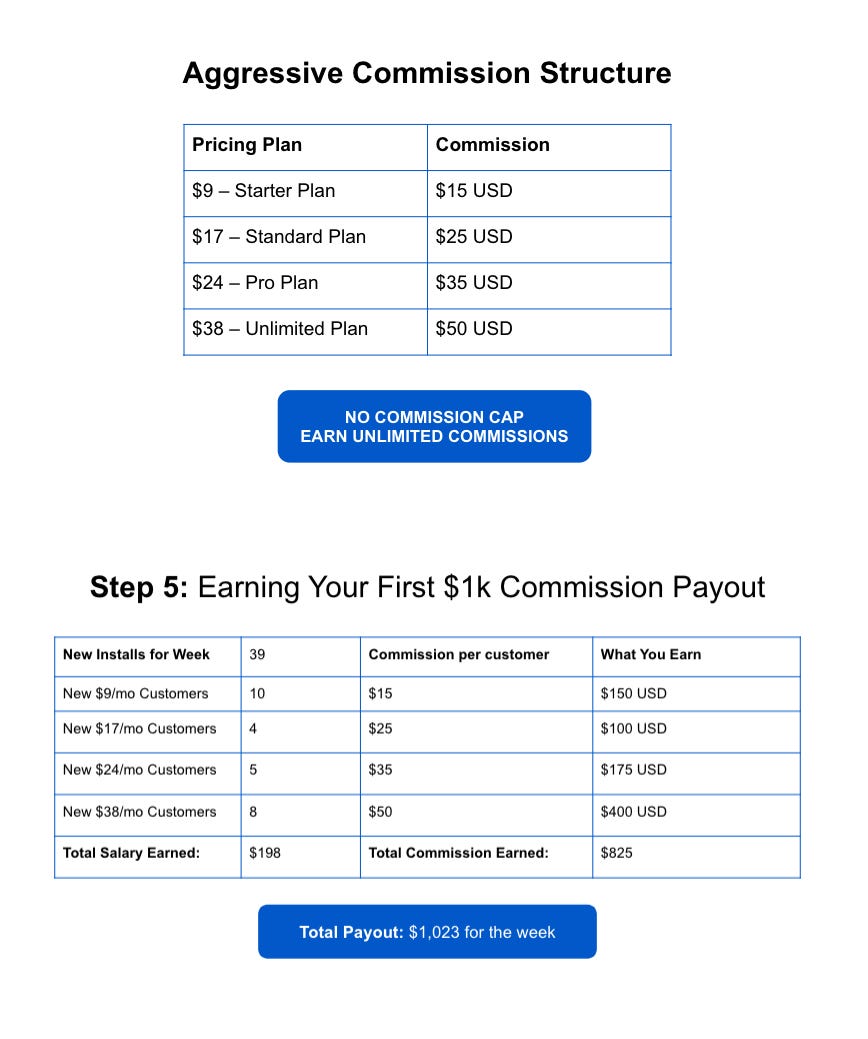

To house the new blog, Reconcilely saw a new website and brand go live as part of the campaign. With an updated centralized location for the top of the funnel and mechanisms to turn new visitors into newsletter subscribers, installs and/or Reconcilely customers, I turned to create an additional acquisition channel that looks and smells a lot like affiliate marketing. Outbound Sales & AffiliateThis feels like the Achilles heel of so many indie hackers. Outbound is seen as a devilish activity that will return very little for too much input. In a world where inbound marketing and product-led growth, one might wonder what the purpose of outbound is and what role it could ever play vis-a-vis other more elegant means of acquiring users. The number one purpose of outbound lead generation is to build a process by which an existing list of prospects can be turned into new customers. This is very difficult to do on an inbound or PLG basis since you already know who you are going after and want to pitch your solution up-front so you can immediately put points up on the board. Consider the Australian Shopify market, which is comprised of roughly 100k active stores of all sizes. That’s not a lot, but it’s not small either. Provided a list of those 100k stores, there’s a clear outreach path whereby the list can produce a decent number of new customers. The simple reason that’s true is because of those 100k stores, a percentage — never mind how small — will be looking for your solution right now and if you aren’t in front of them at that moment, the opportunity will be lost to a Google search. In short, it’s important to respect the context in which outbound works, but also what the upper ceiling of performance will be, and the consequence of burning through 100k stores and not having any other means of acquiring customers is of course severe. One of the main things blocking the use of outbound sales is the cost implied in that process. You need people talking to people in a high-touch format, and that assumes a much higher cost of acquisition than, say, self-service SaaS driven through ads. The fact is you need individuals that you pay to be talking to other individuals to elicit a conversion rate out of that process which historically has been pretty shit. For this to even be possible for a product like Reconcilely — which offers ARPUs of ~$20 and LTV of ~$350 — the cost of those individuals needs to be really low. Finally, a use for those VA outbound messages on LinkedIn. I decided to come up with an offer that would make hiring those VA types not only possible, but advantageous vis-a-vis the kind of income they’re used to and the kind of offer I could make them. I created a presentation that I would use to shoot a video sales letter, which in turn would be hosted on a page I could send prospective VAs to. This would make it possible for me to source new VAs from existing Facebook groups where folks are looking for sales jobs as well as direct anyone from elsewhere to the video so they can better understand the opportunity. The goal is to circumvent the outbound sales limitations by leveraging an economic reality (low cost workers) which would itself take advantage of my offer. This is a seriously good offer for individuals in parts of the world who already bet on virtual assistance as a means of making ends meet. And it’s a win-win for both our company and them. My goal at this point is to validate the manual process I’ll require of the VAs and to use that validation time as a way of training new hires to quickly ramp up and start driving installs. Of course, I need to be very deliberate about that and be careful not to raise an army of spammers — which of course is the opposite of what I’m after. Instead of spamming, the goal is to leverage low-cost labor as a means of checking under every rock, and having the ability to chat 1:1 with real merchant prospects who would happily use Reconcilely to solve their ecommerce accounting were they introduced to it at the right place and time. I’m using a similar value proposition for powering my affiliate offer, which considering an existing audience of merchants could well turn into a valuable source of commissions: Joint Marketing VenturesBeyond all that can be done on your own, something else I’ve been meaning to explore is joint marketing collaborations with other app developers. Sure, marketing collabs are the basis of many partnerships, but what I’m after is some systemic advantage that could be acquired by working with others that I otherwise could never acquire on my own. Let me explain: Part of why marketing channels like Facebook Ads are losing value is because acquisition costs are rapidly skyrocketing. It’s real-time bidding on a very finite number of people whom are interacting less and less with ads. It’s inevitable. The number of people trying to reach Audience ABC on Facebook is rising, and the likelihood anyone in Audience ABC will interact with ads is rapidly falling. Thus, costs are increasing. While this may fully disqualify Facebook as a channel for some app developers, it teeters on the edge for others. It’s not profitable, but it kinda could be. It’s not enough to invest in, but clearly represents some potential if a few things could be figured out — namely cost per click and or cost per lead. In considering different ways to reduce CPL, I’ve been meaning to use joint ventures as a way to reduce those costs. Imagine I spend $2,400 on, say, Facebook Ads, to drive webinar attendees for a Shopify-focused program intended to show merchants how they can save money on shipping costs (for example). The goal is to drive new customer acquisition for Postcode Shipping in this particular example. The breakdown might look something like this:

The results wouldn’t be terrible, but they wouldn’t be good either—and jeopardized by 5 different spots in the funnel that could fail to perform as required to produce the projected acquisition cost. These numbers are pretty optimistic, but they can often become impossible if the top of the funnel breaks down at the start (i.e. clicks end up turning $4+, then what?) The risk implied by the funnel performance, and the CAC it enables, could potentially be quelled by working with other app developers and splitting the campaign bill. If I partnered with 2 other developers and delivered the same funnel, the webinar value would go up (from additional perspectives) and my acquisition cost would be cut by 2/3 as my partners would each pay their share of the campaign cost. The goal of course is to reach a larger number of customers (as the targeting would now include my partners’ traffic too) while decreasing the total cost per lead — which can be done by sharing leads that sign up for the webinar (as an example) between partners. In that example, I could then realistically expect the same 72 installs — and 29 eventual customers — but at a cost of $2,400 / 3 = $800. At that rate, we’d be looking at a CPI of $11 vs. $33 and a CAC of $27.30 vs. $82. It could transform the viability of ad networks the economics of which have started to price out bootstrappers. With the website up, it makes sense to kickoff paid media experiments to figure out at least one repeatable process to profitably acquire new customers at scale. Ended the month in a pretty good place as it relates to the top of the funnel. In March, I hope to kickoff the outbound sales process for direct-to-merchant while designing the first iteration of the same outbound process but which would focus on accountants serving ecommerce clients. That will open the door for a ‘partner certification’ which will likely require the creation of a basic Reconcilely course that helps turn any accountant into a Reconcilely expert. Similarly, opening the B2B opportunity which accountants represents will require some product adjustments to make it easy for those accountants to both get rewarded for signing on multiple clients to Reconcilely as well as equipped to manage many Reconcilely accounts from a central location. Lastly, we’re setting our sights on Quickbooks after having laid the initial groundwork for that integration, which I’m very excited to start working on as it represents a very real opportunity to double our run rate. Learnings and adjustmentsSince the start of the year, I’ve spent very little time on engineering/development and even less time on support operations. This communicates that the systems I’ve spent the past few months building, and the teammates I’ve partnered with, are now at the forefront of supporting the new ground I break every day. I’ve become more focused in the type of activities I allow myself to do, but am so glad most of that time is spent on marketing as the systems I build every day are starting to slowly starting to materialize into installs and new customers. It’s more important than ever that I continue to focus on high value tasks now that most of my blockers are out. I’m focused on leveraging and using my assets moreso than building new ones. I’m iterating as much if not more than creating. Full steam ahead. Until next time! Thanks to MicroAcquire, Arni Westh, John Speed, Henry Armistread & the many other silent sponsors. → Sponsor MicroAngel ← You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

MicroAngel State of the Fund: January 2022

Friday, February 11, 2022

One year anniversary, $300K ARR and 30% cash-on-cash milestone, and a focus on growth systems. Closing MRR: $25.37k

MicroAngel State of the Fund: December 2021

Tuesday, January 18, 2022

Seasonal MRR and user acquisition fluctuations, Black Friday + Cyber Monday and deep product work. Closing MRR: $24115

MicroAngel State of the Fund: November 2021

Friday, December 10, 2021

Cash-on-cash wins, shipping product improvements, removing zombie accounts and a brand refresh. Closing MRR: $24.7k

How to plan and implement a customer data tracking strategy for your Micro-SaaS

Tuesday, November 16, 2021

From start to finish, learn how I'm tracking customer key events and behaviour across the portfolio

MicroAngel State of the Fund: October 2021

Saturday, November 6, 2021

A spooky month of large refactors, churn & support team tooling. Reached $100k+ Cash on cash. Closing MRR: $24k

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved