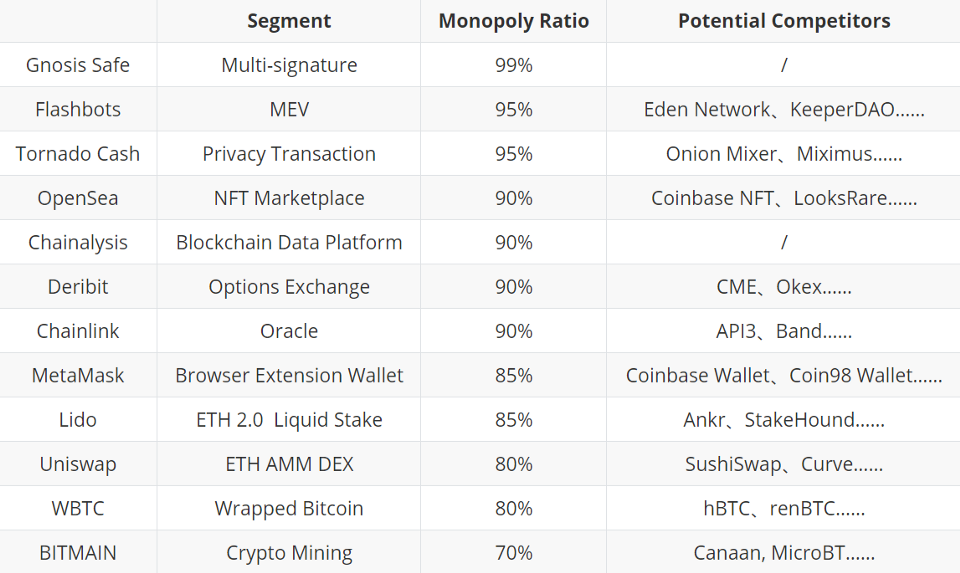

Twelve Crypto Monopolies: OpenSea Bitmain MetaMask Deribit and more

Recently, @0xTomoyo, an ethereum developer, listed the platforms that he thought were near monopolies in the current cryptocurrency industry, and this article uses this idea to expand the idea and try to sort out the current monopoly list in the cryptocurrency industry. OpenSeaSegment: NFT Marketplace Monopoly Ratio: 90% We can roughly divide this monopoly era of OpenSea into pre- & post-era.

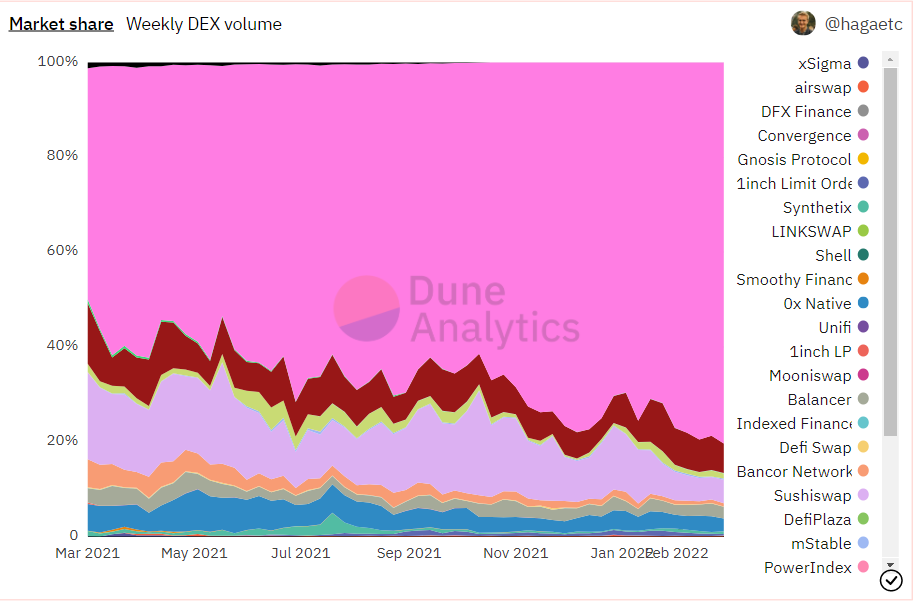

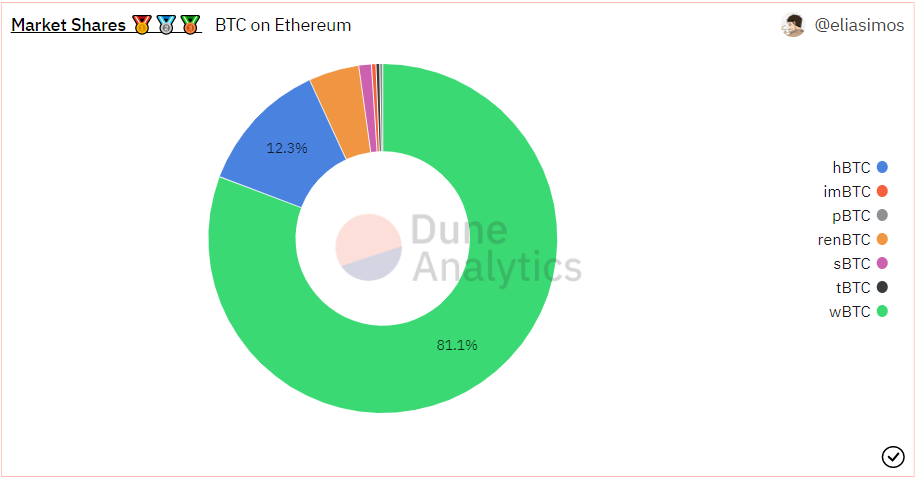

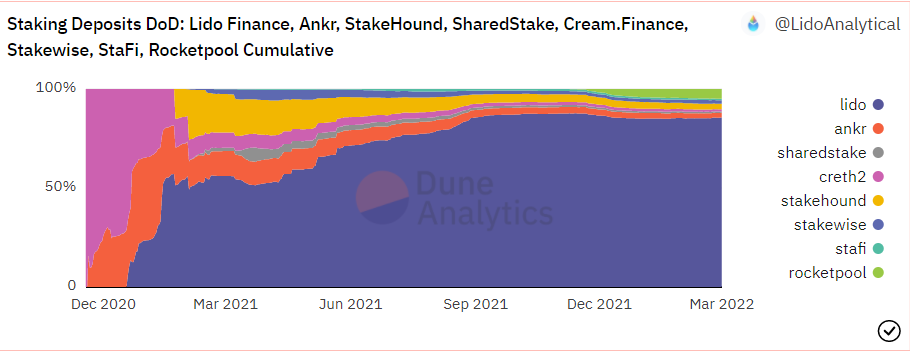

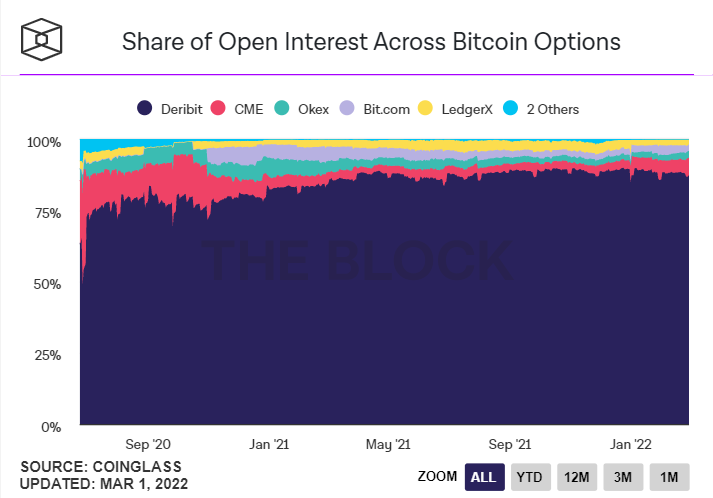

With OpenSea’s volume now at a new level (over $6 billion), competitors like Rarible are no longer a threat. Although the market has also seen the rise of grassroots such as LookRare and X2Y2, with volumes even surpassing OpenSea at one point, the essence is all about wash trades, and even veering into the path of playing with the tokenomics. Nevertheless, in this post-OpenSea monopoly era, there are quite a lot of exciting competitors entering, such as Coinbase’s NFT market, FTX’s NFT market; at the same time, with the maturity of the multi-chain trend, OpenSea may miss the market share of NFT volume outside of ethereum, such as Magic Eden is currently the largest NFT market on the Solana network. Although the volume is still much smaller than OpenSea, the number of transactions is sometimes two or three times that of OpenSea UniswapSegment: AMM DEX Monopoly Ratio: 80% According to Dune Analytics, Uniswap’s market share is currently 80% by volume, and in the stablecoin AMM segment, Uniswap’s market share is close to 90% even after the new fee (e.g. 0.01%) option was passed at a time when Curve War was in full swing. While there is no technological monopoly on AMMs, and there are numerous micro-innovations on the market, Uniswap Labs’ continued innovation in the DEX space (pioneering of AMMs, centralized liquidity, etc.) may be the key to maintaining its market share. However, it should be noted that Uniswap does not have access to other chains such as BSC & Solana, so if you expand your perspective to other chains, it does not have as much of a monopoly overall. MetaMaskSegment: Browser Extension Wallet Monopoly Ratio: 85% In the Ethereum ecosystem and all EVM-compatible ecosystems, MetaMask browser extension wallet has almost achieved a crushing monopoly by virtue of its first-mover advantage; however, MetaMask has not yet launched an offensive in this market outside of EVM. We don’t know if the new products in this track can take advantage of some new trends and quickly capture some market share. There are also many new wallets in the market, such as Coinbase Wallet, Coin98 Wallet, Rabby, Wheat Wallet Plugin, TP Plugin Wallet, XDEFI, Liquality and etc. Areas where MetaMask does not have a monopoly include the Chinese market, where TP wallets have more influence, and non-EVM chains such as Solana, which have their own wallets. WBTCSegment: Wrapped Bitcoin Monopoly Ratio: 80% WBTC, a wrapped bitcoin jointly launched by BitGo, Kyber Network and Republic protocol and other project parties, officially launched in January 2019, is the first ERC20 version of wrapped bitcoin and is currently the most supplied wrapped bitcoin on ethereum, with a market share of 81%, while other wrapped bitcoin on ethereum currently are hBTC, renBTC, sBTC, imBTC, tBTC, and pBTC. LidoSegment: ETH 2.0 Liquid Stake Solution Monopoly Ratio: 85% Lido is a liquid staking solution for Ethereum 2.0 that allows ETH holders to stake any amount of ETH without having to operate staking infrastructure or foregoing the liquidity of their funds.This segment also has other players, such as Ankr, StakeHound, SharedStake, Stakewise, StaFi, Rocketpool and etc. but Lido currently has a near monopoly with a current market share of 85%. DeribitSegment: Options Exchange Monopoly Ratio: 90% Deribit is world’s biggest bitcoin and ethereum options exchange. According to The Block, Deribit accounts for a whopping 87% of the total open interest across bitcoin options in the current market, and 96% of the total open interest across ethereum options. FlashbotsSegment: MEV Monopoly Ratio: 95% ps: Maximal (formerly “miner”) extractable value (MEV) refers to the maximum value that can be extracted from block production in excess of the standard block reward and gas fees by including, excluding, and changing the order of transactions in a block. Flashbots is a research and development organization formed to mitigate the negative externalities and existential risks posed by miner-extractable value (MEV) to smart-contract blockchains. Although there are players such as Eden Network and KeeperDAO in the MEV segment, they are basically not in the same league as Flashbots. ChainlinkSegment: Oracle Monopoly Ratio: 90% Although there are many new players in the oracle segment, such as API3, Band, NEST, DOS, Tellor and etc. The majority of DeFi projects are still using Chainlink’s feeds, after all, the authenticity and stability of the feeds directly affects the survival of DeFi projects, so it is naturally the safest approach to choose the leading service. It is worth mentioning that quite a few DeFi projects are now also compatible with Uniswap’s TWAP (Time Weighted Average Price) . Gnosis SafeSegment: Multi-signature Monopoly Ratio: 99% Gnosis Safe is a smart contract wallet running on Ethereum that requires a minimum number of people to approve a transaction before it can occur (M-of-N).It is currently used by many DeFi protocols and DAOs to manage their funds. There doesn’t seem to be a slightly better known product competing in the asset multi-signature management segmentat the moment. Tornado CashSegment: Non-custodial Ethereum Privacy Solution Monopoly Ratio: 95% Tornado Cash is a biggest fully decentralized protocol for private transactions on Ethereum. There are also new players in this segment such as Onion Mixer and Miximus, but they are not in the same league as Tornado Cash yet. ChainalysisSegment: Blockchain Data Platform Focused On Compliance & Safety Monopoly Ratio: 90% Chainalysis provide data, software, services, and research to government agencies, exchanges, financial institutions, and insurance and cybersecurity companies in over 60 countries. Their data platform powers investigation, compliance, and risk management tools that have been used to solve some of the world’s most high-profile cyber criminal cases and grow consumer access to cryptocurrency safely. BITMAINSegment: Crypto Mining Monopoly Ratio: 70% BITMAIN is the world’s leading manufacturer of digital currency mining servers through its brand ANTMINER, which has long maintained a global market share and leading position in technology, serving customers across over 100 countries and regions. BITMAIN have sales of approximately $5 to $10 billion in 2021, capturing over 70% of the Bitcoin mining servers market. Other players in this segment are Canaan, MicroBT, Intel and etc. Follow us If you liked this post from Wu Blockchain, why not share it? |

Older messages

Crypto Giant Forced to Participate in U.S. Sanctions Against Russia, Is American Centralization a concern?

Friday, March 4, 2022

In addition to the huge amount of cryptocurrency donations in this Russia-Ukraine conflict (accounting for more than half of the total donations), the crypto's involvement in the sanctions has also

Crypto Donation and Payment Become Flashpoints in Russia-Ukraine Conflict

Tuesday, March 1, 2022

In this conflict between Russia and Ukraine, US stocks and cryptocurrency prices have not collapsed as feared, but instead cryptocurrencies have become an important flashpoint as a means of donation

Global Crypto Mining News (Feb 21 to Feb 27)

Monday, February 28, 2022

1. Guangzhou Huangpu Customs recently seized 49 sets of second-hand crypto currency Ant mining machines with fake names in the shipping channel, according to a report by China News Network. According

OpenSea Challenger's Dilemma

Friday, February 25, 2022

Airdrops are a trend and the anti-OpenSea is a new narrative. Since OpenDAO fired the first shot of DAO OpenSea, LooksRare, X2Y2 and other platforms followed, sending airdrops for OpenSea's trading

Which VCs Invested the Most Blue-chips

Thursday, February 24, 2022

Here's a ranking of the VCs who bought the most blue-chip (large-cap) projects (updated Feb. 20). This ranking represents the comprehensive strength of VC, including the amount of capital, brand

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏