Earnings+More - Mar11: Weekend Edition no.37

Mar11: Weekend Edition no.37Genius Sports Q4, NeoGames Q4, Accel Q4, DraftKings analyst meeting Full House earnings call +MoreGood morning. The US sports-betting market is on the cusp of March Madness and expectations are high following a hugely successful but expensive NFL season. Better, perhaps, news came through late yesterday that the MLB has come to an agreement with its players and the season will now get underway on April 4, saving the sportsbooks a blank sporting summer. Bring on the major leagues. Click below:  Genius Sports Q4

#StandWithUkraine While it is early days, the company noted that the war in Ukraine would mean a $2m-$6m annualized hit to revenues. It previously announced it has suspended all its business relationships in Russia and Belarus. The abyss: Genius’ pre-tax losses for the quarter came in at $64.6m while full-year losses came in at a whopping $604.5m. The company said the tumbling adj. EBITDA figure was due to “accelerated investment” undertaken in Q4. The company maintained its target of being adj. EBITDA positive for 2022.

Bovvered: Asked about how the slowdown being spoken about in promotional and marketing spend would affect the company’s advertising arm, CCFO Jack Davison suggested it wouldn’t affect Genius’ main area of focus of programmatic.

** Sponsor’s message Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club. As a proud sponsor of Earnings+More from Wagers.com, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat. AGS Q4

Blip service: Momentum continued in all three business segments of gaming machines, table games and interactive and on the call CEO David Lopez said this had continued into Q1 despite “the little blip” caused by the omicron variant. He noted that recent events in Ukraine appeared not to have affected the domestic markets where AGS has a footprint.

Market reaction: AGS fell over 10% in after-hours trading on the basis of the Q4 miss. NeoGames Q4

Czech mates: The company initiated FY22 guidance at between $90m-$97m. This number will change with the Aspire Global deal, which should complete by the end of H2. On the call, CEO Moti Malul noted the business had operational staff in Ukraine and has been busy relocating them and operations outside the country with the help of client Sazka/Allwyn. Winning the argument: Over the quarter, the company announced deals with Milli Piyango in Turkey and the Atlantic Lottery Corporation in Canada and it hopes for further expansion into US lotteries as they open up further to digital.

Full House Resorts earnings callFull complement: As of Dec21, Full House had six sports-betting skins up and running; however, in the wake of the decision from Churchill Downs to call a halt to its ambitions in that area, two licenses (one in Indiana and one in Colorado) have since been handed back.

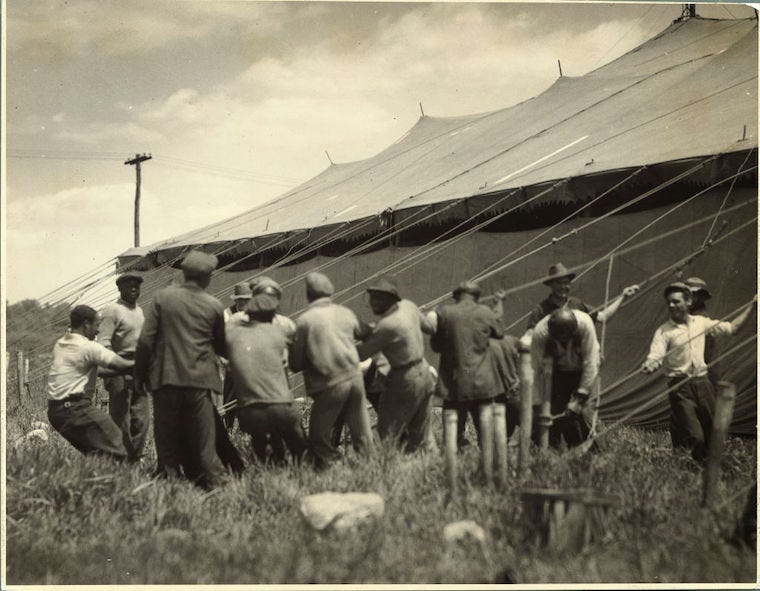

Come on feel the Illinoise: As well as negotiating with potential Churchill Downs replacements, one more skin will now be available via the in-development Waukegan property in Illinois. Lewis Fanger, CFO said Full House had “gotten a ton of phone calls about it.” If it’s good enough for Elon: CEO Dan Lee updated on the progress of the aforementioned ‘The Temporary at American Place’ casino. Talking about the sprung structure soon to be erected, he noted it was similar to one recently used by Tesla and admitted there were limitations when it came to amenities.

Screwball comedy: Noting that even though Full House had been “the best performing stock” in the gaming sector last year, Lee suggested there was more to come if the company doesn't “screw this up”. But he noted events in the outside world.

Earnings in briefInspired Entertainment Q4: Revenue rose 71% to $67m and adj. EBITDA rose sixfold to $22m. Interactive revenue rose 36% and virtual sports was up 26% YoY. The company recently launched games in Connecticut and secured a supplier license in Ontario. Note: the earnings call takes place later today and WE+M will report on this on Monday. Accel Entertainment Q4: Revenue came in at $192m for Q4 and $735m for the year. Adj. EBITDA stood at $33m for Q4 and $140m for the year in line with consensus estimates. The company reiterated 2022 for revenue of between $820m-$870m. Analysts at Macquarie said they were “more confident in cash flows for Accel” than with other land-based or online operators. Deutsche Bank noted the guidance remained despite the negative impact in January from the omicron variant. Bragg Gaming: Q4 revenue increased 14.4% YoY to €15.8m while adj.EBITDA was up 22.2% to €1.5m. FY revenues were up 25.6% to €58.3m, adj.EBITDA was up 29.8% to €7.2m. The group launched its online casino products in the Netherlands and the UK during the period, but handle fell 8.8% due to a new product mix and focus on player account management and managed services. Pollard Banknote: Q4 revenues were up 12.3% to a record $116.5m and the group’s NeoPollard Interactive (NPi) JV revenues were up 15.7% to $127m. Adj.EBITDA was down to $18.7m vs. $20.3m in Q420. FY 21 revenues increased 10.8% to $459m, NPi sales were up 17% to $499.2m, FY adj. EBITDA was up 4.2% to a record $84m. Scout Gaming: Revenues up 1% to SEK17.1m but EBITDA was down 5.8% to minus SEK30.9m. In response to the losses, the company said it has “initiated a review of the cost structure’ of the company. Lightshed on Disney’s ESPN choices5D chess: Wrapped up within what the Lightshed analysts said was a “five-parts multivariable equation’ for Disney CEO Bob Chapek was the future of ESPN. Part of this revolves around whether Disney should cash in now and sell the business, potentially to a sports-betting operator.

For what it’s worth: Lightshed has previously predicted Disney will keep ESPN and that, as rumored previously, it should license the brand to a sportsbook. Global Games SPACMemories of people can remain: Global games - which bought Microgaming’s Quickfire business in November last year - is reported to be in talks with the Tailwind Acquisition Corp SPAC about a deal that would value the combined entity at ~$3bn. Global Games is led by former IGT CEO Walter Bugno and is backed by “private capital”. Sector Watch - Fan tokensAlpine crest: Crypto exchange giant Binance continues to sponsor sports teams. It will be the fan token (and esports) sponsor of the UK-based F1 team BWT Alpine (formerly Renault F1) from this season onwards. In the process, Binance is the first fan token supplier to become team sponsor of a Formula 1 outfit. Token gesture? Socios remains the most high-profile of the fan token providers having signed sponsorship deals with Uefa and a host of major football clubs and national associations. But coverage remains skeptical with critics saying users are unaware of the financial risks. In a recent interview, CEO Alexandre Dreyfus insisted the tokens are not investment products and that though they can be traded, that was not their primary function. Questionable use: One recurring trend is that after an initial surge in value following major signings, for example Lionel Messi’s transfer to PSG last summer, the value of tokens often drops and owners are left with few levers to halt the slide. For critics, this is because the tokens are primarily used as speculation and investment vehicles, rather than offering fans the promised exclusive rewards. Time at the bar: Socios has led the way in popularizing fan tokens through football and has more deals with top level clubs than any other provider. Barcelona FC, which has its own Socios-powered BAR token, is also considering setting up its own cryptocurrency, NFT collection and metaverse. According to club president Joan Laporta, that is one of the reasons why the club has refused sponsorship bids from the likes of Polkadot and Binance. DatalinesIllinois Jan22: Betting handle rose 49.2% YoY to $868m and +10% MoM, GGR including land-based were up 38.1% YoY and + 97% to $66.2 m. The top 3 operators by handle were DraftKings, FanDuel and BetRivers, recording ~82% of the mobile handle vs. 85% in Dec21. Mobile wagering accounted for 96% of total GGR vs. 97% in Dec21. NewslinesAGCO approved: Rush Street Interactive has received a license from Ontario. The group said it was planning to launch its BetRivers online casino and sportsbook in the province on April 4, pending approvals. MoU note: The Canadian Gaming Association has signed a memorandum of understanding with the International Betting Integrity Association to provide a framework for cooperation and coordination on betting integrity issues and protect Ontario and Canadian consumers and betting markets from corrupt sporting activities. Hold the line: The Ontario Lottery and Gaming corporation’s online sportsbook ProLine+ has signed a betting partnership with the NHL. OLG launched Proline+ last Summer after single-event sports betting was regulated for Canadian provinces. Pocketbook: Lottery courier Jackpocket has signed an agreement with WynnBet whereby both companies will reward New Yorkers who sign up to Wynn’s mobile-betting app through Jackpocket with loyalty points and prizes. Giddy up: Caesars launched horse racing account betting app Caesars Racebook on the New York Racing Association’s NYRABets platform. The app will offer pari-mutuel wagering services from more than 250 global tracks. Wyo trio: FanDuel is set to launch in Wyoming in the next few weeks after it was approved by the state’s Pari-Mutuel Commission to operate there. The OSB market leader will be the third betting brand to launch following the arrivals of DraftKings and BetMGM in September. CCJ docks in: Bede Gaming, the Gauselmann Group-owned igaming platform specialist, has appointed Colin Cole-Johnson as its new CEO. Cole-Johnson has held numerous senior positions in the industry over a 20-year career. Bede managing director Alex Butcher will become a non-executive director of the group. What we’re readingRiddle me this: ESPN’s David Purdum runs through the numerous issues that Calvin Ridley’s suspension brings up for pro players, the NFL and the industry. On social Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Mar 9: 888 sorry and enjoys record FY21

Thursday, March 10, 2022

888 FY, Century Casinos, Full House Resorts Q4, Newlines +More

Mar 7: FanDuel asserts NY dominance

Monday, March 7, 2022

New York, RSI acquires Run It Once Poker, Playtech takeover update, Startup focus - WSC Sports +More

Mar 4: Weekend Edition no.36

Friday, March 4, 2022

DraftKings investor day, bet365 analyst reaction, Penn National analyst update, #StandWithUkraine, sector watch - crypto exchanges +More

Mar 3: Bet365 sees in-play fall in 2021

Thursday, March 3, 2022

bet365 annual results, Entain FY, Yahoo Sports rumor, Rush Street Interactive FT, SciPlay earnings call, MGM share buyback +More

Exit SciGames, enter Light & Wonder

Wednesday, March 2, 2022

Scientific Games Q4, IGT Q4, Everi Q4, earnings in brief, Better Collective analyst update +More

You Might Also Like

Sold over 500,000 of products on Amazon

Friday, January 10, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack Sold over 500000 of products on Amazon Did you know that more than 70% of sales on Amazon

🔍 How To Build Your Brand’s Social Narrative

Friday, January 10, 2025

January 09, 2025 | Read Online All Case Studies 🔍 Learn About Sponsorships It's been a minute. Things have changed. Our focus changed. We've narrowed the newsletter down. We're more focused

A Community Just for Agency Owners

Friday, January 10, 2025

Hi there , Most business advice online isn't built for agency owners. Running an agency comes with unique challenges. Whether it's pricing projects or managing client expectations, generic

🎙️ New Episode of The Dime She Hits Different: The Story Behind Cake's Explosive Growth ft. Chloe Kaleiokalani

Thursday, January 9, 2025

Listen here 🎙️ She Hits Different: The Story Behind Cake's Explosive Growth ft. Chloe Kaleiokalani Cake is hitting different. A hockey stick chart is every founder's dream—but what looks

😬 Who's Slammed by the Spam Update

Thursday, January 9, 2025

Massive Local SEO Algo UPDATE ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Email trends and predictions, ‘Returnuary’ is here, advice from newsletter veterans, and more

Thursday, January 9, 2025

The latest email resources from the Litmus blog and a few of our favorite things from around the web last week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bounce Rate is Killing Your SEO 💀

Thursday, January 9, 2025

SEO Tip #68

Python Weekly - Issue 682

Thursday, January 9, 2025

January 09, 2025 | Read Online Python Weekly (Issue 682 January 9 2025) Welcome to issue 682 of Python Weekly. Happy New Year! I hope you had a great holiday and took some time off to recharge. Learn

Bubbles, Crashes & Fiscal Dominance - Should You Be Worried?

Thursday, January 9, 2025

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s Better, X or LinkedIn?

Thursday, January 9, 2025

Our Data and Some Learnings To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Stripe What's Better, X/Twitter or LinkedIn