Earnings+More - Mar 7: FanDuel asserts NY dominance

Mar 7: FanDuel asserts NY dominanceNew York, RSI acquires Run It Once Poker, Playtech takeover update, Startup focus - WSC Sports +MoreGood morning. On today’s agenda:

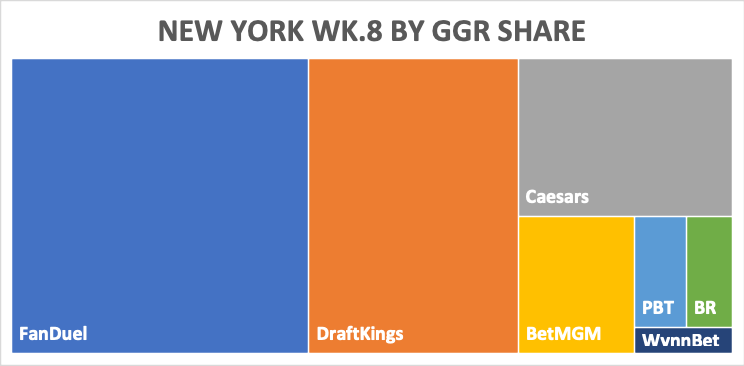

When they kick at your front door, how you gonna come? New York Wk8FanDuel on top: The immediate news from the Empire State is that FanDuel has extended its lead in both handle terms (~38%) and GGR (~41%) and has become the first operator to hit over $1bn in turnover since launch. Datapoints: GGR in the first 8 weeks was $204.7m off a handle of $3.16bn. Apple pie in the sky hopes: Sen. Joseph Addabbo’s proposed bill to legalize icasino in New York would be the proverbial “game-changer” for US online gambling if it became law, said the team at Regulus Partners.

Problem solved: Taxed at the proposed rate of 25% of GGR, online casino’s $2bn in TAM would be added to the predicted post-bonuses c$500m NGR for OSB. Regulus added that it could also solve many of the financial difficulties New York’s OSB market currently faces as the industry’s “net contribution would increase to c$1.4bn”.

Sliding scales: In an attempt to address the high OSB tax rate, Sen. Addabbo has introduced a new bill that would see the state increase the number of licensed operators in the next two years and the rate drop accordingly.

Problem not solved: As WE+M wrote on Friday, the state budget is due on April 1 and with the midterms looming, the chances of the icasino bill passing this year are not high. Regulus noted that the levels of advertising in NY state have also already led to criticism and concerns over labeling of advertisements for adult audiences. With that in mind, NY regulators may hold off regulation in case it is “too much, too soon,” Regulus suggest. Further reading:

** Sponsor’s message: Venture capital firm Yolo Investments is home to €350m of equity in more than 50 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 28-company, €135m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high-roller live casino brand, Bombay Club. As a proud sponsor of Earnings+More from Wagers.com, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat. RSI acquires RIO PokerThe big reveal: Phil Galfond’s plans for Run It Once Poker to pivot towards the US have been rewarded with a buyout from Rush Street Interactive which has snapped the business up for Rush Street $3.2m in cash and a further $2.5m in stock. On social  Pivot move: Galfond announced in January that RIO Poker was pivoting away from its international offering and would be concentrating on the US. On Twitter he said the deal with RSI answered the question of scale.

Playtech takeover updateLast gang in town: Speaking to the FT over the weekend, Tom Hall and Mor Weizer, former and current CEOs at Playtech, hit out at critics who suggested Hall was somehow in league with the Asian-based investors on the Playtech shareholder register regarding the recent failed Aristocrat bid.

Brand new cadillac: Hall contacted TTB in the wake of the Aristocrat failure and then went on to get Weizer on board in mid-February. A key component of the TTB effort will be to further push Playtech’s claims in the US market. Career opportunities: For his part, Weizer said that if the bid being put together by TTB Bond Partners failed, he would effectively find himself out of a job having thrown his weight behind the effort.

Watch this space: Hall and Weizer said a bid would emerge “shortly”. Entain analyst updateTuff Gong: The team at CBRE said it was “encouraged to find no surprises” with Entain’s FY results announced last week, but revised its FY22 EBITDA estimates downwards to £986m (from £1.05bn) on the back of tough online comparatives in H122 and an expected rise in operational costs. Deutsche Bank forecast 2022 EBITDA of £1.01bn, £1.13bn in 2023 and £1.19bn in 2024. M&A driver: Entain has allocated £225m to invest in BetMGM in 2022 with the JV is forecast to generate net revenues of £1.3bn.

Startup focus - WSC SportsWho, what, where and when: The WSC platform uses AI to create customized short-form videos in real-time for sports and media rights holders. WSC Sports is a scale-up; it was founded in 2011. Funding backgrounder: A $100m Series D fundraise was announced last week, its first funding round for three years, it brings the total raised by WSC to $149m. The round was led by ION Crossover Partners (ICP) while existing investors Intel Capital, O.G. Tech and Detroit Venture Partners also participated. So what's new? WSC has signed new clients in the US, such as Indycar, and in Europe and Asia. It has also started working with Italy’s Serie A TimVision league, the highest level of women’s football in Italy. In the OSB field, it has been working with FanDuel and Sportradar for the past year. The longer pitch: Yuval Benyamini, head of sports betting at WSC Sports, says the platform addresses “the betting market’s need for content convergence by providing video highlights solutions” that help operators acquire players and enhance engagement from existing users. For obvious reasons, North America is of key interest currently and “we are seeing highly positive reactions to our products, starting with the video powered push notification,” says Benyamini.

The shares weekWoe is me: DraftKings saw its share price slip 10% after its investor day last week, suggesting investors were expecting more than the expanded TAM estimates. Meanwhile, as the team at Jefferies noted, RSI suffered a worse week with the shares off 20% following its earnings call midweek. Eat my shorts: DraftKings and RSI remain favorites with the shorts at 12.5% and 18.7% of short interest respectively. Catalysts: The team noted that while the narratives around online had shifted “drastically”, there were potential near-term catalysts that might disrupt the negativity. One would be evidence of an accelerated path to profitability while the other is consolidation.

The week aheadMGM is taking part in the JP Morgan leisure conference later today, while Century Casinos and Full House Resorts publish their Q4s tomorrow. Accel Entertainment, NeoGames and PlayAGS announce their results on Wednesday and Thursday and many industry observers will be watching out for Genius Sports’ Q4s on Friday and whether further detail will be provided on the group’s NFL official data deal.

DatalinesColorado Jan22: Sports-betting handle was up 75.5% YoY and 24.3% MoM to a record $573.7m, GGR was up 49.7% YoY and 40% MoM to $34.6m. Mobile betting represented $567.1m of the total handle. The NBA recorded most bets at $163.6m, NFL betting totaled $144m, college basketball $63m, NHL $24.7m and tennis $20m. NewslinesLosing gambit: The D.C. Lottery’s mobile betting app GambetDC announced losses of $4m and revenues of $1.5m after one year of operation, well short of the $20m it had forecast at the outset. Sponsor drive: NFL teams recorded $600m in sponsorship revenues in 2021, a 57% rise YoY and +14% vs. 2019. According to a report by Sponsor United, OSB saw an 83%+ increase in sponsorship and media deals, the largest expansion for the second year in a row. Tri-launch: Inspired Entertainment’s online gaming content went live with DraftKings in Connecticut. For Inspired this marks the third state in which its online gaming portfolio has launched. White gold: White Hat Studios has signed a content deal with Golden Nugget Online Gaming to supply slots, jackpots, full house and more in several US states. This follows the asset purchase of Blueprint Gaming’s catalog of games for the US market last year. Big footprint: Games developer 4ThePlayer has signed a deal with Superbet for distribution into the Romanian market. The first game to be released in Romania is 9k Yeti. What we’re readingPart-time punks: “They were just kind of there to see the spectacle.” Sotheby’s NFT auction doesn’t go as planned. Covid didn’t end the tech backlash. Could Putin? Stamford Bridge is falling down: The inside story of what’s going on at Chelsea. Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Mar 4: Weekend Edition no.36

Friday, March 4, 2022

DraftKings investor day, bet365 analyst reaction, Penn National analyst update, #StandWithUkraine, sector watch - crypto exchanges +More

Mar 3: Bet365 sees in-play fall in 2021

Thursday, March 3, 2022

bet365 annual results, Entain FY, Yahoo Sports rumor, Rush Street Interactive FT, SciPlay earnings call, MGM share buyback +More

Exit SciGames, enter Light & Wonder

Wednesday, March 2, 2022

Scientific Games Q4, IGT Q4, Everi Q4, earnings in brief, Better Collective analyst update +More

Mar 1: Flutter in choppy international waters

Tuesday, March 1, 2022

Flutter FY, January 22 US OSB estimate, Esports Entertainment Q4, IGT payments unit sale, Rush Street Interactive analyst update, New York analyst update +More

Feb 25: Weekend Edition no.35

Friday, February 25, 2022

Churchill Downs Q4 call, Bally analyst reaction, PointsBet investor call, REIT Q4 review, Playtike Q4, sector watch - payments +More

You Might Also Like

Indian Cricket's Annus Horribilis 2.0

Friday, January 10, 2025

2025 is a fecund year for sports lovers, with World Championships scheduled in table tennis (Doha, May), badminton (August, Paris), athletics (September, Tokyo) where Neeraj Chopra defends his world

No, I don't think the P4 Split is coming (right now)

Friday, January 10, 2025

The P4 would like more say in governing championship events. Maybe they get it, maybe not. But I don't think this means a split is coming...yet

Patience pending

Friday, January 10, 2025

Will others follow Flutter's lead and buy their way into Brazil? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Sold over 500,000 of products on Amazon

Friday, January 10, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack Sold over 500000 of products on Amazon Did you know that more than 70% of sales on Amazon

🔍 How To Build Your Brand’s Social Narrative

Friday, January 10, 2025

January 09, 2025 | Read Online All Case Studies 🔍 Learn About Sponsorships It's been a minute. Things have changed. Our focus changed. We've narrowed the newsletter down. We're more focused

A Community Just for Agency Owners

Friday, January 10, 2025

Hi there , Most business advice online isn't built for agency owners. Running an agency comes with unique challenges. Whether it's pricing projects or managing client expectations, generic

🎙️ New Episode of The Dime She Hits Different: The Story Behind Cake's Explosive Growth ft. Chloe Kaleiokalani

Thursday, January 9, 2025

Listen here 🎙️ She Hits Different: The Story Behind Cake's Explosive Growth ft. Chloe Kaleiokalani Cake is hitting different. A hockey stick chart is every founder's dream—but what looks

😬 Who's Slammed by the Spam Update

Thursday, January 9, 2025

Massive Local SEO Algo UPDATE ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Email trends and predictions, ‘Returnuary’ is here, advice from newsletter veterans, and more

Thursday, January 9, 2025

The latest email resources from the Litmus blog and a few of our favorite things from around the web last week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bounce Rate is Killing Your SEO 💀

Thursday, January 9, 2025

SEO Tip #68