The Diff - HelloFresh: Mealkits Can Work After All

You're on the free list for The Diff. Subscribers-only posts you missed this week:

Thanks for being a Diff reader. To access the full back catalog and future subscribers-only pieces, subscribe today! Coming attractions include the site-search business, the case for "contrarian momentum," and a look at a devious incubator that's better than it seems. HelloFresh: Mealkits Can Work After AllPlus! PR Campaigns for Ads; Underperformance; Monetizing Dead Mileage; Movies and Dynamic Pricing; Peloton and Inventory Management

Welcome to the Friday edition of The Diff! This newsletter goes out to 28,077 subscribers, up 207 from last week. In this issue:

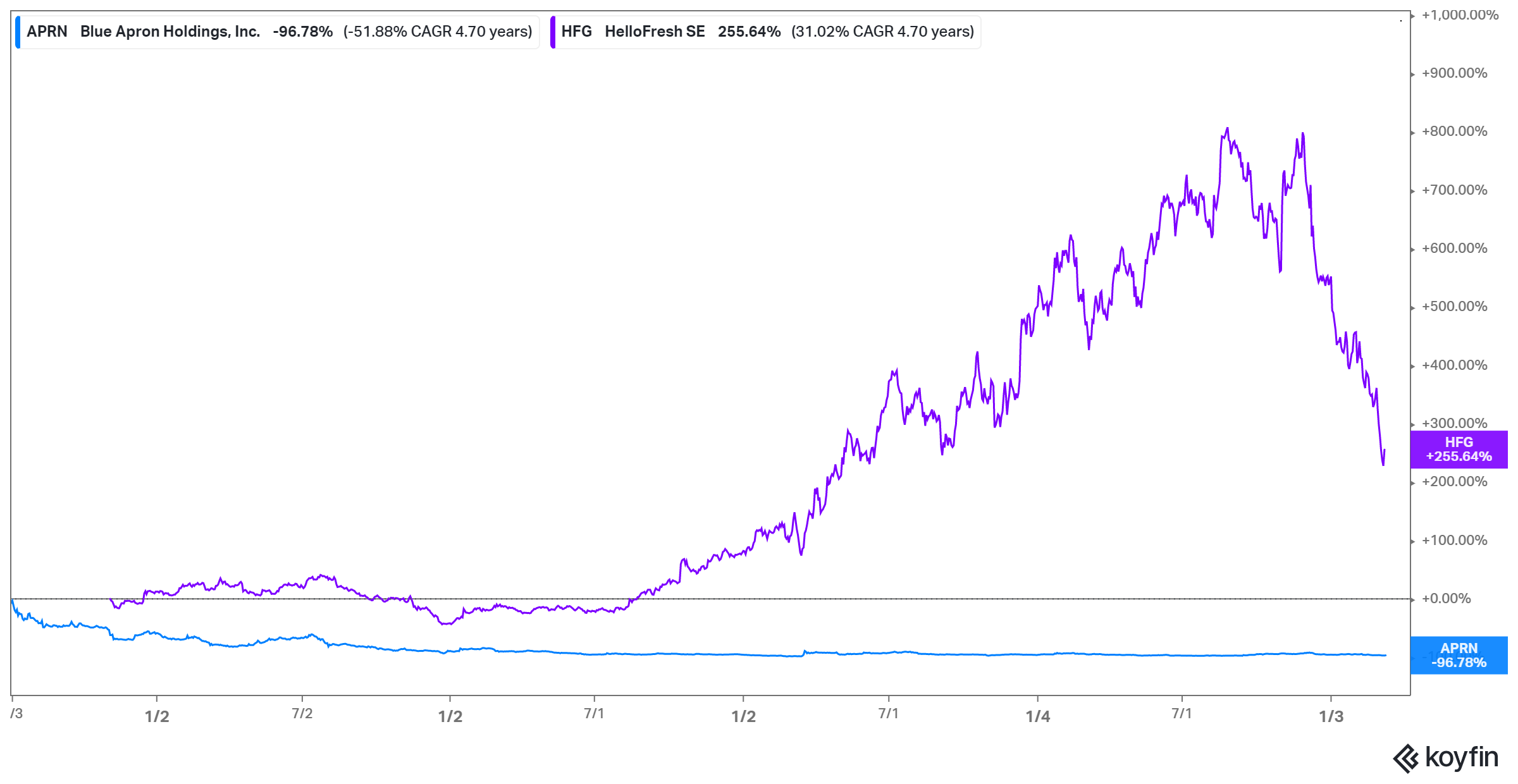

HelloFresh: Mealkits Can Work After AllIn the summer of 2017, mealkit company Blue Apron went public, after cutting its IPO valuation by a third. Since then, it's lost roughly half of its value every year, and is now worth $140m, down from a high of $1.9bn on its IPO day. There was an argument to be made that the meal kit industry was a structurally bad one—and this was an argument I made a few months before the IPO: churn rates were high, meal kit companies were bidding against each other for the same leads, the existence of mass-market companies in the industry promoted the creation of vertical-specific competitors that would eat away at their market share, etc. But Blue Apron wasn't the only meal delivery company to go public in 2017: HelloFresh IPOed a few months later, and since then, despite a large drawdown since the late 2021, it's returned 31% annually. It's easy to construct bull and bear cases for the mealkit industry. On the bearish side:

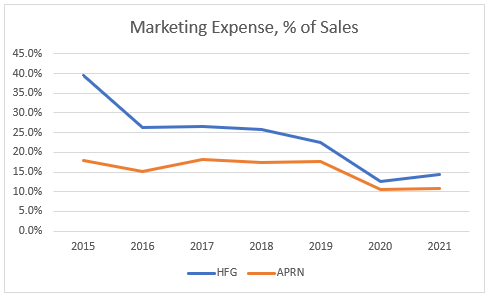

The first bet you could make here is that HelloFresh succeeded where Blue Apron struggled because of a different geographical focus: Blue Apron aimed to capture the US market, while HelloFresh was European. But in the last two years, 55% of HelloFresh's revenue came from the US market. The US venture ecosystem is a wonderful feature for startups most of the time, but it also means that any startup that defines a category quickly makes that a fundable category, and any one company's cost of customer acquisition is defined by their competitors' willingness to buy market share and their own need to do so. That was part of the story: Blue Apron had a successful referral program and ubiquitous podcast ads, in addition to TV and other traditional channels. But, as it turns out, HelloFresh spent more than Blue Apron on marketing as a percentage of sales every year until last year. In 2019, when Blue Apron cut its marketing budget by 59% to stem losses (which worked, in a sense—losses dropped by half on a 32% decline in revenue), HelloFresh's marketing spend as a share of revenue worked out to more than double Blue Apron's, at 22.4% compared to Blue Apron's 10.6%. HelloFresh has been reducing the share of its revenue that goes to marketing, but mostly by growing revenue. One of the gaps is on the gross margin side. HelloFresh has generally been spending 5-10 points less of revenue on fulfillment and products than Blue Apron, and that points to a major gap between the companies: Blue Apron executed well on food, and HelloFresh executed well on delivery. It's debatable which of these matters, but a look at market caps may be a clue: there's less money in fine dining than there is in convenient food with mass-market appeal. The largest publicly-traded restaurant company that isn't focused on low-priced meals is Darden Restaurants, which has roughly one tenth the market cap of McDonald's. Kura Sushi is very large for a sushi chain, and has a market cap of $500m; given Doordash's $28bn valuation, it's likely that there's substantially more market cap in making sushi available by delivery than in making the sushi in the first place.¹ When HelloFresh pitches its story to investors, a big piece of it is about convenient access to a wider selection:

And there are two levels of convenience here: rapid delivery, and minimizing the choices necessary to get a decent dinner. Blue Apron did send customers some great dishes, but some of them required a lot more prep time than the company promised, and it's hard to simultaneously control costs and obsessively source quality ingredients. But if the main axis of quality is delivery time and consistency, then it is more maintainable. This habit-forming quality also shows up in the unit economics. The mealkit industry is notoriously high-churn, but after the first two years HelloFresh says spending roughly stabilizes; after a while, people get accustomed to getting regular meals delivered, and incorporate it into their schedules.² HelloFresh has also gotten good at managing churn in another direction: treating it as a temporary aberration that can be reverted with modest effort. One third of their customer growth comes from former users who sign back on, and they expect that share to grow to 40%-50%. (This can make them a beneficiary of the competition-driven shakeout the industry went through: the customers they lost due to cheap offers from competitors come back when those same cheap offers mean that competitors don't have a sustainable business.) The company has, at times, been more than a little aggressive with reengagement efforts: this 2016 post begging the company to stop marketing to a former customer got almost 300k views. Cohort math means that companies can be a bit less reactive to inflation; they do have to adjust prices when their inputs get more expensive, but they can also consider the tradeoff between expensive customer acquisition and a few points of margin on the customers who don't churn. So HelloFresh has raised prices recently, but by 2% compared to the mid-single digit annual inflation rates in its core markets ($, WSJ). Blue Apron was broadly right but very unlucky: they knew that converting food spending into a subscription could justify an expensive marketing campaign, and that there was a large customer segment that genuinely preferred home-cooked food but didn't like the entire process of picking recipes, buying ingredients, throwing out expired ingredients, etc. They proved their model well enough to justify lots of competition, and then ended up in the very difficult position that their fulfillment cost structure made sense for a larger business, but the exigencies of cash flow required them to pare their marketing down and run a smaller one instead. (It didn't help that their New Jersey fulfillment center took a year and a half to get going ($, WSJ)). If a business is about convenience, then it needs to trade product quality for product consistency. And if it's capital intensive, the outcome also comes down to luck—the company that can raise cheap capital will do unusually well, and the company whose competitors can raise cheap capital will have a much harder time. A Word From Our SponsorsMercury is the banking stack for startups.* Get FDIC-insured accounts, virtual and physical debit cards, currency exchange, and domestic and international wires. Customize the banking experience you want with features like read & write API access, custom team-management, and integrations with the tools your startup uses, like Quickbooks and Stripe. And you can keep growing with Mercury. Use tools like Mercury Raise, which connects founders to quality investors, 1:1 mentorship, and a curated network, or Mercury Capital, which matches startups with the right financing options with just four questions. Head to mercury.com to apply in minutes, right from your laptop. *All banking services provided by Evolve Bank and Trust, member FDIC. ElsewherePR Campaigns for AdsTaboola and Outbrain are "chumbox" advertising companies, which display ads alongside article recommendations on media sites. This business has a bad reputation it's slowly outgrowing, and its economics look very different in a world where third-party cookies aren't available—first, because many of the ads are contextual, and second, because the companies are technically collecting first-party data on a wide swathe of the non-Google/non-Facebook Internet. Both companies went public at around the same time, after a merger fell through, and they continue to behave in very similar ways. Both CEOs, for example, have been running an aggressive PR campaign to get marketers to see their ads as a more viable solution as cross-site tracking gets harder: OutBrain's CEO pitched his company in an advertising trade magazine yesterday, while Taboola's made similar points earlier this week in a guest article on CNBC. Which speaks to how timely the business is, but also how hard it is to operate in a competitive duopoly: the bear case on both companies is that each one can do what the other does, commoditizing their products, and while that bear case isn't entirely true, it does seem to apply to their outreach efforts. (Disclosure: I'm long a small amount of TBLA.) UnderperformanceSince the product's launch, the broad story of Twitter has been that the people who like it really like it, and the company has struggled against widespread indifference and a small core of haters. (In that respect, the big change since they started is that people used to write blog posts about how dumb Twitter was, and now they tweet about how awful it is.) The company is working on new products to broaden its appeal with the large cohort of read-only users and non users. One notable feature of Twitter is that its two core products are timelines/tweets and DMs; it's a way to broadcast to literally everyone (Especially if you say something offensive) or a way to keep in touch with a narrow pre-selected community. They're aiming for features that reach the middle ground: not an everyone-to-everyone broadcast that relies on intense filtering to be usable, and not a messaging service with naturally constrained virality, but something in between. Monetizing Dead MileageDoordash is testing a feature to pick up package returns. Since delivery is all about maximizing utilization, sometimes the right way to look at a service is not in terms of what customers want but in terms of which trips have to happen and could be monetized; making even a little extra money on a trip that moves in the opposite direction of the usual flow can be close to pure incremental profit. They've been doing variants of this for a long time: one of their older ways to take advantage of dead mileage was to distribute flyers in neighborhoods where they made a delivery before returning to their home base. (This was part of the unspoken brilliance of Amazon's sadly-nonexistent New York HQ2: the plan was to place it in Queens, but Amazon pays well enough that some employees would be living in Manhattan, so it would have put far less stress on public transportation than putting the equivalent number of jobs elsewhere in New York City. Movies and Dynamic PricingThe movie industry has long used a sort of cascade of dynamic pricing, where movies start out in full-priced theaters, moved to dollar theaters later on, and then were available for free in redacted form on TV much later. The new Batman movie has seen more aggressive testing of variable pricing ($, FT). As free video entertainment options proliferate, and as more households subscribe to at least one paid service, theater audiences skew more towards people who genuinely prefer to watch a movie in that format. And once that happens, there's more pricing power for this smaller audience. It will be interesting to see how the business evolves from here, especially given its dependence on concessions—at one level, higher ticket prices take money out of an entertainment budget and could hurt popcorn and soda sales. On the other hand, for some people the food is part of the experience, and expensive tickets anchor their expectation to pay a premium for everything else. Peloton and Inventory ManagementOne shift Peloton is considering is a bundled bike and content subscription giving users the option to stop the service and return their bike. As Peloton demonstrated over the last two years, managing production for a durable good experiencing a sudden spike in demand is very tricky; having a population of bike owners who can return their bikes means that the company has more ways to source inventory (by cutting discounts to get bikes returned) or to constrain it (by offering discounts to customers who would otherwise churn—it's still cheaper to maintain a customer than to acquire one). One of the challenges here is that it will be hard for Peloton to maintain its vaunted sub-1% monthly churn number if it makes it more convenient for customers to churn in and out. On the other hand, companies can sometimes become wedded to a metric that no longer tracks something important about their business; making choices that add to free cash flow while hurting popular KPIs is a hard one, but if the company over-emphasized those KPIs it can be the right decision. Disclosure: I am long PTON. Diff JobsSome new jobs from the Diff network.

1 An exception to this, possibly worth exploring in a future piece, is that the biggest alcohol companies by market cap do price things on the high end. Diageo is worth a bit more than Anheuser-Busch InBev, for example, and Kweichow Moutai was once worth half a trillion dollars. One possibility is that with beverages it's easier to do quality-control at scale: even if the price of a bottle is comparable to the price of a fancy meal, it's more scalable to do quality control on a vat of Moutai than to do it on a Michelin-starred kitchen. 2 This was part of what drove the incredible economics of broadcast TV before cable ate into its market share: if a given show was popular enough, it was harder to schedule a social event that overlapped with it. Which meant that more people were stuck at home—perhaps with nothing better to do than to see what was on one of the three TV channels. You’re a free subscriber to The Diff. For the full experience, become a paid subscriber. |

Older messages

Longreads + Open Thread

Saturday, March 5, 2022

ESG, Short Selling, Russia, Sanctions, Kazakhstan, Tisch

Plaid: Data Layer to Payments Layer?

Friday, March 4, 2022

Plus! The Next Conflicts; Decentralization as a Liability; Decentralization as an Asset; Reopening; Succession Problems; Diff Jobs

Longreads + Open Thread

Saturday, February 26, 2022

SF Crime, Tolstoy, Defense Tech, Social Media, Diversification, Diller

Match Group and Managed Dissatisfaction

Friday, February 25, 2022

Plus! Revolving Doors; Sanctions; Iterating; Bad Funds, Conflicts, and Bias; Diff Jobs

Longreads + Open Thread

Saturday, February 19, 2022

Spotify, Groceries, Podcasts, Minsky, Professionalization, Netflix

You Might Also Like

📉 Bonds saw a selloff

Thursday, January 9, 2025

Global investors dumped government bonds, UK shoppers got a break for Christmas, and Encylopedia Britannica became an AI company | Finimize Hi Reader, here's what you need to know for January 10th

Could private student loans help you?

Thursday, January 9, 2025

Find out if you qualify and compare rates today. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🏆 The Demi Moore of it all

Thursday, January 9, 2025

Plus, workshops on estate planning and taking control of your money. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦾 Anthropic looks jacked

Wednesday, January 8, 2025

Claude's AI startup flexed a new valuation, China sought to nudge shoppers, and a wild plot to smuggle drugs | Finimize Hi Reader, here's what you need to know for January 9th in 2:57 minutes.

3 reasons to buy life insurance

Wednesday, January 8, 2025

Make 2025 the year you protect your loved ones Why you should get life insurance now A decreasing bar chart Affordable rates Life insurance premiums typically increase with age or changes in health.

Eight days in and things are already changing

Wednesday, January 8, 2025

plus Tomdaya + birdwatching ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤩 Nvidia takes the stage

Tuesday, January 7, 2025

Nvidia headlined in Vegas, the Pentagon added to its companies blacklist, and an unexpectedly amazing beach destination | Finimize Hi Reader, here's what you need to know for January 8th in 3:11

It’s time to get rid of debt

Tuesday, January 7, 2025

Here's how to find the right debt solution for you ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Retirement Is the Right Call

Tuesday, January 7, 2025

Avoid work for the sake of work ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What America’s Top Economists Are Saying About AI and Inequality

Tuesday, January 7, 2025

Planet Money attended the annual meeting of American economists — and the most popular topic this year was artificial intelligence. View this email online Planet Money AI Was All The Rage At AEA 2025