Teardown | Zetwerk – B2B marketplace for manufacturing

Teardown | Zetwerk – B2B marketplace for manufacturingIn just 3 years, Zetwerk has scaled its global B2B procurement marketplace to a $2.7B valuation.

These briefs are produced by leveraging publicly available data sources and information. If you notice a mistake or see an area for improvement, please let us know through this typeform or via email (team@sandhill.io). Snapshot

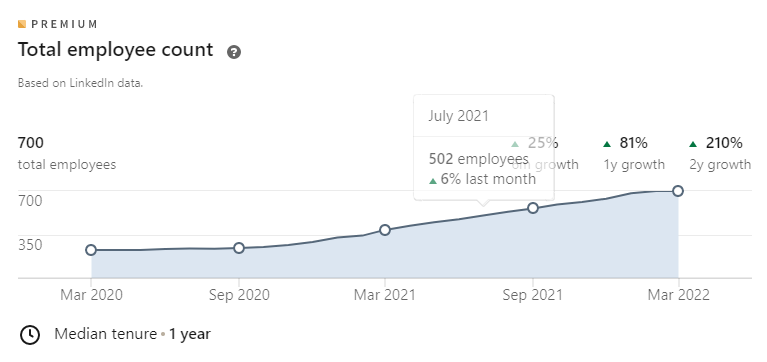

Business Overview & ProductsZetwerk caters to both suppliers and customers by connecting both parties through its platform. It offers a wide range of manufacturing services to its customers like custom-made components, mass production, quality certification, inventory, and supply chain management. Suppliers on the platform benefit from the partnership in terms of visibility and the opportunity to obtain international orders resulting in increased inbound orders and revenue. Moreover, suppliers are offered financial support like working capital loans and invoice discounting services by the company. To date, Zetwerk has developed partnerships in 3 key segments: Precision Parts, Capital Goods and Consumer Goods. The product categories include but are not limited to assembly lines for consumer durables, precision parts for aerospace, prefabricated structure for infrastructure projects, and sheet metal for electric vehicles. The company operates in 15 countries with the majority of its orders coming from established markets like the Middle East, Asia Pacific, and North America. How It WorksZetwerk works with OEMs and EPCs to fulfill their manufacturing requirement for customized components and assemblies by procuring relevant materials from high-quality suppliers. The platform connects both parties by offering a precise match between customer requirements and supplier capacity. The platform executes these projects courtesy of its large network of high-quality partner suppliers and world-class plants. It sells custom-made products like parts of a crane, doors, chassis of different machines, and more. Since it focuses on products that nobody has in stock, orders need to be placed beforehand to manufacturers and workshops. The company operates across 25 industry segments and mostly serves customers in forging, casting, fabrication, and machining businesses. These customers approach Zetwerk with digital designs that they want to be translated into physical products. Zetwerk lists down potential workshops and evaluates their products and offerings to help companies work with them. Once a company places an order, Zetwerk allows it to track the progress of its order, from manufacturing to shipping. Customers have access to information on shipment, tracking, photos of projects, tax compliance, shipping documentation, and inspection reports. Business Model & PricingZetwerk’s business model has evolved immensely since its inception. The company now positions itself as a supplier to their customers so they can delegate orders to the suppliers directly thus increasing efficiency and speed. It has transitioned from a supplier database for large manufacturing companies to a B2B platform for custom manufacturing. The company mainly earns money by sharing margins with suppliers on their platform. In order to increase their margin, it ensures suppliers experience consistent growth in their businesses. Zetwerk also applies a take-rate on each transaction that takes place between suppliers and customers on the platform. This means industrial segments account for 85% of the enterprise’s revenue. Recently Zetwerk expanded to consumer goods which include items like TVs, mixers, grinders, etc. This category now makes up for 15% of the company’s revenue. TractionAccording to an Inc42 article, Zetwerk reported $180M in revenue in 2021 which was roughly a 2.5x increase from its $42M revenue in 2020. Ever since its inception, the company has witnessed incredible growth with a 300% yearly growth rate. This growth is evident by their order book which has crossed over $655M and showcases predictability in business for the rest of the year. Due to this consistent upward trajectory, over 1,800 organizations trust Zetwerk with their contract manufacturing needs. It also claims to be profitable on an Earning Before Interest, Taxes, Depreciation and Amortization (EBIDTA) basis. According to their website, as of March 2022, Zetwerk has:

Founder(s) & TeamAmrit Acharya: Co-Founder and CEO at Zetwerk, prior to which Amrit was an associate at McKinsey and Company where he built a dynamic pricing engine and also helped design an M&A strategy for the F500 company. Srinath Ramakkrushnan: Co-Founder at Zetwerk, prior to which Srinath co-founded OfBusiness, a raw material aggregator and procurement finance provider. Vishal Chaudhary: Co-Founder at Zetwerk, prior to which Vishal was the Supply Chain Manager at ITC Limited, where he led a 30 member strong supply chain function of India's largest Leaf Tobacco Business. Rahul Sharma: Co-Founder at Zetwerk, prior to which Rahul co-founded Prepnut, a job interview preparation site for college graduates. History & Evolution

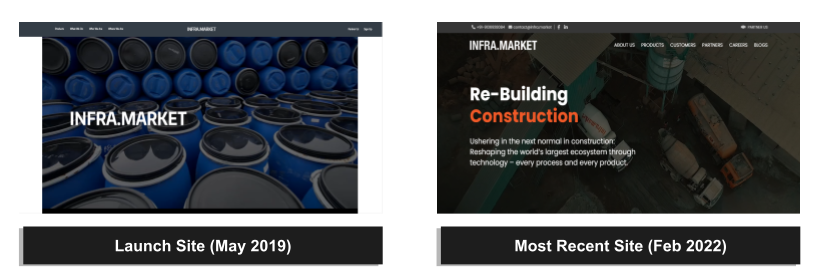

From archive.org Market Snapshot

Additional LearningsZetwerk stands out from its competitors because it not only focuses on infrastructure and construction sectors but also works for industries like aerospace and defense. The company also thrives on building custom-made niche parts for its customers which is a competitive advantage for the enterprise. Suggested Next Reads

If you liked this post from CommerceTech, why not share it? |

Older messages

GlobalBees – Indian House of Brands

Tuesday, March 22, 2022

The retail company that has scaled to a $1.1B valuation in under a year

You Might Also Like

Building complete rank and rent sites in just minutes

Monday, March 3, 2025

This tool is incredible

🌁#90: Why AI’s Reasoning Tests Keep Failing Us

Monday, March 3, 2025

we discuss benchmark problems, such as benchmark saturation, and explore potential solutions. And as always, we offer a curated list of relevant news and important papers to keep you informed

I interviewed THE largest Amazon Seller [Roundup]

Monday, March 3, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

The state of data-driven decision-making for CPG brands

Monday, March 3, 2025

How marketers use purchase insights to maximize campaign performance

Facebook updates, TikTok ROI, Instagram format matches, and more

Monday, March 3, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo New week, fresh insights, Reader! Stay sharp with the latest updates on AI, social

Are you losing revenue to rivals?

Monday, March 3, 2025

This is a challenge that costs businesses millions every year: Their customers are switching to competitors for various reasons... even though most of them could easily be fixed. On Tuesday, March 4,

DeepSeek’s 545% Profit Claim

Monday, March 3, 2025

PLUS: Siri 2027?!

Insurtech VC resets, readies for growth

Monday, March 3, 2025

Europe's share of regional IPOs sinks; the agtech revolution is now; hope flares for natural gas deals Read online | Don't want to receive these emails? Manage your subscription. Log in The

What I Think About The Crypto Strategic Reserve

Monday, March 3, 2025

Listen now (8 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$92K BTC After Trump’s Crypto Call, MARBLEX Invests $20M—WOOF Ups the Game!

Monday, March 3, 2025

PlayToEarn Newsletter #262 - Your weekly web3 gaming news