Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #282

What's 🔥 in Enterprise IT/VC #282Lessons from the early days of VC, relationships not transactions, doubling down when others won't

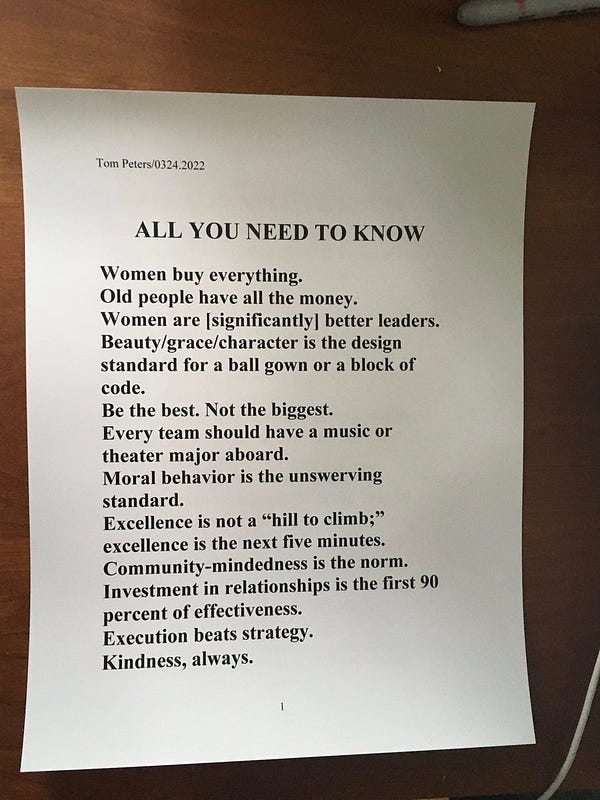

I’ve been reading The Power Law: Venture Capital and the Making of the New Future by Sebastian Mallaby which traces the history of VC and the idea that a small handful of companies generate the majority of returns for investors. Mallaby’s book also reminded me of how VC was in the early days, an industry powered by deep and strong relationships with the founders. With all of this 💰 flushed into the system, I feel that the world is becoming more transactional and data driven versus relationship driven, and Power Law is an important reminder for all of us to make sure we focus on more than just the numbers and don’t lose the personal touch. It’s the personal touch and deep connection that gave Kleiner the conviction to double down on Tandem when no one else would. If investors want to buy up in companies and increase ownership as companies grow, one of the only ways to do it is to have inside information and conviction when others don’t. It’s having the belief a winner is a winner before others believe it is. Here’s a great example:   This brings me back to the Kustomer closing dinner which was held this past week with the Kusty exec team, investors, and bankers. It was so awesome to finally see everyone in person for the first time, celebrate, and also share stories on the journey from day one. That evening I was also reminded of the fact that everything was not always 📈. Fundraising was tough in the early days after the A round, and we at boldstart, Social Leverage, and Canaan led a bridge round between the A and the B, to buy more time to hit a few more product milestones and close a few more customers. So what gave us the conviction to write a bigger check in the bridge round than in our initial seed? Relationship and true belief in the founders and team’s ability to deliver the additional features needed on the product to close more deals. Fortunately that turned out quite well. In fact, looking at a number of our best companies and 🦄 in the portfolio I can say that almost all of them had a few bumps in the road and needed a bridge between some early rounds to get to the promised land. Here’s how the evening ended…with Vikas Bhambri aka @spicedawg56, our first   and only Global Head of Sales, and I dancing in Times Square for a debt owed on a bet made at a board meeting. I will miss the entire Kusty team but along the way I made new friends, learned a ton, and had lots of fun. Founders, investors remember - relationships matter and if you want to make it through the tough times and also realize outsized returns, focus on relationships and not transactions. And who knows you may get to brush up on some of your dance moves along the way! As always, 🙏🏼 for reading and please share with your friends and colleagues! Scaling Startups

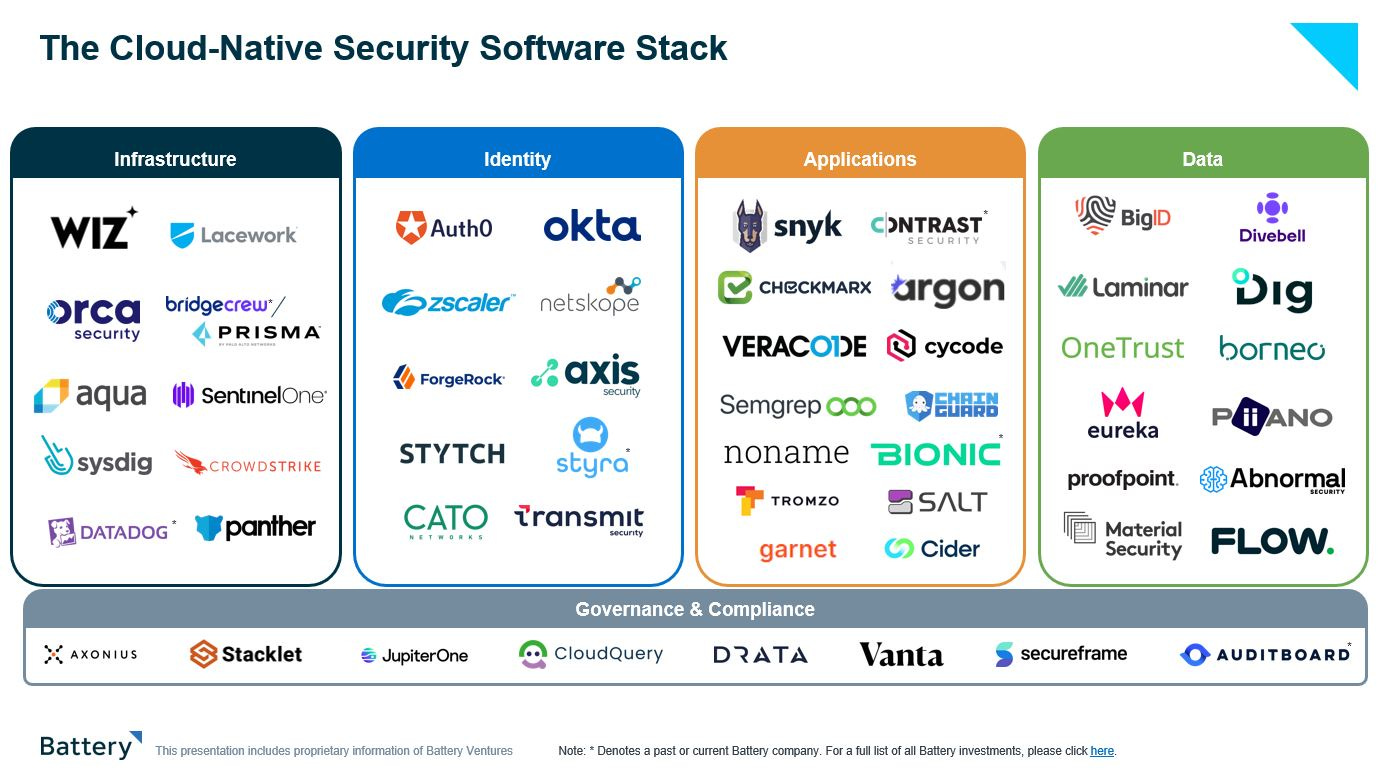

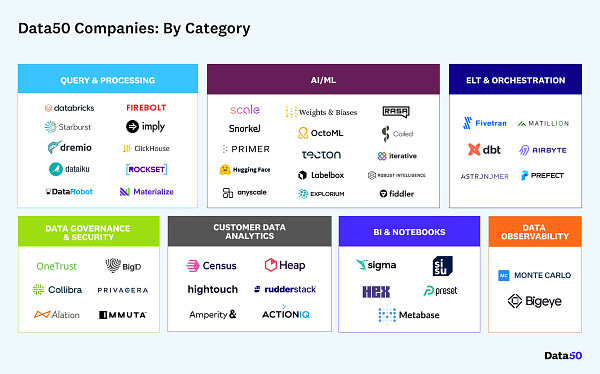

Enterprise Tech

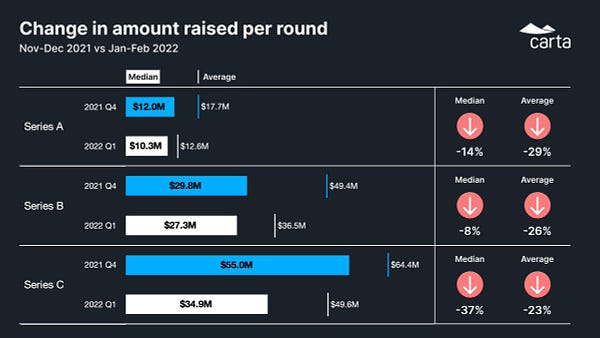

Markets

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Older messages

What's 🔥 in Enterprise IT/VC #280

Saturday, March 12, 2022

Dev first stocks 📉 but still bullish in LT - MongoDB - from $100M ARR to $1B ARR in 5 years 🤯

What's 🔥 in Enterprise IT/VC #279

Saturday, March 5, 2022

What goes up must come down - ❄️ back to earth, what it means for private cos + how a customer discovery email turned into a company

What's 🔥 in Enterprise IT/VC #278

Saturday, February 26, 2022

🙏🏼 🇺🇦...🤔 on your first sales hire...continued

What's 🔥 in Enterprise IT/VC #277

Saturday, February 19, 2022

➕/➖ of backing founders creating new categories 📈 vs. those who reimagine existing markets, it's not the TAM you start with but the TAM you exit with

What's 🔥 in Enterprise IT/VC #276

Saturday, February 12, 2022

Startups like a fine 🍷, the longer arc of success 💪🏼 for some founders

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏